Homestead Property Tax Florida Ballot

Currently if your house has a Homestead exemption and you move you have two years to carry that tax break along with you. INCREASED HOMESTEAD PROPERTY TAX EXEMPTION Ballot language.

Florida Ballot Initiatives For Constitutional Amendments A Mixed Bag

Florida Ballot Initiatives For Constitutional Amendments A Mixed Bag

Under the Florida Constitution every Florida homeowner can receive a homestead exemption up to 50000.

Homestead property tax florida ballot. Provides that the homestead property tax discount for certain veterans with permanent combat-related disabilities carries over to such veterans surviving spouse who holds legal or beneficial title to and who permanently resides on the homestead property until he or she remarries or sells or otherwise disposes of the property. 25000 applies to all property taxes including school district taxes. Florida Legislature HJR 369.

What You Need To Know Amendment 5 extends homestead portability. The application for homestead exemption Form DR-. The Voters Guide examines the proposed amendments to the Florida Constitution that are on the Nov.

Voters Guide to the 2018 Florida Ballot Amendments. There were two amendments on the Florida 2020 general election ballot that addressed Homestead property tax benefits Amendment 6 was one of those but was specifically for spouses of deceased. Its offered based on your homes assessed value and offers exemptions within certain value limits.

The amendment shall take effect January 1 2019. The measure is often referred to as the Save Our Homes. The first 25000 in property value is exempt from all property taxes including school district taxes.

Provides that the homestead property tax discount for certain veterans with permanent combat-related disabilities carries over to such veterans surviving spouse who holds legal or beneficial title to and who permanently resides on the homestead property until he or she remarries or sells. The Florida homestead exemption is an exemption that can reduce the taxable value of your home by as much as 50000. Proposing an amendment to the State Constitution effective January 1 2021 to increase from 2 years to 3 years the period of time during which accrued Save-Our-Homes benefits may be transferred from a prior homestead to a new homestead.

Property owners in Florida may be eligible for exemptions and additional benefits that can reduce their property tax liability. Proposing an amendment to the State Constitution to increase the homestead exemption by exempting the assessed valuation of homestead property greater than 100000 and up to 125000 for all levies other than school district levies. Making the cap permanent so that non-homestead parcels would not see significant property tax increases in any given year makes good tax policy and economic sense.

People who transfer homestead. Homestead Property Tax Discount for Spouses of Deceased Veterans Amendment Summary. The county property appraisers from Palm Beach Broward and Miami-Dade counties are all endorsing amendments 5 and 6 which would lower some voters property taxes.

The additional exemption up to 25000 applies to the assessed value between 50000 and 75000 and only to non-school taxes. The discount may be transferred to a new homestead property. Amendment 5 would extend the Florida deadline from two years to three.

Name of Families for Lower Property Taxes Inc12 proposed an amendment to the Florida Constitution through a citizen initia-tive petition13 The ballot summary for the proposed amendment promised property tax relief to Florida homeowners through an increase in the homestead tax exemption14 Passing the proposed. The homestead exemption and Save Our Homes assessment limitation help thousands of Florida homeowners save money on their property taxes every year. The additional 25000 exemption is available for non-school taxes and applies only to the assessed value between 50000 and 75000.

Limitations On Homestead Property Tax Assessments. See section 196031 Florida Statutes Homestead Property Tax Exemption. See election results a county-by-county map and more for the Florida Amendment 6 - Extend Vet Prop Tax Discount election on Nov.

A constitutional amendment is on the ballot this November that homeowners in the state of Florida will want to pay attention to. Increased Portability Period To Transfer Accrued Benefit. This amendment modified Article VII of the Florida Constitution to limit homestead property valuation increases to a maximum of 3 annually.

The Florida Homestead Valuation Limit Amendment also known as Amendment 10 was an initiated constitutional amendment in Florida which was approved on the ballot on November 3 1992. Further benefits are available to property owners with disabilities senior citizens veterans and active duty military service.

What To Know About Florida S Amendment 6 Transfer Of Veteran Benefits To Surviving Spouses

What To Know About Florida S Amendment 6 Transfer Of Veteran Benefits To Surviving Spouses

Amendments 5 And 6 On Florida S Ballot Focus On Florida Property Taxes The Independent Florida Alligator

What Are These Florida Amendments All About Nonpartisan Analysis From The League Of Women Voters Palm Coast Observer

What Are These Florida Amendments All About Nonpartisan Analysis From The League Of Women Voters Palm Coast Observer

