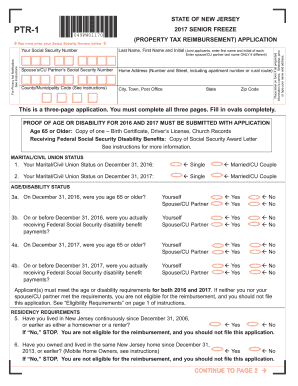

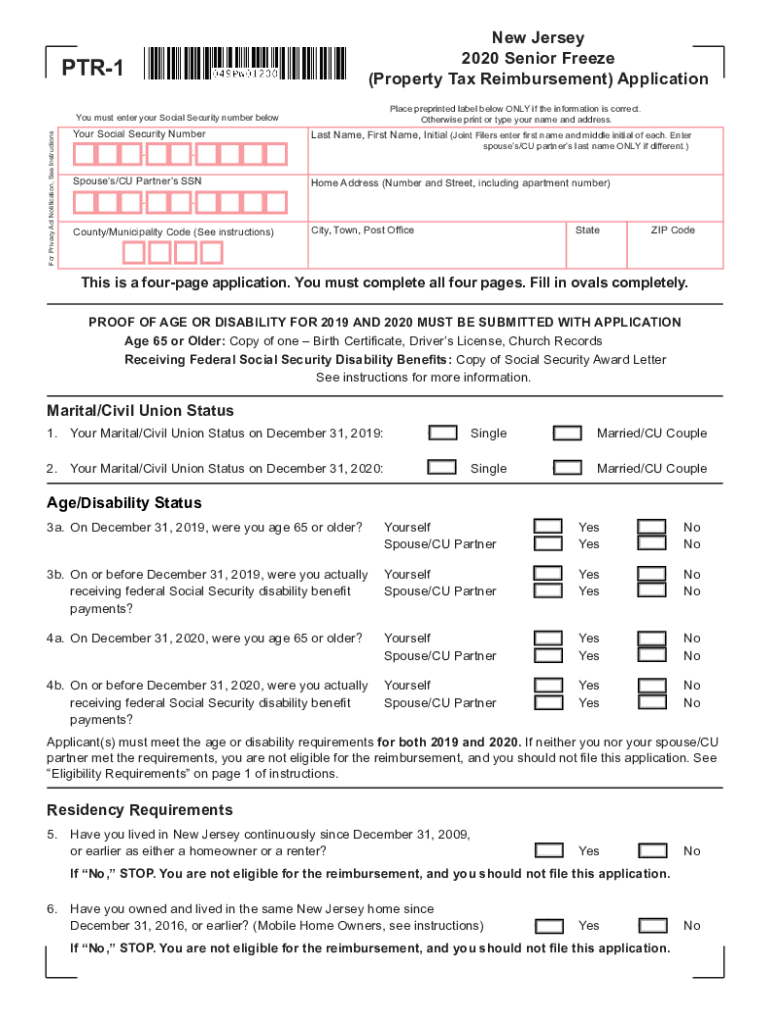

New Jersey Senior Property Tax Freeze Form

For residents who did not receive a prior years reimbursement or Form PTR-2 for residents who did receive a prior years reimbursement. For information call 800-882-6597 or to visit the NJ Division of Taxation website for information and downloadable forms.

Welcome To London S Rental Market Where 2 000 A Month Gets You A Bed Beside The Toilet London Rentals Real Estate Prices Property Marketing

Welcome To London S Rental Market Where 2 000 A Month Gets You A Bed Beside The Toilet London Rentals Real Estate Prices Property Marketing

The verification form is your proof of property taxes due and paid.

New jersey senior property tax freeze form. Check the status of your New Jersey Senior Freeze Property Tax Reimbursement. If a reimbursement has been issued the system will tell you the amount of the reimbursement and the date it was issued. Senior Freeze application for 2020 if you meet all the other eligibility requirements.

Property Tax Reimbursement Program Senior Freeze Forms are sent out by the State of New Jersey in January. Due to COVID-19 ADORs in-person lobby services are by appointment only and in compliance with local municipal and county face covering policies. Njustreasurytaxationptrptr2yearshtml to see if you qualify then call the Senior Freeze Hotline at 1 800 882-6597 for assistance.

How to Apply for the Senior Freeze Property Tax Reimbursement You must file a completed Application PTR-1 and Homeowners Verification of 2018 and 2019 Property Taxes form before December 31 2020 if you are. To use this service you will need the Social Security number that was listed first on your Senior Freeze application Form PTR-1 or Form PTR-2. Senior Freeze PTR PO Box 635 Trenton NJ 08646-0635 Senior Freeze PTR Hotline.

