Property Plant And Equipment Us Gaap Vs Ifrs

I wont go into the issue of property plant and equipment disclosures under GAAP and IFRS but there are differences. US GAAP guidance for PPE was formed from several standards issued over many years until they were combined in the Codification.

Us Gaap Vs Ifrs Examples Pdf Cheat Sheet Wall Street Prep

Us Gaap Vs Ifrs Examples Pdf Cheat Sheet Wall Street Prep

One of the main differences is that IFRS deals with a decommissioning fund that should be recorded and disclosed in the notes.

Property plant and equipment us gaap vs ifrs. And investment property contains some significant differences with potentially far. We would like to show you a description here but the site wont allow us. It should be used in combination with a thorough analysis of the relevant facts and circumstances review of the authoritative accounting literature and.

Property plant and equipment and investment property. Large property plant and equipment items often comprise multiple parts with varying useful lives or consumption patterns. ASC 606 specifies that an entity should consider the nature of its promise in granting a license ie whether the license is a right to access or right to use intellectual property when applying the general revenue recognition model to a combined performance obligation that includes a license and other goods or services.

GAAP is included in the Financial Accounting Standards Boards Accounting Standards Codification ASC Topic 360 Property Plant and Equipment. Property plant and equipment may be revaluated to fair value which is market value which may not be the same as the UKs existing use value or for plant and equipment without such a value depreciation replacement cost. Property Plant and Equipment IFRS Disclosures For each class of property plant and equipment a company must disclose the measurement bases the depreciation method the useful lives or equivalently the depreciation rate used the gross carrying amount and the accumulated depreciation at the beginning and end of the period and a.

IFRS allows another model - the revaluation model - which is based on fair value on the date of evaluation less any subsequent accumulated depreciation and impairment losses. Tune in as Mary Balmer CPA unveils these important considerations for the acco. The guidance related to accounting for property plant and equipment in US.

Under US GAAP harvestable plants are included in inventory while production animals are included in PPE. IFRS and US GAAP that we generally consider to be the most significant or most common. In April 2001 the International Accounting Standards Board Board adopted IAS 16 Property Plant and Equipment which had originally been issued by the International Accounting Standards Committee in December 1993IAS 16 Property Plant and Equipment replaced IAS 16 Accounting for Property Plant and Equipment issued in March 1982IAS 16 that was issued in March 1982 also replaced some.

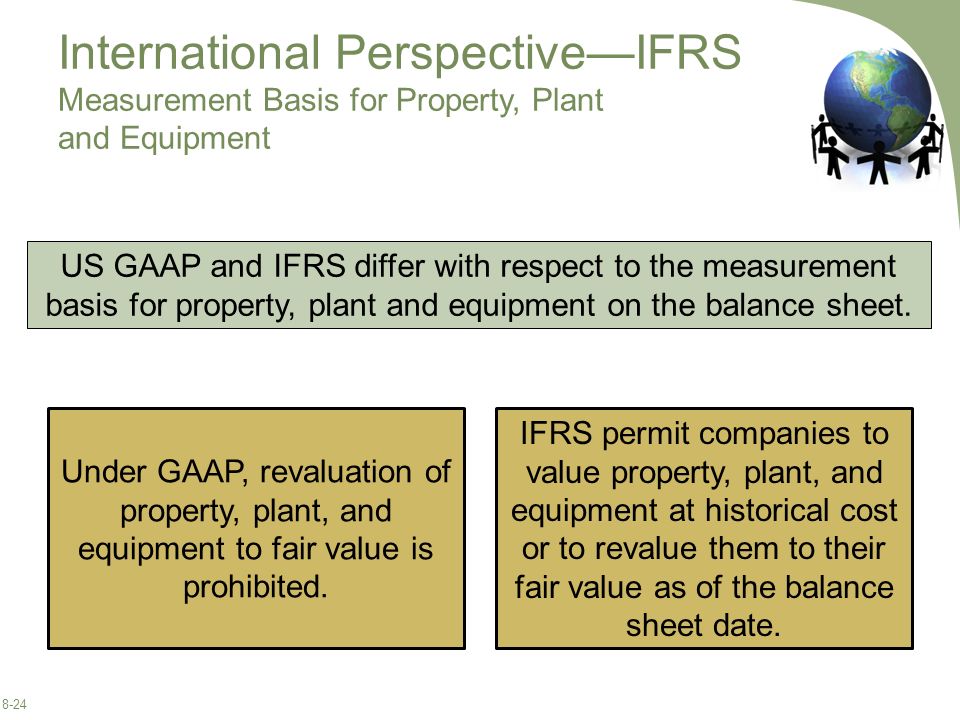

Under US GAAP fixed assets such as property plant and equipment are valued using the cost model ie the historical value of the asset less any accumulated depreciation. 32 Property plant and equipment 116 33 Intangible assets and goodwill 126 34 Investment property 139 35 Associates and the equity method Equity-method investees 146. Property Plant and Equipment Generally.

This pretty much just includes property plant and equipment. On the other hand living animals and plants that can be transformed or harvested are considered biological assets and are measured at their fair value until they can be harvested under IFRS. IAS-16 IAS-20 IAS-36 IAS-40.

The first type of non-current assets that GAAP and IFRS differ about is long-lived tangible assets. IFRS vs US GAAP Nonfinancial assets The guidance under US GAAP and IFRS as it relates to nonfinancial assets eg intangibles. In IFRS the guidance related to accounting for property plant.

Property plant and equipment is treated similarly under GAAP and IFRS but not exactly the same. Both of their definitions state that property plant and equipment as a tangible asset held for the use of producing or storing goods or for rental to others or for administrative purposes. What are the differences between GAAP and IFRS when it comes to fixed assets.

Property plant equipment and other assets. At the start of each chapter is a. It compares US GAAP to IFRS Standards highlighting similarities and differences.

However except for the areas of software oil and gas and mining assets IFRS and US GAAP use nearly. GAAP does not have such a provision on decommissioning funds. Up to 5 cash back The predominant standard that defines the accounting and reporting for Property Plant and Equipment PPE is IAS 16.

Unlike US GAAP IFRS requires companies to separately depreciate those parts that are significant. When a company has an old building or piece of land that they want to restore or overhaul they have to pay for it. Property plant and equipment including leased assets.

While the objective is conceptually simple implementing the component approach can be challenging.

Read more »