Property Tax Exemption For Seniors Nyc

Senior Citizen Homeowners Exemption SCHE For your household to qualify for SCHE. You cannot receive the senior citizens exemption if the income of the owner or the combined income of all the owners exceeds the maximum income limit set by the locality.

What Is The Manhattan Resident Parking Tax Exemption Hauseit Tax Exemption Tax Reduction Buying A Condo

What Is The Manhattan Resident Parking Tax Exemption Hauseit Tax Exemption Tax Reduction Buying A Condo

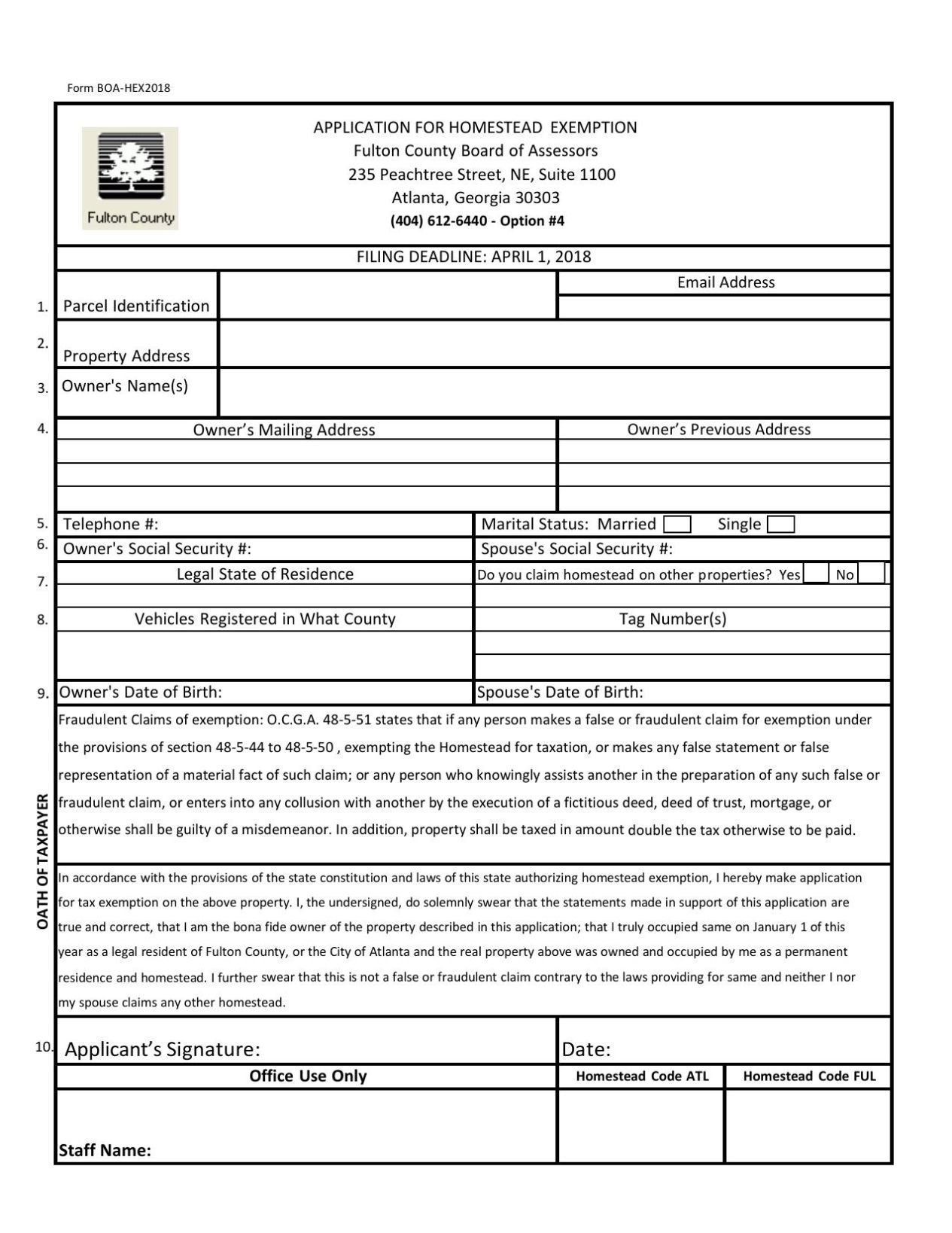

Most homeowners are eligible for this exemption if they meet the requirements for the Homeowner Exemption and were 65 years of age or older during calendar year 2020.

