Do Property Taxes Increase When You Refinance

When an investment property is refinanced the interest rate on the new loan is typically lower than it is on the original loan. Instead of being considered income a cash-out refinance is simply a loan.

How To Increase The Roi Of Your Real Estate Investment Portfolio Epic Real Es Real Estate Investing Real Estate Investing Rental Property Real Estate Rentals

How To Increase The Roi Of Your Real Estate Investment Portfolio Epic Real Es Real Estate Investing Real Estate Investing Rental Property Real Estate Rentals

However you can claim this deduction every year until your loan matures.

Do property taxes increase when you refinance. Tax Implications of Cash-Out Refinancing. Depending on how you spend the money from a cash-out refinance you might even be eligible for a tax. These changes depend on the tax collector specific.

It does not matter how many times the house sells or is refinanced in those 5 years the value stays the same for property tax purposes. Refinancing in and of itself and the vast majority of the time does not cause your property taxes to increase in California. On the bright side youve only paid 7500 in tax to eliminate 70000 in.

The cash you collect from a cash-out refinancing isnt considered income. Expenses you must pay to obtain title to your home are added to the homes tax basis. For example if you spent 15000 on closing costs for a 15-year refinance youd deduct 1000 a year until your loan matures.

When you use the funds from a cash-out refinance to repair or replace components of your house the assessor usually doesnt change your property taxes. The taxes only go up or down during the 5 years if there are changes to the Grand List which than in turn changes the. You can also take money out of your accumulated equity using a cash-out refinance or home equity loan.

The only way that you can connect the refinance process to your property tax amount is as a type of forecast. If you refinanced your mortgage in 2020 there are some specific dos and donts you need to know prior to filing your income taxes as well as a few pointers that might help you lower your tax bite. Therefore you dont need to pay taxes on that cash.

If you use a cash-out refi to add onto your. Is there some law or state rule in California that says the property taxes have to be paid before a refinance. But as you prepare to refinance youre likely doing it alone.

Your property taxes will only go up if your rate or assessment amount increases and refinancing your home including the appraisal does not impact either of these numbers. If you add a new bathroom onto your home for instance that will increase the square footage and with it the assessed value of your home. When you purchased your home its likely you had a real estate agent holding your hand throughout the process helping you navigate things like home insurance closing costs inspections appraisals and more.

If your home is assessed at 300000 and your tax rate is 3 percent youll pay 9000 a year in property tax. However only property tax payments that you or the mortgage servicer. At the 15 percent maximum capital gains rates your tax will be 7500 which youll have to get from other sources.

Expenses Added to Basis. Tax rules for cash-out refinancing. In addition to the mortgage payments you must also pay property taxes.

When you buy a home to live in the only expenses you may deduct for income tax purposes are those for prepayment of interest or any points you pay to obtain a loan. 324 Sir Francis Drake Blvd San Anselmo CA 94960. To be tax-deductable mortgage debt must have been used to buy build or improve your home or second home.

Theres a special wrinkle that affects cash-out refinancing though. If youre refinancing to make changes to your home you could see an increase in your property taxes based solely on the work you do. Many investment property owners refinance to make improvements to their properties increasing both rental and market values.

If you finalize your refinancing on or near the date that your property taxes are due you may end up paying those taxes at the closing. So if you do a cash-out refinance and use the funds for some other purpose than home repairs or improvement theyre no longer. The following information will help to reduce your federal income taxes and get you prepared for mortgage-related tax issues in 2020 and beyond.

Its normal to have questions about these things. You would only be able to deduct 500 per year from your federal taxes. If thats the case you may be able to deduct the property taxes paid during a refinance on your next income tax return.