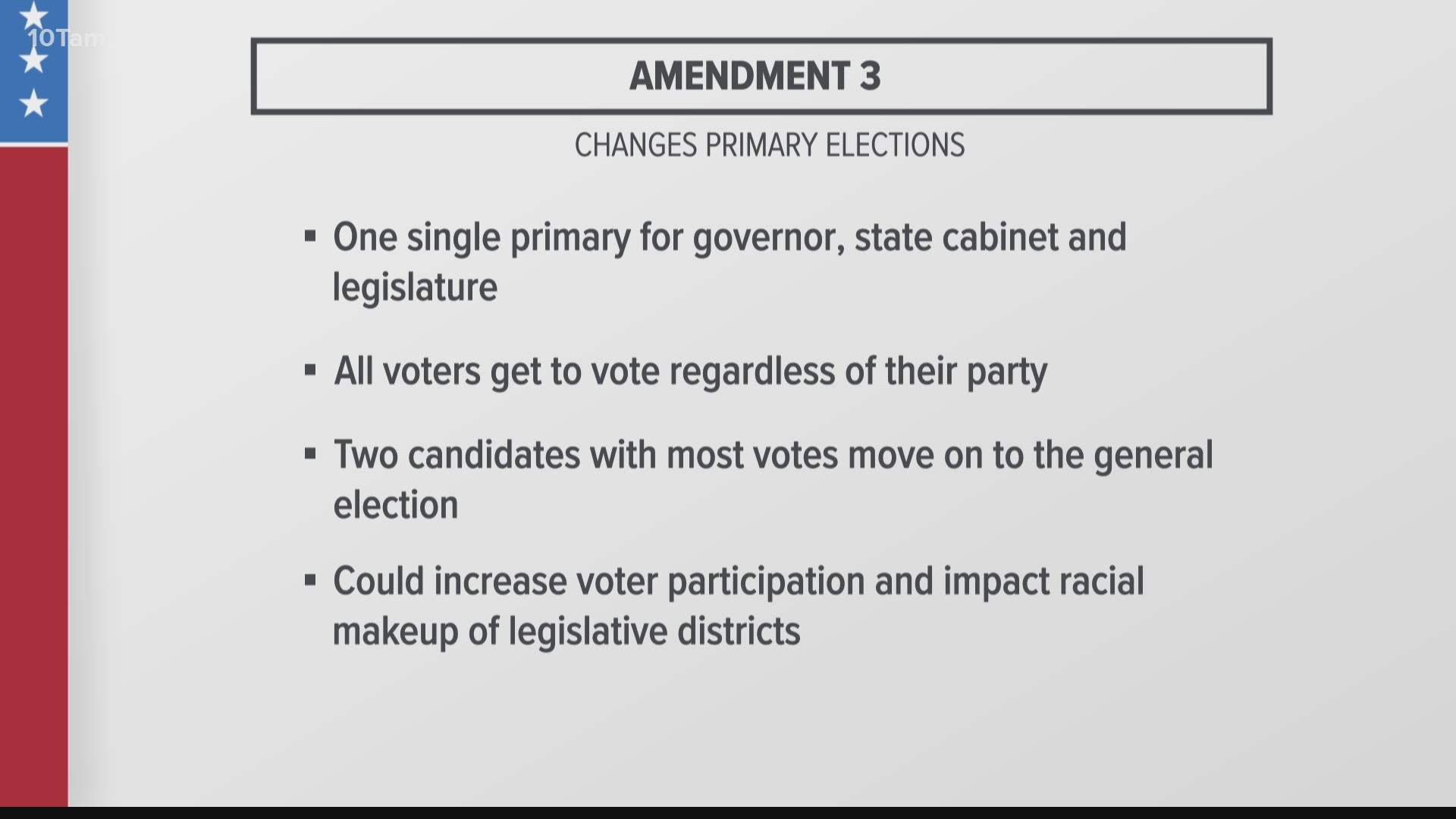

What Are The Florida Amendments To Vote On In 2020 Firstcoastnews Com

What Are The Florida Amendments To Vote On In 2020 Firstcoastnews Com

Understanding Your Vote Naples Florida Weekly

Understanding Your Vote Naples Florida Weekly

Attention Residents Please See The Information From The Broward County Property Appraiser S Office Below Regarding Ballot Amendments Tax Collector Information And Homestead Outreach Southwest Ranches Florida

Attention Residents Please See The Information From The Broward County Property Appraiser S Office Below Regarding Ballot Amendments Tax Collector Information And Homestead Outreach Southwest Ranches Florida

