Property Plant And Equipment Turnover Formula

See full answer to your question here. Fixed Asset Turnover Ratio.

Fixed Assets Turnover Ratio Accounting Play

Fixed Assets Turnover Ratio Accounting Play

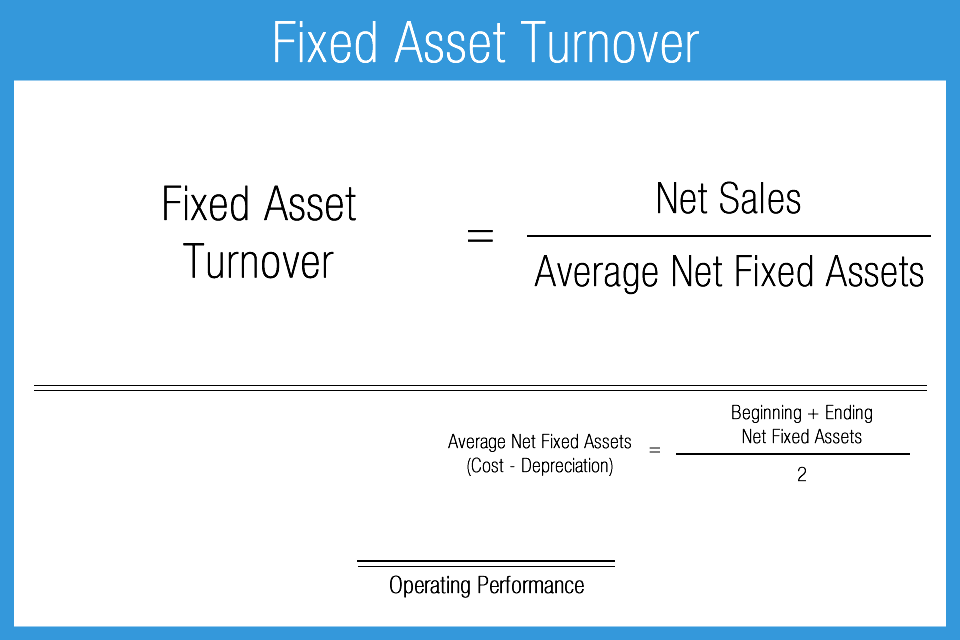

The ratio compares net sales with its average net fixed assetswhich are property plant and equipment PPE minus the accumulated depreciation.

/dotdash_Final_Property_Plant_and_Equipment_PPE_Sep_2020-01-dd61e2f2fdb7481d81e95bc90b5c61d8.jpg)

Property plant and equipment turnover formula. BAverage Total Assets Sales. Knowing how many properties youre losing and why youve lost them helps you modify your business practices to improve customer retention. Property plant and equipment PPE are long-term tangible assets that are physical in nature.

