Irs Maximum Property Tax Deduction 2020

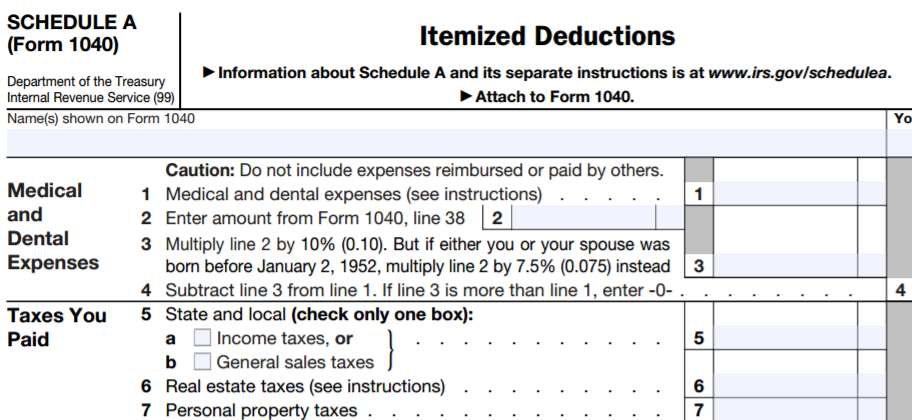

Taxpayers can deduct contributions to a traditional IRA. Those taxes can include state and local personal property taxes state and local sales tax and other.

Give To Charity But Don T Count On A Tax Deduction

Give To Charity But Don T Count On A Tax Deduction

IRS Provides Tax Inflation Adjustments for Tax Year 2020 Accessed Nov.

Irs maximum property tax deduction 2020. Real estate taxes Personal property taxes. The facts are the same as in Example 1 except that Bill used 25000 of the loan proceeds to substantially improve his home and 75000 to repay his existing mortgage. You cant deduct any of the taxes paid in 2020 because they relate to the 2019 property tax year and you didnt own the home until 2020.

You can take personal property tax deductions by listing them as an itemized deduction on your federal tax return according to certain rules. All these taxes fall under the same umbrella. Its not a 10000 limit for each.

Or 5000 if married filing separately. You owned the home in 2020 for 243 days May 3 to December 31 so you can take a tax deduction on your 2021 return of 946 243 366 1425 paid in 2021 for 2020. His deduction is 500 2000 25 025.

For 2020 what is the property tax deduction limit For a main personal residence one form says the property tax deduction limit is 10000 and one form says 8600. But the IRS is picky about which tax deductions you may claim so you have a choice to either. Property tax deductions offer homeowners the opportunity to lower tax bills significantly by reducing taxable income.

5377 which calls for the removal of the SALT deduction. To be clear this is the amount of. Instead you add the 1375 to the cost basis of your home.

Bill deducts 25 25000 100000 of the points 2000 in 2020. In late December 2019 the US. The Restoring Tax Fairness for States and Localities Act would eliminate the 10000 limit on state and local tax deductions for 2020 and 2021.

Which one is correct. The total deduction allowed for all state and local taxes for example real property taxes personal property taxes and income taxes or sales taxes is limited to 10000. In 2018 2019 and 2020 the residential energy property credit is limited to an overall lifetime credit limit of 500 200 lifetime limit for windows.

The TCJA limits the amount of property taxes you can claim. Renting out your second residence. There are also other individual credit limitations.

