Jackson County Property Tax Credit

The Treasurer is responsible for the receipt m anagement disbursement f inancial reporting bonds and investment of all monies paid to the County serves as agent for the State of Iowa Department of Transportation State of Iowa Department of Revenue and Finance and State of Iowa Department of Driver Services. A person regardless of age who either owns or is buying a homestead is entitled to a credit against his or her property taxes.

Will You Get A Break On Your N J Property Taxes During Coronavirus Crisis Nj Com

Will You Get A Break On Your N J Property Taxes During Coronavirus Crisis Nj Com

Jackson County does not collect or retain any portion of this fee.

Jackson county property tax credit. MasterCard DebitCredit American Express Discover and Visa Credit. Make checks out to JACKSON COUNTY TAXATION Mail your tax payments to. Taxes not paid in full on or before December 31 will accrue interest penalties and fees.

The actual credit is based on the amount of real estate taxes or rent paid and total household income. Tax amounts owed or paid and. Provides an annual 2000 reduction in the equalized assessed value EAV of the property owned and occupied as the primary residence on January 1 of the assessment year ba a person with a disability who is liable for the payment of property taxes.

The amount of the credit is determined by multiplying the homestead percentage of credit 1998 through 2001 10 2002 and thereafter 4 by the amount a person owes in property taxes on the homestead portion of their property tax bill. The 2020 Jackson County property tax due dates are May 10 2021 and November 10 2021. The Missouri Property Tax Credit Claim gives credit to certain senior citizens and 100 percent disabled individuals for a portion of the real estate taxes or rent they have paid for the year.

Convenience fees are not refundable. A 275 fee of the total tax bill will be added. Be sure to consider net taxes paid on forestland after accounting for the reduction factor and when applicable the ten percent rollback.

Using the figures on that card you can estimate savings you will receive under Ohios forest property tax laws. The actual credit is based on the amount of real estate taxes or rent paid and total household income taxable. Convenience fees are retained by the service provider and are not paid to or shared with Jackson Township.

Failure to receive a tax bill does not relieve the obligation to pay taxes and applicable late fees. Payments on our website are administered by a third-party who charges a fee. In addition a person who qualifies for a homestead credit.

Visa Debit Card 395 Visa Credit MasterCard DebitCredit American Express and Discover 25 of transaction 200 minimum and Electronic Check 250. Property Tax Payment FAQ Pay Online Pay by Phone Pay Using Online Bill Pay Pay by Mail Pay in Person. A 1500 Payment Would Incur a 4425 Fee.

Search for free Franklin County OH Property Records including Franklin County property tax assessments deeds title records property ownership building permits zoning land records GIS maps and more. 25 of transaction 200 minimum Electronic Check250. Looking for a property survey.

If an e-check transaction is processed against an. The credit is for a maximum of 750 for renters and 1100 for owners who own owned and occupied their home and can only be claimed on the home they occupied during the period being claimed. Contact your county auditors office for a copy of your current property tax appraisal card.

Jackson County does not collect or retain any portion of the fee. Jefferson Township Zoning 6545 Havens Road. Write your account numbers on the front of your check or money order to ensure proper credit.

Users Guide Property Data Online Property values tax computation or appraisal contact Assessment at 541-774-6059. Open Checkbook Public Records Policy Surrounding County Auditor Websites Triennial Update Upon the completion of the new market tax valuation and the Ohio Department of Taxation approval the values have become ready for examination. Taxes are due for the entire amount assessed and billed regardless if property is no longer owned or has been moved from Jackson County.

See Tax Payments for information on how to pay online. Tax bills are mailed once a year with. About the Taxes Taxes are a lien against the real estate and remains with the property not the specific owner of that property.

When paying by mail please make your check or money order payable to Jackson County Tax Collector. Credit or Debit Card - 295 of the Transaction Amount. Need to pay your property taxes using a credit card or e-check.

Credit Card - Visa or MasterCard Debit or Visa MasterCard American Express or Discover Credit card payments will require the 3 digit security code located on the back side of your card. See Surveyor Index Map. If a tax bill is not received by December 10 contact the Collectors Office at 816-881-3232.

Tax Payments Online. Jackson County Iowa Treasurer. Jackson Township Zoning 3756 Hoover Road Grove OH 43123 614-875-0100 Directions.

If you have questions. The credit is for a maximum of 750 for renters and 1100 for owners who owned and occupied their home. Taxes are assessed on personal property owned on January 1 but taxes are not billed until November of the same year.

Tax Due Dates Based on the January 1 2019 ownership taxes are due and payable the following year in two equal installments. Please do not send cash through the mail.

