How Do I Apply For Homestead Exemption In Cobb County

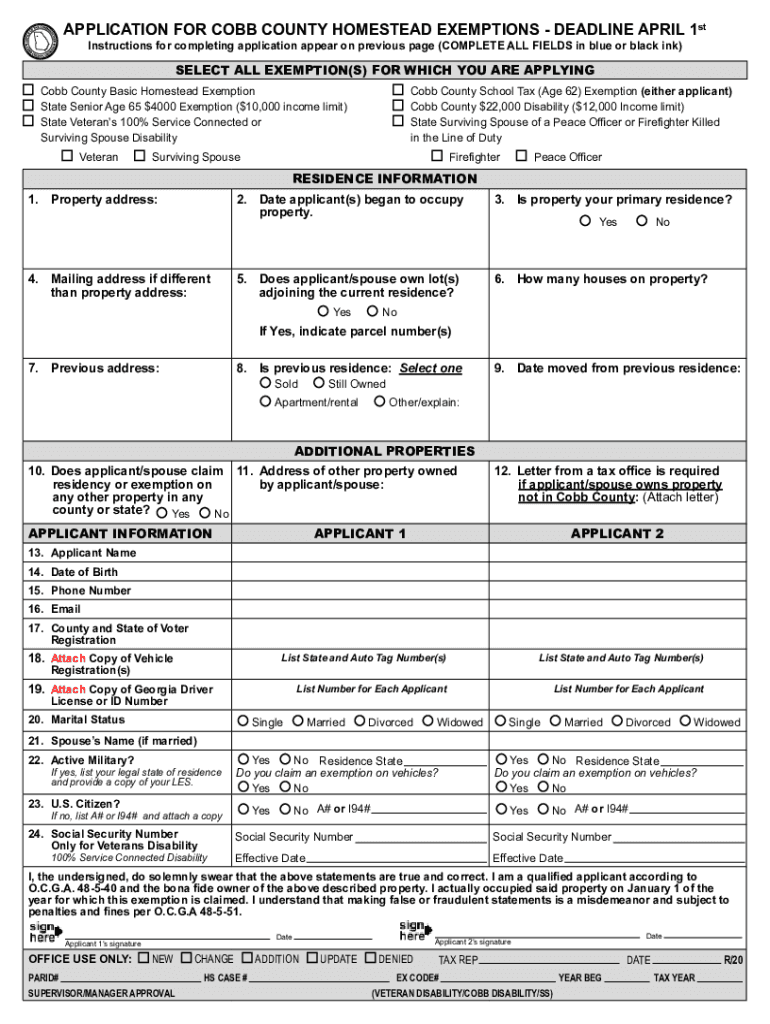

You cannot apply online for exemptions where proof of age or income is required. Failure to properly and timely file the application constitutes.

Primarylegal residence do applicants live at this property 4.

How do i apply for homestead exemption in cobb county. Homeowners may qualify for different homestead exemptions from the various taxing jurisdictions including school system cities and Fulton County. Additional exemptions are available to those who meet legal criteria. Open the fillable PDF file with a click.

Faxed or emailed copy not accepted COBB COUNTY TAX COMMISSIONER PO BOX 100127 MARIETTA GA 30061 May apply in person at. You must apply for each exemption type for which you are eligible. You must be a deeded owner and occupy the property as your primary residence as of January 1 of the year for which application is being made.

Property address property address where applicants is applying for exemptions 2. Get GA Application for Cobb County Homestead Exemptions within your internet browser from any gadget. Can I have an extension to file my homestead exemption.

Select Type of Exemptions select all exemptions for which you are applying. All applicants names must appear on the deed to the property. In such cases you must apply in person.

That is the absolute deadline for filingall forms filed after April 1 will be processed for the following year. All vehicles owned by the applicant should be registered in Gwinnett County. You must not claim homestead on any other property.

For all homestead exemptions. You may apply for exemptions year-round with the Tax Commissioners Office however your application must be received or postmarked by April 1st to receive the exemption for that tax year. 736 Whitlock Ave Ste.

Cobb Tax Commissioners Office shared some commonly-asked questions and answers during limited operations due to COVID-19. Post marked by Wednesday April 1 to apply to the current 2020 tax year. Homestead exemptions applications must be received or US.

Real Property Exemptions - Effective July 12008 may apply at anytime prior to April 1st of effective year. To receive any Exemptions you must apply in person at the Tax Assessors Office located at 2782 Marietta Hwy Suite 200 Canton GA 30114. You need to apply only once not yearly.

Homestead school tax and disability exemptions may be filed all year long but to qualify for the current year exemption you must occupy the property by January 1 and apply by April 1. Mail applications with all required documentation to. Homestead exemption on only one residence.