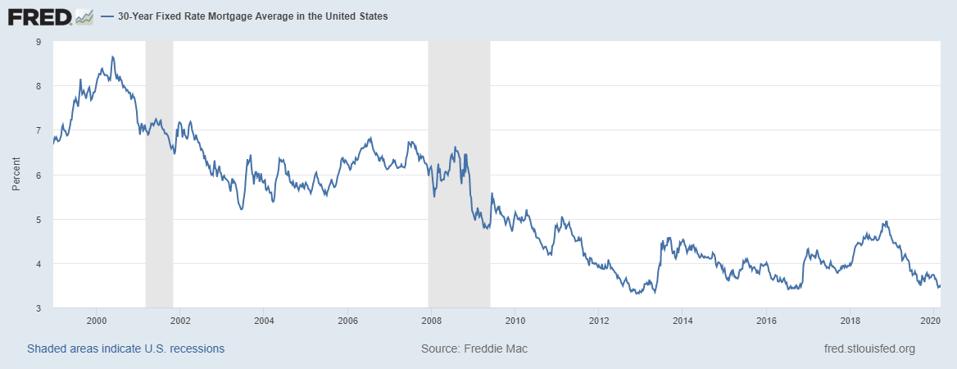

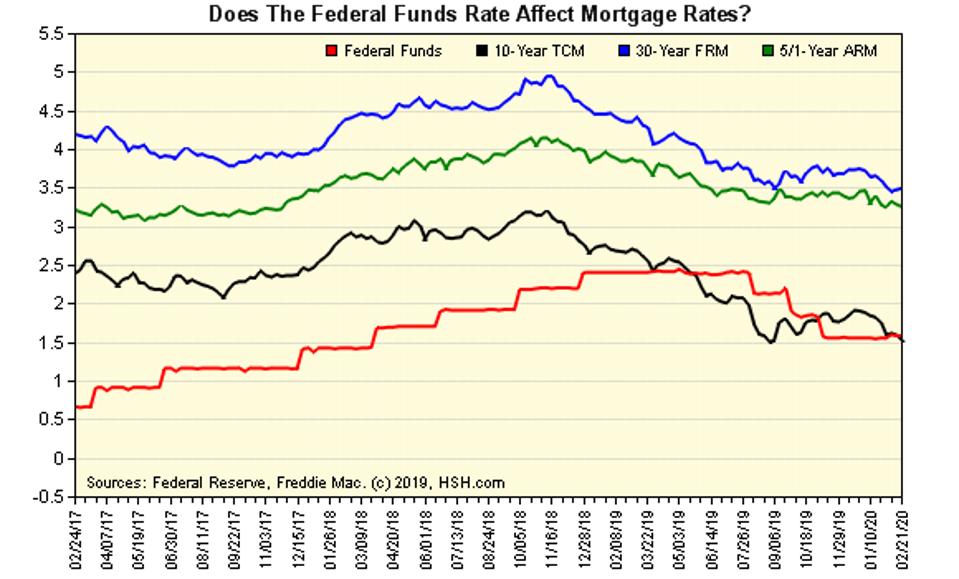

Over time your property tax bill will change most likely increasing. The lower interest rate on the new loan will result in less interest overall which means the interest deduction will be lower and the owner will ultimately have to pay more taxes. When you refinance you may be able to secure a lower interest rate or change the terms of your loan.

The same rules apply for closing costs on a rental property refinance. This means the expenses will increase the value of the home for tax. The taxes are not due until December 10th but the lender wants me to either pay them to the county now before closing or pay the amount in to the lender at closing so I assume they can pay them.

Complete List Of Mortgage Application Documents Hsh Com Refinance Mortgage Mortgage Tips Mortgage Loans

Complete List Of Mortgage Application Documents Hsh Com Refinance Mortgage Mortgage Tips Mortgage Loans

How Much House Can I Afford Insider Tips And Home Affordability Calculator Mortgage Payment Calculator Mortgage Free Mortgage Calculator

How Much House Can I Afford Insider Tips And Home Affordability Calculator Mortgage Payment Calculator Mortgage Free Mortgage Calculator

With Mortgage Rates So Low Is Now A Good Time To Refinance

With Mortgage Rates So Low Is Now A Good Time To Refinance

Reader Question Should I Refinance My Student Loans Refinance Student Loans Student Loans Refinancing Student Loans

