Irs Property Tax Deduction Limit 2019

Renting out your second residence. Ask for an extension to file to Oct.

Latest Tds Rates Chart For Fy 2018 19 Ay 2019 20 Tax Deducted At Source Tax Income Tax

Latest Tds Rates Chart For Fy 2018 19 Ay 2019 20 Tax Deducted At Source Tax Income Tax

If you pay either type of property tax claiming the tax deduction is a simple matter of itemizing your.

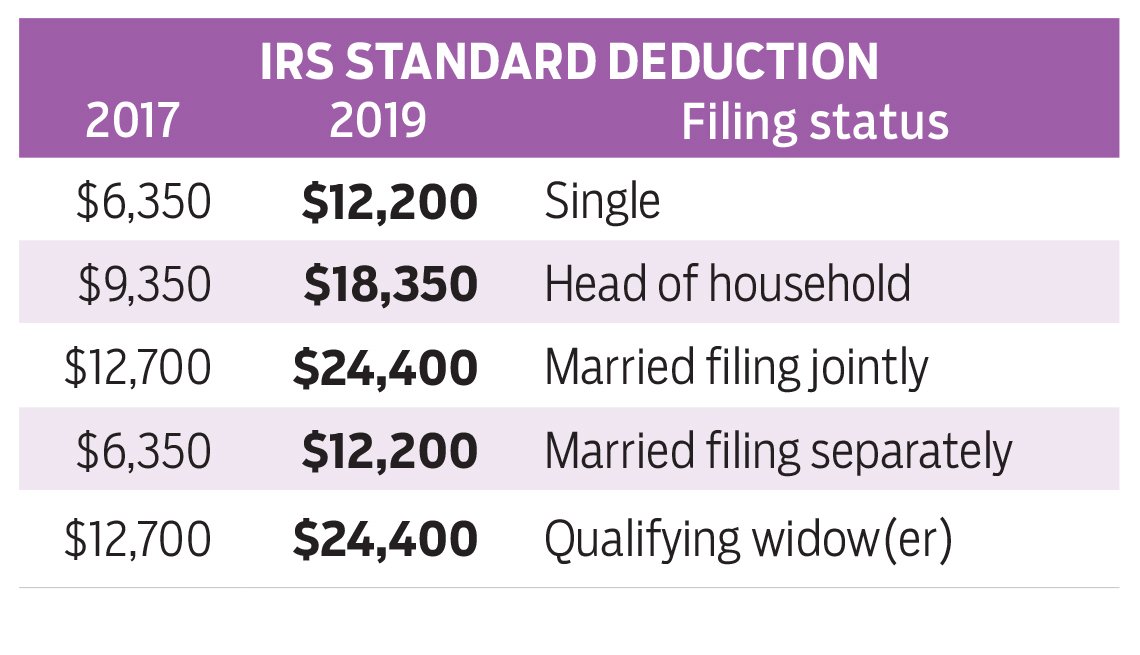

Irs property tax deduction limit 2019. You no longer get a 12000 deduction if you spend 6000 on state income taxes and 6000 on property taxes thanks to the TCJA. Due to tax reform signed into law in December 2017 the standard deduction that almost doubled for 2018 Tax Returns increased for 2019 Returns see table below. Taxpayers cannot deduct any state and local taxes paid above this amount.

Most state and local tax authorities calculate property taxes based on the value of the homes located within their areas and some agencies also tax personal property. The 11000 amount is the sum of your current and carryover contributions to 50 limit organizations 6000 5000 The deduction for your 5000 carryover is subject to the special 30 limit for contributions of capital gain property. New Tax Deadline is May 17.

The total deduction allowed for all state and local taxes for example real property taxes personal property taxes and income taxes or sales taxes is limited to 10000. Or 5000 if married filing separately. 7200 your 30 limit or.

Get details on the new tax deadlinesIf you need more time. The law limits the deduction of state and local income sales and property taxes to a combined total deduction of 10000. Because of the limit however the taxpayers SALT deduction is only 10000.

Instead you add the 1375 to the cost basis of your home. The Restoring Tax Fairness for States and Localities Act would eliminate the 10000 limit on state and local tax deductions for 2020 and 2021. However its important to point out.

The amount is 5000 for married taxpayers filing separate returns. Therefore it will not be beneficial for most taxpayers to itemize on their returns and the changes to the SALT deduction wont affect them. You are eligible to take interest payment deductions of up to 1000000.

You owned the home in 2020 for 243 days May 3 to December 31 so you can take a tax deduction on your 2021 return of 946 243 366 1425 paid in 2021 for 2020. In other words you cant take the standard deduction and deduct your property taxes. Now the total of state and local taxes eligible for a.

You can claim 10000 of these expenses but the law effectively forces you to leave 2000 on the table unclaimed. An extension to file is not an extension to pay taxes owed. Find out what to do if you cant pay what you owe by May 17.

The major change made by the new tax law is that the entire deduction is capped at 10000 per return 5000 for married filing separately. In 2019 the taxpayer receives a 750 refund of state income taxes paid in 2018 meaning the taxpayers actual 2018 state income tax liability was 6250 7000 paid minus 750 refund. You cant deduct any of the taxes paid in 2020 because they relate to the 2019 property tax year and you didnt own the home until 2020.

For 2019 you can deduct up to 10000. This means it is limited to the smaller of. If you pay taxes on your personal property and owned real estate they may be deductible from your federal income tax bill.

