Commercial Property Tax Exemption Nyc

Exemptions lower the amount of tax owed by reducing a propertys assessed value whereas abatements reduce taxes by applying credits to the amount of taxes owed. The 421-g Tax Incentive was an NYC tax incentive program that offered both exemptions and abatements to building owners that converted commercial buildings to residential in downtown Manhattan.

Shovel Ready Lot For A 40 000 Sf Building For Sale In Ne Pa Sustainable Business Park Commercial Real Estate

Shovel Ready Lot For A 40 000 Sf Building For Sale In Ne Pa Sustainable Business Park Commercial Real Estate

Mail the form and any required documents to.

Commercial property tax exemption nyc. The New York State Transfer Tax is 04 for sales below 3 million and 065 for sales of 3 million or more. The type of organization and the use of the property must be in one or more of the exemptible categories listed in the New York State Real. Form RP-487 Application for tax exemption of solar or wind energy systems or farm waste energy systems.

A property-tax deduction for seniors with household incomes below 75000. Some properties such as those owned by religious organizations or governments are completely exempt from paying property taxes. Includes all local government and school district exemptions.

685 of gross wages 2 of qualified investments 10 RD credit 50 of assessed property taxes. Others are partially exempt such as veterans who qualify for an exemption on part of their homes and homeowners who are eligible for the School Tax Relief. Tax exemptions for property located in New York City is administered by the NYC Department of Finance NYC-DOF.

Gifts arent includible if they were made while the decedent was a non-resident if the gift was made before April 1 2014 or if the gift consists of real or tangible property. To receive a tax exemption the propertys legal title must be in the name of a nonprofit organization the organization must be the owner of the property and the property must be used for an exempt purpose. For information visit NYC-DOF Benefits for property owners.

Exemption Programs The DOF offers several tax exemption abatement and money-saving programs for property owners and renters. ICIP has been the largest commercial property tax exemption in. Exempts new small businesses from the tax based on allocated business and investment capital.

Federal 501c3 status alone does not automatically qualify you for the exemption. 16 Three programs for new construction of housing 421-a housing renovation J-51 and commercial development Industrial and Commercial. All owners must sign date and provide their Social Security numbers on the form.

The legal title of the property must be in the name of the non-profit organization. This application has been optimized for use on browsers. If an owner has died a copy of the death certificate must be included.

Property Business Excise Tax Professionals Forms Select Tax Bills and Payments Data and Lot Information Dividing Merging Lots Assessments Tax Rates Guides. Whether or not you are familiar with the concept of p. NYC Department of Finance Property Exemptions AdministrationCompliance Unit.

Welcome to the NYC Department of Finances Property Tax Public Access web portal your resource for information about New York City property taxes. Though all property is assessed not all of it is taxable. Exemptions for housing and economic development are fewer in number but are more costly as they provide more generous tax reductions more than 3 billion in 2016 compared to 350 million for personal exemptions and generally provide benefits for 10 to 25 years.

In Public Access you can. Look up information about a property including its tax class and market value. Complete NYS Real Property Transfer Tax rates are as follows.

You can get the Property Tax Exemption Removal Form online or by mail. This depreciation can be deducted as a loss on their tax return. To be eligible for the NFP exemption.

But if the building is sold and the sales price is higher than the depreciated value the increase is treated as a capital gain to be taxed. New York State 808 10 Local Government School District 2100 25 US Foreign or Native American 518 6 Residential includes STAR 2236 27 Non-Profit 1118 14 Industrial Commercial 758 9 Other 734 9 Full Value of Exempt Property 2012 Source. NYS Tax and Finance.

The tax reform plan also includes calls for a 2 cap on increases of the citys annual property tax levy. The higher rate of 065 kicks-in at a lower threshold of 2 million for commercial transactions and residential properties with 4 or more units. Industrial and commercial properties.

Chrome Safari Mozilla Firefox IE8 and higher. The types of properties which may be eligible include properties. For a list of property types that may be eligible for the exemption visit the Eligibility page.

By Prevu Team on January 02 2021 If you started your search to buy an apartment or home in NYC youve likely come across countless mentions of tax abatements in the various listing descriptions youve read online. Last June the state Legislature passed legislation allowing New York City to establish the Industrial and Commercial Abatement Program ICAP replacing the Industrial and Commercial Incentive Program ICIP. 1 New Yorks Estate Tax encompasses not just the federal gross estate but also any includible gifts that were made in the three years preceding death.

Not-for-profit NFP organizations involved in charitable educational medical or religious work may be eligible for a full or partial property tax reduction. Provides a credit equal to a percentage of investments made if specified employment growth targets are reached. A commercial real estate owner is permitted to depreciate a commercial building over time to lessen taxable income.

