Property Plant And Equipment Quizlet

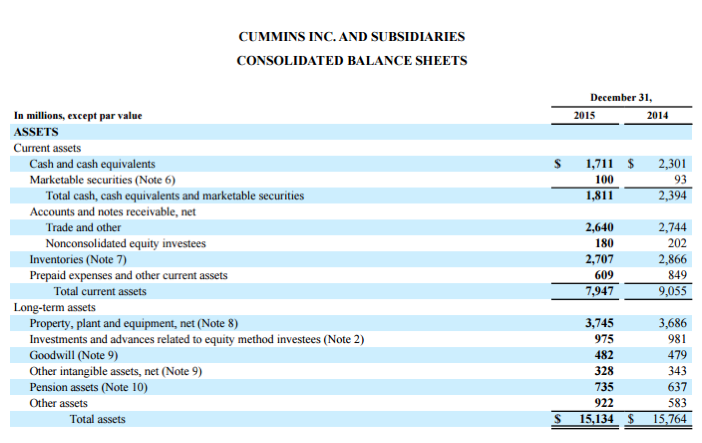

B Measuring property plant and equipment subsequent to acquisition. Property plant and equipment fixed assets or operating assets compose more than one-half of total assets in many corporations.

Beautiful Couple Of Elderly People Looking At A Sunflower People Double Exposure Photography Double Exposure

Beautiful Couple Of Elderly People Looking At A Sunflower People Double Exposure Photography Double Exposure

Expected to be ised over a period of more than one year.

Property plant and equipment quizlet. Major spare parts and stand-by equipment which an entity expects to use over more than one period would qualify as a. Roger Philipp CPA CGMA explains Plant Property and Equipment as Fixed Assets in this video. Property plant and equipment c.

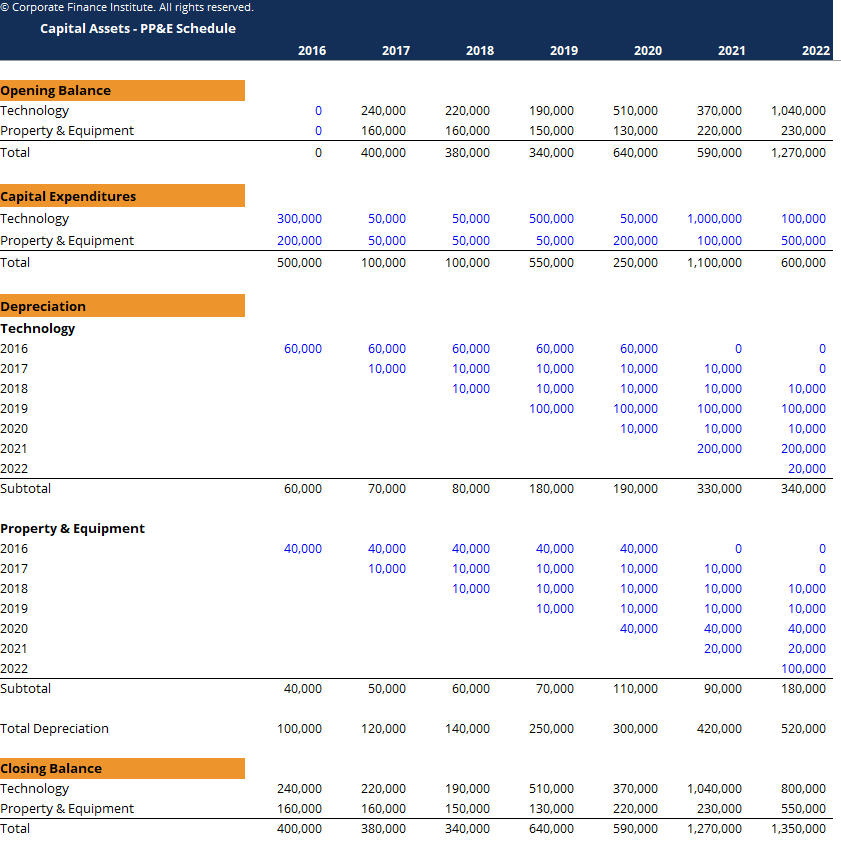

Learn vocabulary terms and more with flashcards games and other study tools. These resources are necessary for the companies to operate and ultimately make a profit. 102 Purchases of Property Plant and Equipment.

