Property Tax Deduction Limit $10 000

State and local and foreign income war profits and excess profits taxes. In other words if you paid 6000 in property taxes and 8000 in state income taxes for 2019 your SALT deduction is 10000 not the 14000 you actually paid for those expenses.

How To Pay Little To No Taxes For The Rest Of Your Life

How To Pay Little To No Taxes For The Rest Of Your Life

Unfortunately property taxes paid on personal use property second homes and vacation homes while still deductible as itemized deductions are subject to the 10000 limitation.

Property tax deduction limit $10 000. This will leave some high-income filers with a higher tax bill. This ceiling applies to income taxes you pay at the state and possibly local level as well as property taxes. And general sales taxes if elected for any tax year to 10000 5000 for marrieds filing separately.

The TCJA limits the amount of property taxes you can claim. For tax years 2018 through 2025 TCJA limits deductions for taxes paid by individual taxpayers in the following ways. State income or sales taxes you can deduct either income taxes or sales taxes but not both in the same year Real estate taxes.

Tax Reform limits the aggregate deduction for state and local real property taxes. It places a 10000 cap on state local and property taxes collectively beginning in 2018. Other property taxes not subject to the 10000 cap are those paid for rental properties and those paid in the ordinary course of a trade or business such as an operating company.

State and local and foreign income war profits and excess profits taxes. All these taxes fall under the same umbrella. There is a 10000 limit for state and local taxes state tax local taxes property taxes and sales tax.

The limit is 10000 - 5000 if married filing separately. State and local personal property taxes. New dollar limit on total qualified residence loan balance.

Or can it be deducted even if youve reached 10K limit. Is car registration fee subject to 10000 limit on state and local taxes. A sweeping overhaul of the tax code unveiled by House Republicans on Thursday would cap the deduction for property taxes at 10000 and preserve the.

This 10000 cap applies to all tax. Under this tax reform bill which was signed into law in December 2017 taxpayers are allowed to deduct a maximum of 10000 5000 for married taxpayer filing a separate return for all state and local taxes paid in a tax year including property taxes and income taxes or sales taxes. There was previously no limit.

And general sales taxes if elected for any tax year to 10000 5000 for marrieds filing separately. Starting with the 2018 tax year the maximum SALT deduction became 10000. So if you owned a luxury home with a 20000 real estate tax bill the maximum tax deduction you could take for it is 10000.

If your property taxes are 3000. State and local personal property taxes. This cap is in effect from 2018 until Dec.

However property taxes and income taxes not sales taxes are the primary drivers of the SALT deduction. Anything above this amount is not deductible. The Tax Cuts and Jobs Act of 2017 TCJA slapped a 10000 maximum deduction cap on state and local taxes including real estate taxes.

According to data direct from the IRS allowing property tax deductions up to 10000 which I fought for and won will cover nearly every taxpayer in the Third Congressional District. The Democratic-controlled House passed a bill on Thursday that would do away with the 10000 limit on the itemized deduction for state and local taxes for two years. That means that if your real estate property taxes are 10000 and your state income taxes are 10000 you will be limited in deduction a grand total of 10000.

According to the TCJA state and local income sales tax and property tax deductions have been limited to 10000 per person or 5000 if you are married and filing separately. A taxpayers deduction for state and local income sales and property taxes is limited to a combined total deduction. Your itemized deductions have to be more than your standard deduction before you will see a change in your tax owed or tax refund.

It limits the aggregate deduction for state and local real property taxes. If your fees count as deductible state taxes not all states qualify then it is subject to the same overall cap for all state and local taxes.