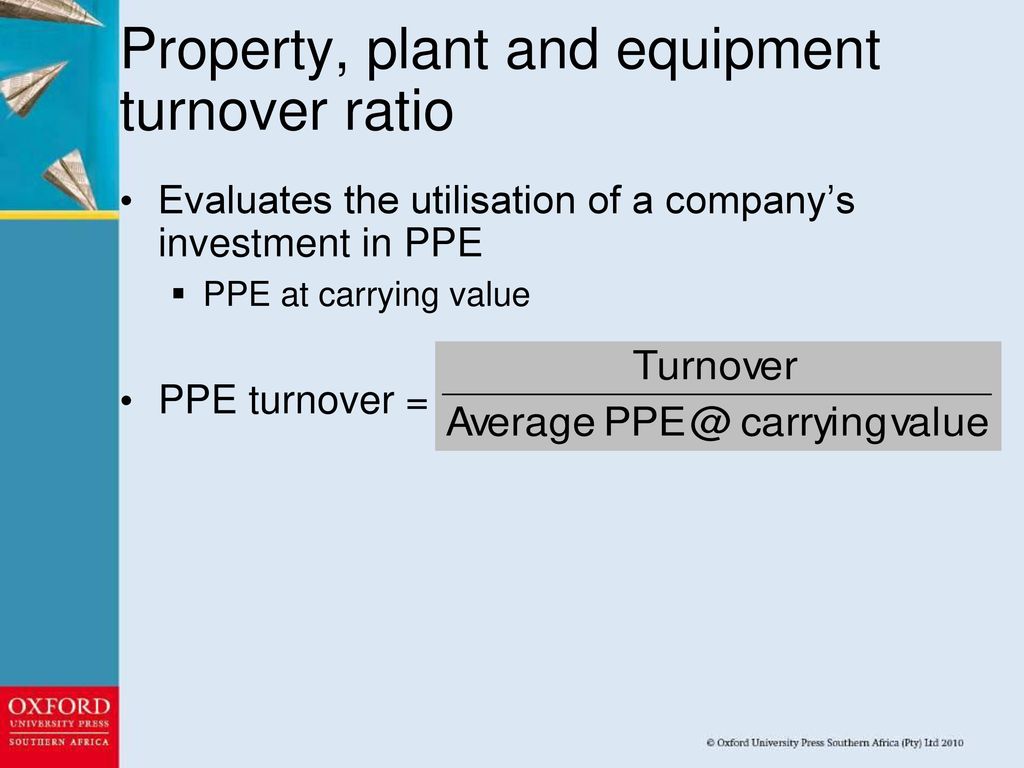

Intangible assets balances are calculated in much the same way by adding the. The fixed asset turnover ratio measures a company s ability to generate net sales from fixed asset investments specifically property plant and equipment PP E net of depreciation. If we have 8000 in revenue this year and divide that by property plant and equipment investments worth 2000 our PPE Turnover is.

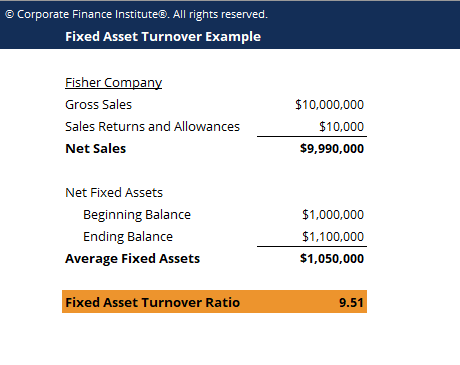

Fisher Company has annual gross sales of 10M in the year 2015 with sales returns and allowances of 10000. The fixed asset turnover ratio formula is calculated by dividing net sales by the total property plant and equipment net of accumulated depreciation. This means we generated 4 in sales revenue for every 1 of PPE.

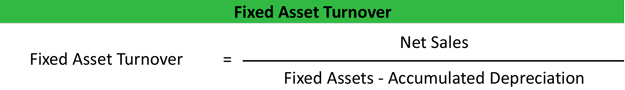

The fixed asset turnover ratio formula is calculated by dividing net sales by the total property plant and equipment net of accumulated depreciation. To determine the Fixed Asset Turnover ratio the following formula is used. As you can see its a pretty simple equation.

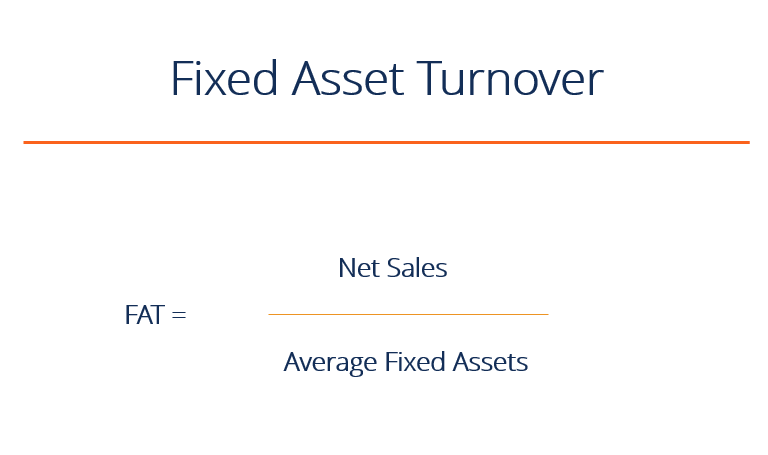

Since using the gross equipment values would be misleading its recommended to use the net asset value thats reported on the balance sheet by subtracting the accumulated depreciation from the gross. Next subtract accumulated depreciation from the result. Fixed Asset Turnover Net Sales Average Fixed Assets.

