What Documents Do I Need For Homestead Exemption

A deed to the new property and a former tax bill or homestead card from the old property will be required. You need to show the appraiser quite a bit of documentation in order to claim the homestead exemption.

Residential Homestead Exemption How To File Electronically

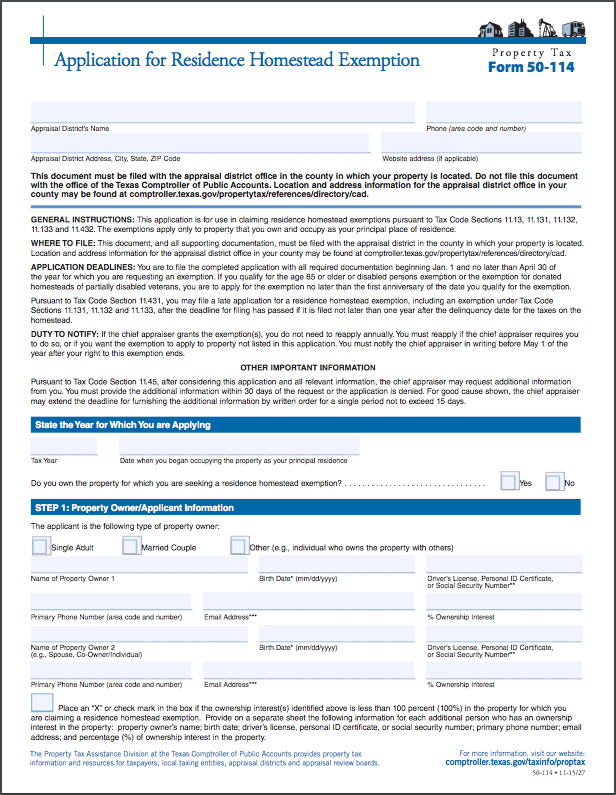

Property owners applying for a residence homestead exemption file this form and supporting documentation with the appraisal district in each county in which the property is located Tax Code Sections 1113 11131 11132 11133 11134 and 11432.

What documents do i need for homestead exemption. DOCUMENTS AND OTHER INFORMATION NEEDED IN FILING. Proof of ownership of your property in the form of a copy of a tax bill or your deed. Homestead exemption amounts reflected on the tax statements sent by county treasurers.

Mortgage companies receive a copy of the tax statement indicating any homestead exemption granted. What documents are required as proof of eligibility when applying. Do I qualify for the Homestead Exemption.

Proof of payment of utilities at homestead address Examples. Homestead exemption will remain on the property until there is a change in ownership. Homestead exemption is a constitutional benefit of a 50000 exemption from the propertys assessed value.

Valid Georgia Drivers License with current residence address. If you are applying due to disability you will need to present documentation from the state or federal agency certifying the disability. Contact your states tax office or secretary of states office for specific instructions on how to apply for a homestead exemption.

Assessed Value 45000 The first 25000 of value is exempt from all property tax and the remaining 20000 of value is taxable. It is granted to those. Required Documentation for Homestead Exemption Application All applications submitted must include copies of the following required documentation Proofs of Residency for all owners who apply.

WidowWidower Exemption 500 Exemption for Totally and Permanently Disabled Persons Income. In many cases particularly if you have owned the residence for a while and are applying for the homestead exemption online the Appraisers office will have a record of your ownership of the property. Accordingly you should gather this material as soon as possible.

If you do qualify for a credit you must submit a copy of your 2020 property tax bill if you owned and occupied your home or an original rent certificate signed by your landlord if you rented your home along with your Schedule H or H-EZ. Your recorded deed or tax bill Florida Drivers License or Identification Card. A homestead is defined as a single-family owner-occupied dwelling and the land thereto not exceeding 160 acres.

If statements 1 2 and 3 are true you qualify to receive the Homestead Exemption. Florida drivers license or if you dont drive a. The Warranty Deed or a copy of the closing statement may be required along with photo.

The Homestead Exemption credit continues to completely exempt the value of 50000 for all purposes except for school operating purposes already exempted by the new 2007 legislation. If you currently have a homestead exemption and purchased a new home in the same county you must come into the office to do a transfer. HOMESTEAD EXEMPTION REQUIRED DOCUMENTS All applicants must submit a completed DR-501 with no less than four 4 forms of identification as listed below for each applicant.

Social Security CardNumber REQUIRED By law the social security number of the applicant and the applicants spouse must be. Collect the following for each of the propertys owners. Documents Required with Homestead Exemption Application Depending upon which application is completed one or more of the following items shall be required.

