Property Tax Rate Tulsa County

The County Assessors only function is assessment of property. 6th St 8th Floor Tulsa OK 74119-1004.

Tulsa County Web Site Tulsa Oklahoma

The countys average effective property tax rate of 113 is above both the state average of 087 and the national average of 107.

Property tax rate tulsa county. In 2019 total mill rates in Tulsa County ranged from a low of about 61 mills to a high of about 132 mills. Tulsa County Treasurer 218 W. In-depth Tulsa County OK Property Tax Information.

Taxes may be paid in one full payment or two half payments. 6th St 5th Floor Tulsa OK 74119-1004 Website Purpose of the County Assessor. To make a payment in person either come to the Tulsa County Treasurers Office 8th Floor or pay at one of the remote bank locations shown on the link Tax Collection Sites.

918 596-5100 Fax. The median property tax on a 12620000 house is 133772 in Tulsa County. The following link will take you to a PDF version of the Ad Valorem Property Taxes in Tulsa County OK guide prepared by the Tulsa County Assessors Office.

If the due date falls on a weekend or holiday where the Tulsa County Courthouse is closed. Fothergill Tulsa County Treasurer Tulsa Oklahoma. IMPORTANT NOTICE The Tulsa County Assessors Office has moved.

Certain Tulsa County properties lie within special assessment districts drainage EMS fire etc. Tulsa County Treasurers Office Treasurer John M. Yearly median tax in Tulsa County.

County Properties for Sale. Tulsa County Headquarters 5th floor 218 W Sixth St Tulsa OK 74119. Tulsa County Assessor Tulsa County Court House 218 W.

The median property tax also known as real estate tax in Tulsa County is 134400 per year based on a median home value of 12620000 and a median effective property tax rate of 106 of property value. Wright Tulsa County Assessor Tulsa County Headquarters 5th floor 218 W Sixth St Tulsa OK 74119 Phone. The Tulsa County Tax Assessor is the local official who is responsible for assessing the taxable value of all properties within Tulsa County and may establish the amount of tax due on that property based on the fair market value appraisal.

Enter 15 digit Tax Roll like. Tax Roll Item Number. Family Safety Center.

Ad Valorem Property Taxes guide PDF John A. Oklahoma is ranked 972nd of the 3143 counties in the United States in order of the median amount of property taxes collected. The median property tax on a 12620000 house is 132510 in the United States.

9185965071 Search by Tax Roll or Parcel Number. Enter 14 digit Parcel Number like. We are now located at Tulsa County Headquarters 5th floor 218 W.

Doing Business with Tulsa County. 918 596-4799 Email. 6th St 8th Floor.

At least one half of the tax must be paid before January 1. The median property tax on a 12620000 house is 93388 in Oklahoma. To make a payment by phone call 18883791062.

This calculator can only provide you with a rough estimate of your tax liabilities based on the property taxes collected on similar homes in Tulsa County. Publication of tax liens for unpaid taxes and or special assessments. The median property tax in Tulsa County Oklahoma is 1344 per year for a home worth the median value of 126200.

Wright Tulsa County Assessor. By Title 68 Section 2815 of the Ad Valorem Tax code The County Assessor shall take an oath that she will assess all property as provided by law. These districts function independent of the Tulsa County Assessors Office though the assessment amounts may be included in the county property tax bill you receive from the Tulsa County Treasurer.

In order to determine the tax bill your local tax assessors office takes into account the propertys assessed value the current assessment rate as well as any tax exemptions or abatements for that property. Tulsa County collects on average 106 of a propertys assessed fair market value as property tax. Tulsa County Assessors Office Services.

Tulsa Countys appraisal system is based on modern sound and nationally accepted appraisal principles and methods. The Assessors office does not set your tax rate or collect taxes. Sixth St Tulsa OK 74119.

Neither the Tulsa County Treasurer nor Tulsa County receives any portion of the convenience fees.