You can no longer deduct the entire amount of property taxes you paid on real estate you own. The IRA contribution limit is 5500 for the 2018 tax year and 6000 for 2019 with an additional 1000 catch-up contribution allowed if youre 50 or older. Property tax deductions offer homeowners the opportunity to lower tax bills significantly by reducing taxable income.

If you want to deduct your real estate taxes you must itemize. If your adjusted gross income on Form 1040 or 1040-SR line 11 is more than 100000 50000 if your filing status is married filing separately the amount of your mortgage insurance premiums that are otherwise deductible is reduced and may be eliminated. This deduction was unlimited until the Tax Cuts and Jobs Act TCJA imposed an annual cap of 10000 effective tax year 2018.

Take the standard IRS property tax deduction. Individuals can deduct personal property taxes paid during the year as an itemized deduction on Schedule A of their federal tax returns at least up to a point.

2019 Irs Federal Income Tax Brackets And Standard Deduction Updated Tax Brackets Federal Income Tax Income Tax Brackets

2019 Irs Federal Income Tax Brackets And Standard Deduction Updated Tax Brackets Federal Income Tax Income Tax Brackets

Investing In A Retirement Account Is Like Taking Out A Loan The Wealthy Accountant Retirement Accounts Finance Blog Financial Motivation

Investing In A Retirement Account Is Like Taking Out A Loan The Wealthy Accountant Retirement Accounts Finance Blog Financial Motivation

Give To Charity But Don T Count On A Tax Deduction

Give To Charity But Don T Count On A Tax Deduction

Do You Qualify For Deductions On Your 2018 Taxes New Reminder Real Estate Marketing Home Mortgage

Do You Qualify For Deductions On Your 2018 Taxes New Reminder Real Estate Marketing Home Mortgage

Irs Tax Attorney Irs Tax Lawyers For Tax Problems Legal Tax Defense Tax Attorney Tax Prep Checklist Irs Taxes

Irs Tax Attorney Irs Tax Lawyers For Tax Problems Legal Tax Defense Tax Attorney Tax Prep Checklist Irs Taxes

Irs Releases 2020 Tax Rate Tables Standard Deduction Amounts And More

Irs Releases 2020 Tax Rate Tables Standard Deduction Amounts And More

Irs Announces 2019 Tax Rates Standard Deduction Amounts And More A E Financial Services

Irs Announces 2019 Tax Rates Standard Deduction Amounts And More A E Financial Services

10 Changes In Itr 1 Filing In 2019 Income Tax Tax Refund Income Tax Return

10 Changes In Itr 1 Filing In 2019 Income Tax Tax Refund Income Tax Return

13 Proven Mileage Tax Deduction Tips For 2019 The Handy Tax Guy Teachingtaxes Hightaxes Taxespuppy Taxesforsel Tax Deductions Deduction Mileage Deduction

13 Proven Mileage Tax Deduction Tips For 2019 The Handy Tax Guy Teachingtaxes Hightaxes Taxespuppy Taxesforsel Tax Deductions Deduction Mileage Deduction

Irs Section 179 And Qualifying Property What You Need To Know 2020

Irs Section 179 And Qualifying Property What You Need To Know 2020

What Does It Cost To Outsource Your Tax Preparation Tasks Filing Taxes Tax Preparation Tax Deductions

What Does It Cost To Outsource Your Tax Preparation Tasks Filing Taxes Tax Preparation Tax Deductions

What Is Tax Deducted At Source Tds Threshold Limit Tds Return Tds Refund Exceldatapro Tax Deducted At Source Payroll Tax Exemption

What Is Tax Deducted At Source Tds Threshold Limit Tds Return Tds Refund Exceldatapro Tax Deducted At Source Payroll Tax Exemption

Pin By Charles Rene On Taxes Tax Refund Irs Taxes Refund

Pin By Charles Rene On Taxes Tax Refund Irs Taxes Refund

Section 179 Irs Tax Deduction Updated For 2021

Section 179 Irs Tax Deduction Updated For 2021

How To Deduct Property Taxes On Irs Tax Forms Irs Tax Forms Mortgage Interest Irs Taxes

How To Deduct Property Taxes On Irs Tax Forms Irs Tax Forms Mortgage Interest Irs Taxes

Owe The Irs But Can T Afford The Full Balance Right Now Set Up A Payment Plan With The Irs And Pay Them Over Time Tax How To Plan Payment Plan How

Owe The Irs But Can T Afford The Full Balance Right Now Set Up A Payment Plan With The Irs And Pay Them Over Time Tax How To Plan Payment Plan How

Rental Property Tax Deductions The Ultimate Tax Guide 2021 Edition Stessa

Rental Property Tax Deductions The Ultimate Tax Guide 2021 Edition Stessa

Irs Issues Long Term Care Premium Deductibility Limits For 2019 Bookkeeping Long Term Care Insurance Long Term Care

Irs Issues Long Term Care Premium Deductibility Limits For 2019 Bookkeeping Long Term Care Insurance Long Term Care

Publication 590 A 2018 Contributions To Individual Retirement Arrangements Ira Social Security Benefits Social Security Disability Benefits Social Security

Publication 590 A 2018 Contributions To Individual Retirement Arrangements Ira Social Security Benefits Social Security Disability Benefits Social Security

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home