Property Tax Cycle King County Wa Property Tax Tax Property

Property Tax Cycle King County Wa Property Tax Tax Property

Https Www Jacksongov Org Documentcenter View 116 Real Property Tax Exemption Pdf

Oregon Property Tax Important Dates Annual Calendar Ticor Northwest

Easyknock South Carolina Property Tax Rate A Complete Guide

Easyknock South Carolina Property Tax Rate A Complete Guide

Tax Bills Are Being Delivered Jackson County Mo

Here S How Tennessee S Property Taxes Stack Up Nationwide Nashville Business Journal

Jackson Howard Whatley Cpas A Professional Tax And Accounting Firm In Vestavia Hills Alabama Splash Page Tax Attorney Accounting Firms Tax

Jackson Howard Whatley Cpas A Professional Tax And Accounting Firm In Vestavia Hills Alabama Splash Page Tax Attorney Accounting Firms Tax

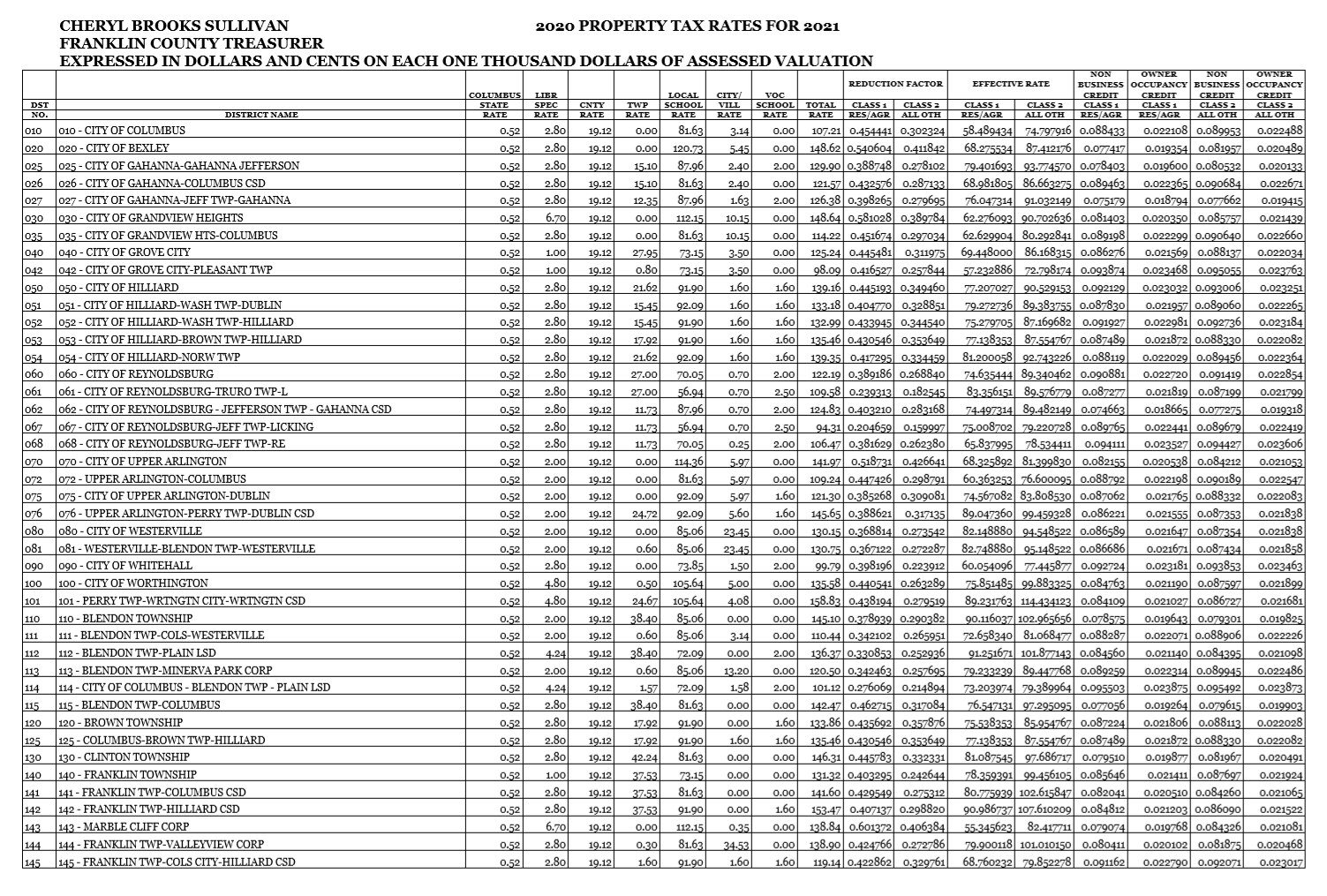

Franklin County Treasurer Tax Rates

Franklin County Treasurer Tax Rates

Paying Your Taxes Online Jackson County Mo

