Personal Property Tax Missouri Vehicle

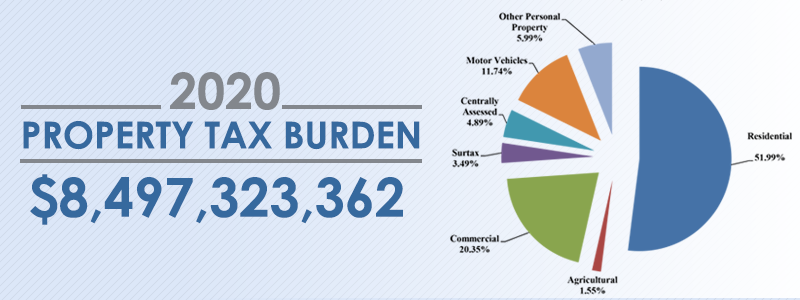

Calculate personal property tax vehicle missouri. Personal property is assessed valued each year by the Assessors Office.

You pay tax on the sale price of the unit less any trade-in or rebate.

Personal property tax missouri vehicle. Calculate Personal Property Tax - Vehicle - Missouri. Personal Property Personal property tax is collected by the Collector of Revenue each year on tangible property eg. Please bring your Vehicle Titles Vehicle Registrations or Renewals Or your Missouri Application for Title and Title if a new purchase.

Is there a calculator that anyone is aware of. State law requires that personal property taxes be paid before license plates on vehicles can be issued or renewed. Motor Vehicle Trailer ATV and Watercraft Tax Calculator The Department collects taxes when an applicant applies for title on a motor vehicle trailer all-terrain vehicle boat or outboard motor unit regardless of the purchase date.

Vehicles are the most widely owned form of taxable personal property and for this the Assessor uses a rate book provided by the Missouri State Tax Commission. An automobile with a market value of 10000 would be assessed at 33 13 or 3333. For any questions concerning the valuation of your property your point of contact is the Greene County Assessors Office.

To enter your Personal Property Taxes go to Federal Taxes then click on Deductions and Credits. Can I deduct this. Once market value has been determined the assessor calculates a percentage of that value to arrive at the assessed value.

Filing and paying taxes electronically is a fast growing alternative to mailing paper returns and payments. Taxes are due for the entire amount assessed and billed regardless if property is no longer owned or has been moved from Jackson County. After the assessed value is calculated the tax levy is applied.

The Personal Property Department collects taxes on all motorized vehicles boats recreational vehicles. Yes you can deduct those personal property taxes if they were paid in 2016. Missouri refers to the fees you pay at the time of purchasing a car as registration fees but then requires that we pay personal property taxes yearly based on.

For personal property it is determined each January 1. The Missouri Department of Revenue received more than 238000 electronic payments in 2020. If you did not file a Personal Property Declaration with your local assessor.

If you obtain a 2 year license plate with the State you are still responsible to pay personal property tax each year by December 31 or. Obtaining a property tax receipt. Are Missouri Personal Property Taxes on vehicles considered car registration fees.

Property Tax Receipts are obtained from the county Collector or City Collector if you live in St. The Department collects or processes individual income tax fiduciary tax estate tax returns and property tax credit claims. Market value of vehicles is determined by the October issue of the NADA.

To remove a vehicle to your existing individual personal property account you must bring the following documents to our offices. Missouri Department of Revenue. General Information about Personal Tax Electronic Filing and Paying.

Motorized vehicles boats recreational vehicles owned on January 1st of that year. This rate book is used by all Missouri counties. As an example a residence with a market value of 50000 would be assessed at 19 which would place its assessed value at 9500.

Personal property tax is paid to Jackson County by December 31 of every year on every vehicle you owned on January 1. Missouris effective vehicle tax rate according to the study is 272 percent which means the owner of a new Toyota Camry LE four-door sedan. I am looking for a way to calculate what my personal property tax will be on my car for the state of Missouri.

In the state of MO we pay Personal Property tax for each car we own this is not a registration fee. Louis City in which the property is located and taxes paid. Use this calculator to estimate the amount of tax you will pay when you title your motor vehicle trailer all-terrain vehicle ATV boat or outboard motor unit and obtain local option use tax information.

You may click on this collectors link to access their contact information. Information and online services regarding your taxes.

