Are Taxes Higher In New York Or New Jersey

For an in-depth comparison try using our federal and state income tax calculator. NJ Division of Taxation - NJ Income Tax Wages - State of New Jersey.

How High Are Cell Phone Taxes In Your State Tax Foundation

How High Are Cell Phone Taxes In Your State Tax Foundation

For an in-depth comparison try using our federal and state income tax calculator.

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/9551427/distribution_repeal_SALT.png)

Are taxes higher in new york or new jersey. Here is an FAQ to assist you to prepare the nonresident return. The figures below are from the Massachusetts Taxpayers Foundation. New Jersey has the third-highest income per capita in the US but it also has the highest property taxes.

For more information about the income tax in these states visit the New Jersey and New York income tax pages. Property taxes as a percentage of income ranged from a low of 288 in New York County to a high of 359 in Queens County well under the rate in most New Jersey counties. Tax dollars state by state See where your state ranks.

The New York state Senate and Assembly late Wednesday passed a 212 billion budget proposal after. New Jerseys tax rates are similar to New York states so it doesnt affect individuals total taxes much. 7 8 Notably sales tax.

Tax season can be stressful for the millions of Americans who owe money to Uncle Sam. For more information about the income tax in these states visit the Connecticut and New Jersey income tax pages. This tool compares the tax brackets for single individuals in each state.

Furthermore while youll have to file taxes in both states if you commute New Jersey lets you take the tax youve already paid as a dollar-for-dollar credit against your New Jersey tax. For income taxes in all fifty states see the income tax by state. You wont have to pay New York City taxes and you wont be fully double taxed on your state income.

While both New York and New Jersey have relatively high income taxes New Jerseys lowest income tax rate is 14 percent while New Yorks is 4 percent. The highest-earning New Yorkers are about to be hit with a tax hike. New York State collected 3 billion more tax revenue in the last fiscal year than projected by Governor Andrew Cuomo two months ago boosted by strong personal income tax receipts state.

Every year the average US. NEW YORK CNNMoney -- Residents in which states pay the most in taxes. More taxed income in Jersey could mean major savings for residents.

The resources from New Jerseys income tax goes into whats called the property tax relief fund New Jersey State Senator Steve Oroho said. Connecticut and New Jersey had the dubious distinction of coming in second and third place with state and local taxes gobbling up 126 and 122 of income respectively. New Jersey does include some items as taxable income that are not taxable to either NY nor the IRS as this website shows.

The New York state tax starts at 4 and goes as high at 882 while in New Jersey rates start at 14 though they go as high as 1075 if you make more than 5000000. For income taxes in all fifty states see the income tax by state. Your employer will have withheld New York state taxes throughout the year and you will then gain a New Jersey tax credit back for those taxes.

Household pays over 8800 in federal income taxes according to the Bureau of Labor Statistics. Therefore if youre thinking of moving closer to your job you may want to think twice about it. The lowest tax bracket is also wider in New Jersey than in the Empire State as of 2018.

Moving from New Jersey to New York City means youll face. Its also good to keep in mind that New York tax rates are higher than New Jersey tax rates. Yes and no.

So if you pay 124250 to New Jersey for taxes but live in New York and you owe New York 288670 on that income New York will reduce your New York tax by 124250 and leave you with a. The slightly higher portion to NJ is taxed only in NJ. According to the Tax Foundation the state-local tax burden in New York averaged 127 of income the highest rate in the nation.

In New York legislators are proposing higher income taxes and a billionaires tax that would annually tax unrealized capital gains on those worth 1 billion or. This tool compares the tax brackets for single individuals in each state.

