Business Personal Property Tax King County

2021 Extension Request for Filing Business Personal Property. Hanford CA 93230 Mailing Address.

Proof Your Mortgage Is Paid In Full By Your Signature Mortgage Companies Mortgage Origination Fee

Proof Your Mortgage Is Paid In Full By Your Signature Mortgage Companies Mortgage Origination Fee

Personal Property Vehicle Taxes.

Business personal property tax king county. Notify Me Job Opportunities. Transient Lodging Tax Form. For further information contact the Commissioner of the Revenues Office at.

The assessoruses this information to propertyfor. Personal Property returns business and personal are due on May 1. Tutorial 3MB PPS PDF format - Please view this tutorial prior to e-filing.

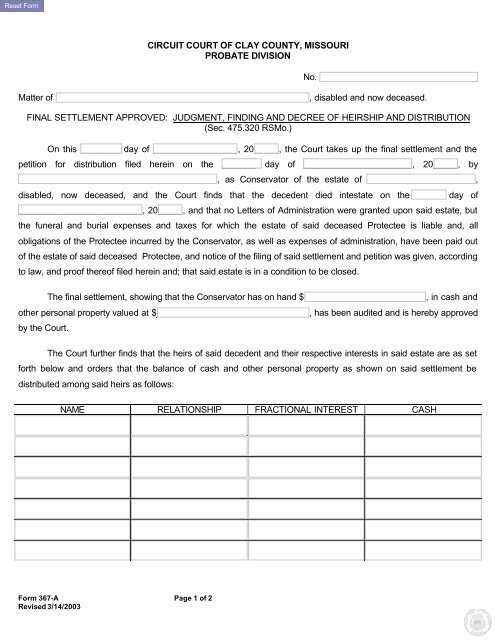

The United States claimed priority in the proceeds of the sale of the mortgaged property in King County not only for this tax lien which was assessed and notice thereof filed in King. If you use personal that not exempt you must complete a PersonalProperty Tax Listing Form by April 30 each yearListing forms are available from your local county s office. Any boats trailers business personal property must be reported on a form provided by the Commissioners Office for proper assessment information.

A notice of this. King County eListing Home Page. If not successful the BPP owner can appeal to the North Carolina Property Tax Commission in Raleigh.

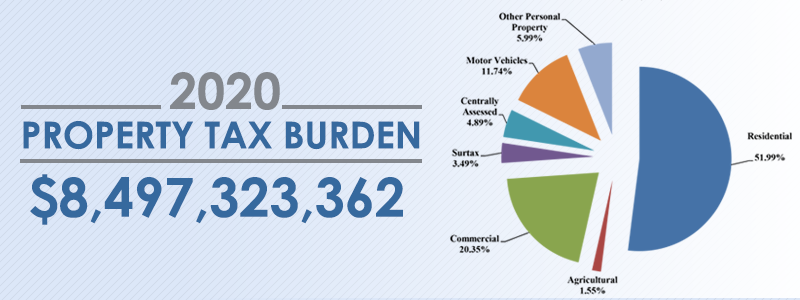

The listing must identifyall taxable propertylocated in the county as of noon on January 1. Personal property assessments are based on information provided by taxpayers on King County personal Property Listing form or eListing where you provide a description of the personal property its cost and year of acquisitionWe use this information and the Department of Revenue personal property valuation guidelines to determine value taking into consideration the type of. The tax relief for qualifying vehicles in King William County for 2020 is 35.

Main Phone 559 852-2479 Fax Number 559 582-1236 Office Location Government Center-Bldg. EListing is an online application for reporting this information. Kings County Tax Collector.

All businesses owning or leasing property housed in Prince George County are required to file a Return of Business Tangible Personal Property by February 5 of each tax year and taxes are due on June 5. The business personal property owner first appeals to the county Board of Equalization and Review. By April 30 or the taxpayer will incur a monthly penalty of 5 percent of the tax due not to exceed 25 percent.

Under state law current year King County property tax statements are mailed once a year in mid-February. How When to Appeal Business Personal Property Tax Valuation. Create an Account - Increase your productivity customize your experience and engage in information you care about.

State law requires that property used in a business on January 1 be reported in that year to the assessor of the county in which the property is located for assessment purposes. Either expressed or implied regarding the quality content. Please note that you dont get receive additional statements ahead of the April and October payment deadlines from the county Treasurers office.