Do You Have To Pay A Vehicle Tax Here S Some Good News The Motley Fool

Do You Have To Pay A Vehicle Tax Here S Some Good News The Motley Fool

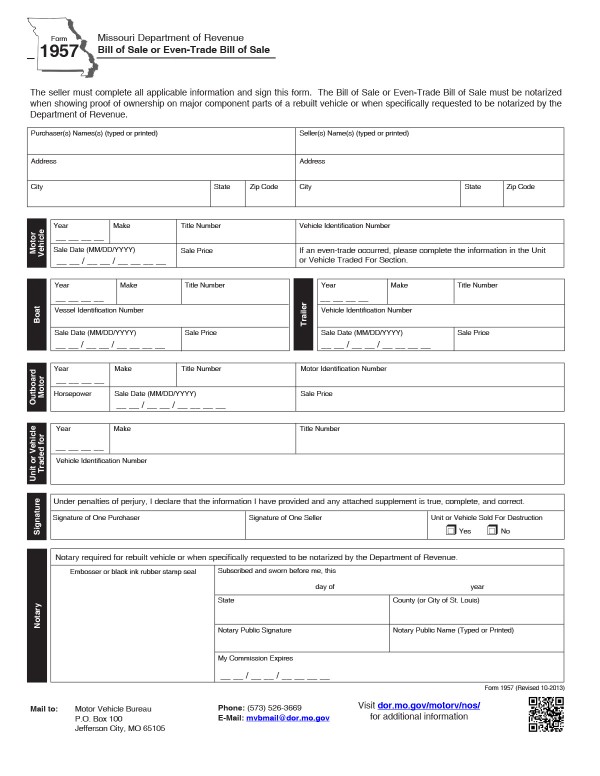

Missouri Bill Of Sale Form Templates For Autos Boats And More

Missouri Bill Of Sale Form Templates For Autos Boats And More

Download Print Tax Receipt Clay County Missouri Tax

Download Print Tax Receipt Clay County Missouri Tax

Https Dor Mo Gov Forms 426 Pdf

Online No Tax Due System Information

Online No Tax Due System Information

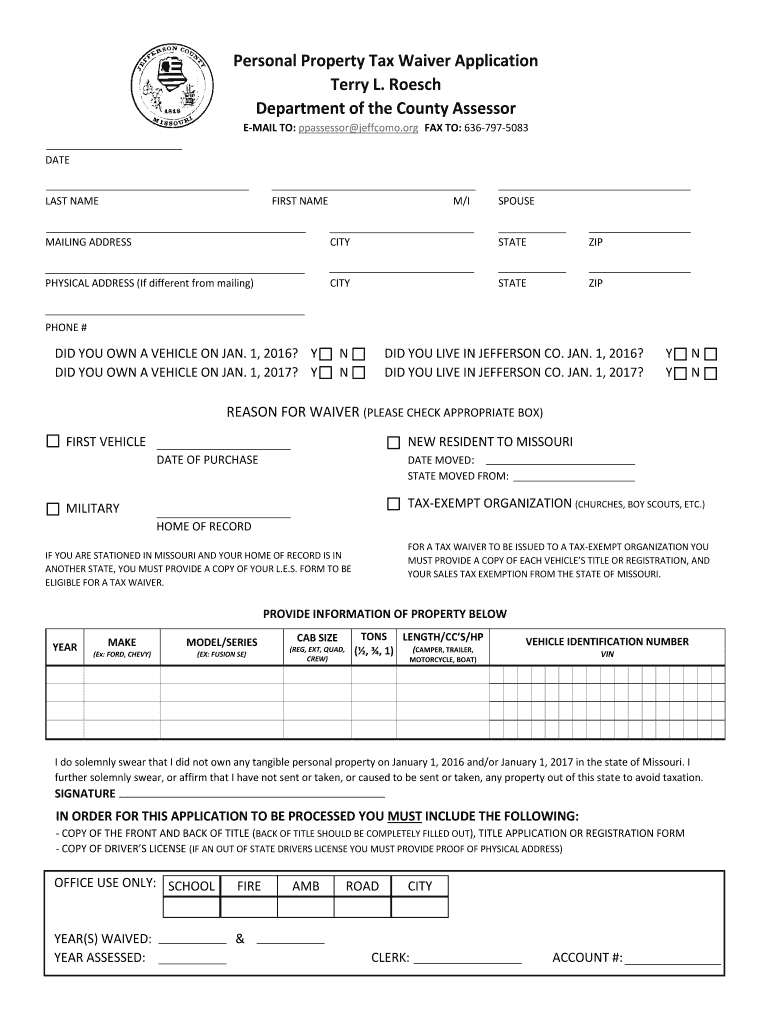

Missouri Personal Property Tax Waiver Online Property Walls

Missouri Personal Property Tax Waiver Online Property Walls

Missouri Car Registration Everything You Need To Know

Missouri Car Registration Everything You Need To Know

How To Use The Property Tax Billing Portal Clay County Missouri Tax

How To Use The Property Tax Billing Portal Clay County Missouri Tax

Online No Tax Due System Information

Online No Tax Due System Information

Missouri Residents Avoid Taxes Inspections By Driving With Illinois Plates

Missouri Residents Avoid Taxes Inspections By Driving With Illinois Plates

How To Get A Sales Tax Exemption Certificate In Missouri Startingyourbusiness Com

How To Get A Sales Tax Exemption Certificate In Missouri Startingyourbusiness Com

Missouri Personal Property Tax Waiver Online Property Walls

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home