Fairborn Ohio Property Tax Rate

The minimum combined 2021 sales tax rate for Fairborn Ohio is. Property tax in Fairborn Ohio almost always takes the form of a tax levied on the appraised value of the property in question.

Home Loans By Carlos Scarpero On Twitter Ohio Real Estate Dayton Ohio Dayton

Home Loans By Carlos Scarpero On Twitter Ohio Real Estate Dayton Ohio Dayton

Use our free directory to instantly connect with verified Property Tax attorneys.

Fairborn ohio property tax rate. Fairborns income tax rate is currently 15. The County sales tax rate is. This is the effective tax rate.

From Date Thru Date Tax Rate Credit Factor Tax Credit Credit Rate Credit Limit 01012021. Tax amount varies by county. Tax rates and reduction factors.

Promote a Business Friendly Environment. Compare the best Property Tax lawyers near Fairborn OH today. If multiple properties are found a list of parcels will be displayed.

Residents of Fairborn who do not have. Ohio is ranked number twenty two out of the fifty states in order of the average amount of property taxes collected. Section 5719042 of the Ohio Revised Code states that at the time of the bid for said contract was submitted said bidder _____ charged with delinquent property was was not taxes on the General Tax list of personal property of a county in which the City of Fairborn.

The average property tax on Ironwood Dr is 1593yr and the average house or building was built in 1958. Range from 02 to around 5 of the propertys value. The average price for real estate on Ironwood Dr is 28947.

Unofficial results from the Ohio Secretary of States office show 176 million ballots cast from Ohios 777 million registered voters in. The Ohio sales tax rate is currently. The Fairborn sales tax rate is.

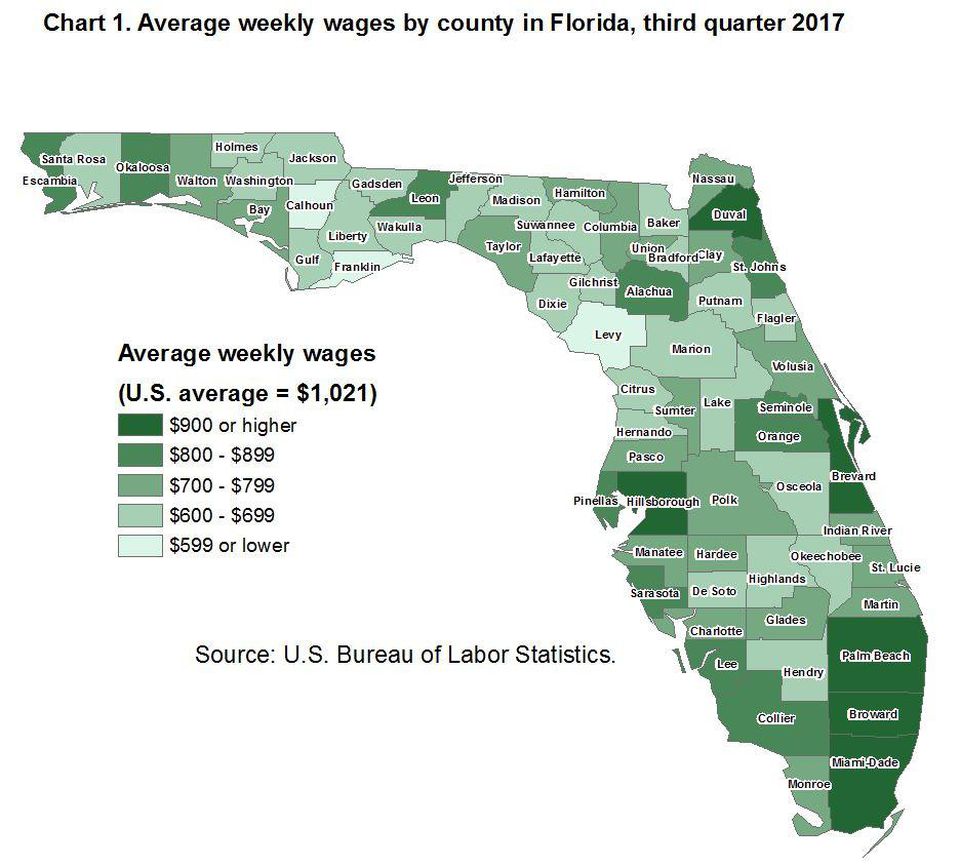

How Property Tax is Calculated in Fairborn Ohio. Property transfer and conveyances. We are available to assist with resources for incentive packages property and land information statistical data and training and networking opportunities.

