Property Plant And Equipment Definition In Accounting

A are held by an enterprise for use in the production or supply of goods or services for rental to others or for administrative purposes and. That are owned by the company.

Pp E Property Plant Equipment Overview Formula Examples

Pp E Property Plant Equipment Overview Formula Examples

B are expected to be used during more than one period.

Property plant and equipment definition in accounting. Property plant and equipment are tangible assets that are used for economic benefit during more than one period. The property plant and equipment PPE exists and owned by the business organization. 17 Nov 2019 Property Plant and Equipment PPE is one among item of the assets element presented in the financial statements.

These assets are commonly referred to as the companys fixed assets or plant assets. It is the second long term asset section after current assets. PPE consists of building computer equipment office equipment furniture vehicle or truck and machinery etc.

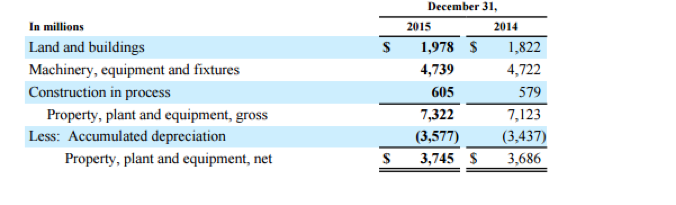

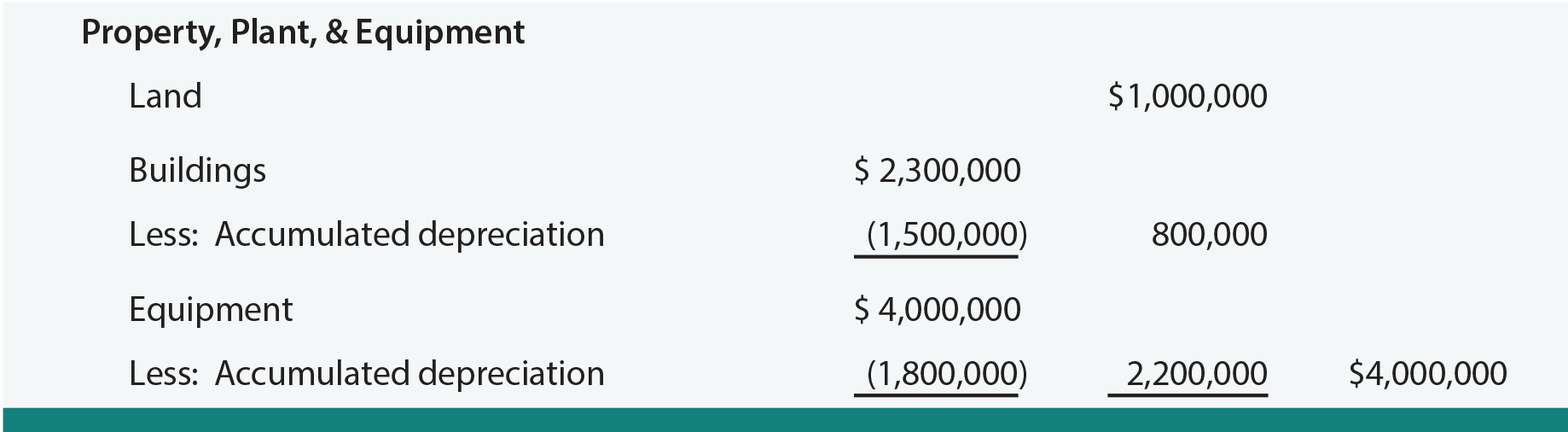

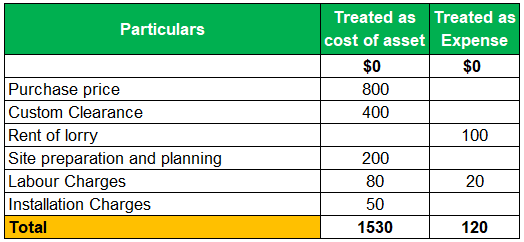

The objective of Accounting Standard AS 10 Property Plant and Equipment is to prescribe the accounting treatment for property plant and equipment so that users of the financial statements can discern information about investment made by an enterprise in its property plant and equipment and the changes in such investment. Generally the property plant and equipment assets are reported at their cost followed by a deduction for the accumulated. Common examples include office buildings land machinery office furniture and computers.