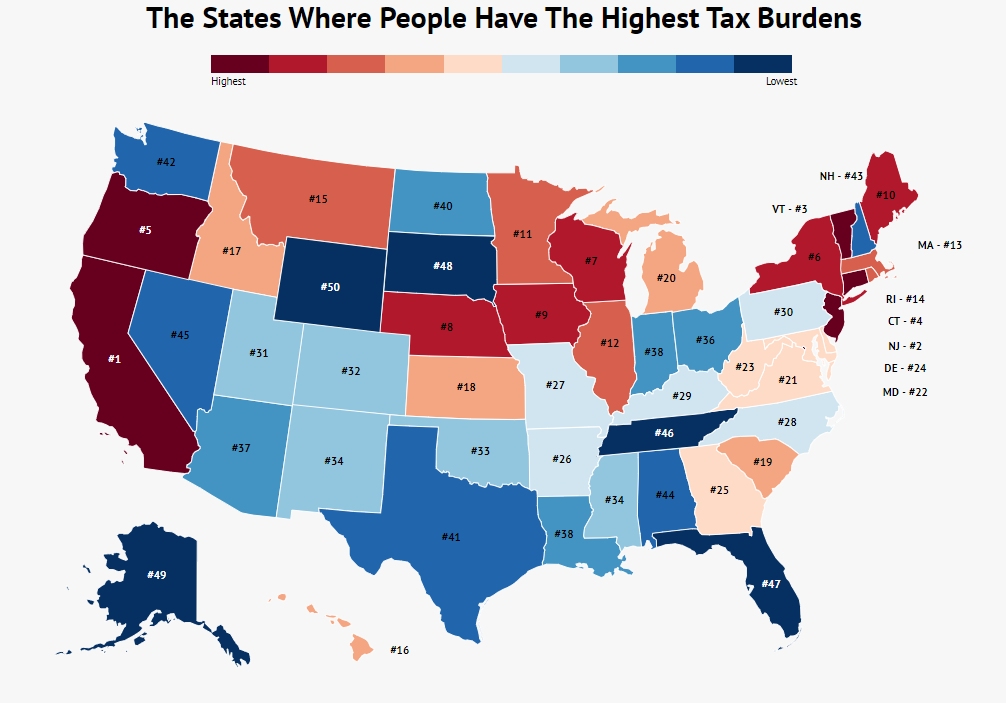

The States Where People Are Burdened With The Highest Taxes Zippia

The States Where People Are Burdened With The Highest Taxes Zippia

How Much Tax Do Small Businesses Pay A Simple Guide Freshbooks Resource Hub

