Can I Claim My Son's Rent As A Tax Deduction

The Internal Revenue Service allows you to take a tax deduction for anyone who meets the definition of a qualifying relative and you may be able to deduct some of the expenses you pay for them in addition to claiming them as a dependent. Meanwhile homeowners are allowed to deduct mortgage interest costs along with related expenses as an itemized deduction on their federal tax returns which can in some cases lower a homeowners tax liability considerably.

Tax Deductions For Landlords What Are They And How Do You Get Them Legal Templates

Tax Deductions For Landlords What Are They And How Do You Get Them Legal Templates

The tax benefit for a disabled dependent is also in the fact that you can claim him as your.

Can i claim my son's rent as a tax deduction. If youre an employee and required to have a home office as a condition of your employment a portion of your monthly rent can be included on your tax return as an Employment Expense. If the student cant be claimed as a dependent by someone else the student gets to claim his own college tax deduction and therefore gets to take the education credit. You can deduct up to 4000 a year for tuition and related fees for yourself your spouse or your tax dependent.

Amounts paid for condominium fees and advance payments such as a security deposit and last months rent do not constitute rent. However he must indicate on this tax return that he can be claimed as a dependent on someone elses return. Those who itemize their taxes can deduct up to 10000 worth of state and local property taxes they paid for real estate cars boats planes land and more.

To be a Qualifying Child -. Your son can also file his tax return and receive a refund of the taxes withheld. There are two tax benefits for claiming a disabled dependent.

A student you claim as a dependent on your return or. If your student made less than the standard deduction amount 12400 in 2020 they are not required to file their own tax return and you do not have to claim their income as a parent. Are allocated between rental and personal use.

Just like utilities your deduction for rent. When a vacation home is rented expenses such as mortgage interest real estate taxes etc. Even if someone else such as a parent is paying the costs directly to the school the IRS treats the parent as making a gift to the son and then the son paying the expenses.

To be considered permanently and totally disabled by the Internal Revenue Service the person you claim must not be able to do any substantial gainful activity and a doctor must decide the condition must be expected to last for at least a year or end in death. Thats 4000 total not 4000 for each of you. This should not affect what you can and cant claim for college expenses.

Caring for a disabled adult might qualify for an extra tax benefit by claiming that person as a dependent on your return. Rental expenses may only be deducted to the. You can deduct his medical expenses and if your son is mentally or physically incapable of self-care you can claim child and dependent care credit if you paid any expenses to an individual so that you can work or go to school full time.

If you are self-employed and use your home for business purposes or meeting clients you can also claim a portion of your rent as a Business Use of Home expense. Although these deductions can drop your rental income to. Yes you can still claim your son as a dependent under the Qualifying Child rules.

A third party including relatives or friends. Only amounts paid specifically as rent can be taken as a deduction in addition to amounts paid for utilities furnishing and parking only if the landlord doesnt make separate charges for these items. There is no federal deduction or renters credit for rental payments made by a Michigan housing tenant to a landlord.

You can claim an education credit for qualified education expenses paid by cash check credit or debit card or paid with money from a loan. Although property tax is commonly considered a qualifying deduction for homeowners individuals assisting their parents with these taxes may not be able to deduct them unless they are listed on the. Although you cannot claim your childs apartment and dorm rental payments on your tax return there are educational credits you can claim that can increase your refund or reduce the amount you owe.

You can deduct rental expenses related to the home but only for the days you rented it to your daughter.

Rv Rental Tax Deductions Tax Deductions For Your Private Rv Rentals Rv Rental Income And Rv Rental Tax Deductions How To Report Rv Rental Income

Rv Rental Tax Deductions Tax Deductions For Your Private Rv Rentals Rv Rental Income And Rv Rental Tax Deductions How To Report Rv Rental Income

Renting Out Check Out How You Can Create The Perfect Rental Ad Http Blog Homes Com 2013 04 Real Estate Rentals Rental Property Investment Being A Landlord

Renting Out Check Out How You Can Create The Perfect Rental Ad Http Blog Homes Com 2013 04 Real Estate Rentals Rental Property Investment Being A Landlord

31 Tax Deductions Often Overlooked By Landlords Mynd Management

31 Tax Deductions Often Overlooked By Landlords Mynd Management

Rv Rental Tax Deductions Tax Deductions For Your Private Rv Rentals Rv Rental Income And Rv Rental Tax Deductions How To Report Rv Rental Income

Rv Rental Tax Deductions Tax Deductions For Your Private Rv Rentals Rv Rental Income And Rv Rental Tax Deductions How To Report Rv Rental Income