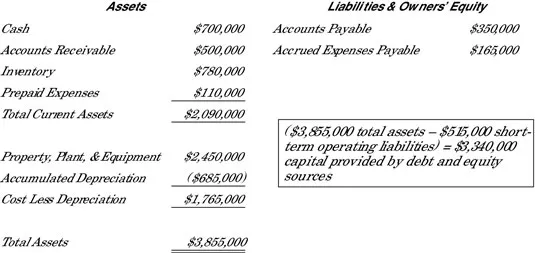

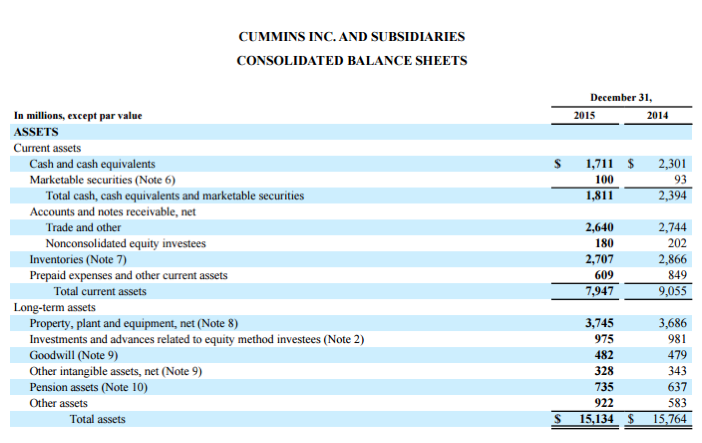

Property plant and equipment is initially measured at its cost subsequently measured either using a cost or revaluation model and depreciated so that its depreciable amount is allocated on a systematic basis over its useful life. The name plant assets comes from the industrial revolution era where factories and plants were one of the most common businesses. Property plant and equipment PPE are a companys physical or tangible long-term assets that typically have a life of more than one year.

The principal issues in accounting for property plant and equipment are the recognition of the assets the determination of their carrying amounts and the depreciation charges and impairment losses to be recognised in relation to them. Depreciation is the systematic allocation of the depreciable amount of the asset over its. Property plant and equipment are tangible assets that.

Scope 2 This Standard shall be applied in accounting for property plant and equipment except. Principal issues in accounting for property plant and equipment are the recognition of the assets the determination of their carrying amounts and the depreciation charges and impairment losses to be recognised in relation to them. Property plant and equipment PPE includes tangible items that are expected to be used in more than one reporting period and that are used in production for rental or for administration.