Tulsa Real Estate Market Trends And Forecasts 2020

Hallway To Bonds Window In Tulsa County Jail County Jail Jail Tulsa

Hallway To Bonds Window In Tulsa County Jail County Jail Jail Tulsa

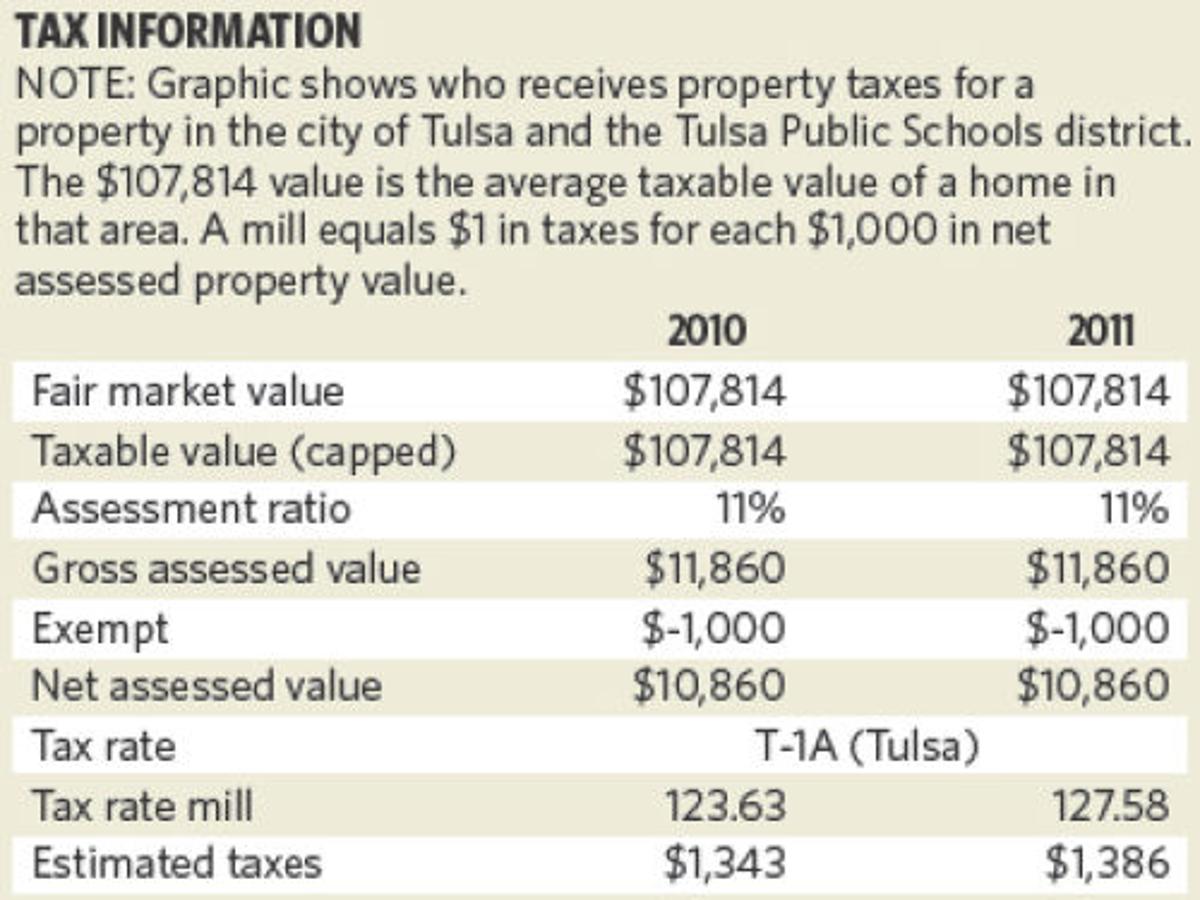

Property Taxes 101 Getting Past Some Of The Confusion Govt And Politics Tulsaworld Com

Property Taxes 101 Getting Past Some Of The Confusion Govt And Politics Tulsaworld Com

Https Www Assessor Tulsacounty Org Pdfs Property Taxation 102 Pdf

Https Www Assessor Tulsacounty Org Pdfs Property Taxation 102 Pdf

Https Www Assessor Tulsacounty Org Pdfs Property Taxation 102 Pdf

2021 Best Tulsa Area Suburbs To Buy A House Niche

2021 Best Tulsa Area Suburbs To Buy A House Niche

Https Www Assessor Tulsacounty Org Pdfs Property Taxation 102 Pdf

House Hunters Nb Specializes In New Braunfels Tx Homes Real Estate And Property Listings House Hunters New Braunfels Real Estate

House Hunters Nb Specializes In New Braunfels Tx Homes Real Estate And Property Listings House Hunters New Braunfels Real Estate

A Great Property Tax Primer By The Tulsa World Stateimpact Oklahoma

Tulsa Office Real Estate Tightens Up Slightly Real Estate Estates Office

Tulsa Office Real Estate Tightens Up Slightly Real Estate Estates Office

Taxes Broken Arrow Ok Economic Development

Http Www Assessor Tulsacounty Org Pdfs Property Taxation 101 Pdf

Oklahoma Property Tax Calculator Smartasset

Oklahoma Property Tax Calculator Smartasset

Oklahoma Property Tax Calculator Smartasset

Oklahoma Property Tax Calculator Smartasset

Utility Submetering Systems Or Rubs Allocation For New And Existing Properties Dependable Monthly Billing With Optional Pay Payment Processing Finance Payment

Utility Submetering Systems Or Rubs Allocation For New And Existing Properties Dependable Monthly Billing With Optional Pay Payment Processing Finance Payment

Most Expensive States To Live In The Us Map Cheapest Places To Live Infographic Map

Most Expensive States To Live In The Us Map Cheapest Places To Live Infographic Map

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home