Alternate documents to send as proof can be found in the Senior Freeze FAQ. 2020 Senior Freeze Applications Which Form to Use. If you qualify and have not received this application call 1-800-882-6597.

Form PTR-2 is a personalized application that is not available online. The deadline for first quarter tax year 2021 individual estimated tax payments remains April 15 2021. There are two separate and distinct property tax relief programs available to New Jersey homeowners.

But first its important to note that New Jersey has frozen 920 million in state government spending including 142 million in Homestead property tax. Mail a completed application to. This form establishes your base year property tax amount which is used to calculate the reimbursement going forward.

NJ Division of Taxation Revenue Processing Center Senior Freeze PTR PO Box 635 Trenton NJ 08646-0635. If you do not receive your booklet by early March contact the Senior Freeze Property Tax Reimbursement Information Line for assistance at 1-800-882-6597. NJ Division of Taxation.

NJ Division of Taxation Revenue Processing Center Senior Freeze PTR PO Box 635 Trenton NJ 08646-0635 Senior Freeze. Arizona has moved the individual income taxes deadline to May 17 2021 without penalties and interest. Senior Freeze Property Tax Reimbursement Program.

1-800-882-6597 Under penalties of perjury I declare that I have examined this Senior Freeze Property Tax Reimbursement Application including accompanying schedules and statements and to the best of my knowledge and belief it is true correct and complete. Reminder The Homestead Benefit and Senior Freeze Property Tax Reimbursement programs are. Department of the Treasury Division of Taxation PO Box 281 Trenton NJ 08695-0281.

Form PTR-1 is for applicants who are filing for a reimbursement the first time or who filed an application the previous year that we denied because the applicant did not meet all the eligibility requirements. Property Tax Relief Programs. The PTR-1 is the application used by first-time applicants or for those who must re-establish themselves back into the Senior Freeze program.

For information call 1-800-882-6597. Sign your parents name on the application and in parenthesis write deceased and underneath it write your name and in parenthesis write sondaughter Complete an Affidavit of Person Claiming Senior Citizens Freeze Exemption Due to a Deceased Taxpayer form. The Senior Freeze Property Tax Reimbursement program reimburses eligible New Jersey residents who are senior citizens or disabled persons for property tax increases on their principal residence home.

Complete this questionnaire to see if you may be eligible for a 2020 Senior Freeze. Your Signature Date SpousesCU Partners Signature if filing jointly BOTH must sign Your daytime telephone number andor email address optional Paid Preparers Signature Federal Identification Number Firms name Federal Employer Identification Number Division Use 1 2 3 4 Due Date. November 2 2020 Mail your completed application to.

2020 Senior Freeze Applications. The US Postal Service does not forward application booklets. Senior Freeze Property Tax Reimbursement Inquiry.

Forms are sent out by the State in late Februaryearly March. Applications for Senior Freeze PTR-2 Forms were mailed in February to the residents prior year address.

Printform Finance Incoming Call Screenshot Property Tax

Printform Finance Incoming Call Screenshot Property Tax

Https Www Twp Maplewood Nj Us Sites G Files Vyhlif3396 F News Tax Freeze Presentation Pdf

When You Contribute To A Roth 401 K The Contribution Won T Lower Your Taxable Income Today But When You Even Roth Required Minimum Distribution Contribution

When You Contribute To A Roth 401 K The Contribution Won T Lower Your Taxable Income Today But When You Even Roth Required Minimum Distribution Contribution

Ptr 1 Fill Out And Sign Printable Pdf Template Signnow

Ptr 1 Fill Out And Sign Printable Pdf Template Signnow

3 12 154 Unemployment Tax Returns Internal Revenue Service

3 12 154 Unemployment Tax Returns Internal Revenue Service

2020 Nj Form Ptr 1 Fill Online Printable Fillable Blank Pdffiller

2020 Nj Form Ptr 1 Fill Online Printable Fillable Blank Pdffiller

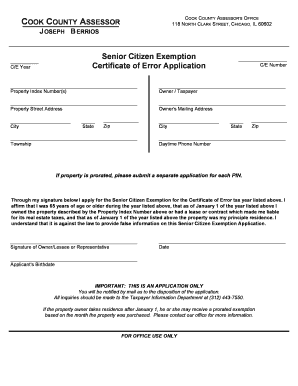

Cook County Senior Exemption Form Fill Out And Sign Printable Pdf Template Signnow

Cook County Senior Exemption Form Fill Out And Sign Printable Pdf Template Signnow

Nj Division Of Taxation Nj Division Of Taxation Senior Freeze Property Tax Reimbursement

Nj Division Of Taxation Nj Division Of Taxation Senior Freeze Property Tax Reimbursement