Reader Question Should I Refinance My Student Loans Refinance Student Loans Student Loans Refinancing Student Loans

Ebook Buy Rehab Rent Refinance Repeat The Brrrr Rental Property Investment Strategy Made Simple Rental Property Investment Investing Investment Property

Ebook Buy Rehab Rent Refinance Repeat The Brrrr Rental Property Investment Strategy Made Simple Rental Property Investment Investing Investment Property

Infographic What Do Mortgage Lenders Look For When Approving A Home Loan Thinking About Buying A House While Idl Home Loans Mortgage Lenders Mortgage Loans

Infographic What Do Mortgage Lenders Look For When Approving A Home Loan Thinking About Buying A House While Idl Home Loans Mortgage Lenders Mortgage Loans

Your Interest Rate Matters Nmls 1467435 Home Refinance Mortgage Lenders Mortgage Companies

Your Interest Rate Matters Nmls 1467435 Home Refinance Mortgage Lenders Mortgage Companies

10 Ways To Pay Off Your Mortgage Early Pay Off Mortgage Early Mortgage Payoff Mortgage Tips

10 Ways To Pay Off Your Mortgage Early Pay Off Mortgage Early Mortgage Payoff Mortgage Tips

Is It A Good Idea To Prepay Property Taxes Embrace Home Loans

Is It A Good Idea To Prepay Property Taxes Embrace Home Loans

Should You Be Charging Sales Tax On Your Online Store Commercial Rental Property Rental Property Investment Investment Property

Should You Be Charging Sales Tax On Your Online Store Commercial Rental Property Rental Property Investment Investment Property

Brrrr Strategy For Real Estate Investing A Complete Guide Fearless Frankie Real Estate Investing Investing Investing Strategy

Brrrr Strategy For Real Estate Investing A Complete Guide Fearless Frankie Real Estate Investing Investing Investing Strategy

Should You Rent Or Sell Your House Real Estate Rentals Refinance Mortgage Selling Your House

Should You Rent Or Sell Your House Real Estate Rentals Refinance Mortgage Selling Your House

Have You Ever Thought Your Property Taxes Were Too High As It Turns Out You Can Fight Them And Win Here S How I Property Tax Saving Money Refinance Mortgage

Have You Ever Thought Your Property Taxes Were Too High As It Turns Out You Can Fight Them And Win Here S How I Property Tax Saving Money Refinance Mortgage

Why You Shouldn T Impound Your Property Tax Insurance

Why You Shouldn T Impound Your Property Tax Insurance

7 Things A First Time Home Buyer Should Do Before Starting A Home Search Nmls 1467435 First Time Home Buyers Home Refinance Get Educated

7 Things A First Time Home Buyer Should Do Before Starting A Home Search Nmls 1467435 First Time Home Buyers Home Refinance Get Educated

Rhonda Quillin Realtor At Exp Realty League City Tx Surrounding Areas Real Estate Homes For Sale Home Ownership Real Estate Home Buying

Rhonda Quillin Realtor At Exp Realty League City Tx Surrounding Areas Real Estate Homes For Sale Home Ownership Real Estate Home Buying

Preparing For A Refinance Mortgage Mortgage Tool Reverse Mortgage Mortgage Loans Refinancing Mortgage

Preparing For A Refinance Mortgage Mortgage Tool Reverse Mortgage Mortgage Loans Refinancing Mortgage

With Mortgage Rates So Low Is Now A Good Time To Refinance

With Mortgage Rates So Low Is Now A Good Time To Refinance

Just As You Want To Put Your Best Financial Foot Forward When Applying For A Mor Refinance House Wat Refinance Mortgage Mortgage Loans Refinancing Mortgage

Just As You Want To Put Your Best Financial Foot Forward When Applying For A Mor Refinance House Wat Refinance Mortgage Mortgage Loans Refinancing Mortgage

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home