Property Plant And Equipment Classification

SIC-14 was superseded by and incorporated into IAS 16 2003. Property plant and equipment are assets with relatively long useful lives that ARE currently used in.

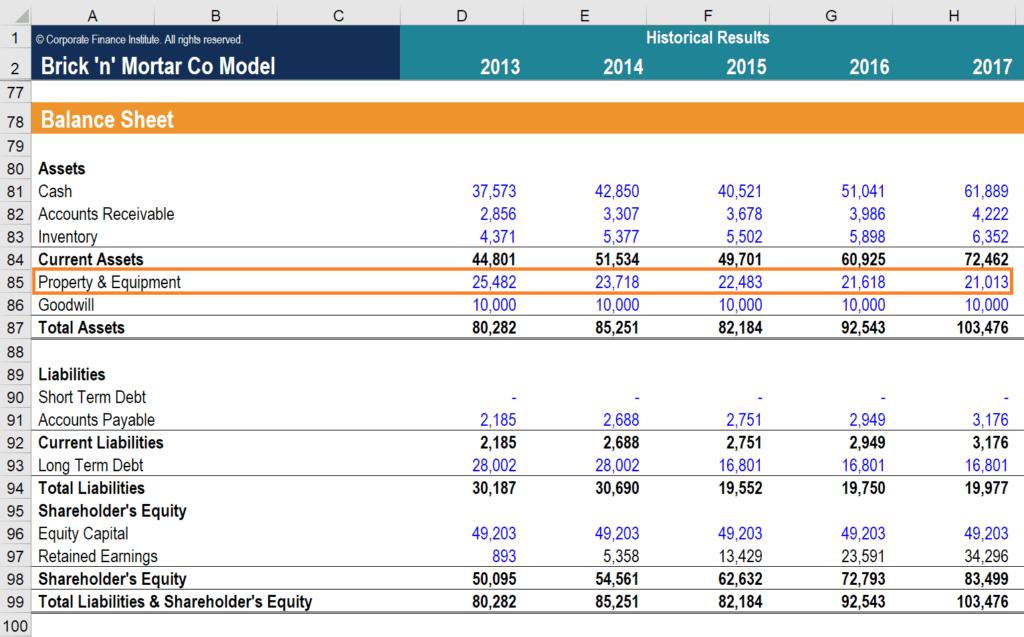

Pp E Property Plant Equipment Overview Formula Examples

Pp E Property Plant Equipment Overview Formula Examples

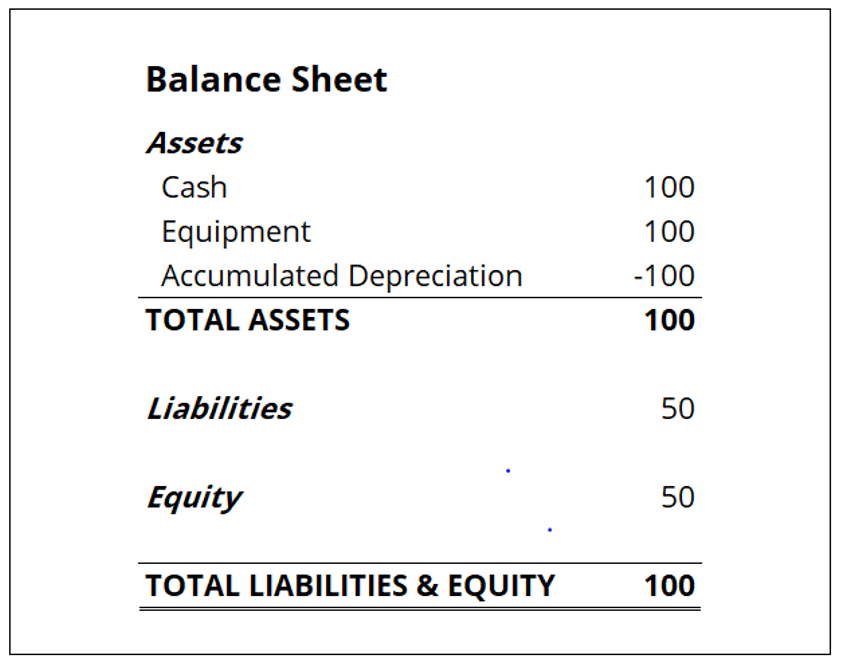

Property plant and equipment definition A major classification on the balance sheet.