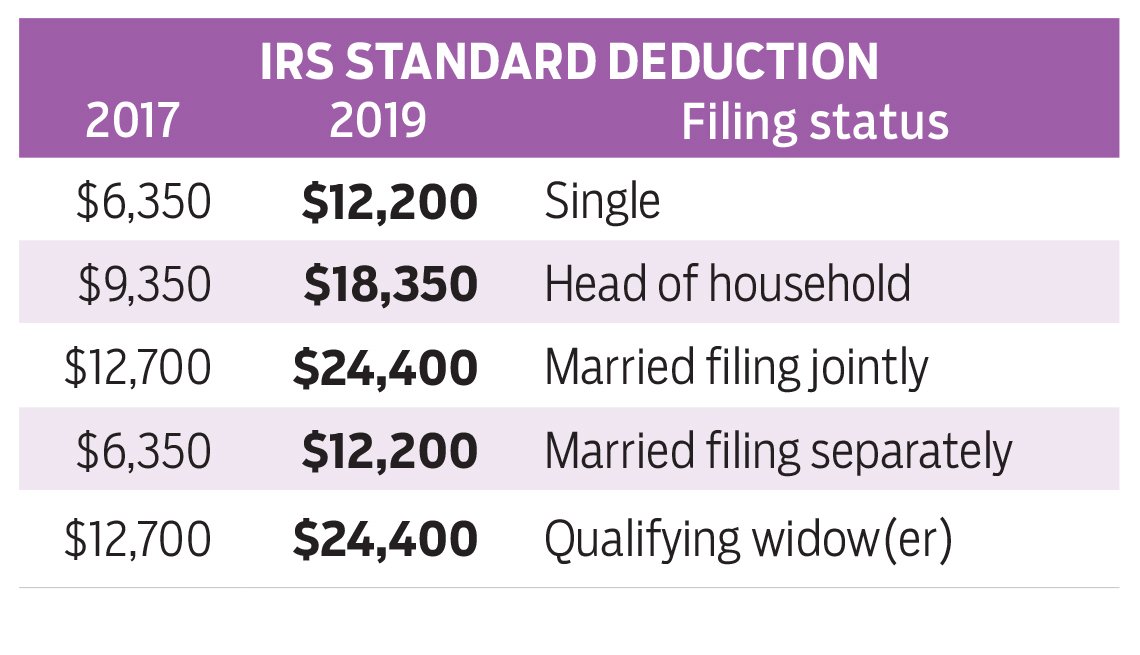

For the 2019 and 2020 tax years the traditional IRA contribution limit is 6000 per person with an additional 1000 catch-up. Take the standard IRS property tax deduction. Separate filers face a.

The 2020 standard deduction For 2020 the standard deduction is rising by 200 to 400 depending on your filing status. This ceiling applies to income taxes you pay at the state and possibly local level as well as property taxes. House of Representatives passed the Restoring Tax Fairness for States and Localities Act HR.

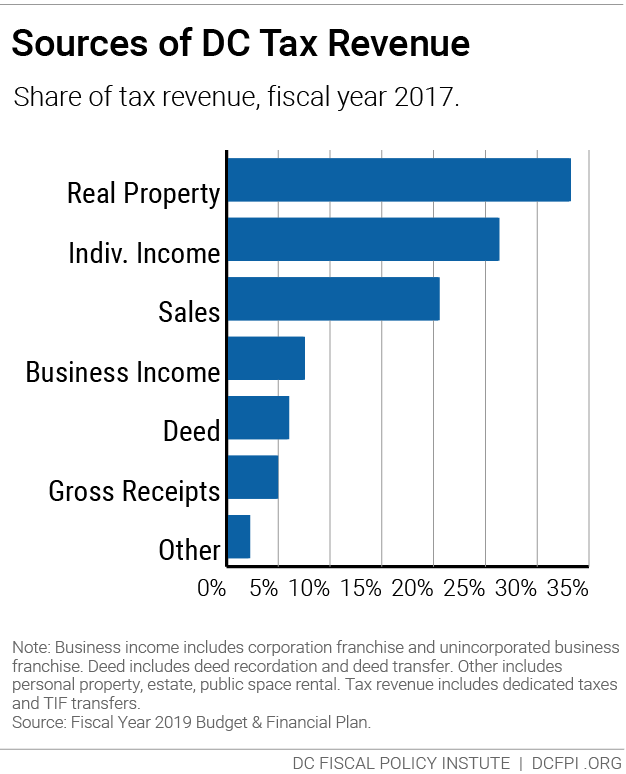

Including real estate and income taxes inclusively. 50 for any advanced main air circulating fan 150 for any qualified natural. Filers may deduct taxes paid in 2020 up to 10000 5000 if married filing separately.

It places a 10000 cap on state local and property taxes collectively beginning in 2018. According to the TCJA state and local income sales tax and property tax deductions have been limited to 10000 per person or 5000 if you. This 10000 cap applies to all tax filers regardless of their filing status except for married filing separately.

Read more »