The disposal of assets involves eliminating assets from the accounting recordsThis is needed to completely remove all traces of an asset from the balance sheet known as derecognitionAn asset disposal may require the recording of a gain or loss on the transaction in the reporting period when the disposal occurs. As you can see its a pretty simple equation. 8000 2000 4.

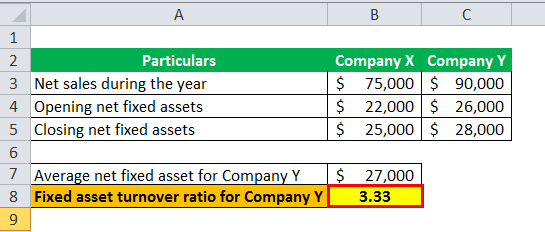

DSales Average Total Assets excluding long-term investments. The formula to calculate the asset turnover is. So from the above calculation the Fixed asset turnover ratio for company Y will be.

Fixed Asset Turnover Ratio Formula. On the other side is the number of properties lost. The property plant equipment balances on the balance sheet are calculated by adding the purchases of property plant equipment entered on the Assumptions sheet in the first balance sheet assumptions section and then deducting the appropriate depreciation charges that are included on the income statement.

Img altfixed asset turnover ratio srchttps4. The ratio is commonly used as a. CTotal Assets at the Beginning of the Year Total Assets at the End of the Year Sales.

Net Sales Gross sales less returns and allowances Average Fixed Assets 2NABB Ending Balance. The average property manager sees 10 to 20 percent turnover in any given year. The fixed asset turnover ratio formula is calculated by dividing net sales by the total property plant and equipment net of accumulated depreciation.

These are non-current assets that are used in the companys operations for a longer part of the time. Client turnover is never desirable but nevertheless inevitable. ATotal Assets at the Beginning of the Year Sales.

The formula for PPE Turnover is simply total revenue from the income statement divided by ending PPE from the balance sheet. To calculate PPE add the amount of gross property plant and equipment listed on the balance sheet to capital expenditures. Keeping this in view what is PPE turnover.

Property plant and equipment is considered a long-term. For the purposes of this discussion we will assume that the asset being. What is Property Plant and Equipment PPE.

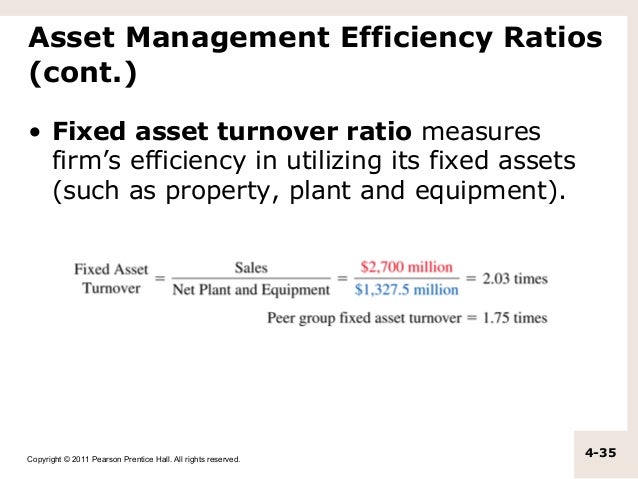

Fixed asset turnover ratio FAT is an indicator measuring a business efficiency in using fixed assets to generate revenue. Fixed asset turnover ratio for Company Y Net sales Average net fixed assets. NABB Net fixed assets beginning balance.