Property plant and equipment classification. 6 Accounting for Property Plant and Equipment PDF. Cost of construction in. 3 PPE refers to long-term assets such as equipment that is vital to a.

An item of property plant or equipment shall not be carried at more than recoverable amount. PROPERTY PLANT AND EQUIPMENT CLASSIFICATION Executive Summary Tools such as the Federal Supply Classification system also known as the NATO Codification System and the United Nations Standard. 42 Deferred Maintenance and Repairs PDF.

IRM 21491 Asset. 10 Accounting for Internal Use Software PDF. IRM 1144 Personal Property Management.

That are owned by the company. It is the second long term asset section after current assets. In certain asset-intensive industries PPE is the largest class of assets.

1381 Property Plant and Equipment and related liabilities must be recorded in the Unrestricted Fund since segregation in a separate fund would imply the existence of restrictions on the use of the asset. SIC-23 was superseded by and incorporated into IAS 16 2003. Property plant and equipment are the recognition of the assets the determination of their carrying amounts and the depreciation charges and impairment losses to be recognized in relation to them.

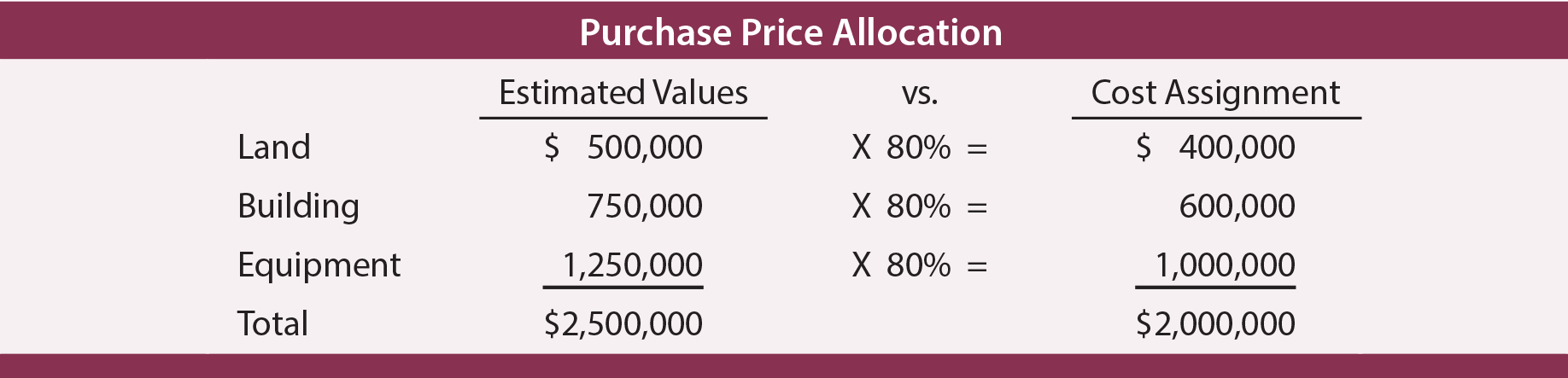

300 Vacant land. Following successful testing an operating. PROPERTY PLANT AND EQUIPMENT DEFINITION IDENTIFICATION AND CLASSIFICATION 1.

Assets like property plant and equipment PPE are tangible assets. 600 Community services. The PPE addition are authentic and it is recorded properly at its cost while such costs are being able to distinguish from the repairs and maintenance expenses.

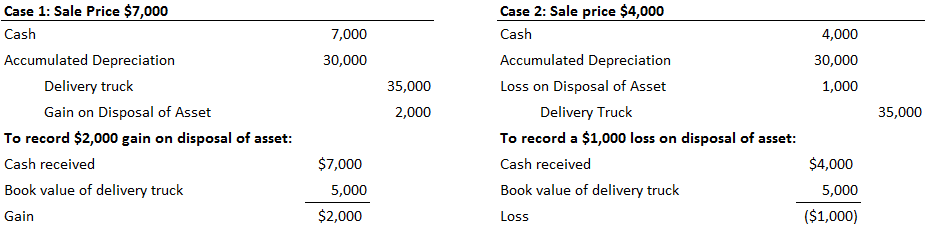

Due to rapid expansion of its operations the company acquired additional machinery on 1 March 2011 for RM10000000. The difference between long term investments and property plant and equipment are long-term assets such as land or building that a company is NOT currently using in its operating activities. SIC-23 Property Plant and Equipment - Major Inspection or Overhaul Costs.