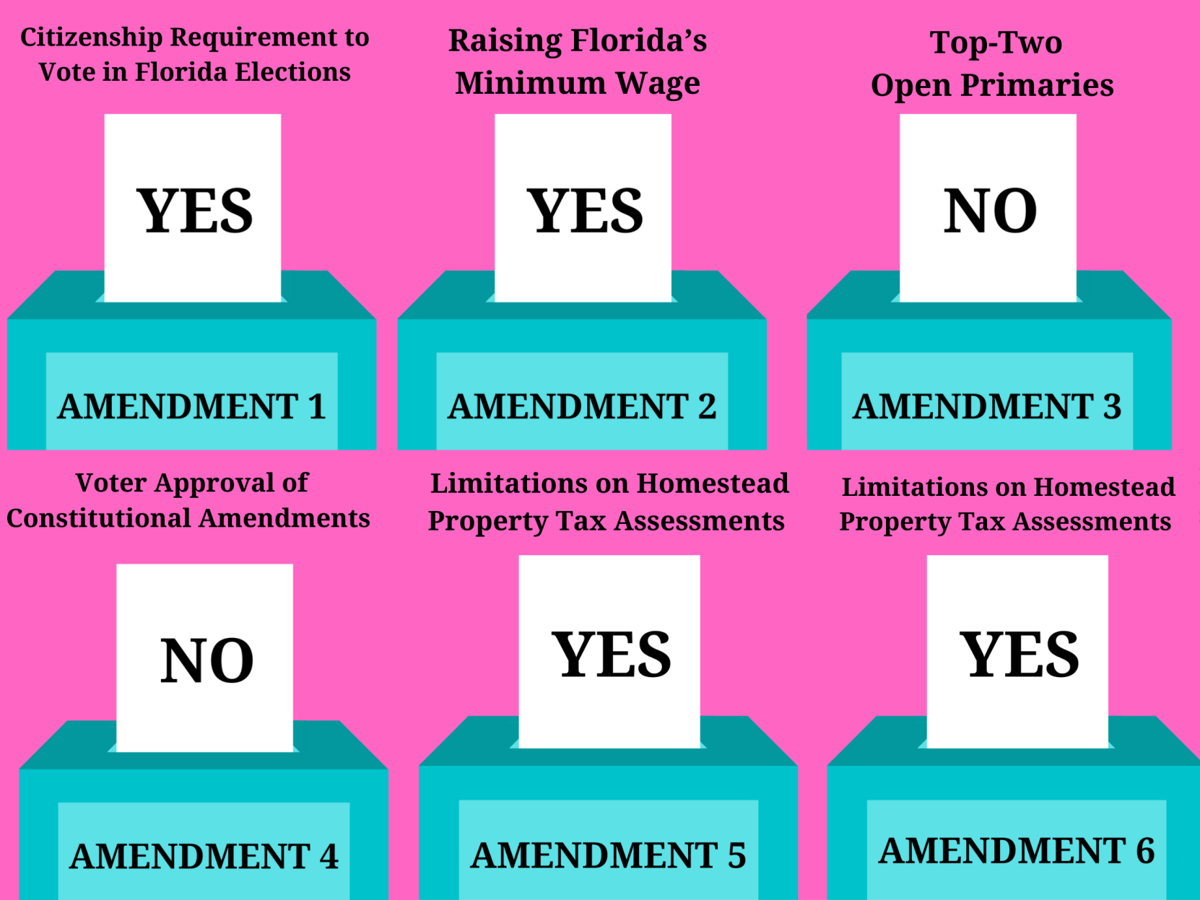

Six Florida Constitutional Amendments Appear On This Year S Ballot 2020 Amendments Chronicleonline Com

Six Florida Constitutional Amendments Appear On This Year S Ballot 2020 Amendments Chronicleonline Com

Florida Amendments 2020 Watch For These 6 On The Ballot 10tv Com

Florida Amendments 2020 Watch For These 6 On The Ballot 10tv Com

Amendment 6 Would Transfer Veterans Property Tax Break To Surviving Spouses Wusf Public Media

Amendment 6 Would Transfer Veterans Property Tax Break To Surviving Spouses Wusf Public Media

Attention Residents Please See The Information From The Broward County Property Appraiser S Office Below Regarding Ballot Amendments Tax Collector Information And Homestead Outreach Southwest Ranches Florida

Attention Residents Please See The Information From The Broward County Property Appraiser S Office Below Regarding Ballot Amendments Tax Collector Information And Homestead Outreach Southwest Ranches Florida

Florida Taxwatch Recommendations On Proposed 2020 Amendments To State Constitution Fernandina Observer

Florida Taxwatch Recommendations On Proposed 2020 Amendments To State Constitution Fernandina Observer

What To Know About Florida S Amendment 5 Extend Homestead Exemption Transfer Period

What To Know About Florida S Amendment 5 Extend Homestead Exemption Transfer Period

Florida Amendments16ge The League Of Women Voters Of Miami Dade

Florida Amendments16ge The League Of Women Voters Of Miami Dade

Amendments 5 And 6 On Florida S Ballot Focus On Florida Property Taxes The Independent Florida Alligator

Amendments 5 And 6 On Florida S Ballot Focus On Florida Property Taxes The Independent Florida Alligator

Http Www Floridaleagueofcities Com Docs Default Source Civic Education Historyoffloridaspropertytax Pdf Sfvrsn 2

What Are These Florida Amendments All About Nonpartisan Analysis From The League Of Women Voters Palm Coast Observer

What Are These Florida Amendments All About Nonpartisan Analysis From The League Of Women Voters Palm Coast Observer

Florida Taxwatch Recommendations On Proposed 2020 Amendments To State Constitution Fernandina Observer

Florida Taxwatch Recommendations On Proposed 2020 Amendments To State Constitution Fernandina Observer

4 Florida Amendments Pass 2 Do Not News Theonlinecurrent Com

4 Florida Amendments Pass 2 Do Not News Theonlinecurrent Com

Https Www Miamidade Gov Pa Library Letter And Informal Assessment Review Form Pdf

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home