A financial ratio of net sales to fixed assets. Therefore company Y generates a sales revenue of 334 for each dollar invested in fixed assets as compared to company X which generates a sales revenue of 319 for each dollar invested in fixed assets. They are also called as the fixed assets of the company as it cannot be easily liquidated.

The estimates can be hard to develop for most plant assets Cost-residual valuetotal est usage depreciable cost per unit D cost per unit x actual usage yeardepr expense Units of.

Pp E Property Plant Equipment Overview Formula Examples

Pp E Property Plant Equipment Overview Formula Examples

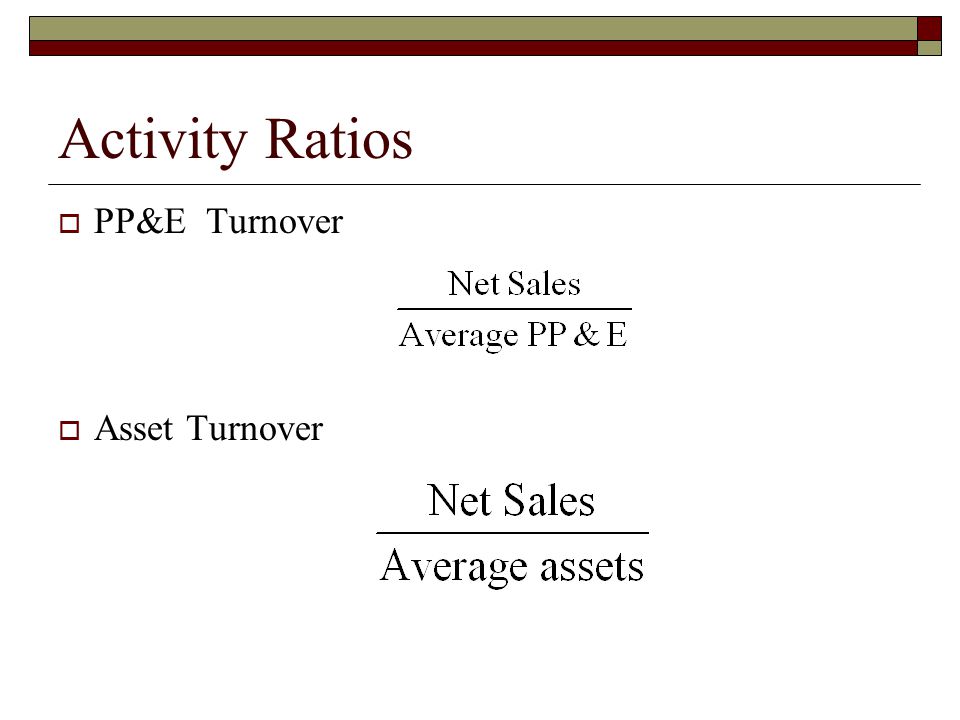

Chapter 3 Ratio Analysis Ppt Download

Chapter 3 Ratio Analysis Ppt Download

Asset Turnover How Effective Assets Are At Generating Revenue

Asset Turnover How Effective Assets Are At Generating Revenue

Asset Turnover Ratio Plan Projections

Asset Turnover Ratio Plan Projections

:max_bytes(150000):strip_icc()/dotdash_Final_Asset_Turnover_Ratio_Aug_2020-03-c36b34f0f73c4529bbfeaeee335d33d0.jpg) Asset Turnover Ratio Definition

Asset Turnover Ratio Definition

Fixed Asset Turnover Ratio Formula Example Calculation Explanation

Fixed Asset Turnover Ratio Formula Example Calculation Explanation

Fixed Asset Turnover Overview Formula Ratio And Examples

Fixed Asset Turnover Overview Formula Ratio And Examples

/dotdash_Final_Property_Plant_and_Equipment_PPE_Sep_2020-01-dd61e2f2fdb7481d81e95bc90b5c61d8.jpg) Property Plant And Equipment Pp E Definition