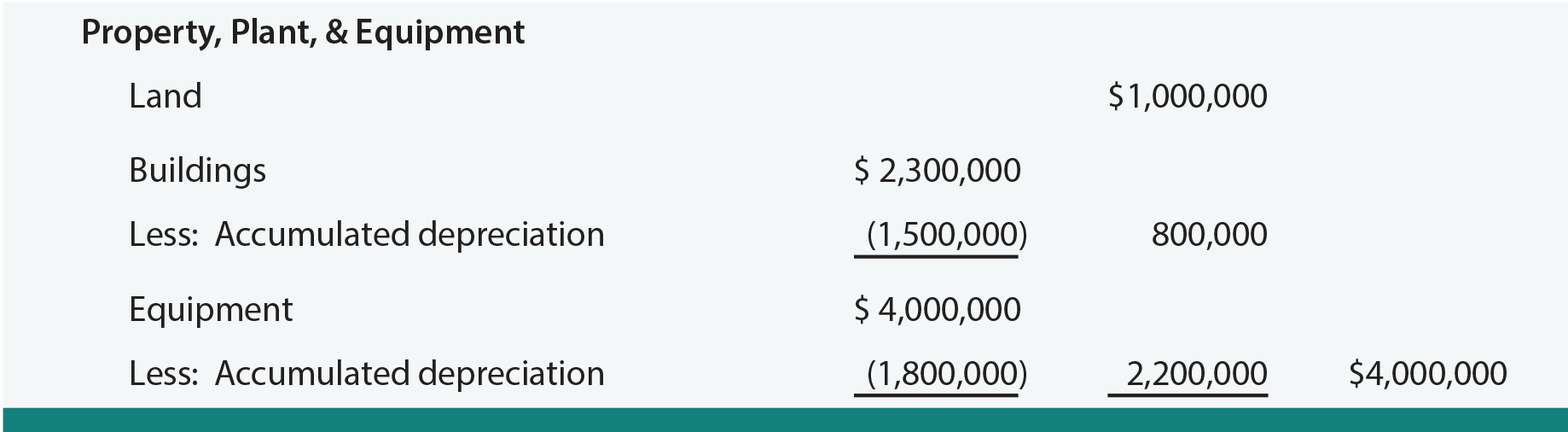

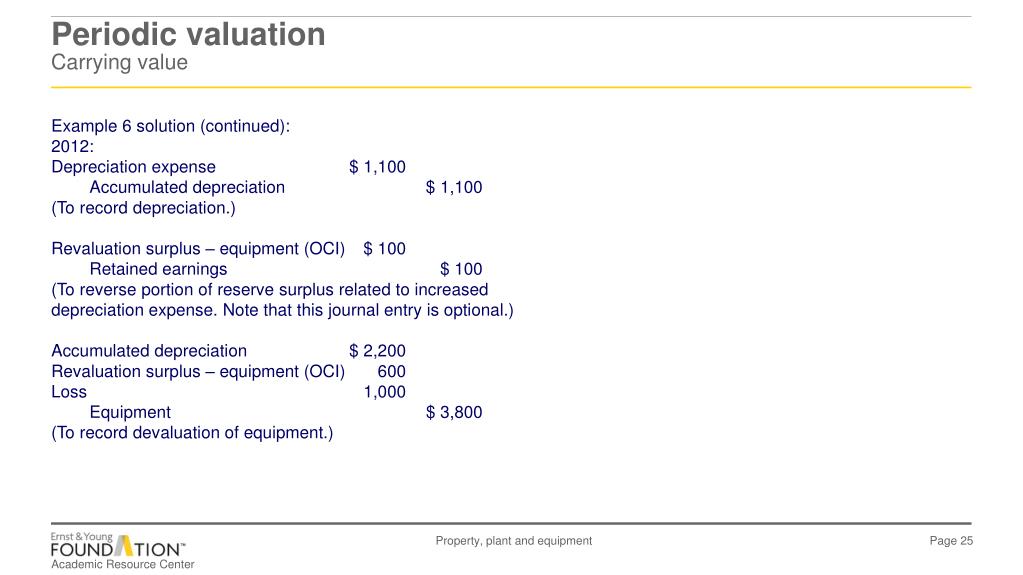

Determination of the residual value The objective of IAS 16 is to prescribe the accounting treatment for property plant and equipment. Property plant and equipment PPE includes tangible items that are expected to be used in more than one reporting period and that are used in production for rental or for administration. Property plant and equipment PPE are a companys physical or tangible long-term assets that typically have a life of more than one year.

Because these assets are expected to be used over multiple accounting periods they are called as long-lived assets. In certain asset-intensive industries PPE is the largest class of assets. The objective of this Standard is to prescribe the accounting treatment for property plant and equipment so that users of financial statements can discern information about an entitys investment in its property plant and equipment and the changes in such investment.

