How Many Months Of Property Taxes Are Collected At Closing In New York

But- the tax amount needed is estimated at the time of closing. A purchase loan closes on July 1st.

New Development Closing Cost Calculator For Nyc Interactive Hauseit

New Development Closing Cost Calculator For Nyc Interactive Hauseit

Unlike many states there is no personal property tax in New York.

How many months of property taxes are collected at closing in new york. For example the formula may determine that eight months of property taxes are required to be collected at closing. Real Estate Tax Escrow or Maintenance Escrow. Similar to what lenders need some co-ops have begun mandating that buyers hold 6.

Rather than taxing items such as jewelry and vehicles only real property is taxed. That is when the county accesses the value of the property. Typically between 3 to 8 months of taxes are collected for escrow.

The New York State Tax Department will provide a closing letter to certify that no tax is due or to serve as a final receipt for the tax due. Likely your tax bill in December will be. However the amount can be based on either the unimproved value or improved value.

Finance mails property tax bills four times a year. The letter is issued after all processing is completed and should be kept as a permanent record. 15 closing there are 8 full.

Your payment amount is your choice. Second half taxes are due at the end of October and cover July through December. In fiscal years ending in 2009 local governments and school districts outside of New York City levied 28.

Your insurance premium is 600 per year but the annual premium is due January 1. I would bet your home was just a dirt lot January 1st. Your lender will be able to better answer a question of why they collected 10 months worth of tax payments in your escrow account.

So at closing they will escrow or ask you to pay ten months worth of property taxes so that they have enough to pay a full twelve months when they are due. Heres how it works. Thats because in most cases it is your mortgage lender who takes care of paying out your property taxes either from funds collected in escrow or from your monthly mortgage payment.

Count the number of full months from closing day to June 30. Funding Month First Payment Impounds Collected Closing November January 4 Months Plus 1st Half Paid December February 5 Months Plus 1st Half Paid January March 2nd Half Taxes Due Plus 2 Months February April 2 Months. BUT the sellers will reimburse you for their prorated portion of property taxes and your out of pocket net will be three months.

You either pay your property taxes two or four times a year depending on the propertys assessed value. Click the following link to download a printable version of the Property Tax Annual Cycle Infographic. What the escrow formula doesnt determine is the value to use for the property taxes.

Where the property tax goes. Not the tricky part. First half taxes are due at the end of April and cover January through June.

Typically when you take out a mortgage on a property your lender will require you to put six months of taxes in an escrow account. NYCs Property Tax Fiscal Year is July 1 to June 30. Same with homeowners or hazard insurance.

Most closing letters will be issued about nine months from the time of filing. Multiply the number of months by 30 days. School districts are the largest users of the property tax.

A buyer must reimburse the seller at closing by paying the prorated portion of annual property taxes that the seller has already prepaid effective on the closing date through the end of the tax. The amount of property taxes collected from you the buyer on the Closing Disclosure CD will be more than three months. Taxes are due twice a year but towards the middle each cycle.

The chart below shows how many months of Tax Impounds are required with an impound account with your loan. At closing you will be required to put into escrow your first year or so generally around 12 to 13 months of property taxes. The lender pays property taxes on your behalf and collects enough funds in your escrow to cover taxes and homeowners insurance.

Bills are generally mailed and posted on our website about a month before your taxes are due. For example if your closing date is in June escrow collection is only 3mo of taxes plus. So at the end of the year you would have 12 months of taxes to pay those property bills plus a 3-month buffer.

Lets take a look at the facts.

New York S Death Tax The Case For Killing It Empire Center For Public Policy

New York S Death Tax The Case For Killing It Empire Center For Public Policy

25 Ways To Make Money As A Real Estate Agent Real Estate Information Real Estate Tips Real Estate License

25 Ways To Make Money As A Real Estate Agent Real Estate Information Real Estate Tips Real Estate License

Https Www Budget Ny Gov Pubs Archive Fy21 Exec Book Briefingbook Pdf

New York Real Estate Market Reports Trends Analysis Nest Seekers

New York Real Estate Market Reports Trends Analysis Nest Seekers

New Development Closing Cost Calculator For Nyc Interactive Hauseit

New Development Closing Cost Calculator For Nyc Interactive Hauseit

New Development Closing Cost Calculator For Nyc Interactive Hauseit

New Development Closing Cost Calculator For Nyc Interactive Hauseit

New York Real Estate Market Reports Trends Analysis Nest Seekers

New York Real Estate Market Reports Trends Analysis Nest Seekers

Real Estate Tv Vs Reality Infographic Keeping Current Matters Real Estate Infographic Real Estate Buyers Real Estate Humor

