How To Find My Personal Property Tax Account Number

In keeping with our Mission Statement we strive for excellence in all areas of property tax collections. Learn more about MyDec or to find additional information.

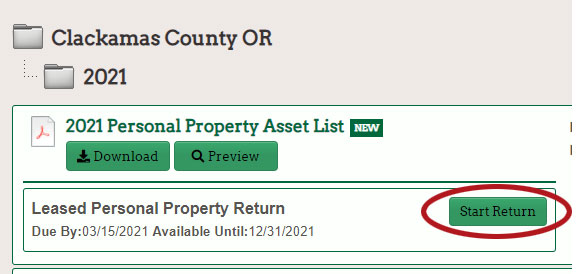

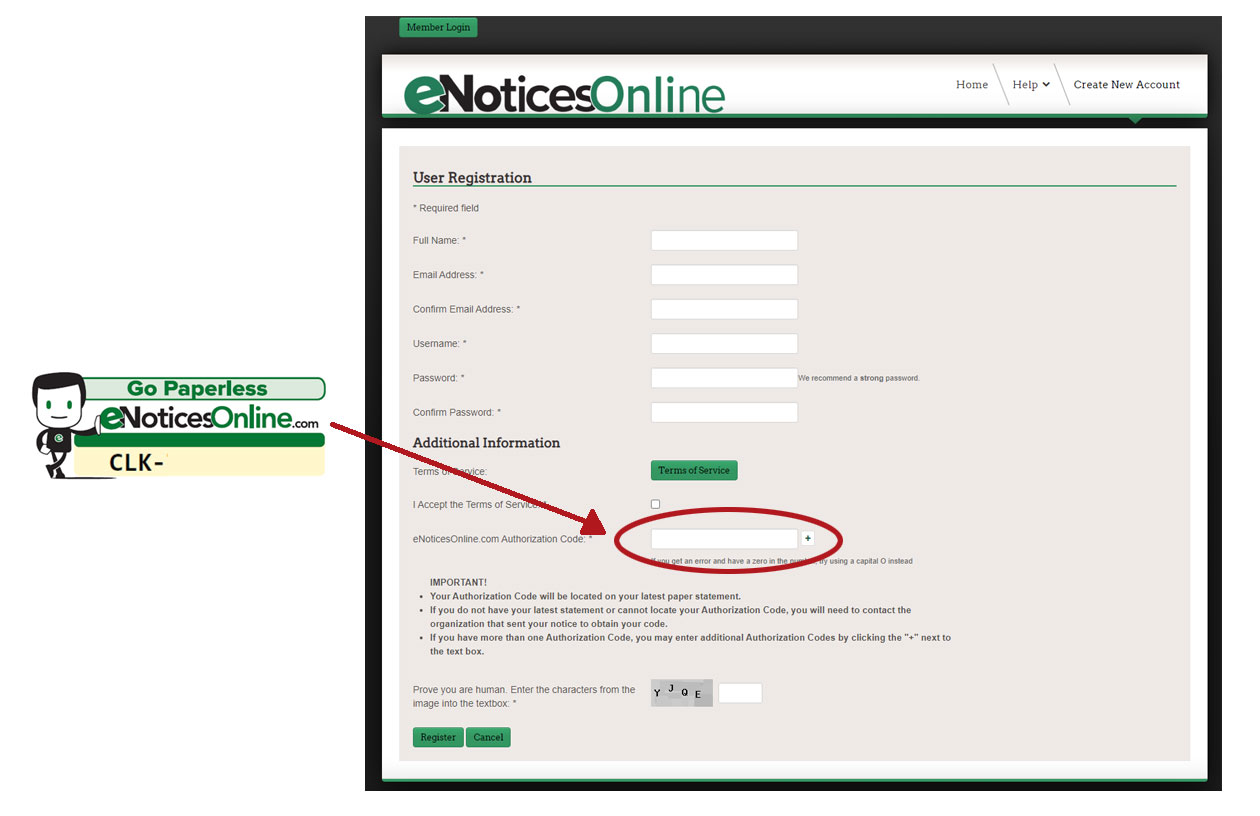

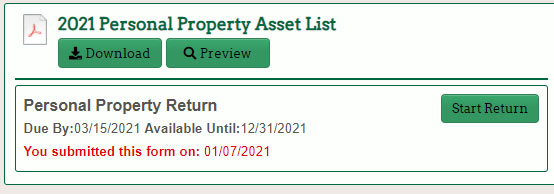

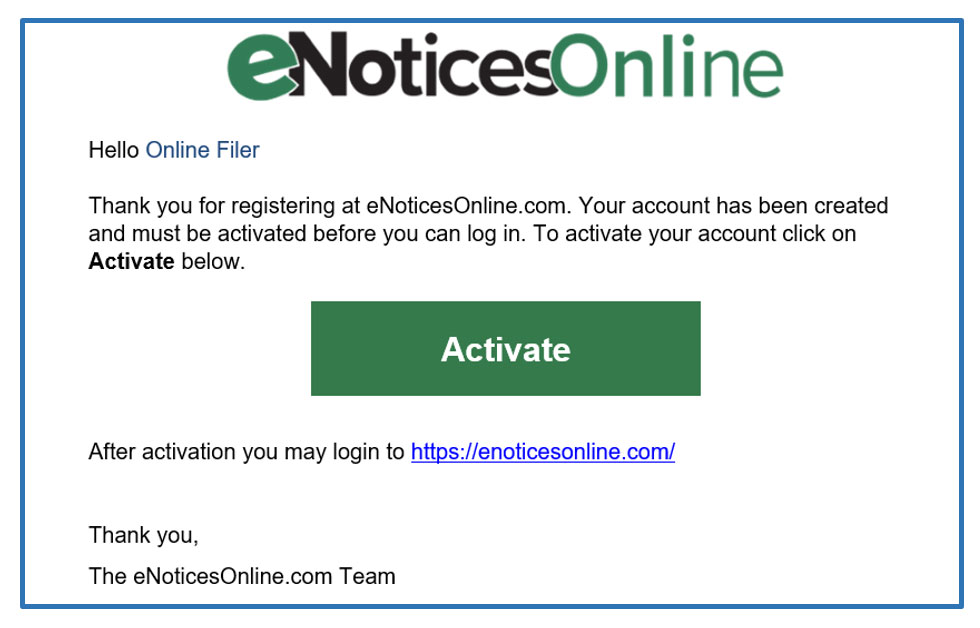

E Filing Business Personal Property Taxes Clackamas County

E Filing Business Personal Property Taxes Clackamas County

When you use this method to pay taxes please make a separate payment per tax account number.

How to find my personal property tax account number. Declare Your Personal Property Declare your personal property online by mail or in person by April 1st and avoid a 10 assessment penalty. If a tax statement for this year does not exist it means the Assessor did not receive an assessment form from you. Your property account identification number is located above your name and address on your assessment notice.

Tarrant County has the highest number of property tax accounts in the State of Texas. ACCT 01 02 123456 4 40500 0391 302000 C DOE JOHN 123 MAIN ST ANYTOWNIN MD 21200-0000. Real Property Tax Real Estate 206-263-2890.

Look on your last tax bill the deed to your property a. You may also get this number from your county assessors office. Finding Property Tax ID Numbers If the ID number you need to find is for a property you own you may already have the number in your files.

Personal Property Tax Rates Vehicles Autos trucks motorcycles and utility trailers are assessed on a prorated basis using the National Automobile Dealers Associations Blue Book NADA value at. See if you are eligible for 46 million in missing tax exemptions. Mobile Homes and Personal Property Commercial Property Tax 206-263-2844.

Access your tax records via Get Transcript. If you have questions about how to create an account see Secure Access. Please enter your seven-digit account number OR your street address in the boxes below.

Search 76 million in available refunds. Check or money order payments may take up to 3 weeks to appear in your account. Click GO to access your account information.

The ten-digit AIN 1234-056-789 is made up of a four-digit Mapbook Number a. Our primary focus is on taking care of citizens. This number is located on your county tax bill or assessment notice for property tax paid on your principal residence during the tax year for which you are filing your return.

