Property Tax Pay San Francisco

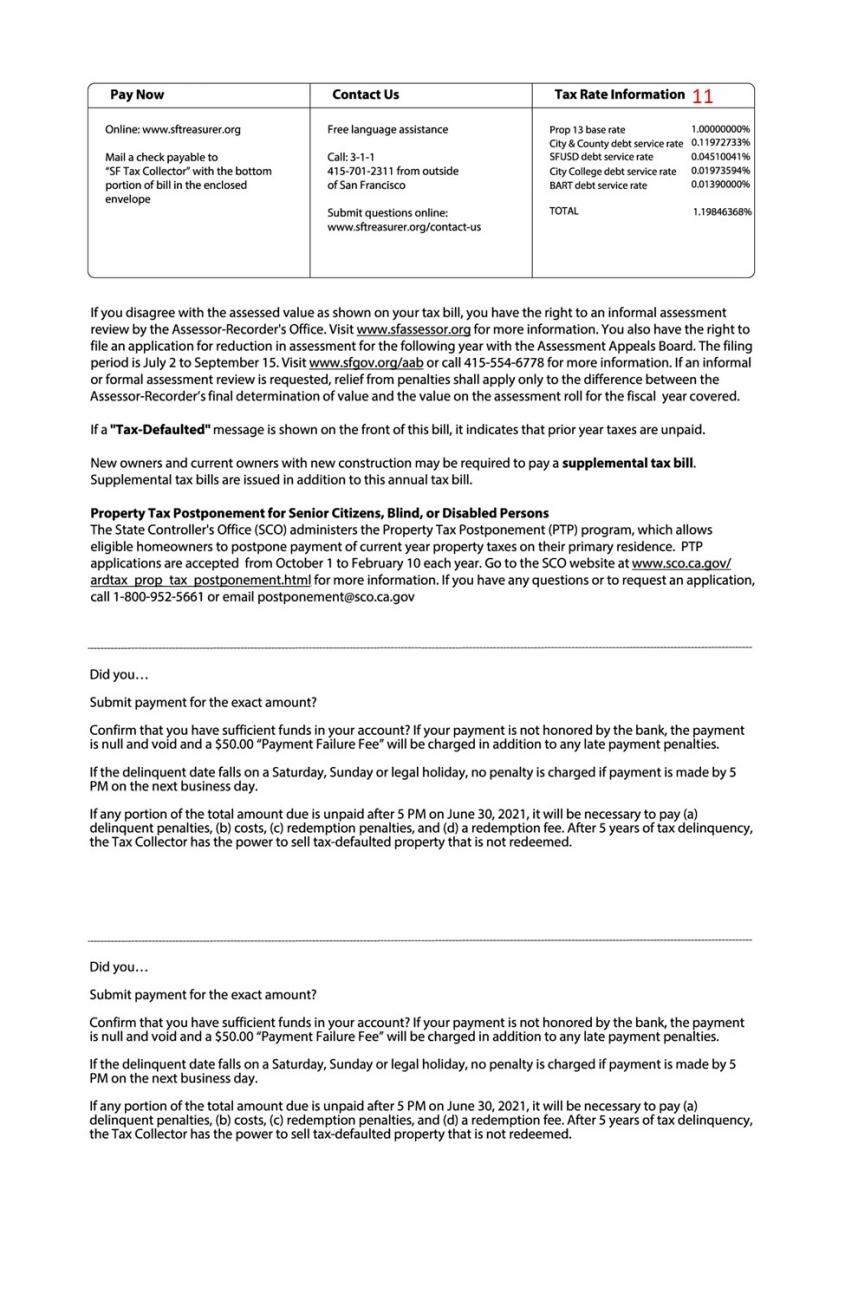

The tax rate changes every year. San Francisco taxes businesses based on gross receipts and payroll as well as business personal property like machinery equipment or fixtures.

A Michigan Man Underpaid His Property Taxes By 8 41 The County Seized His Property Sold Itand Kept The Profits Property Tax County Michigan

A Michigan Man Underpaid His Property Taxes By 8 41 The County Seized His Property Sold Itand Kept The Profits Property Tax County Michigan

View a property tax bill and make property taxes payments including paying online by mail or in-person.

Property tax pay san francisco. Payments made by credit card or debit card require a 239 processing fee paid to the payment processor with a minimum processing charge of. Please note that these offices are closed for lunch from 12 - 1pm everyday. The fastest way to process your Property Tax payment is online using the Taxes on the Web system.

Hotels parking or business personal property. Payments made by eCheck routing and account number from your checking or savings account required are made without an additional processing fee. For best search results enter your bill number or blocklot as shown on your bill.

The second installment is due on Feb. Complete and sign the Plan Request form. The secured property tax amount is based on the assessed value of the property as established annually by the Citys AssessorRecorder.

Property tax payments will be accepted per this schedule. You must either mail your payment or pay by credit card on our phone payment system at 619 696-9994 or 855 829-3773. San Francisco collects more than five billion dollars annually from property taxes and these funds go right back into the San Francisco community funding essential services like schools first responders and public hospitals.

Access and view your bill online learn about the different payment options and how to get assistance form. 1 and must be paid by Dec. And are closed all day for all Holidays.

Property owners pay secured property tax annually. Nonresidents who work in San Francisco also pay a local income tax of 150 the same as the local income tax paid by residents. Make a Property Tax Payment.