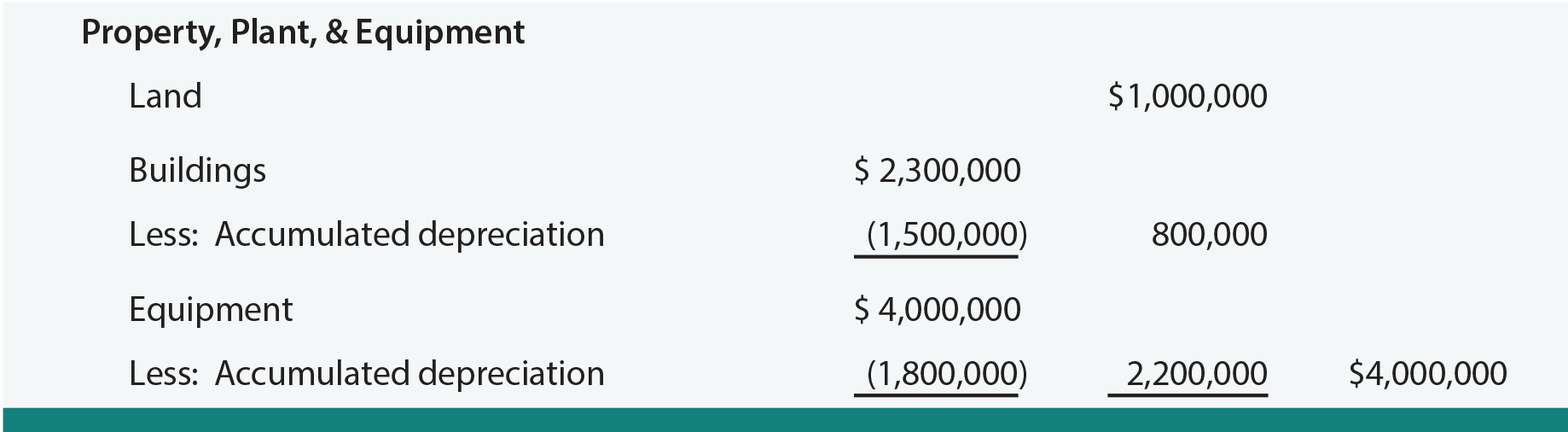

IAS 16 Property Plant and Equipment requires impairment testing and if necessary recognition for property plant and equipment. Property plant and equipment are tangible items that. Included are land buildings leasehold improvements equipment furniture fixtures delivery trucks automobiles etc.

The machinery was to be tested before it could be used. This can include items acquired for safety or environmental reasons. Fixed assets land including the perpetual usufruct right to.

Are held for use in the production or supply of goods or services for rental to others or for administrative purposes. Anas Bhd is a leading garment manufaturer. 44218 Accounting for property plant and equipment.

The property plant and equipment PPE exists and owned by the business organization. 1380 a Classification of fixed asset expenditures. 500 Recreation and entertainment.

If so inquire with the local assessor to verify their code definitions. How to Locate the proper property type classification code. Recoverable amount is the higher of an assets fair value less costs to.

Property plant and equipment includes bearer plants related to agricultural activity. Property plant and equipment PPE includes tangible items that are expected to be used in more than one reporting period and that are used in production for rental or for administration. SIC-14 Property Plant and Equipment Compensation for the Impairment or Loss of Items.

And are expected to be used during more than one period. 10 rows Property plant and equipment. 44 Accounting for Impairment of General Property Plant and Equipment Remaining in Use PDF.

