Personal Property Tax Form Virginia

Browse our site or download our app for information on the County news alerts events Commission offices agencies taxes forms and more. DV Application for Lowered Vehicle Tax Rate.

Arizona Tax Forms 2020 Printable State Az Form 140 And Az Form 140 Instructions

Arizona Tax Forms 2020 Printable State Az Form 140 And Az Form 140 Instructions

If you need to order forms call Customer Services.

Personal property tax form virginia. In accordance with Virginia State Code 581-3518 it is the responsibility of every taxpayer who owns leases rents or borrows tangible personal property which is used or is available for use in a business and which is located in Hanover County as of January 1 to report such property on the annual Business Personal Property return. 8043678037 To purchase Virginia Package X copies of annual forms complete and mail the Package X order form. 2021 Form 762 Return of Tangible Personal Property Nahcinery and Tools and Merchants Capital FOR LOCAL TAXATION ONLY Author.

These documents are in PDF format. What You Need to Know about Virginias PPE Sales Tax Exemption for Businesses Read More Your 1099-G1099-INT. Although jurisdictions throughout Virginia levy a personal property tax many US.

Return of Tangible Personal Property Machinery and Tools and Merchants Capital - for local. Military Spouse Residency Affidavit. Schedule of Affiliated Corporations Consolidated and Combined Filers 760ES.

Online forms provide the option of submitting the form electronically to our office. If you have questions relating to any of our Personal Property forms please contact the Commissioner of the Revenues Office. Revenue collected from the personal property tax is used to fund services like police and fire protection and other services such as parks libraries and education.

The Official Site for Monroe County West Virginia. Personal Property Tax Forms. This department is responsible for assessing personal property business personal property and machinery and tools Each year Personal Property and Business Personal Property forms are due to be filed by May 1 and Machinery and Tools by March 1.

VA Estimated Income Tax Payment Vouchers and Instructions for Individuals 760F. Return of Tangible Personal Property Nahcinery and Tools and Merchants Capital FOR LOCAL TAXATION ONLY 2021 Form 762 Keywords. Instructions for Form 760C Underpayment of Virginia Estimated Tax by Individuals Estates and Trusts 500AC.

804-768-8649 Administration Individual Personal Property Income Tax Tax Relief 804-796-3236 Business License Business Tangible Personal Property Hours Monday - Friday 830 am. As a result some County residents may not be aware that a tax on personal property exists. The types of personal property to be taxed are personal vehicles business vehicles boats trailers motor homes campers airplanes.

The individual taxpayer must verify that the information on the form is correct fully. Disabled veterans personal property tax relief Affidavit for Exemption from Real Estate Taxes for Disabled Veterans Surviving Spouse Form Affidavit for Exemption from Real Estate Taxes for a. Personal Property taxes are assessed each year by the Commissioner of Revenues COR Office for all personal property garaged within the City of Virginia Beach.

Please mail filing form to. Each year the Commissioner mails to each city taxpayer around mid-February a tangible personal property return form listing the individuals personal property owned as of January 1 of the taxable year. Form Instructions for Virginia Consumers Use Tax Return for Individuals.

What You Need to Know Form 1099-G1099-INTs are now available. 40 rows Form Instructions for Virginia Consumers Use Tax Return for Individuals 770 Waiver. A 1099-INT may be issued by the City of Virginia Beach for this additional interest.

Use this form to report business personal property other than vehicles including furniture and fixtures machinery and tools and computer equipment. The Commissioner of Revenue administers the tangible personal property tax and the personal property tax relief. Instructions for completing the Business Personal Property Tax Filing are in the Business Personal Property Tax Brochure below.

41 rows Instructions for Form 760C Underpayment of Virginia Estimated Tax by Individuals Estates.

Browse Our Image Of Quit Claim Letter Template Quitclaim Deed Letter Templates Doctors Note Template

Browse Our Image Of Quit Claim Letter Template Quitclaim Deed Letter Templates Doctors Note Template

/ScreenShot2021-02-07at12.05.18PM-be978757a0b5431d8a4642626004cbb3.png) Schedule C Profit Or Loss From Business Definition

Schedule C Profit Or Loss From Business Definition

Free Business Expense Spreadsheet Small Business Tax Deductions Small Business Tax Business Tax Deductions

Free Business Expense Spreadsheet Small Business Tax Deductions Small Business Tax Business Tax Deductions

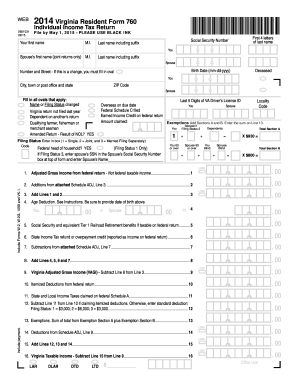

Form 760 Fill Out And Sign Printable Pdf Template Signnow

Form 760 Fill Out And Sign Printable Pdf Template Signnow

Real Estate Coaching The One Page Real Estate Business Plan Real Estate Business Plan Real Estate Agent Business Plan Real Estate Coaching

Real Estate Coaching The One Page Real Estate Business Plan Real Estate Business Plan Real Estate Agent Business Plan Real Estate Coaching

New Jersey Tax Forms 2020 Printable State Nj 1040 Form And Nj 1040 Instructions

New Jersey Tax Forms 2020 Printable State Nj 1040 Form And Nj 1040 Instructions

Reconciliation Agreement Legal Forms Invoice Template Word Reconciliation

Reconciliation Agreement Legal Forms Invoice Template Word Reconciliation

Maine Tax Forms And Instructions For 2020 Form 1040me

Maine Tax Forms And Instructions For 2020 Form 1040me

Rhode Island Tax Forms And Instructions For 2020 Form Ri 1040

Rhode Island Tax Forms And Instructions For 2020 Form Ri 1040

How To Fill Out Form 1065 Overview And Instructions Bench Accounting

How To Fill Out Form 1065 Overview And Instructions Bench Accounting

Small Business Tax Forms Block Advisors

Small Business Tax Forms Block Advisors

What Is Irs 1040ez Tax Form Tax Forms Income Tax Return Tax Refund Calculator

What Is Irs 1040ez Tax Form Tax Forms Income Tax Return Tax Refund Calculator

Scammers Are Sending Fake Tax Forms To Taxpayers Via Email

Scammers Are Sending Fake Tax Forms To Taxpayers Via Email

California Tax Forms 2020 Printable State Ca 540 Form And Ca 540 Instructions

California Tax Forms 2020 Printable State Ca 540 Form And Ca 540 Instructions

National Tax Reports 2020 2021 Tax Refund Free Tax Filing Irs Tax Forms

National Tax Reports 2020 2021 Tax Refund Free Tax Filing Irs Tax Forms

Property Taxes In America Property Tax Business Tax Tax

Property Taxes In America Property Tax Business Tax Tax

Free Florida Last Will And Testament Template Pdf Word Eforms Free Fillable Forms Will And Testament Last Will And Testament Obituaries Template

Free Florida Last Will And Testament Template Pdf Word Eforms Free Fillable Forms Will And Testament Last Will And Testament Obituaries Template

501 C 3 Bylawrequirements Loans Personal Loans Things To Sell Personal Loans Loan

501 C 3 Bylawrequirements Loans Personal Loans Things To Sell Personal Loans Loan

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home