Does Form 1098 Include Property Taxes

Form 1098-T Tuition Statement. What are 1098 forms.

Form 1099 S Substitute 2017 2018 Irs Forms Federal Taxes Estate Tax

Form 1099 S Substitute 2017 2018 Irs Forms Federal Taxes Estate Tax

On smaller devices click in the upper left-hand corner then click Federal.

Does form 1098 include property taxes. If you wish you may enter the name of the person for whom you collected the interest in box 10. Your mortgage lender might pay your real estate taxes from an escrow account. Any amounts shown should include a description such as.

If the loan is not secured by any real property you are not required to file Form 1098. If you pay your real property taxes by depositing money into an escrow account every month as part of your mortgage payment make sure you dont treat the entire payment as a property tax deduction. The principal and the interest plus taxes and insurance if your loan has an escrow account.

Enrolled Agency is issued by the Dept of Treasury to those who demonstrate knowledge of the tax code. We do however provide that information to you for informational. You must file this form even though you do not include the interest received in your income but you merely transfer it to another person.

Examine Box 4 on Form 1098. You can deduct up to 10000 or 5000 if married filing separately of state and local taxes including property taxes. Your lender uses this general information box to report information other than your mortgage interest to you.

The mortgage interest youve paid out over the past year. There are nearly 1000 forms related to federal income taxes and seven different types of 1098 forms. When you make a mortgage payment there are two figures that are added together to make up your monthly payment.

The IRS does not require us to report real estate taxes paid by you on Form 1098. If so theyll send you Form 1098. If this form shows any refund of overpaid interest do not reduce your deduction by the refund.

Form 1098 is the form used to record one of the big itemized deductions you have. Thats because the amount you must pay to an escrow account is. Your tuition statement gives you details about the educational expenses and gives you the opportunity to obtain tax.

Every year Rocket Mortgage is required to report Form 1098 the Mortgage Interest Statement to the Internal Revenue Service IRS for your mortgage and provide this statement to you. Form 1098-C Contribution for Motor Vehicles Boats and Airplanes. However the borrower may be entitled to a deduction for qualified residence interest such as in the case of a loan for a boat.

If Form 1098 reports real estate property taxes paid. However if a cash purchase is not financially possible include mortgage interest mortgage insurance if possible points which are often overlooked as well as property taxes as part of an itemized tax deduction on IRS Form 1098 provided the total exceeds the standard deduction for which you are eligible. But even if your lender handles your property tax payments that.

Generally only the amount that the bank or lender reports to the Internal Revenue Service IRS often noted on Form 1098 qualifies for the deduction. Forms that include 1098 in the title contain information about transactions youve made during a calendar year that could potentially affect your taxes when its time to file your return in the beginning of the next calendar year. This form can be used for charitable donations of a vehicle worth more than 500 to a tax-exempt organization.

Click Itemized or Standard Deductions in the Federal Quick QA Topics menu to. From within your TaxAct return Online or Desktop click Federal. Mortgage Interest Statement is an Internal Revenue Service IRS form that is used by taxpayers to report the amount of interest and related expenses paid on a mortgage during the tax.

Yes - if a real estate taxes paid amount was reported to you in Box 10 of your Form 1098 this represents the amount of real estate taxes you paid on your residence during the tax year which are claimable as an itemized deduction on your federal income tax return on Form 1040 Schedule A Itemized Deductions Line 6 Real estate taxes. This statement assists homeowners in filing their own tax forms required by the IRS particularly in helping to take advantage of home tax deductions. Regardless of why you may not have received a Form 1098 you typically can still deduct qualifying mortgage interest.

You might be familiar with tax documents like Form W-2 Form 1040 and Form 1099 if you recently paid education expenses youll receive IRS Form 1098-T Tuition Statement. If you bought a property with owner financing the seller might not file a Form 1098. The person for whom you collected the interest need not file Form 1098.

