Floor Rate Of Property Tax Meaning

Some municipalities use the term millage rate or mill rate when they refer to the property tax rate. Net property tax Rs 3600.

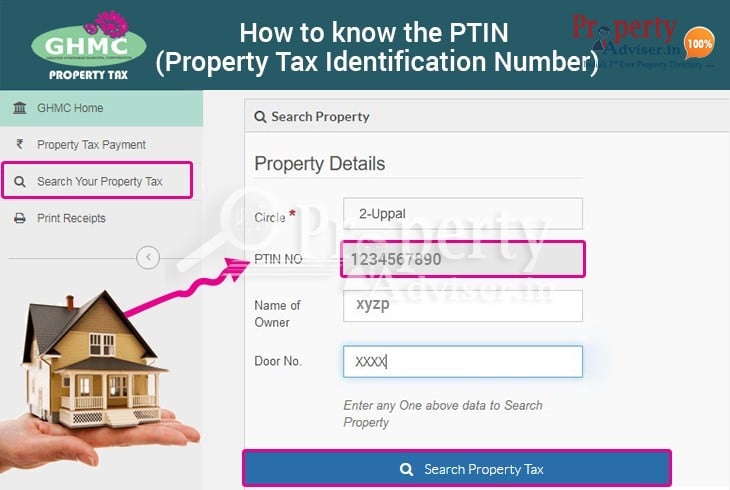

Now Get Your Ghmc Property Tax Search Details By Door Number In Hyderabad

Now Get Your Ghmc Property Tax Search Details By Door Number In Hyderabad

The different boards councils and legislatures meet to decide the appropriate rates.

Floor rate of property tax meaning. Property tax Annual value x Rate of tax as mentioned above in category B tax rate 30000 x 12 Rs 3600. If it is F G or H category you will have to pay a tax of 7. An interest rate floor is an agreed-upon rate in the lower range of rates associated with a floating rate loan product.

Property tax Annual value x Rate of tax. But in order to keep US. On May 21 2008 the Governor signed legislation that amended Real Property Tax law Article 7 Title 1-A Section 738 changing the definition of the residential assessment ratio.

Property taxes are a major source of income for city and county governments. Previously the media ratio of residential sales compared to assessed values was calculated to determine the RAR. Property tax base value built-up area Age factor type of building category of use floor factor.

Yellen is lobbying for other countries to commit to a tax floor. One mill is equal to one one-thousandth of a dollaror 1 for every 1000of property value. The GCC takes the following factors into consideration while assessing property tax.

The rate of tax is the percentage of tax levied on the total value of your property. An interest rate floor is a series of European put options or floorlets on a specified reference rate usually LIBOR. There is a 30 floor so the actual assessment is generally the greater of the actual True Tax Value calculated from the pooling schedule or the 30 of cost calculation.

Property tax in Chennai. If your home is an A or B category residential property you will pay a property tax of 12. While a base tax changes the amount of taxes paid for a specific property a base tax does.

The amount owners owe in property tax is determined by multiplying the property tax rate by the current market value of the lands in question. However there were several legislative changes in 2014 including the creation of a enhanced abatement. If your home is a category C D or E residential property you will have to pay 11 in tax.

Rate of Tax. Most taxing authorities will recalculate the tax rate. Assessment rates or floor rates arent known to the general public so it can be very easy for applicants to fail the banks serviceability test.

Base Tax Taxable Assessment X Municipal Mill Rate X Mill Rate Factor 1000 Municipal Taxes. Rebates on property tax in Delhi. The buyer of the floor receives money if on the maturity of any of the floorlets the reference rate is below the agreed strike price of the floor.

Division of GHMC into Zones GHMC is divided into the following Taxation Zones for the Assessment of Property Tax. The Greater Chennai Corporation GCC adopts the system of Reasonable Letting Value RLV for calculating the annual rental value of a property. Key Takeaways Mill rate is a tax ratethe amount of tax payable per dollar of the assessed value of a property.

The MCD offers rebates on some property tax payments. Bidens 2 trillion infrastructure package requires higher corporate taxes. Rate of Property Tax Property tax is levied 30 on Annual Rental value ARV of Non residential buildings.

Mill is derived from the Latin word millesimum meaning thousandth. With changes announced last year some banks are now using a floor assessement rate. Thats because banks dont advertise them.