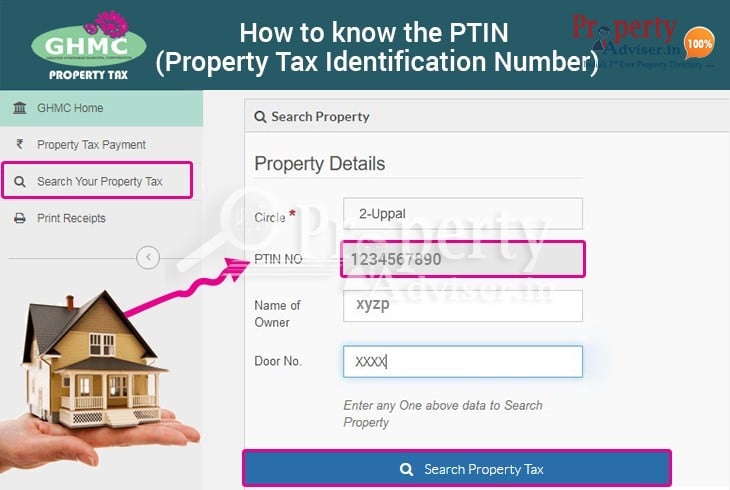

Clicking on the Parcel ID number for a specific parcel will display its real estate information. Property tax rates in the US. If a single property is found real estate information about that parcel will be displayed immediately within this window.

We found 151 address and 151 property on Ironwood Dr in Fairborn OH. Partial or full credit can be given to residents paying Municipal Income Taxes to a different municipality where they work. As of January 2021 208 school districts impose an income tax.

Hebble Avenue Fairborn OH 45324 937 754-3030 Â 2018 City of Fairborn Login Powered by The Government Website Experts SHARE. Property taxes are collected nearly exclusively by state county and local governments. And Ohio Revised Code 72949 Sidewalk Curb and Driveway Approach.

1258 The property tax rate shown here is the rate per 1000 of home value. Hebble Avenue Fairborn OH 45324 937 754-3030. Greene County Property Search.

The median property tax in Ohio is 183600 per year for a home worth the median value of 13460000. To levy this tax Fairborn Ohio tax authorities must first figure. We are working to.

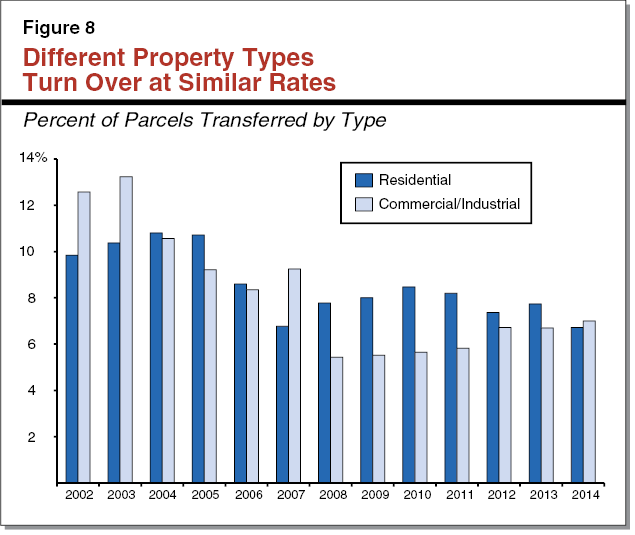

May 2021 Property Tax Levies Understanding Property Taxes in Ohio. The HB 920 reduction factor mandated by Ohio law is designed to keep tax revenues stable when property values increase or decrease The factor that prevented taxes from dramatically increasing when property values were on the rise will also keep taxes from significantly decreasing despite declining property. 136 of home value.

Beavercreek - None Bellbrook - None Bradford - 100 Brookville - 200 Cedarville - 125 Centerville - 225 Covington - 150 Dayton - 250 Englewood - 175 Enon - None Fairborn - 200 Farmersville - 100. Years from the City of Fairborn. The income tax rate for the City of Fairborn is currently 2.

Ohio school districts may enact a school district income tax with voter approval. The City of Fairborn levies a tax on salaries wages commissions and other compensation as well as on net profits from business operations and rental activities. This is the total of state county and city sales tax rates.

PROPERTY TAX ASSESSMENTS The following is a list of items and the corresponding City Ordinance and Ohio Revised Code ORC. Counties in Ohio collect an average of 136 of a propertys assesed fair market value as property tax per year. That could potentially be assessed.

For real estate inquiries contact the department at 937 562-5072 or view the resources online for more information. The Ohio school district income tax generates revenue to support school districts who levy the tax. Property Tax Rate.

The Income Tax Rates are. This tax is in addition to and separate from any federal state and city income or property taxes. Water Sewer and Trash Charges City Ordinances 91304 91504 and 91708.

If the tax rate is 1400 and the home value is 250000 the property tax would be 1400 x 2500001000 or 3500.

Read more »