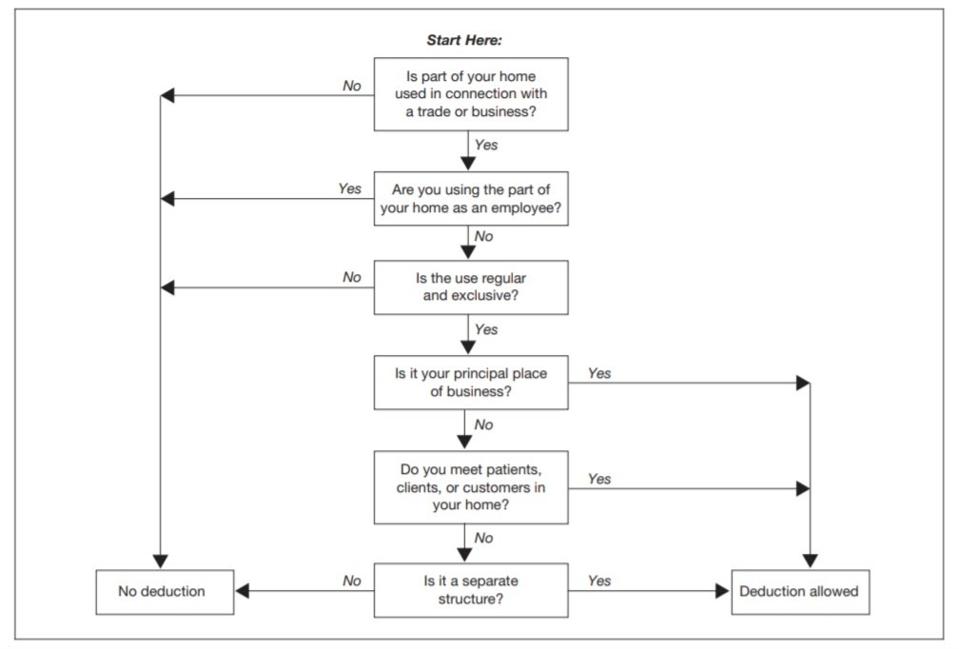

How People Working From Home Can Claim A Home Office Tax Deduction

How People Working From Home Can Claim A Home Office Tax Deduction

Home Office Tax Deductions Calculator 2019 Microsoft Excel Spreadsheet Excel Spreadsheets Tax Deductions Microsoft Excel

Home Office Tax Deductions Calculator 2019 Microsoft Excel Spreadsheet Excel Spreadsheets Tax Deductions Microsoft Excel

Rv Rental Tax Deductions Tax Deductions For Your Private Rv Rentals Rv Rental Income And Rv Rental Tax Deductions How To Report Rv Rental Income

Rv Rental Tax Deductions Tax Deductions For Your Private Rv Rentals Rv Rental Income And Rv Rental Tax Deductions How To Report Rv Rental Income

Rv Rental Tax Deductions Tax Deductions For Your Private Rv Rentals Rv Rental Income And Rv Rental Tax Deductions How To Report Rv Rental Income

Rv Rental Tax Deductions Tax Deductions For Your Private Rv Rentals Rv Rental Income And Rv Rental Tax Deductions How To Report Rv Rental Income

7 Tax Saving Strategies For Landlords Being A Landlord Real Estate Investing Rental Property Rental Property Investment

7 Tax Saving Strategies For Landlords Being A Landlord Real Estate Investing Rental Property Rental Property Investment

Dependent Tax Deduction Tax Exemptions And Deductions For Families Turbotax Tax Tips Videos

Dependent Tax Deduction Tax Exemptions And Deductions For Families Turbotax Tax Tips Videos

Airbnb Expense Tracker Template Airbnb Spreadsheet Template Etsy Rental Property Management Rental Property Property Management

Airbnb Expense Tracker Template Airbnb Spreadsheet Template Etsy Rental Property Management Rental Property Property Management

Rental Property Deductions You Can Take At Tax Time Turbotax Tax Tips Videos

Rental Property Deductions You Can Take At Tax Time Turbotax Tax Tips Videos

How To Save Tax On Rental Income Deductions Calculations Procedure

How To Save Tax On Rental Income Deductions Calculations Procedure

Claiming Expenses On Rental Properties 2021 Turbotax Canada Tips

Rental Property Tax Deductions Tax Deductions Rental Property Property Tax

Rental Property Tax Deductions Tax Deductions Rental Property Property Tax

Rv Rental Tax Deductions Tax Deductions For Your Private Rv Rentals Rv Rental Income And Rv Rental Tax Deductions How To Report Rv Rental Income

Claiming Expenses On Rental Properties 2021 Turbotax Canada Tips

Claiming Expenses On Rental Properties 2021 Turbotax Canada Tips

List Of The Expenses You Can Claim As A Tax Deduction In Australia Is You Rent Out A Commercial Rental Property Rental Property Investment Investment Property

List Of The Expenses You Can Claim As A Tax Deduction In Australia Is You Rent Out A Commercial Rental Property Rental Property Investment Investment Property

Labels: deduction

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home