How Much Tax Do Small Businesses Pay A Simple Guide Freshbooks Resource Hub

Nyc S High Income Tax Habit Empire Center For Public Policy

Nyc S High Income Tax Habit Empire Center For Public Policy

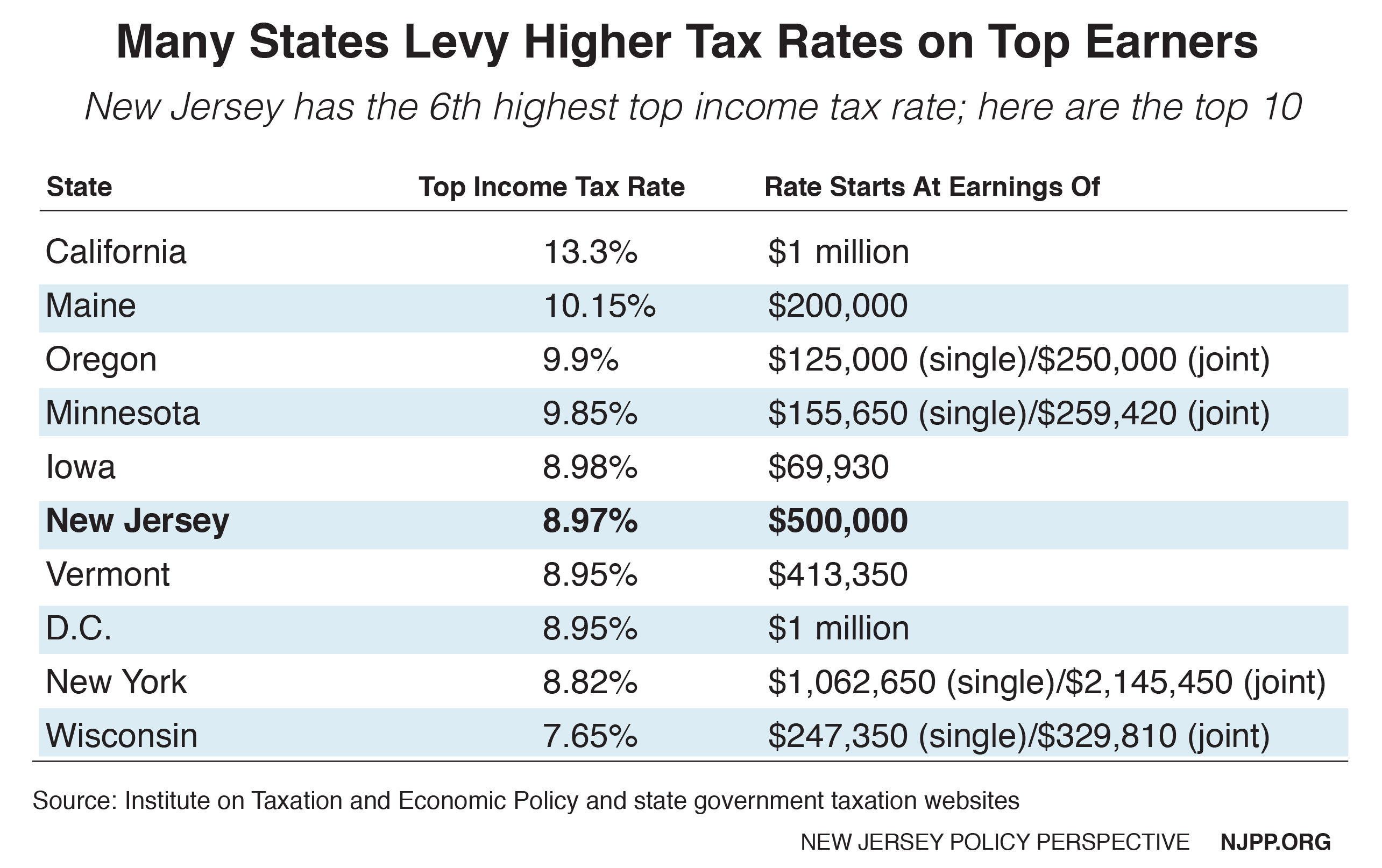