Real Estate Tv Vs Reality Infographic Keeping Current Matters Real Estate Infographic Real Estate Buyers Real Estate Humor

London Housing Crisis Past Present Future Infographic Portal London House London Real Estate Real Estate Infographic

London Housing Crisis Past Present Future Infographic Portal London House London Real Estate Real Estate Infographic

New York S Death Tax The Case For Killing It Empire Center For Public Policy

New York S Death Tax The Case For Killing It Empire Center For Public Policy

New Hampshire Property Tax Calculator Smartasset

New Hampshire Property Tax Calculator Smartasset

6 Reasons To Hire A Buyer S Broker In Nyc Infographic Portal Real Estate Infographic Brokers Property Buying Guide

6 Reasons To Hire A Buyer S Broker In Nyc Infographic Portal Real Estate Infographic Brokers Property Buying Guide

When Is The Best Time To Close On A New Home Newhomesource

The Story Of Why Real Estate Taxes Are Paid In Arrears And How Property Tax Prorations Work Chicago Real Estate Closing Blog

The Story Of Why Real Estate Taxes Are Paid In Arrears And How Property Tax Prorations Work Chicago Real Estate Closing Blog

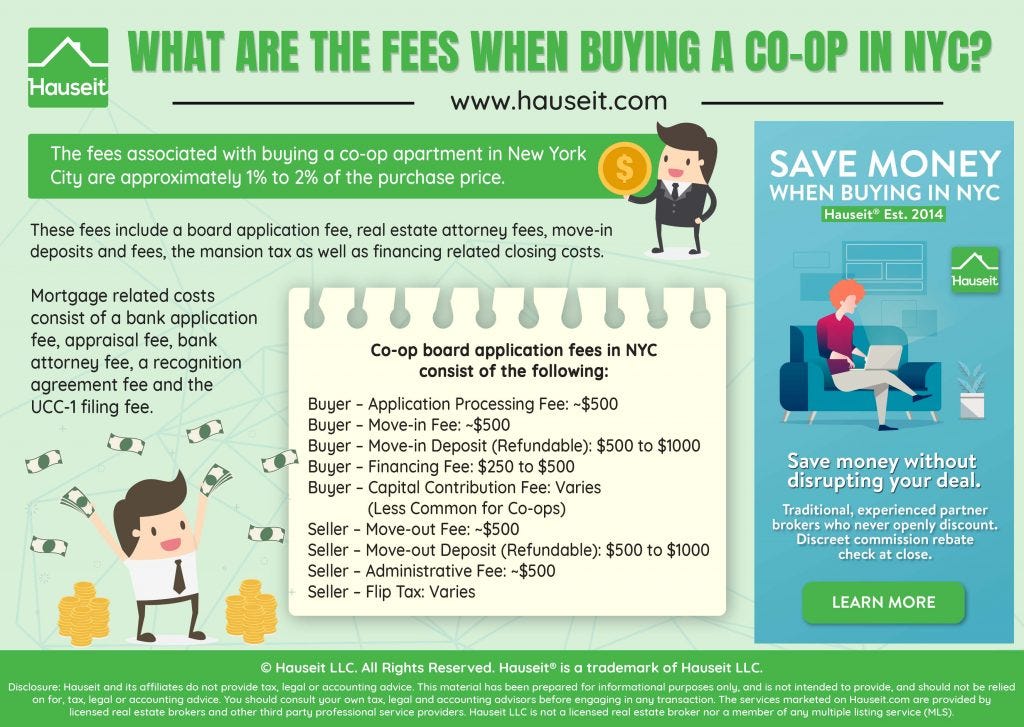

What Are The Fees And Closing Costs When Buying A Coop In Nyc By Hauseit Medium

What Are The Fees And Closing Costs When Buying A Coop In Nyc By Hauseit Medium

How Technology Is Changing The Way We Do Real Estate Infographic Portal

How Technology Is Changing The Way We Do Real Estate Infographic Portal

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home