Property Assessment Appeals Information on how to appeal your Property Assessment from the Assessors Office. You can pay your personal property tax through your online bank account. 285 Walnut Street number not.

0123456 7 digits No District Enter an account number as given in example. If a tax statement for this year is available look up your account and print a copy of your statement HERE. Your balance will update no more than once every 24 hours usually overnight.

You need to contact the Assessors office. Portsmouth levies a personal property tax on vehicles boats aircraft and mobile homes. Tax Waiver Statement of Non-Assessment How to obtain a Statement of Non-Assessment Tax Waiver.

Also if it is a combination bill please include both the personal property tax amount and VLF amount as a grand total for each tax account number. General Information and Resources - Find information about property assessment and valuation assessment appeals and special assessments as well as links to several helpful resources. On the Pay Personal Property Taxes Online Screen press the button containing your preferred method for finding tax information.

Pay or view your account online do a property search or sign up for e-Reminder Notices via text or email. For property tax purposes you will need to know and use your AIN. The AIN is a ten-digit number assigned to each piece of real property and is used on tax bills and correspondence to identify real property.

Information and online services regarding your taxes. Department Ticket Number Social Security Number or. The Department collects or processes individual income tax fiduciary tax estate tax returns and property tax credit claims.

First look up your account on this website. In the example above the property account indentification number ACCT consists of the county code 01 the assessment district 02. How to Register for Certain Online Self-Help Tools.

Property Transfer Tax Declarations and MyDec - Real Property Transfer Tax Declarations can now be completed online through the free MyDec program. Change your name and mailing address. If your property tax is paid through your mortgage you can contact your lender for a copy of your bill.

Enter integer value only. You can find a propertys tax ID number in several ways. This of course is only easy if you happen to have your current bill or deed handy.

The Assessors Identification Number or AIN is the main indexing system used for property tax purposes. However if youre the owner of the house the easiest way is by looking on your deed or most recent property tax bill. Look for the information in the following format.

WELCOME TO TARRANT COUNTY PROPERTY TAX DIVISION.

Secured Property Taxes Treasurer Tax Collector

Secured Property Taxes Treasurer Tax Collector

What S My Property S Tax Identification Number

What S My Property S Tax Identification Number

What S My Property S Tax Identification Number

What S My Property S Tax Identification Number

E Filing Business Personal Property Taxes Clackamas County

E Filing Business Personal Property Taxes Clackamas County

How To Pay Property Taxes Through An Escrow Account Property Tax Escrow Tax Help

How To Pay Property Taxes Through An Escrow Account Property Tax Escrow Tax Help

Real Estate Personal Property Tax Unified Government

Real Estate Personal Property Tax Unified Government

Individual Tax Preparation Checklist Tax Preparation Tax Preparation Services Tax Checklist

Individual Tax Preparation Checklist Tax Preparation Tax Preparation Services Tax Checklist

Https Dor Mo Gov Forms 426 Pdf

Appealing Property Taxes How To Challenge Your Tax Assessment Property Tax Assessment Real Estate Advice

Appealing Property Taxes How To Challenge Your Tax Assessment Property Tax Assessment Real Estate Advice

Property Tax Appeals Process Property Tax Tax Estate Tax

Property Tax Appeals Process Property Tax Tax Estate Tax

E Filing Business Personal Property Taxes Clackamas County

E Filing Business Personal Property Taxes Clackamas County

Secured Property Taxes Treasurer Tax Collector

Secured Property Taxes Treasurer Tax Collector

Paying Your Taxes Online Jackson County Mo

Paying Your Taxes Online Jackson County Mo

Abandoned Personal Property Letter Sample Beautiful 60 Best Images About Property Management On Being A Landlord Property Management Marketing Landlord Tenant

Abandoned Personal Property Letter Sample Beautiful 60 Best Images About Property Management On Being A Landlord Property Management Marketing Landlord Tenant

E Filing Business Personal Property Taxes Clackamas County

E Filing Business Personal Property Taxes Clackamas County

Schedule K 1 Tax Form What Is It And Who Needs To Know Tax Forms Income Tax Filing Taxes

Schedule K 1 Tax Form What Is It And Who Needs To Know Tax Forms Income Tax Filing Taxes

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home