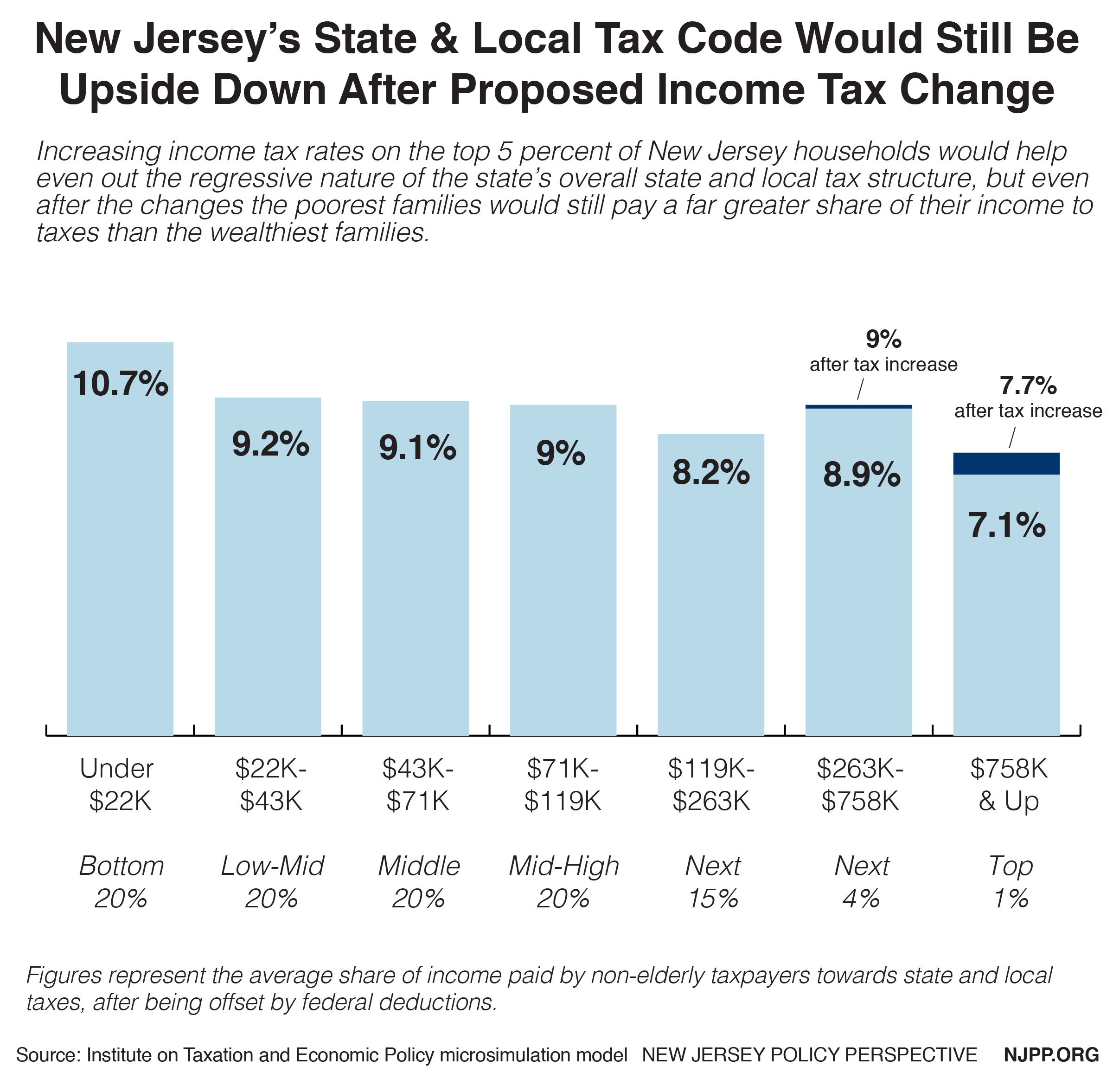

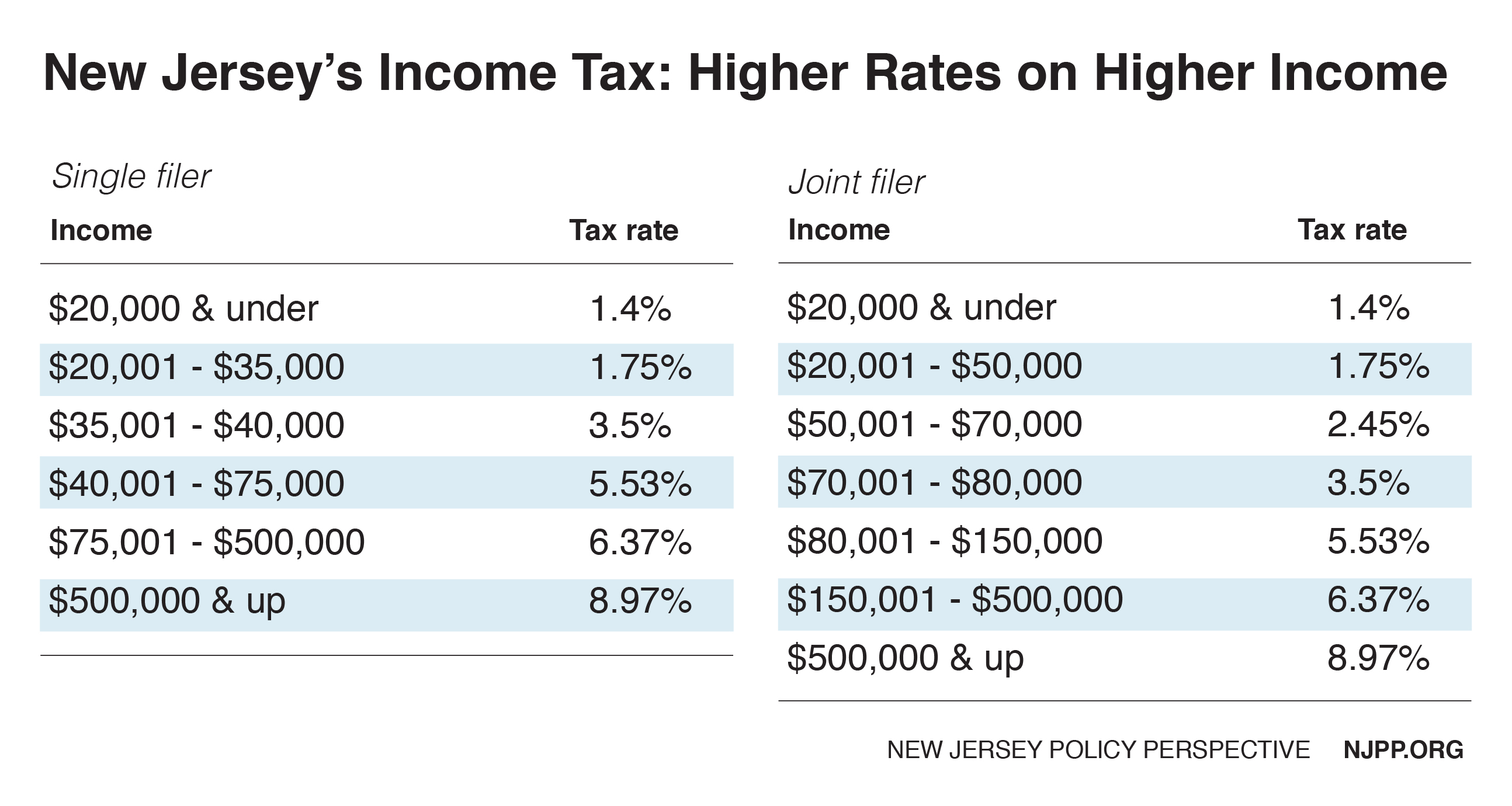

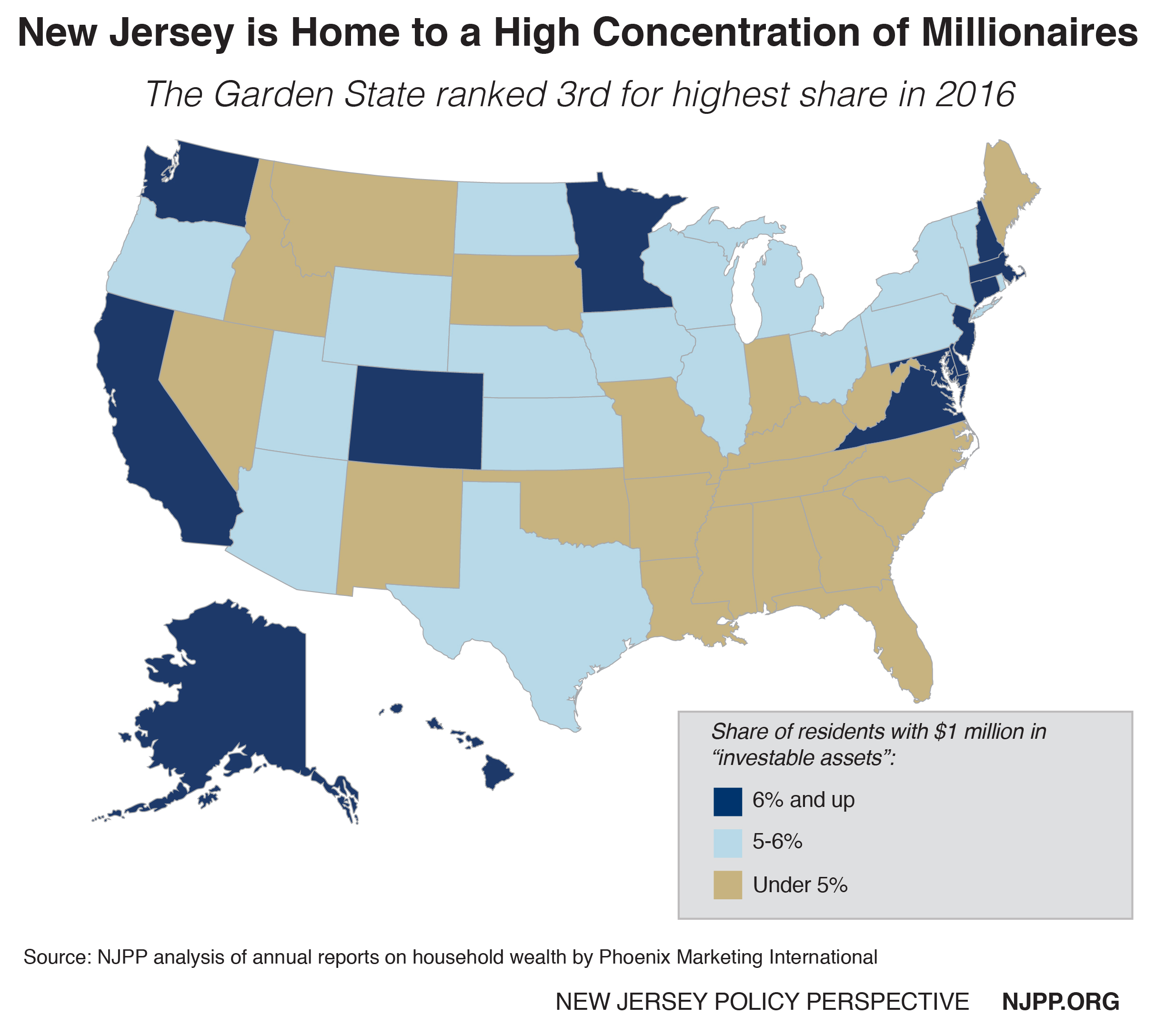

Reforming New Jersey S Income Tax Would Help Build Shared Prosperity New Jersey Policy Perspective

Reforming New Jersey S Income Tax Would Help Build Shared Prosperity New Jersey Policy Perspective

Reforming New Jersey S Income Tax Would Help Build Shared Prosperity New Jersey Policy Perspective

Reforming New Jersey S Income Tax Would Help Build Shared Prosperity New Jersey Policy Perspective