In order to determine the tax bill your local tax assessors office takes into account the propertys assessed value the current assessment rate as well as any tax exemptions or abatements for that property. Pay at least 20 of the total tax excluding delinquent penalties plus a 50 installment plan fee per parcel. The Property Tax Rate for the City and County of San Francisco is currently set at 11801 of the assessed value for 2019-20.

Treasurer-Tax Collector mails out original secured property tax bills. First installment of secured taxes is due and payable. Pay at least 20 of the total balance due plus a 50 installment plan set up fee.

City and County Tax Collector PO. The first installment of property taxes is due on December 10th 2020. 1 and delinquent after April 1.

If eligible a Redemption Installment Payment Plan Request form will be prepared and sent to you by email. A 10 penalty is added January 1. In-depth San Francisco County CA Property Tax Information.

View and pay a property tax bill online. Some of these measures include an exemption for seniors. The assessed value is initially set at the purchase price.

You may purchase duplicate tax bills for 1 at any Tax Collectors office. The Office of the Treasurer Tax Collector serves as the banker tax collector collection agent and investment officer for the City and County of San Francisco. Residents of San Francisco pay a flat city income tax of 150 on earned income in addition to the California income tax and the Federal income tax.

The first installment of property taxes is due and payable beginning on Nov. Property Tax Information Learn about the Citys property taxes. Some businesses may be required to pay additional taxes based on their business type eg.

2 Mail your payment. COVID-19 Tax Relief for Businesses The Board of Supervisors recently passed legislation that provides pandemic business tax relief to certain businesses that have gross receipts of. Box 7426 San Francisco CA 94120-7426.

The citizens of San Francisco approved measures to provide funding to the San Francisco Unified School District and City College of San Francisco. Ask to set up a payment plan by contacting the Property Tax division by submitting a 311 service request. Watch our instructional video on making an online property tax payment.

The Agreement form and payment can be submitted. Enter only the values not the words Block or Lot and include any leading zeros. First installment of secured taxes payment deadline.

Credit and Debit Card service fees are non-refundable and cover administrative costs associated with accepting payments online. Please have your payment postmarked on or before the delinquent date. Tax Lien date affects the upcoming fiscal year January.

Pay your tax bill online by electronic check eCheck with no service fee by entering in your checking account information. When is property tax due in county San Francisco.

Will County Announces Property Tax Relief Measures For 2020 Estate Tax Property Tax Tax Time

Will County Announces Property Tax Relief Measures For 2020 Estate Tax Property Tax Tax Time

Por Que El Renacimiento De Medellin Es Un Modelo De Exportacion Real Estate Buying Process Real Estate Guide Estate Tax

Por Que El Renacimiento De Medellin Es Un Modelo De Exportacion Real Estate Buying Process Real Estate Guide Estate Tax

Secured Property Taxes Treasurer Tax Collector

Secured Property Taxes Treasurer Tax Collector

Secured Property Taxes Treasurer Tax Collector

Secured Property Taxes Treasurer Tax Collector

Best Bare Knuckled Street Fight Victory San Francisco Association Of Realtors Transfer Tax Campaign Street Fights Fight Back Saw

Best Bare Knuckled Street Fight Victory San Francisco Association Of Realtors Transfer Tax Campaign Street Fights Fight Back Saw

California Public Records Public Records California Public

California Public Records Public Records California Public

Santa Clara County Wants Your Property Tax Payments On Time The California Retort Tax Payment Property Tax Santa Clara

Santa Clara County Wants Your Property Tax Payments On Time The California Retort Tax Payment Property Tax Santa Clara

Understanding California S Property Taxes

Understanding California S Property Taxes

California Property Tax Calendar Property Tax Home Ownership July 1

California Property Tax Calendar Property Tax Home Ownership July 1

Panama Real Estate Panama Legal Center Real Estate Estate Tax Estates

Panama Real Estate Panama Legal Center Real Estate Estate Tax Estates

Realtymonks One Stop Real Estate Blog Property Tax Municipal Corporation Increase Revenue

Realtymonks One Stop Real Estate Blog Property Tax Municipal Corporation Increase Revenue

Usa County Of Orange California Property Tax Bill Template In Word Format Bill Template Property Tax Bills

Usa County Of Orange California Property Tax Bill Template In Word Format Bill Template Property Tax Bills

Chicago Real Estate Attorney Get The Best Local Legal Advice Property Tax Chicago Real Estate Legal Advice

Chicago Real Estate Attorney Get The Best Local Legal Advice Property Tax Chicago Real Estate Legal Advice

For Sale 435 Broadway San Francisco Ca 9 750 000 View Details Map And Photos Of This Commercial Proper San Francisco Commercial Property Taxes History

For Sale 435 Broadway San Francisco Ca 9 750 000 View Details Map And Photos Of This Commercial Proper San Francisco Commercial Property Taxes History

Secured Property Taxes Treasurer Tax Collector

Secured Property Taxes Treasurer Tax Collector

Really Rich Real Estate San Francisco S Five Most Expensive Property Tax Bills Luxury Mansions Interior Beautiful Homes Expensive Houses

Really Rich Real Estate San Francisco S Five Most Expensive Property Tax Bills Luxury Mansions Interior Beautiful Homes Expensive Houses

Labels: property

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home