Property tax exemption for seniors nyc. The Senior Citizen Homeowners Exemption SCHE provides a reduction of 5 to 50 on New York Citys real property tax to seniors age 65 and older. Combined service-connected evaluation rating of 80 or higher. Senior citizens exemption nys Verified Just Now.

The deadline to apply for SCHE for the current tax year is March 15. At least 61 years of age or older. It lowers the taxes of seniors who own one to three homes condos or coop apartments.

New Yorks Senior Citizen Exemption is 50 of your homes appraised value but you must be age 65 or older and have an annual income of no more than 29000 as of 2020. The combined income of all owners and their spouses cannot be more than 37399. To be eligible for SCHE you must be 65 or older earn no more than 58399 for the last calendar year and the property must be your primary residence.

Retired from regular gainful employment due to a disability. Senior citizens exemption. Property Tax Exemptions for Seniors.

New Yorks Senior Citizen Exemption is 50 of your homes appraised value but you must be age 65 or older and have an annual income of no more than 29000 as of 2020. SCHE gives property tax help to senior homeowners. This program provides a property tax exemption for senior citizens who own one two or three family homes condominiums or cooperative apartments.

The Senior Citizen Homeowners Exemption SCHE provides a reduction of 5 to 50 on New York Citys real property tax to seniors age 65 and older. A Senior Exemption provides property tax savings by reducing the equalized assessed value of an eligible property. Senior Citizen Homeowners Exemption SCHE The SCHE benefit is available to property owners who are 65 with an annual income of 58399 or less.

Apply online by March 15th for benefits to begin on July 1. The property must be the primary residence of all owners and their spouses. A property-tax deduction for seniors with household incomes below 75000.

If you are married the income of your spouse must be included in the total unless your spouse is absent from the residence due to a legal separation or abandonment. Thanks to changes in city and state law the SCHE and DHE Disabled Homeowners Exemption tax breaks are now available to homeowners with a combined annual income of 58399 or less. To qualify seniors generally must be 65 years of age or older and meet certain income limitations and other.

All owners must be 65 or olderor if you own your property with a spouse or sibling at least one of you must be 65 or older. All owners must be 65 or olderor if you own your property with a spouse or sibling at least one of you must be 65 or older. SCHE exemption The Senior Citizen Homeowners Exemption SCHE is available for people ages 65 and older who own cooperative apartments condominiums or.

If you live in a co-op you can apply online using the SCHE co-ops application. Senior Citizen Homeowners Exemption SCHE Renewal For your household to continue to qualify for SCHE. To be eligible for SCHE you must be 65 or older earn no more than 58399 for the last calendar year and the property must be your primary residence.

If March 15 falls on a weekend or holiday the deadline is the next business day. This is accomplished by reducing the taxable assessment of the seniors home by as much as 50. The tax reform plan also includes calls for a 2 cap on increases of the citys annual property tax levy.

Certain local governments allow homeowners whose income exceeds the limit to receive the reduction but a much lower percentage. The property must continue to be the primary residence of all owners. Senior Citizen Homeowners Exemption SCHE A property tax break for seniors who own one- two- or three-family homes condominiums or cooperative apartments.

Property tax exemption program for senior citizens and people with disabilities. If March 15 falls on a weekend or holiday the deadline is the next business day. Local governments and school districts in New York State can opt to grant a reduction on the amount of property taxes paid by qualifying senior citizens.

All owners must be 65 years of age or older in the year that they apply. The person claiming the exemption must live in the home as their primary residence The minimum age requirement for senior property tax exemptions is generally between the ages of. The NY senior citizen property tax exemption is essentially a tax reduction.

Your homes taxable assessment will get a 50 reduction if your income isnt higher than the set maximum income limit.

Read more »