Property Plant And Equipment Pp E Definition

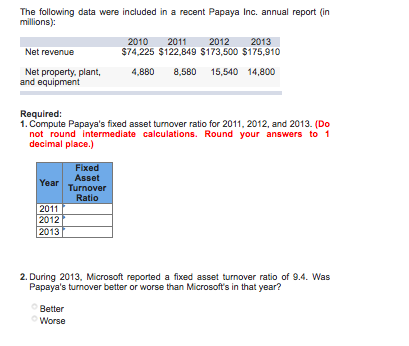

Solved The Following Data Were Included In A Recent Papay Chegg Com

Solved The Following Data Were Included In A Recent Papay Chegg Com

Pp E Property Plant Equipment Overview Formula Examples

Pp E Property Plant Equipment Overview Formula Examples

What Is The Fixed Asset Turnover Ratio

What Is The Fixed Asset Turnover Ratio

Activity Or Efficiency Ratios Nitin D Sharma

Activity Or Efficiency Ratios Nitin D Sharma

Activity Or Efficiency Ratios Nitin D Sharma

Activity Or Efficiency Ratios Nitin D Sharma

Fixed Asset Turnover Ratio Formula Calculation Examples

Fixed Asset Turnover Ratio Formula Calculation Examples

Financial Statement Analysis Ppt Video Online Download

Financial Statement Analysis Ppt Video Online Download

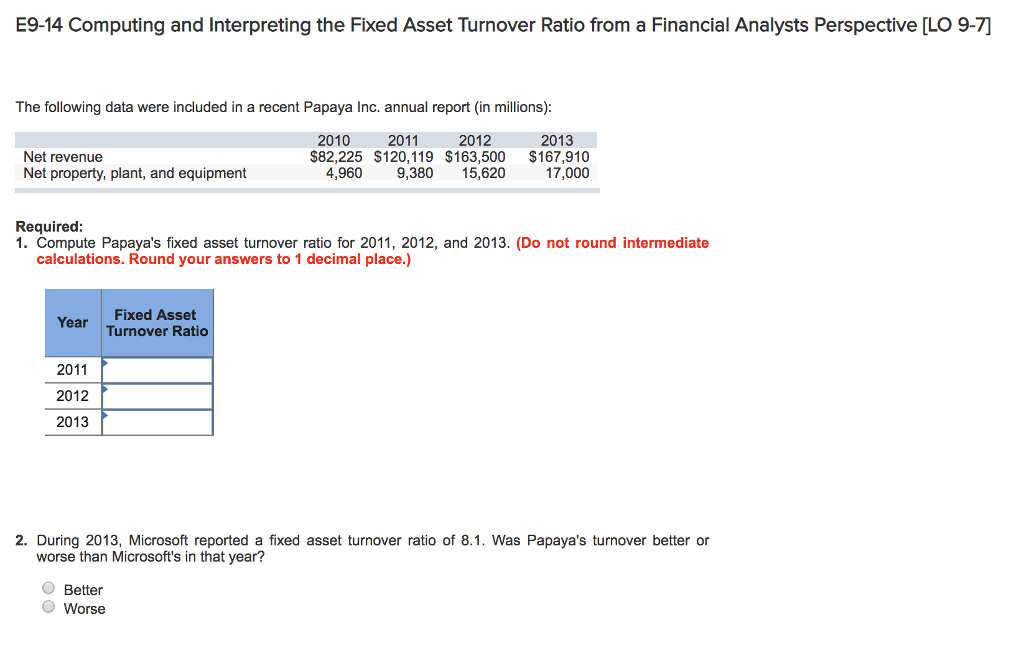

Solved E9 14 Computing And Interpreting The Fixed Asset T Chegg Com

Solved E9 14 Computing And Interpreting The Fixed Asset T Chegg Com

/dotdash_Final_Asset_Turnover_Ratio_Aug_2020-03-c36b34f0f73c4529bbfeaeee335d33d0.jpg) Asset Turnover Ratio Definition

Asset Turnover Ratio Definition

Fixed Asset Turnover Template Download Free Excel Template

Fixed Asset Turnover Template Download Free Excel Template

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home