Here S How Biden S Tax Plan Would Affect Each U S State

New York Is Raising Taxes For Millionaires What You Need To Know

New York Is Raising Taxes For Millionaires What You Need To Know

Live In Nj And Work In Nyc Who Gets My Taxes Streeteasy

Live In Nj And Work In Nyc Who Gets My Taxes Streeteasy

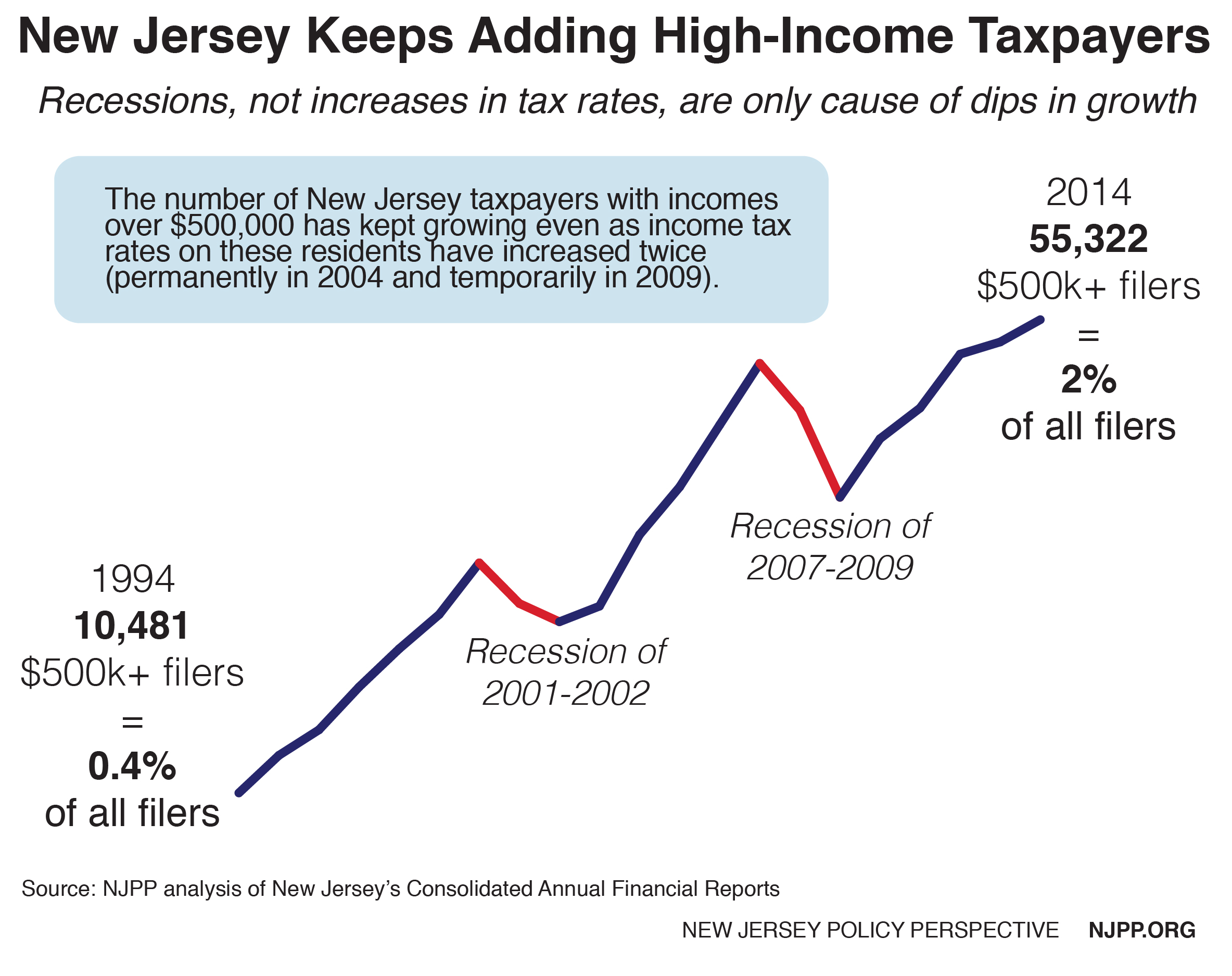

Reforming New Jersey S Income Tax Would Help Build Shared Prosperity New Jersey Policy Perspective

Reforming New Jersey S Income Tax Would Help Build Shared Prosperity New Jersey Policy Perspective