In June 2018 Irithel Company acquired a machine in exchange for another machine with a cost of P1200000 and an accumulated depreciation of P600000 and paid a cash difference of P160000. Learn vocabulary terms and more with flashcards games and other study tools. D Classifying interest paid in the statement of cashflows.

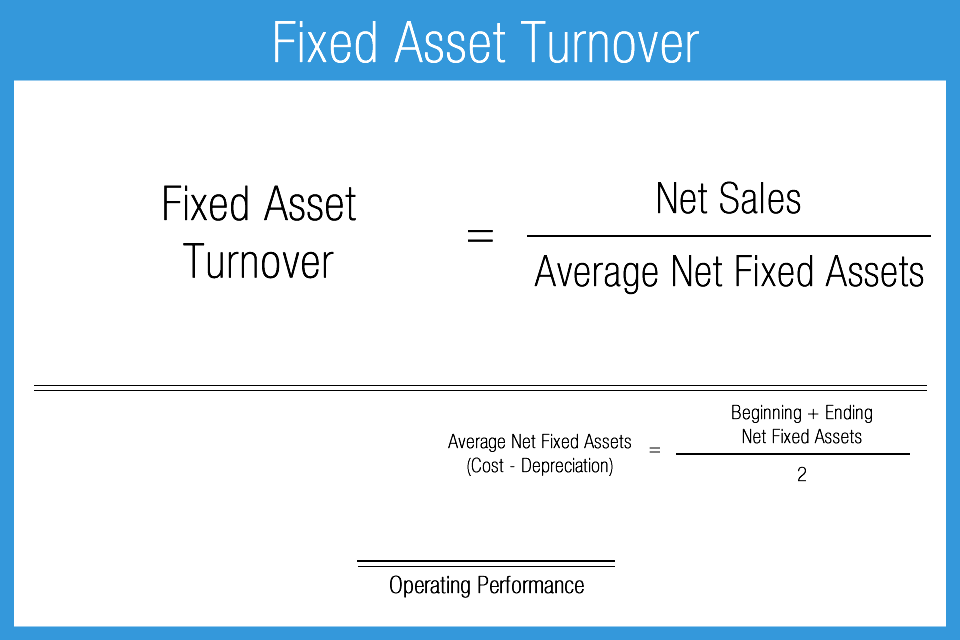

Learn vocabulary terms and more with flashcards games and other study tools. STANDARD 17PROPERTY PLANT AND EQUIPMENT Objective 1. Property plant and equipment 241000 Total Assets 367000 Liabilities and Stockholders Equity Current liabilities 73000 Long-term liabilities 81000 Stockholders equitycommon 213000 Total Liabilities and Stockholders Equity 367000 Income Statement Sales revenue 88000 Cost of goods sold 44000 Gross profit 44000 Operating expenses 16097.