While the department has sought to provide current and correct information it makes no warranties representations or guarantees whatsoever. Tax lien was filed in the auditors office of King County October 26 1955 and in the auditors office of Island County on February 17 1959. King George VA.

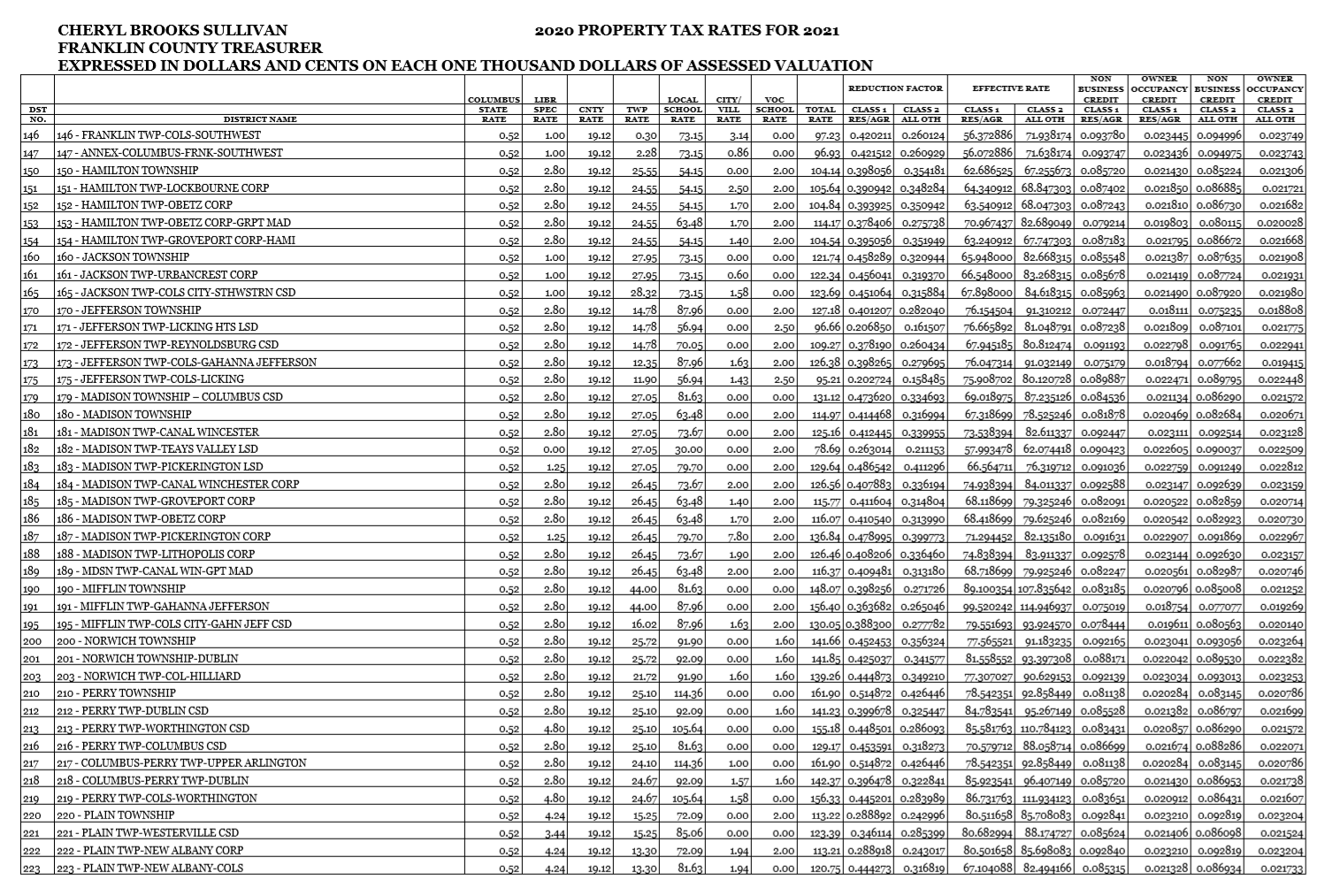

The King County Department of Assessments strives to provide the public with accurate business personal property account information. In Washington State business personal property is assessed for tax purposes unless specifically exempted by law. Reports must be filed.

The appeal process for business personal property is the same as for real estate. Personal property used in a business on January 1 must be reported in that year to the assessor of the county in which the property is located. Personal Property Tax Forms.

View and pay for your Property Tax bills for King County Washington online.

Read more »