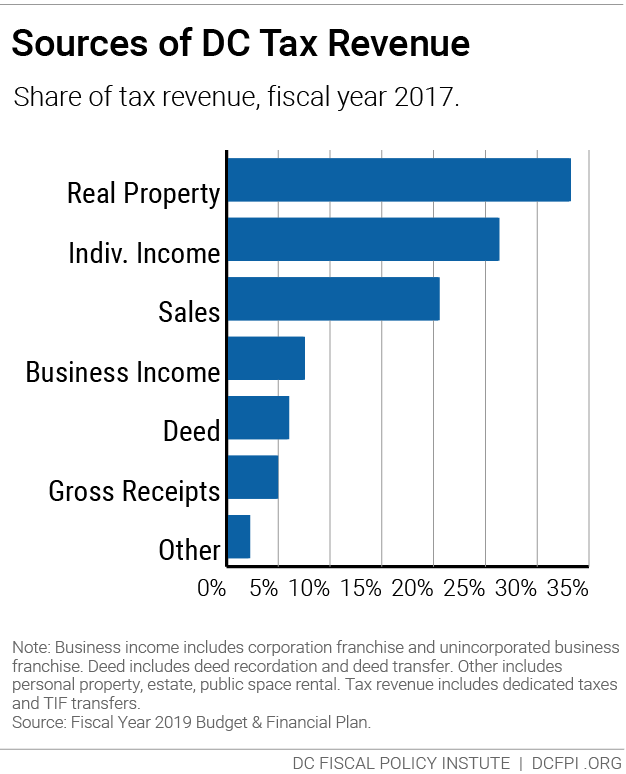

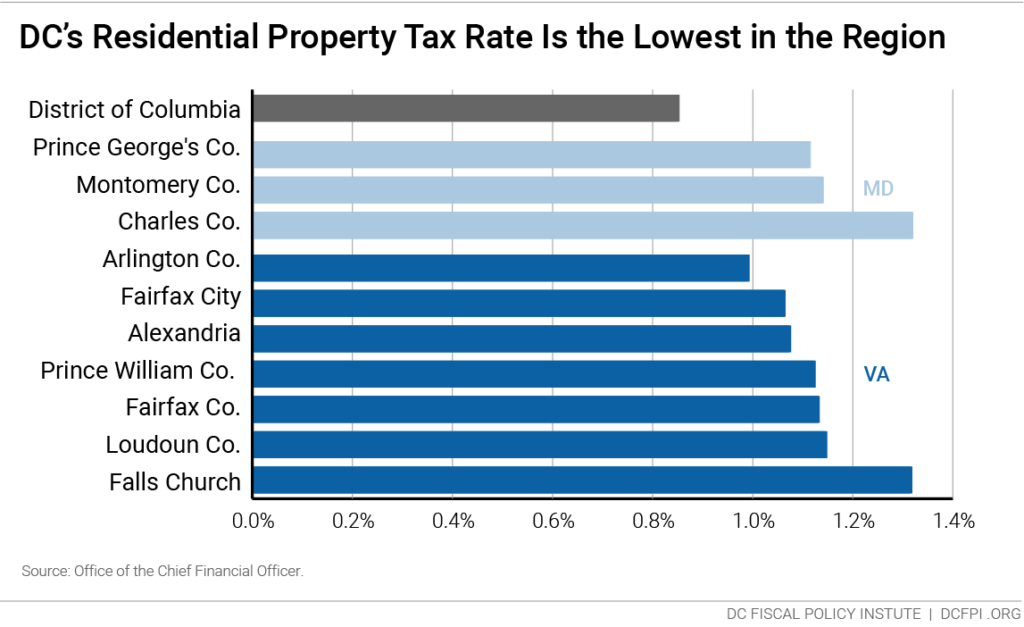

Taxes In The District The Evolution Of Dc Tax Rates Since The Early 2000s

Taxes In The District The Evolution Of Dc Tax Rates Since The Early 2000s

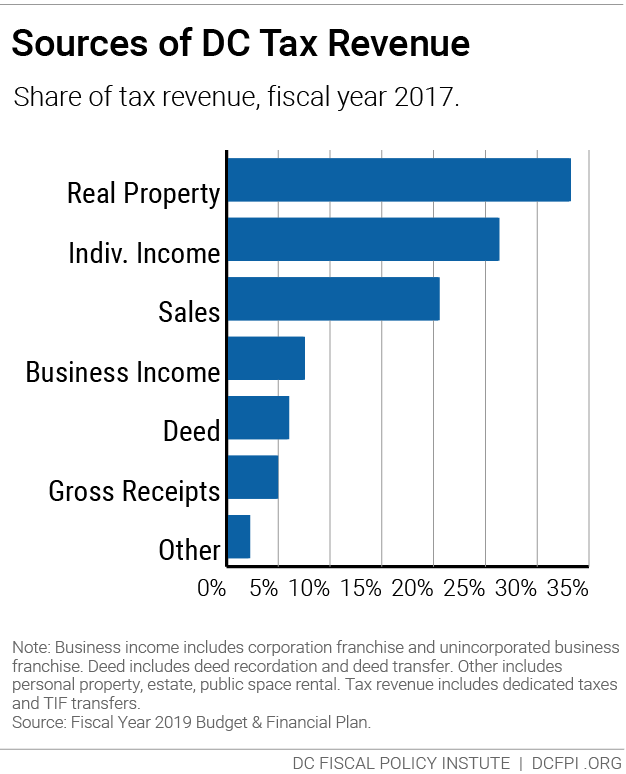

Property Taxes Compression Ballot Measures League Of Women Voters Of Portland

Property Taxes Compression Ballot Measures League Of Women Voters Of Portland

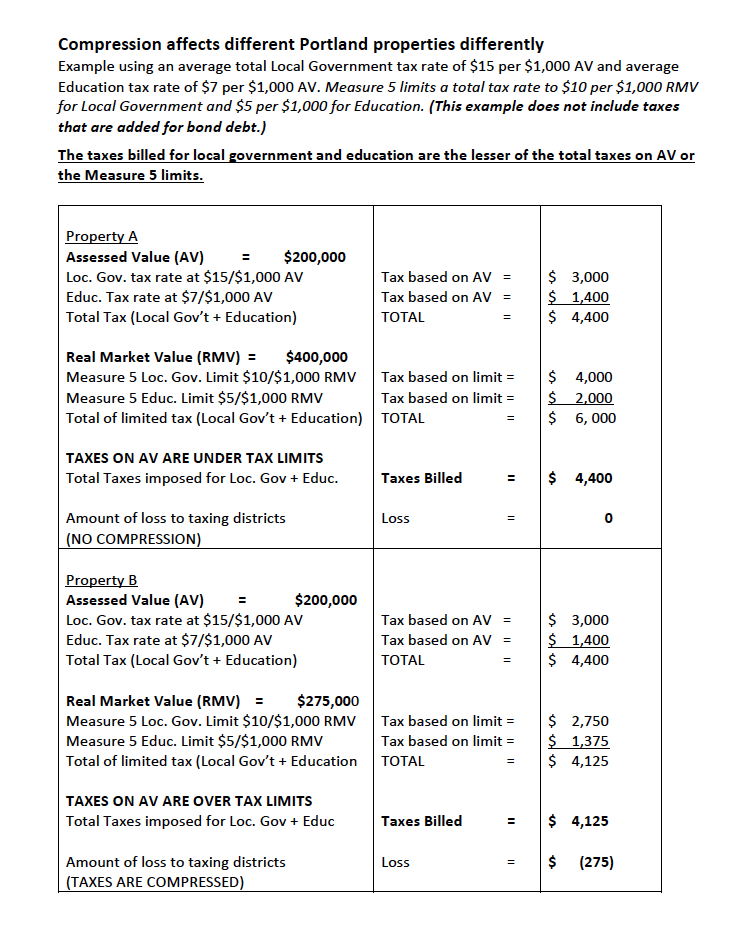

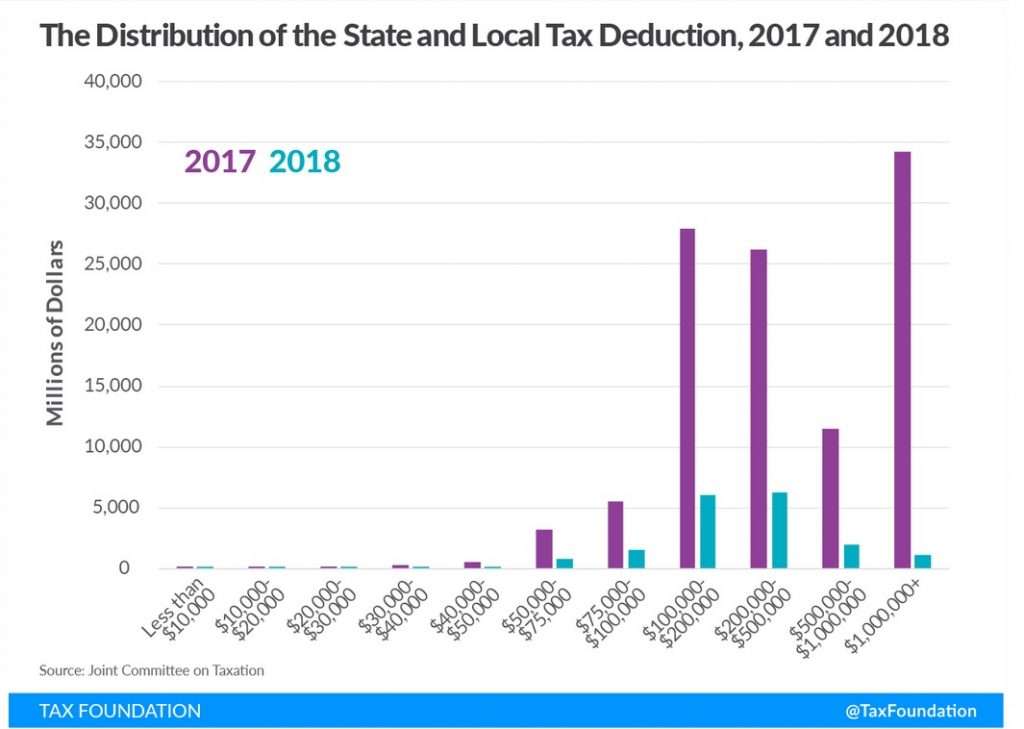

How Does The Deduction For State And Local Taxes Work Tax Policy Center

How Does The Deduction For State And Local Taxes Work Tax Policy Center

10 000 Cap On State Local Tax Deductions In Play In U S Congress Loop North News

10 000 Cap On State Local Tax Deductions In Play In U S Congress Loop North News

Salt Tax Deduction 2020 Changes What Changed Millionacres

Salt Tax Deduction 2020 Changes What Changed Millionacres

Eat The Rich House Democrats Plan To Pass Huge Tax Break For Wealthy Homeowners Reason Com

Eat The Rich House Democrats Plan To Pass Huge Tax Break For Wealthy Homeowners Reason Com