Taxpayers who live in states with a state estate tax may wish to consider making lifetime gifts before the increased federal exemption amounts sunset.

Property Tax Appeals When How Why To Submit Plus A Sample Letter

Property Tax Appeals When How Why To Submit Plus A Sample Letter

Homes For Sale Real Estate Listings In Usa Property Tax Real Estate Buying Investment Property

Homes For Sale Real Estate Listings In Usa Property Tax Real Estate Buying Investment Property

Are There Any States With No Property Tax In 2021 Free Investor Guide

Are There Any States With No Property Tax In 2021 Free Investor Guide

Get Download Property Tax Appeals Property Tax Reduction Bonus Http Inoii Com G Learn Affiliate Marketing Marketing Checklist Email Marketing Examples

Get Download Property Tax Appeals Property Tax Reduction Bonus Http Inoii Com G Learn Affiliate Marketing Marketing Checklist Email Marketing Examples

Hartford S Exorbitant Commercial Property Tax Curbs Economic Growth

Hartford S Exorbitant Commercial Property Tax Curbs Economic Growth

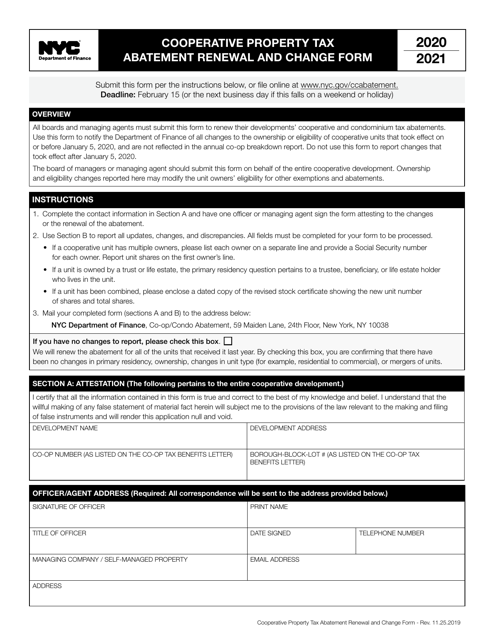

2021 New York City Cooperative Property Tax Abatement Renewal And Change Form Download Fillable Pdf Templateroller

2021 New York City Cooperative Property Tax Abatement Renewal And Change Form Download Fillable Pdf Templateroller

What S My Property S Tax Identification Number

What S My Property S Tax Identification Number

Managing Your New York Business Property Tax

Managing Your New York Business Property Tax

Luxury Orlando Apartment Community Changes Owners Name Commercial Real Estate Commercial Property Real Estate News

Luxury Orlando Apartment Community Changes Owners Name Commercial Real Estate Commercial Property Real Estate News

Wayne County Property Tax Records Wayne County Property Taxes Ny

Wayne County Property Tax Records Wayne County Property Taxes Ny

Should You Get A Home Inspection Before Making An Offer Hauseit Home Inspection Buying A Condo Inspect

Should You Get A Home Inspection Before Making An Offer Hauseit Home Inspection Buying A Condo Inspect

Types Of Property Tax Exemptions Millionacres

Types Of Property Tax Exemptions Millionacres

Solar Property Tax Exemptions Explained Energysage

Solar Property Tax Exemptions Explained Energysage

Are There Any States With No Property Tax In 2021 Free Investor Guide

Are There Any States With No Property Tax In 2021 Free Investor Guide

Explain This To Me How 2016 Legislation Shifted Property Tax Burden From Commercial Land To Homeowners

Explain This To Me How 2016 Legislation Shifted Property Tax Burden From Commercial Land To Homeowners

Oakland County Bonus Tax Breaks When Selling Your Home Http Homes2moveyou Com Oakland County Bonus Tax Breaks Selli Homeowner Taxes Property Tax Estate Tax

Oakland County Bonus Tax Breaks When Selling Your Home Http Homes2moveyou Com Oakland County Bonus Tax Breaks Selli Homeowner Taxes Property Tax Estate Tax

Minnesota Takeaways From The Payable 2018 50 State Property Tax Comparison Study

Minnesota Takeaways From The Payable 2018 50 State Property Tax Comparison Study

Hartford S Exorbitant Commercial Property Tax Curbs Economic Growth

Hartford S Exorbitant Commercial Property Tax Curbs Economic Growth

U S Property Taxes Comparing Residential And Commercial Rates Across States The Journalist S Resource

U S Property Taxes Comparing Residential And Commercial Rates Across States The Journalist S Resource

Labels: commercial, exemption, property

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home