Senior Freeze Hazlet Township Nj

Https Www Rockawaytownship Org 218 Property Tax Relief

Https Www State Nj Us Treasury Taxation Pdf Homestead Hownerappins Pdf

Ptr 1 Form Fill Online Printable Fillable Blank Pdffiller

Ptr 1 Form Fill Online Printable Fillable Blank Pdffiller

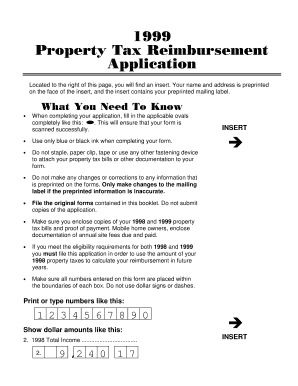

Http Www Lebanonboro Com Content Pdf Forms 2015 Property Tax Reimbursement Form Pdf

Hich Form To Use Form Ptr 1 Is For Applicants Who Are Filing For A Reimbursement The First Time Or Who Filed An Applicati Application Previous Year First Time

Hich Form To Use Form Ptr 1 Is For Applicants Who Are Filing For A Reimbursement The First Time Or Who Filed An Applicati Application Previous Year First Time

Tax Assessor Chester Township Nj

Tax Assessor Chester Township Nj

Mom S Senior Freeze Form Got Lost In The Mail What Can We Do Frozen Seniors Financial Planner

Mom S Senior Freeze Form Got Lost In The Mail What Can We Do Frozen Seniors Financial Planner

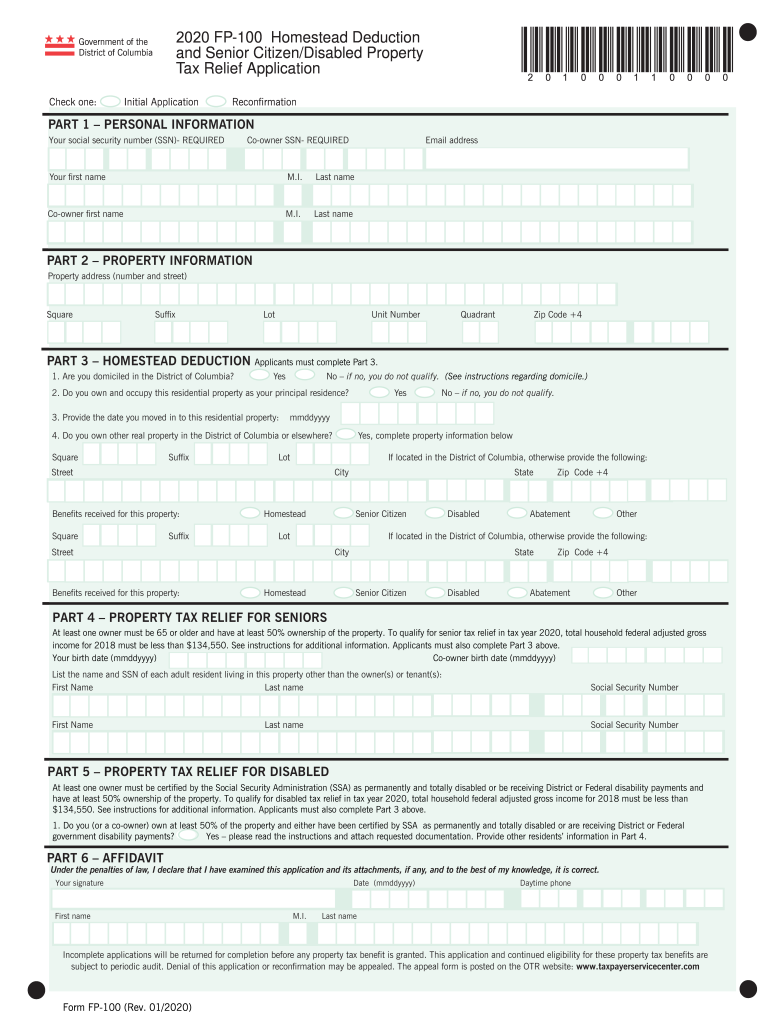

Dc Fp 100 2020 2021 Fill Out Tax Template Online Us Legal Forms

Dc Fp 100 2020 2021 Fill Out Tax Template Online Us Legal Forms

Publication 590 A 2018 Contributions To Individual Retirement Arrangements Ira Social Security Benefits Social Security Disability Benefits Social Security

Publication 590 A 2018 Contributions To Individual Retirement Arrangements Ira Social Security Benefits Social Security Disability Benefits Social Security

Senior Freeze Hazlet Township Nj

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home