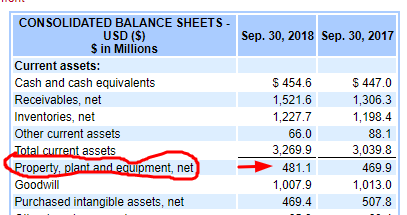

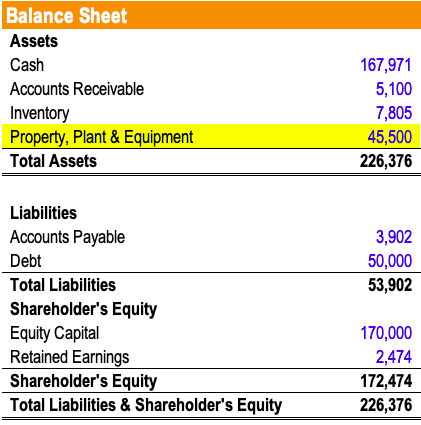

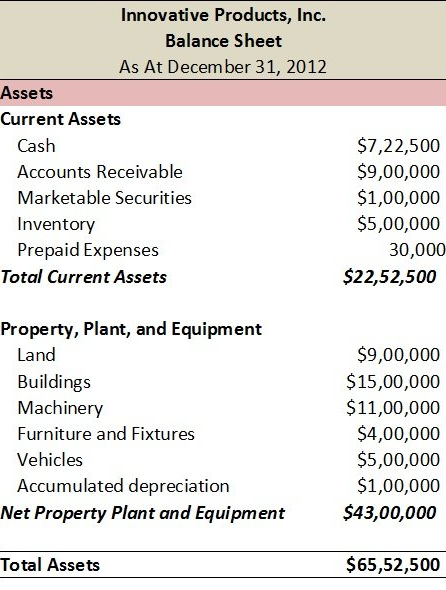

Property plant and equipment definition A major classification on the balance sheet. PROPERTY PLANT AND EQUIPMENT Definition. Property plant and equipment is the long-term asset or noncurrent asset section of the balance sheet that reports the tangible long-lived assets that are used in the companys operations.

Included are land buildings leasehold improvements equipment furniture fixtures delivery trucks automobiles etc. Property Plant and EquipmentReal Estate Sales in order to derecognize the real estate. Property plant and equipment are reported in the balance sheet by the carrying amount which is the difference between its cost or fair value and any accumulated depreciation and.

The objectives of the audit of property plant and equipment PPE audit are to determine that. Plant assets can include vehicles fixtures and land. The PPE addition are authentic and it is recorded properly at its cost while such costs are being able to distinguish from the repairs and maintenance expenses.

This category of assets is not limited to factory equipment machinery and buildings though. This can include items acquired for safety or environmental reasons. IAS 16 Property Plant and Equipment outlines the accounting treatment for most types of property plant and equipment.

Maintenance Capital Expenditures The Easy Way To Calculate It

Maintenance Capital Expenditures The Easy Way To Calculate It

Ias 16 Property Plant And Equipment Acca Financial Accounting Fa Lectures Youtube

Ias 16 Property Plant And Equipment Acca Financial Accounting Fa Lectures Youtube

What Are Fixed Assets A Simple Primer For Small Businesses Freshbooks Resource Hub

What Are Fixed Assets A Simple Primer For Small Businesses Freshbooks Resource Hub

Property Plant And Equipment Ppe Covering Financials Reynolds Center

Property Plant And Equipment Ppe Covering Financials Reynolds Center

Pp E Property Plant Equipment Overview Formula Examples

Pp E Property Plant Equipment Overview Formula Examples

Fixed Assets Definition Characteristics Examples

Fixed Assets Definition Characteristics Examples

What Costs Are Included In Property Plant Equipment Principlesofaccounting Com

What Costs Are Included In Property Plant Equipment Principlesofaccounting Com

Property Plant And Equipment Pp E Formula Calculations Examples

Property Plant And Equipment Pp E Formula Calculations Examples

:max_bytes(150000):strip_icc()/dotdash_Final_How_Current_and_Noncurrent_Assets_Differ_Oct_2020-01-e74218e547134e3db0ac9e9a7446d577.jpg) Current And Noncurrent Assets The Difference