The bank then pays the taxes to the taxing agency when they become due. Home mortgage interest and points are generally reported to you on Form 1098 Mortgage Interest Statement by the financial institution to which you made the payments for the current tax year. The boat must have sleeping space cooking facilities and toilet facilities.

Deducting Property Taxes for Real Estate Where to Look. This form will report any real estate taxes you paid. If you take the mortgage interest write-off the form gives you and the government a record of how much interest you paid.

This form can be used to claim tuition expenses for post-secondary education. Property taxes that show up on a form 1098 are usually taxes that are paid from an escrow account into which the mortgagee pays on a monthly basis. The borrower must use the boat as a home.

Can You Claim Your Property Taxes On Your Income Tax Tips

Can You Claim Your Property Taxes On Your Income Tax Tips

What S My Property S Tax Identification Number

What S My Property S Tax Identification Number

Payment Schedule Template Sample

Payment Schedule Template Sample

Real Estate Property Tax Constitutional Tax Collector

Real Estate Property Tax Constitutional Tax Collector

Can You Claim Your Property Taxes On Your Income Tax Tips

Can You Claim Your Property Taxes On Your Income Tax Tips

The Property Tax Deduction Will Remain In The U S House Tax Reform Bill Ways And Means Committee Chairman Kevin Brady Tax Deductions Higher Income Income Tax

The Property Tax Deduction Will Remain In The U S House Tax Reform Bill Ways And Means Committee Chairman Kevin Brady Tax Deductions Higher Income Income Tax

What S My Property S Tax Identification Number

What S My Property S Tax Identification Number

/Clipboard01-f2dbf519c5934e4cb3d9baca6efe0ec7.jpg) Form 1099 Misc Miscellaneous Income Definition

Form 1099 Misc Miscellaneous Income Definition

Camp Registration Form Template Luxury Registration Forms In Pdf Registration Form Sample Registration Form Business Template

Camp Registration Form Template Luxury Registration Forms In Pdf Registration Form Sample Registration Form Business Template

A Guide To The 1098 Form And Your Taxes Turbotax Tax Tips Videos

A Guide To The 1098 Form And Your Taxes Turbotax Tax Tips Videos

What S My Property S Tax Identification Number

What S My Property S Tax Identification Number

Mortgage Interest Tax Deduction What You Need To Know

Mortgage Interest Tax Deduction What You Need To Know

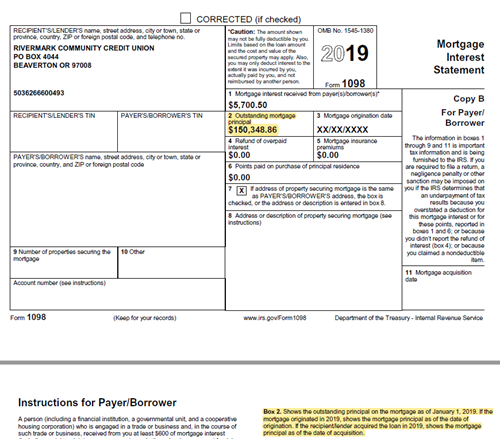

Why Does My Mortgage 1098 Have The Incorrect Outstanding Mortgage Principal Rivermark Community Credit Union

Why Does My Mortgage 1098 Have The Incorrect Outstanding Mortgage Principal Rivermark Community Credit Union

:max_bytes(150000):strip_icc()/Clipboard01-f2dbf519c5934e4cb3d9baca6efe0ec7.jpg) Form 1099 Misc Miscellaneous Income Definition

Form 1099 Misc Miscellaneous Income Definition

Can You Claim Your Property Taxes On Your Income Tax Tips

Can You Claim Your Property Taxes On Your Income Tax Tips

/getty-moneyhouse_1500_157590565-56a7269c5f9b58b7d0e757e3.jpg) How To Pay Your Property Tax Bill

How To Pay Your Property Tax Bill

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home