How Does The Deduction For State And Local Taxes Work Tax Policy Center

How Does The Deduction For State And Local Taxes Work Tax Policy Center

House Passes Bill To Lift 10 000 Cap On State And Local Tax Deduction

House Passes Bill To Lift 10 000 Cap On State And Local Tax Deduction

If You Want To Become A Real Estate Mogul You Don T Need Much Money To Get There Real Estate Investing Rental Property Real Estate Investing Real Estate Tips

If You Want To Become A Real Estate Mogul You Don T Need Much Money To Get There Real Estate Investing Rental Property Real Estate Investing Real Estate Tips

Replace A 70k Salary With Passive Income Through Real Estate Getting Into Real Estate Real Estate Investing Rental Property Real Estate Tips

Replace A 70k Salary With Passive Income Through Real Estate Getting Into Real Estate Real Estate Investing Rental Property Real Estate Tips

How Does The Deduction For State And Local Taxes Work Tax Policy Center

How Does The Deduction For State And Local Taxes Work Tax Policy Center

Higher Standard Deduction May Offset Salt Limit News Telegram Com Worcester Ma

Irs Publishes Guidance On Interplay Between 10 000 Salt Cap Tax Treatment Of State Tax Refunds

Irs Publishes Guidance On Interplay Between 10 000 Salt Cap Tax Treatment Of State Tax Refunds

Property Tax Relief In Pennsylvania The Pennsylvania Budget And Policy Center

Property Tax Relief In Pennsylvania The Pennsylvania Budget And Policy Center

Property Tax Relief In Pennsylvania The Pennsylvania Budget And Policy Center

Property Tax Relief In Pennsylvania The Pennsylvania Budget And Policy Center

Selfemployedproduct Job Info Tax Forms Self Assessment

Selfemployedproduct Job Info Tax Forms Self Assessment

How To Prepare For Trump S Middle Class Tax Hike Financial Samurai

How To Prepare For Trump S Middle Class Tax Hike Financial Samurai

How To Pay Little To No Taxes For The Rest Of Your Life

How To Pay Little To No Taxes For The Rest Of Your Life

Taxes In The District The Evolution Of Dc Tax Rates Since The Early 2000s

Taxes In The District The Evolution Of Dc Tax Rates Since The Early 2000s

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home