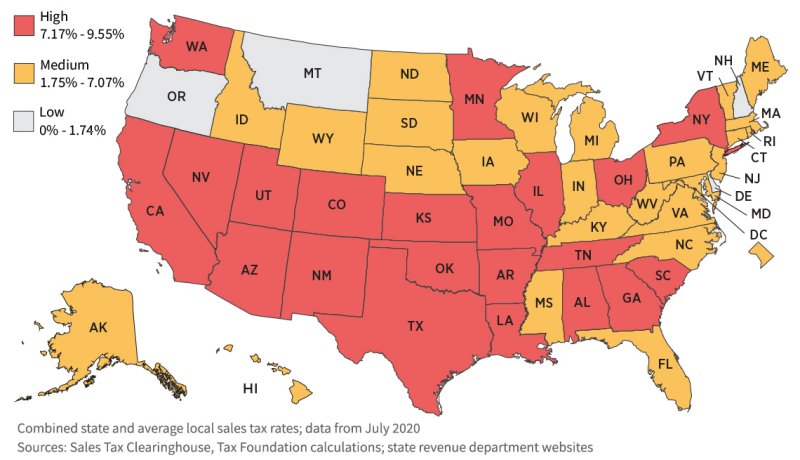

States With Highest And Lowest Sales Tax Rates

States With Highest And Lowest Sales Tax Rates

:max_bytes(150000):strip_icc()/GettyImages-1161240357-7ccd50e8080a4155a3dc7a24cccbf48e.jpg) Benefits Of Living In Nj While Working In Nyc