Fixed Assets Definition Characteristics Examples

Fixed Assets Definition Characteristics Examples

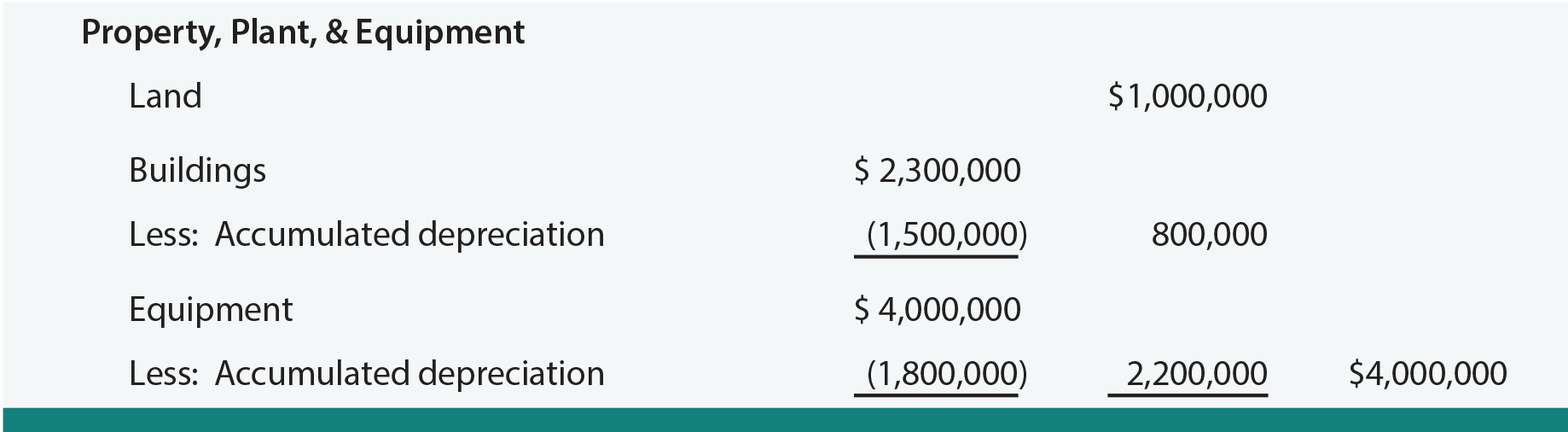

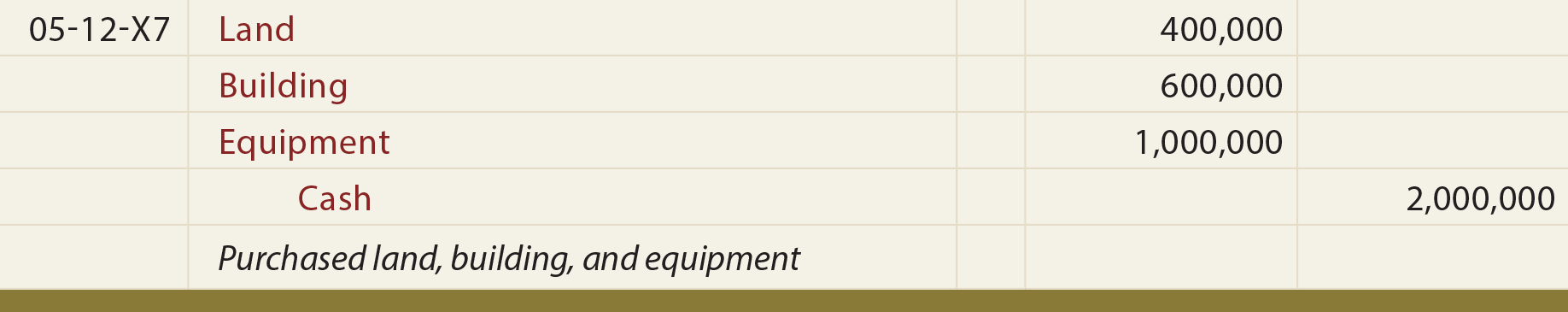

What Costs Are Included In Property Plant Equipment Principlesofaccounting Com

What Costs Are Included In Property Plant Equipment Principlesofaccounting Com

Fully Depreciated Asset Overview Calculation Examples

Fully Depreciated Asset Overview Calculation Examples

Derecognition Of Property Plant Equipment Cfa Level 1 Analystprep

Derecognition Of Property Plant Equipment Cfa Level 1 Analystprep

/dotdash_Final_How_Current_and_Noncurrent_Assets_Differ_Oct_2020-01-e74218e547134e3db0ac9e9a7446d577.jpg) Current And Noncurrent Assets The Difference