Learn more about this topic that is covered in the Financial. It is the efficient use of these resources that in many cases determines the. Property plant and equipment are recorded at the acquisition.

C Measuring non-controlling interest in a business combination. Overview of property plant and equipment. Used in business in production or supply of goods or services.

Tangible assets meaning with physical substance. Property Plant and Equipment that qua. Property plant and equipment Assets of.

Property plant and equipment PPE are long-term assets vital to business operations and not easily converted into cash. Start studying Property plant and equipment. Start studying Chapter 10 Property Plant and Equipment and Intangible Assets.

View CH 10 QUIZLET from ACCOUNTING 312 at California Polytechnic State University San Luis Obispo. Audit of Property Plant and Equipment and the Related Depreciation. Start studying Chapter 10 Property Plant and Equipment and Intangible Assets.

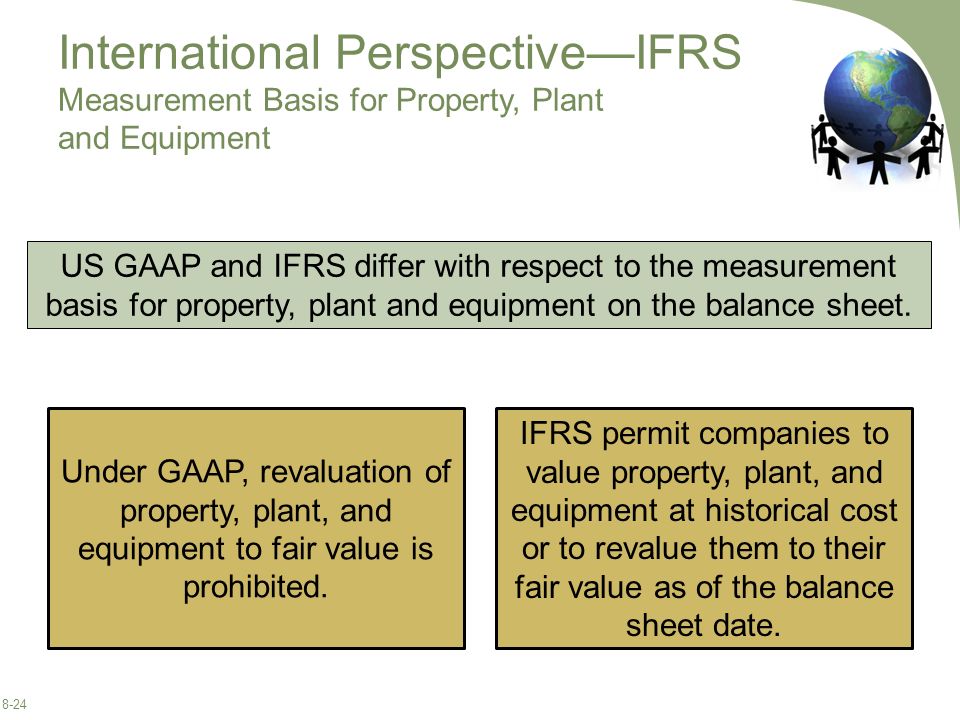

This can include items acquired for safety or environmental reasons. A Recognizing development costs that meet criteria for capitalization as an asset. Property Plant and Equipment.

The term property plant and equipment fixed assets include all tangible assets with a service life of more than one year that are used in the operation of the business and are not acquired for the purpose of resale. Property Plant and Equipment. The principal issues are the recognition of assets the determination of their carrying amounts and the depreciation charges and.

Property plant and equipment DEFINITION. Property plant and equipment include tangible assets that have physical substance such as land buildings machinery equipment vehicles furniture and fixtures.

Read more »

/dotdash_Final_Property_Plant_and_Equipment_PPE_Sep_2020-01-dd61e2f2fdb7481d81e95bc90b5c61d8.jpg)

/dotdash_Final_How_Current_and_Noncurrent_Assets_Differ_Oct_2020-01-e74218e547134e3db0ac9e9a7446d577.jpg)