Benefits Of Living In Nj While Working In Nyc

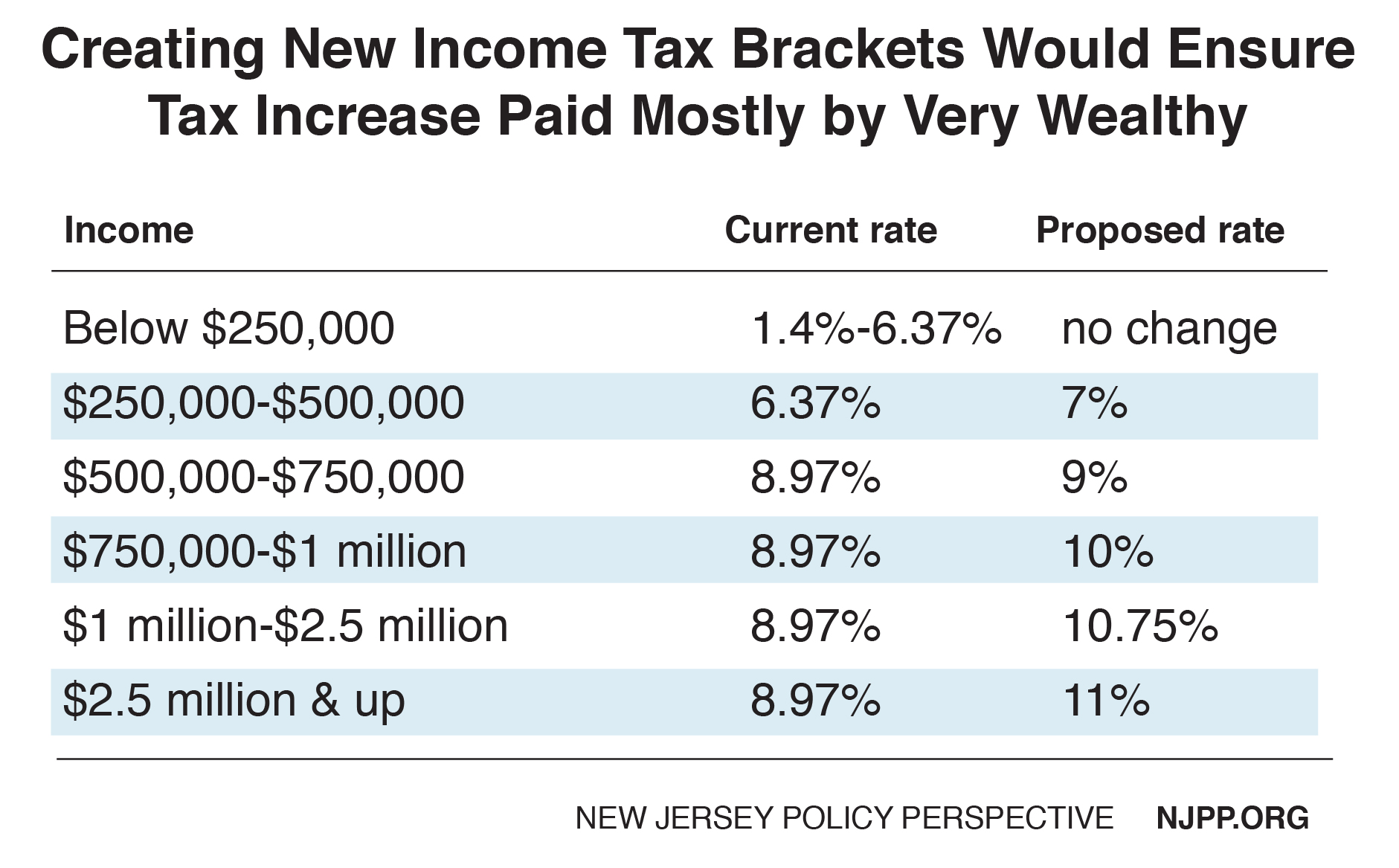

Reforming New Jersey S Income Tax Would Help Build Shared Prosperity New Jersey Policy Perspective

Reforming New Jersey S Income Tax Would Help Build Shared Prosperity New Jersey Policy Perspective

Reforming New Jersey S Income Tax Would Help Build Shared Prosperity New Jersey Policy Perspective

Reforming New Jersey S Income Tax Would Help Build Shared Prosperity New Jersey Policy Perspective

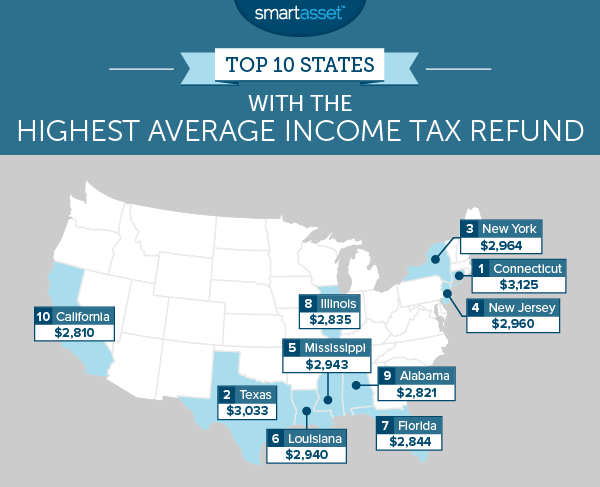

The Average Tax Refund In Every State Smartasset

The Average Tax Refund In Every State Smartasset

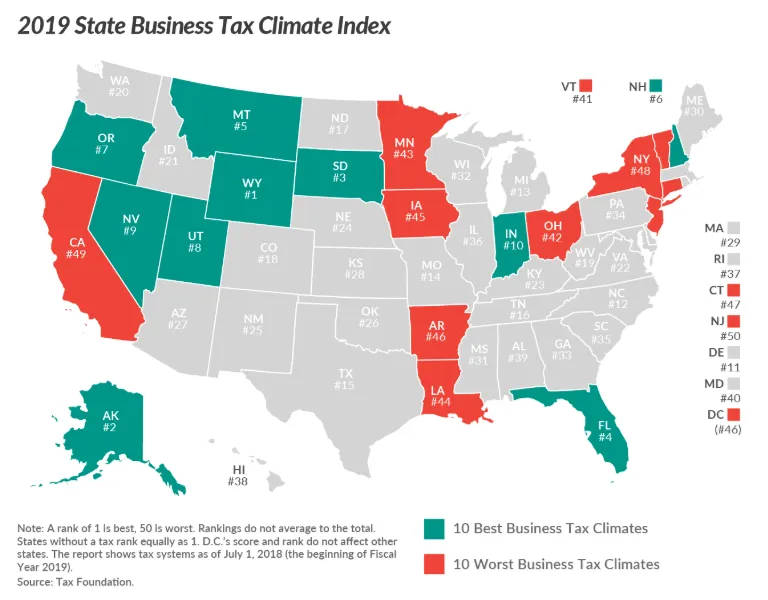

The Best And Worst U S States For Taxpayers

The Best And Worst U S States For Taxpayers

Reforming New Jersey S Income Tax Would Help Build Shared Prosperity New Jersey Policy Perspective

Reforming New Jersey S Income Tax Would Help Build Shared Prosperity New Jersey Policy Perspective

/GettyImages-538594694-791e2c621e27472fbdf9a3f1b7cfcb67.jpg) Benefits Of Living In Nj While Working In Nyc

Benefits Of Living In Nj While Working In Nyc

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/9551427/distribution_repeal_SALT.png) The State And Local Tax Deduction Explained Vox

The State And Local Tax Deduction Explained Vox

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home