Current And Noncurrent Assets The Difference

Disposal Of Property Plant Or Equipment Play Accounting

Disposal Of Property Plant Or Equipment Play Accounting

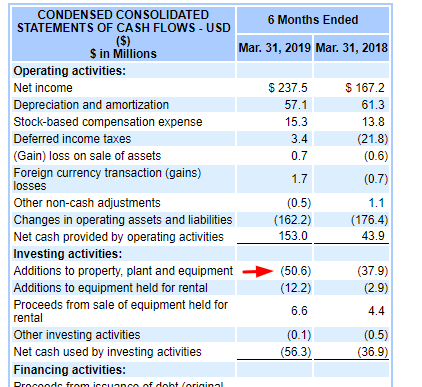

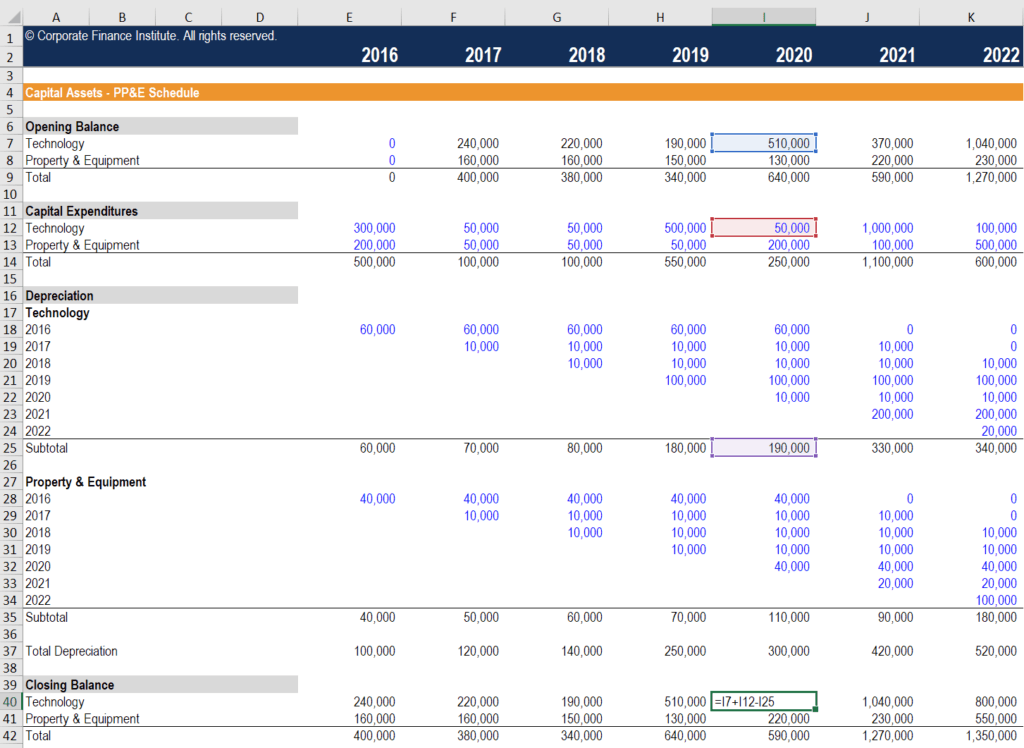

Maintenance Capital Expenditures The Easy Way To Calculate It

Maintenance Capital Expenditures The Easy Way To Calculate It

/trucks-80b2f89674414a0bb2a1f42f28b8ef88.jpg) What Is Property Plant And Equipment Pp E

What Is Property Plant And Equipment Pp E

What Costs Are Included In Property Plant Equipment Principlesofaccounting Com

What Costs Are Included In Property Plant Equipment Principlesofaccounting Com

What Costs Are Included In Property Plant Equipment Principlesofaccounting Com

What Costs Are Included In Property Plant Equipment Principlesofaccounting Com

Auditing Property Plant And Equipment Auditing And Attestation Cpa Exam Youtube

Auditing Property Plant And Equipment Auditing And Attestation Cpa Exam Youtube

/dotdash_Final_Property_Plant_and_Equipment_PPE_Sep_2020-01-dd61e2f2fdb7481d81e95bc90b5c61d8.jpg) Property Plant And Equipment Pp E Definition