Current And Noncurrent Assets The Difference

Pp E Property Plant Equipment Overview Formula Examples

Pp E Property Plant Equipment Overview Formula Examples

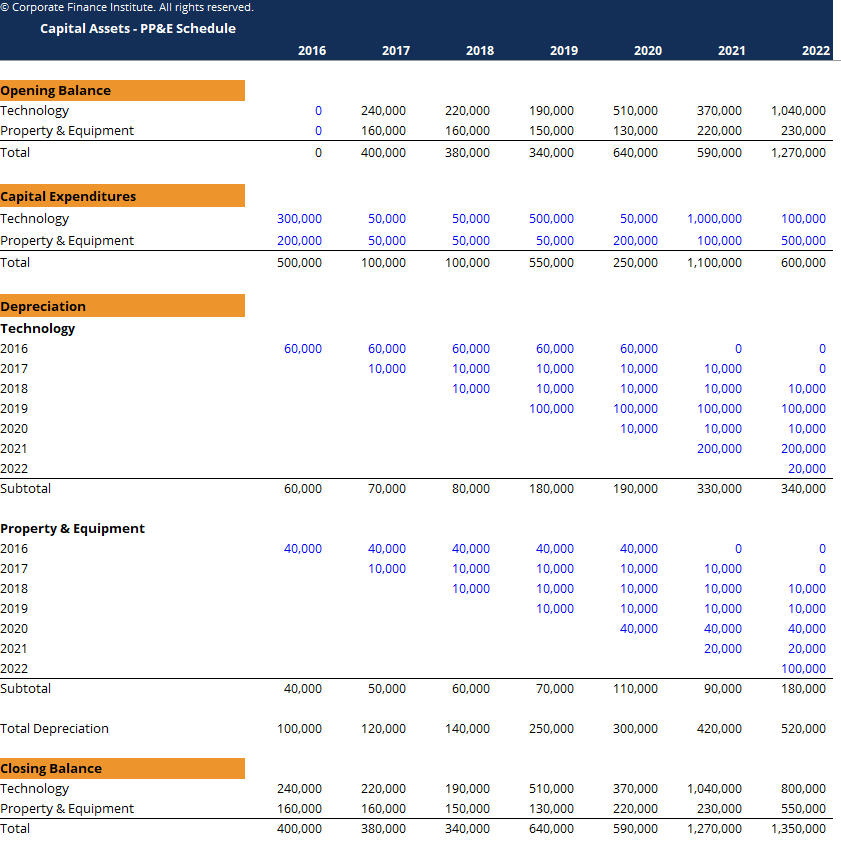

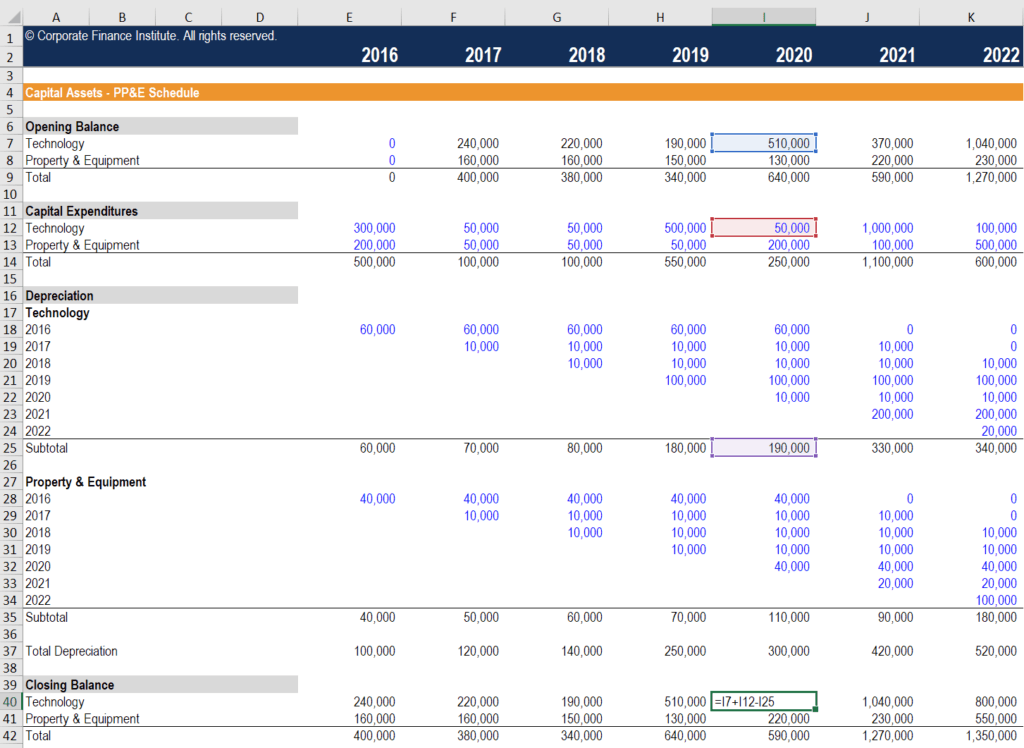

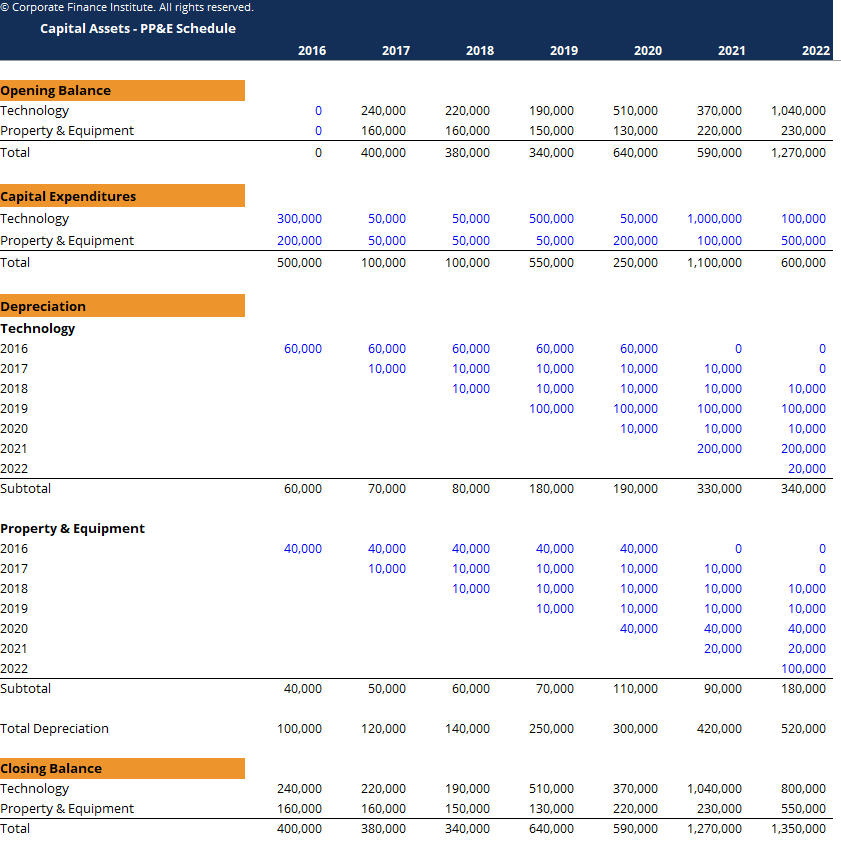

Property Plant And Equipment Schedule Template Download Free Excel

Property Plant And Equipment Schedule Template Download Free Excel

Property Plant And Equipment Pp E What Is Property Pla Youtube

Property Plant And Equipment Pp E What Is Property Pla Youtube

Plant Assets What Are They And How Do You Manage Them The Blueprint

Plant Assets What Are They And How Do You Manage Them The Blueprint

Property Plant And Equipment Ppe Covering Financials Reynolds Center

Property Plant And Equipment Ppe Covering Financials Reynolds Center

:max_bytes(150000):strip_icc()/dotdash_Final_Property_Plant_and_Equipment_PPE_Sep_2020-01-dd61e2f2fdb7481d81e95bc90b5c61d8.jpg) Property Plant And Equipment Pp E Definition

Property Plant And Equipment Pp E Definition

Property Plant And Equipment Schedule Template Eloquens

Property Plant And Equipment Schedule Template Eloquens

Property Plant And Equipment Pp E Formula Calculations Examples

Property Plant And Equipment Pp E Formula Calculations Examples

/ExxonLongtermAssets2018-5c5485414cedfd0001efdb2c.jpg)

/ExxonLongtermAssets2018-5c5485414cedfd0001efdb2c.jpg)

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home