Property tax in India depends on the location of a property in question with taxes varying from state to state. Interest rate collars and reverse collars. The municipal portion of the property tax bill is calculated as.

Where Annual value Unit area value per sq metre x Unit area of property x Age factor x Use factor x Structure factor x Occupancy factor. Interest rate floors are utilized in derivative contracts and loan.

Ghmc Property Tax Hyderabad Rate Calculation Payment Housing News

Ghmc Property Tax Hyderabad Rate Calculation Payment Housing News

Property Tax Chennai Online Calculator And Payment Guide

Property Tax Chennai Online Calculator And Payment Guide

Property Taxes By State Why We Should All Embrace Higher Property Taxes

Property Taxes By State Why We Should All Embrace Higher Property Taxes

Ghmc Property Tax Hyderabad Rate Calculation Payment Housing News

Ghmc Property Tax Hyderabad Rate Calculation Payment Housing News

Ghmc Property Tax Hyderabad Rate Calculation Payment Housing News

Ghmc Property Tax Hyderabad Rate Calculation Payment Housing News

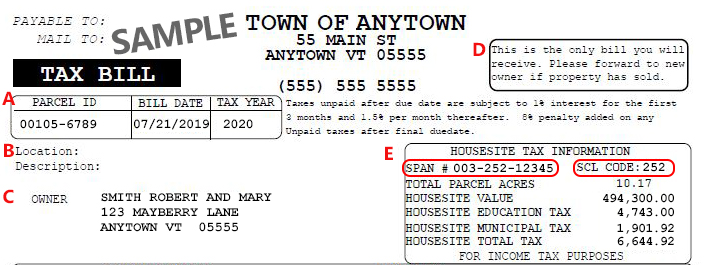

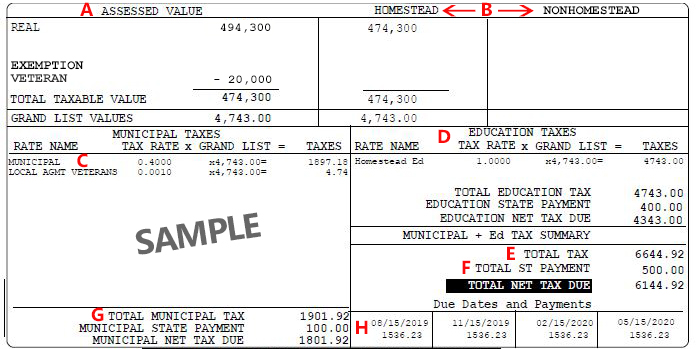

Understanding Your Property Tax Bill Department Of Taxes

Understanding Your Property Tax Bill Department Of Taxes

Business Personal Property Tax How To Maximize Your Efficiency

Business Personal Property Tax How To Maximize Your Efficiency

Property Tax Chennai Online Calculator And Payment Guide

Property Tax Chennai Online Calculator And Payment Guide

Property Taxes By State Why We Should All Embrace Higher Property Taxes

Property Taxes By State Why We Should All Embrace Higher Property Taxes

Property Taxes By State Why We Should All Embrace Higher Property Taxes

Property Taxes By State Why We Should All Embrace Higher Property Taxes

Property Tax Chennai Online Calculator And Payment Guide

Property Tax Chennai Online Calculator And Payment Guide

Pay Property Tax In Mumbai Bmc And Mcgm Step Wise Procedure

Pay Property Tax In Mumbai Bmc And Mcgm Step Wise Procedure

How Your Property Tax Is Calculated Youtube

How Your Property Tax Is Calculated Youtube

Property Tax Chennai Online Calculator And Payment Guide

Property Tax Chennai Online Calculator And Payment Guide

Ghmc Property Tax Hyderabad Rate Calculation Payment Housing News

Ghmc Property Tax Hyderabad Rate Calculation Payment Housing News

Ghmc Property Tax Hyderabad Rate Calculation Payment Housing News

Ghmc Property Tax Hyderabad Rate Calculation Payment Housing News

Property Tax Chennai Online Calculator And Payment Guide

Property Tax Chennai Online Calculator And Payment Guide

Understanding Your Property Tax Bill Department Of Taxes

Understanding Your Property Tax Bill Department Of Taxes

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home