Paying Your Taxes Online Jackson County Mo

Are There Any States With No Property Tax In 2021 Free Investor Guide

Are There Any States With No Property Tax In 2021 Free Investor Guide

Easyknock The Guide To Georgia Property Tax Rates And Options

Easyknock The Guide To Georgia Property Tax Rates And Options

What Is The Disability Property Tax Exemption Millionacres

What Is The Disability Property Tax Exemption Millionacres

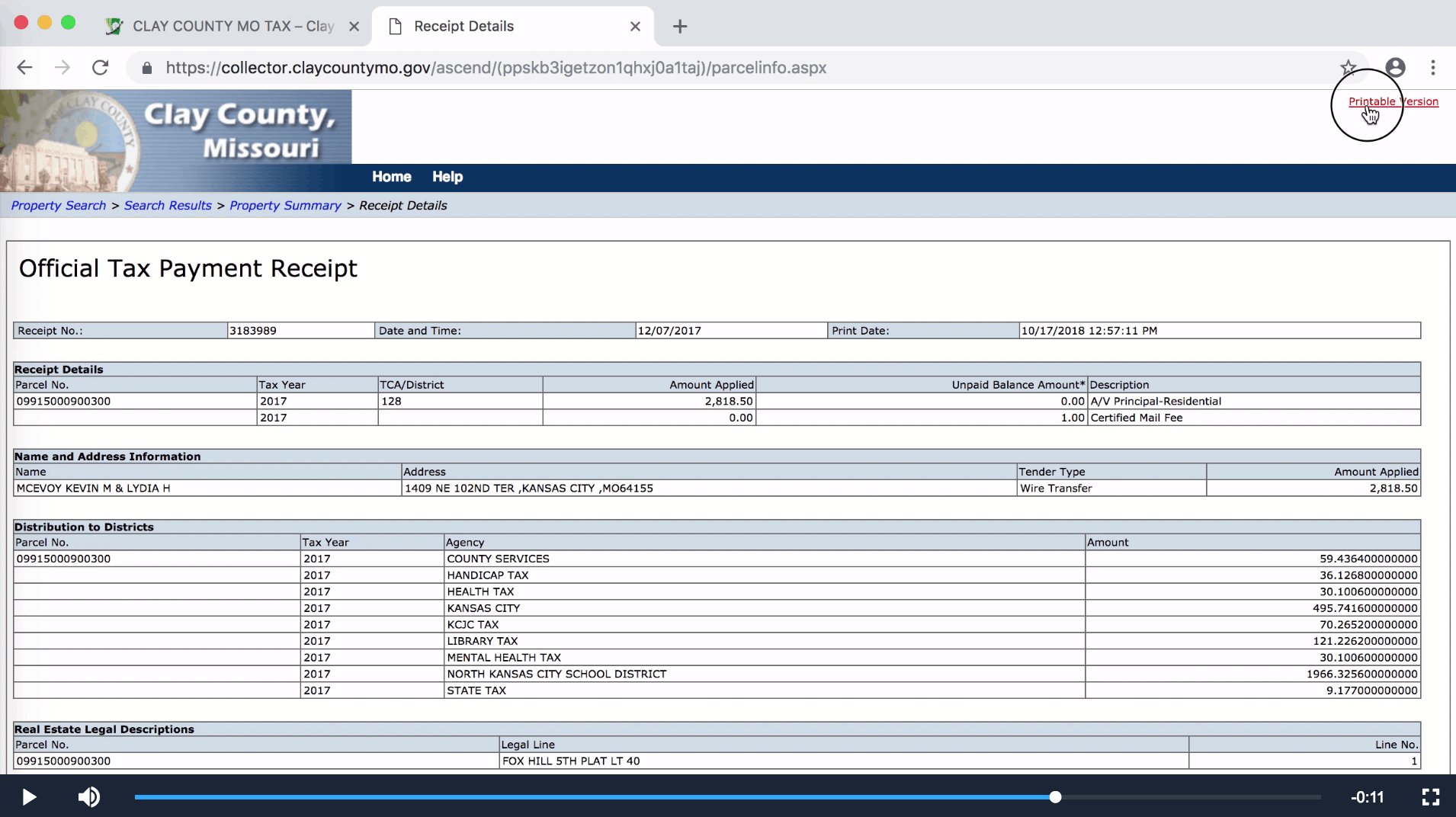

Clay County Mo Collector And Assessor S Offices Claycountymo Tax

Clay County Mo Collector And Assessor S Offices Claycountymo Tax

What The Gov Will The Coronavirus Pandemic Affect Your Property Tax Bills Better Government Association

What The Gov Will The Coronavirus Pandemic Affect Your Property Tax Bills Better Government Association

Florida Property Tax H R Block

Florida Property Tax H R Block

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home