Property Plant And Equipment Pp E Definition

What Costs Are Included In Property Plant Equipment Principlesofaccounting Com

What Costs Are Included In Property Plant Equipment Principlesofaccounting Com

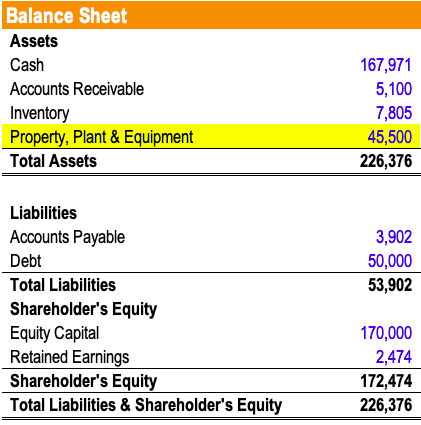

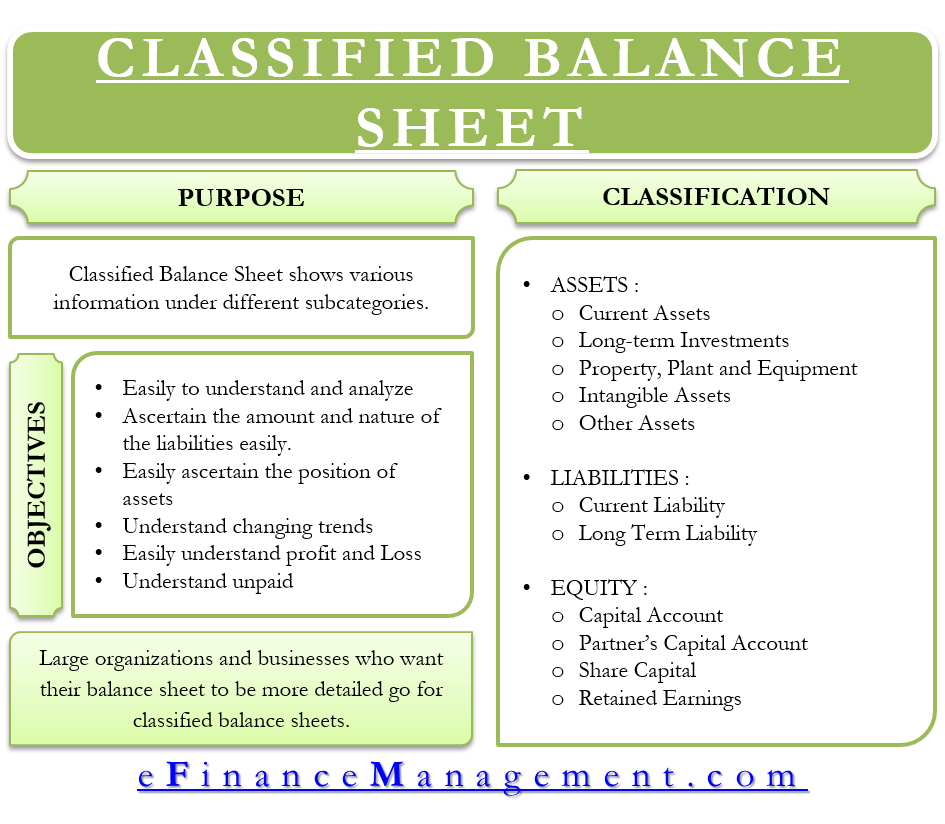

Classified Balance Sheet Meaning Importance Format And More

Classified Balance Sheet Meaning Importance Format And More

Types Of Assets List Of Asset Classification On The Balance Sheet

Types Of Assets List Of Asset Classification On The Balance Sheet

Pp E Property Plant Equipment Overview Formula Examples

Pp E Property Plant Equipment Overview Formula Examples

Pp E Property Plant Equipment Overview Formula Examples

Pp E Property Plant Equipment Overview Formula Examples

Information To Be Presented Either In The Statement Of Financial Position Or In The Notes Annualreporting Info

Information To Be Presented Either In The Statement Of Financial Position Or In The Notes Annualreporting Info

/ExxonLongtermAssets2018-5c5485414cedfd0001efdb2c.jpg)

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home