Surviving Spouse of a Disabled Veteran 5000 Homestead Exemption. Assessed Value 65000 The first 25000 of value is exempt from all property tax thenext 25000 of value is taxable and 15000 of value is exempt from non-. The property owner may be entitled to a homestead exemption if he or she owns a single-family residence and occupies it as their primary residence on the first day of the tax year for which they are applying.

The filing deadline for. If you are applying due to age your birth certificate or South Carolina Drivers License.

Homestead Exemption Mysouthlakenews

Homestead Exemption Mysouthlakenews

Texas Homestead Tax Disabled Veteran Home Exemption Information

Texas Homestead Tax Disabled Veteran Home Exemption Information

The Fund 2019 Florida Homestead Exemption Download

Homestead Exemption Mysouthlakenews

Homestead Exemption Mysouthlakenews

What Is A Homestead Exemption And How Does It Work Lendingtree

What Is A Homestead Exemption And How Does It Work Lendingtree

Texas Homestead Application O Connor Property Tax Reduction Experts

Texas Homestead Application O Connor Property Tax Reduction Experts

Florida Homestead Exemptions Emerald Coast Title Services

Florida Homestead Exemptions Emerald Coast Title Services

Free Form Otc 921 Application For Homestead Exemption Free Legal Forms Laws Com

Free Form Otc 921 Application For Homestead Exemption Free Legal Forms Laws Com

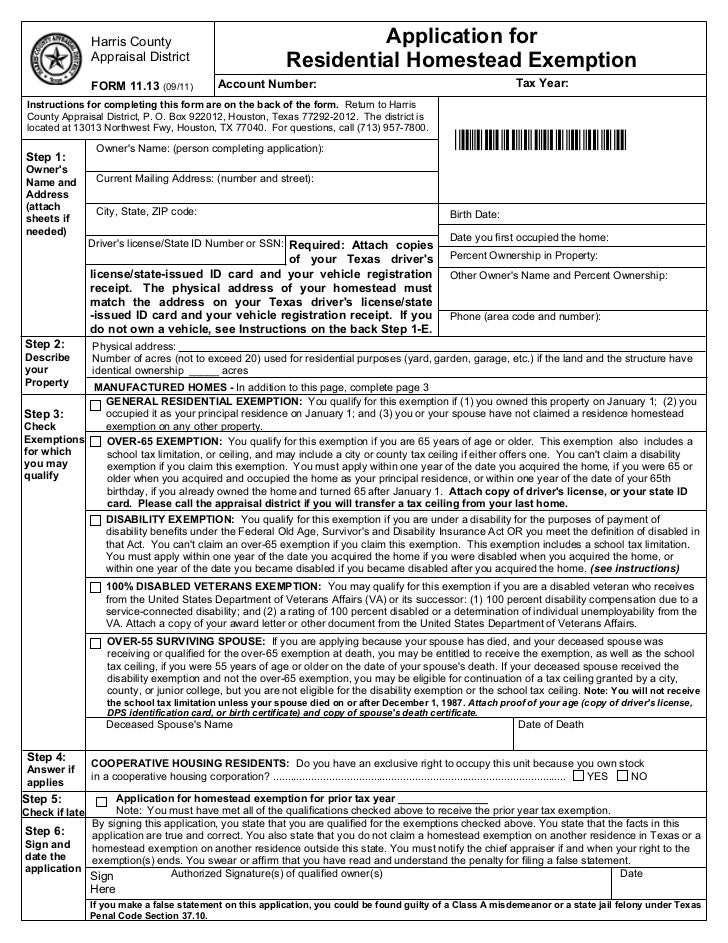

2021 Update Houston Homestead Home Exemptions Step By Step Guide

2021 Update Houston Homestead Home Exemptions Step By Step Guide

Homestead Exemption Application Montgomery County Tx

Homestead Exemption Application Montgomery County Tx

What Is A Homestead Exemption And How Do I Apply For One All Your Questions Answered Twelve Rivers Realty

What Is A Homestead Exemption And How Do I Apply For One All Your Questions Answered Twelve Rivers Realty

Harris Co Tx Homestead Exemption

Harris Co Tx Homestead Exemption

Homestead Exemptions And Taxes Madison Fine Properties

Homestead Exemptions And Taxes Madison Fine Properties

Florida Homestead Exemption Chrisluis Com

Florida Homestead Exemption Chrisluis Com

What Is Homestead Exemption Find Houston Homes

What Is Homestead Exemption Find Houston Homes

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home