Please call 770-531-6720 if you have questions. To file for the homestead exemption the property owner shall provide the Chatham County Board of Assessors staff with the following. You may apply for homestead exemptions if you own reside and claim the property as your primary residence on January 1.

View the 2020 Homestead Exemption Guide Once granted exemptions are automatically renewed each year as long as the homeowner continually occupies the property under the same ownership. How you can complete GA Application for Cobb County Homestead Exemptions online. If you are applying for a Homestead Exemption that is related to age or income you must come to the Tax Assessors Office at 2875 Browns Bridge Road and apply.

To apply fill out the form provided by the Cobb County Tax Assessor Office by March 1 for the exemption. In Forsyth County if you own the property reside on that property and are a legal resident of the County all as of January 1st of the tax year you may qualify for homestead exemption. A A valid Georgia Drivers License or Georgia Identification Card b Registration for vehicles owned by and registered in the name of the applicant.

Start accomplishing the template field by field following the prompts of the sophisticated PDF editors interface. West Park Govt Center 736 Whitlock Ave Marietta GA 30064 South Govt Center 4700 Austell Rd Austell GA 30106 East Govt Center. If you own occupy and claim your home as your legal residence on January 1st you are eligible for a Homestead Exemption.

Apply for any and all types of homestead exemptions includes Age 62 Senior etc Affidavit for Homestead Exemption Where Property Is Owned by a Trust. We must conform to the April 1. The exemption will save you approximately 65 of the tax bill for unincorporated Cobb County.

If the property is in the City of Atlanta when you apply for the Homestead Exemption in DeKalb County it will automatically place an application for the City of Atlanta 7. Date moved date moved to this property as primary residence 3. Homestead exemptions are granted based on the qualifications of the applicant.

Cobb County Property Tax Division. And for most the savings is hundreds of dollars. Homestead Exemption is one way to reduce the amount of property tax you pay on your residential property.

Cobb County Tax Commissioner Cobbtax Twitter

Cobb County Tax Commissioner Cobbtax Twitter

Top Ranked High Schools In Cobb County Harry Norman Realtors

Top Ranked High Schools In Cobb County Harry Norman Realtors

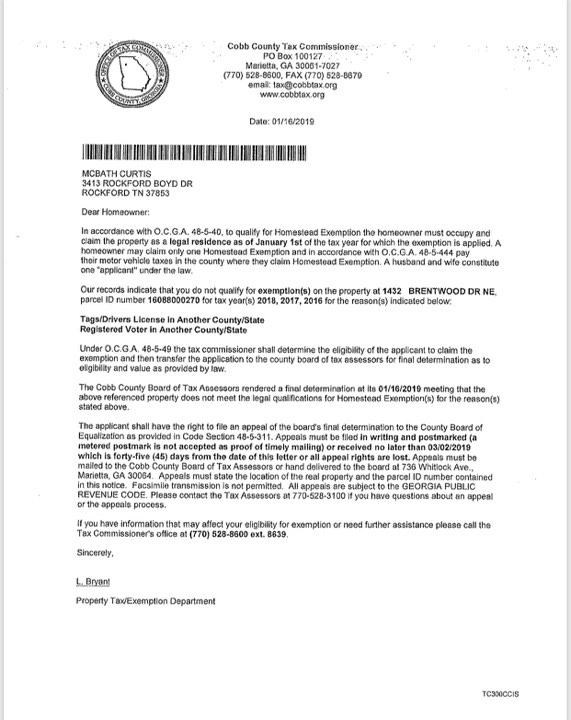

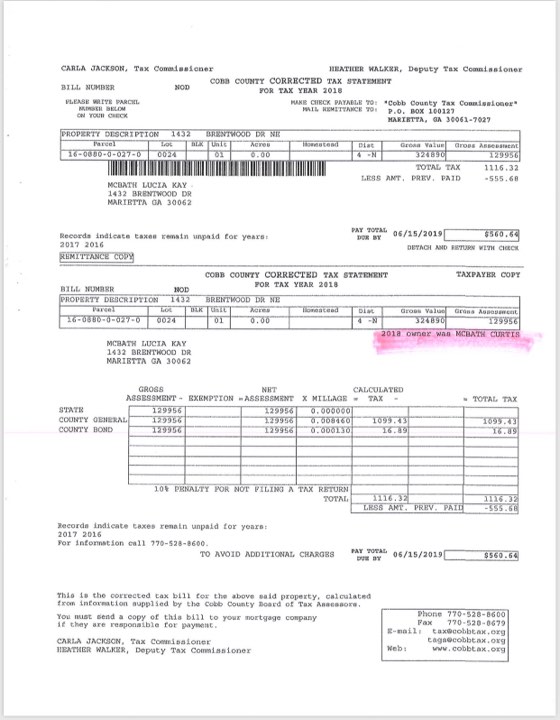

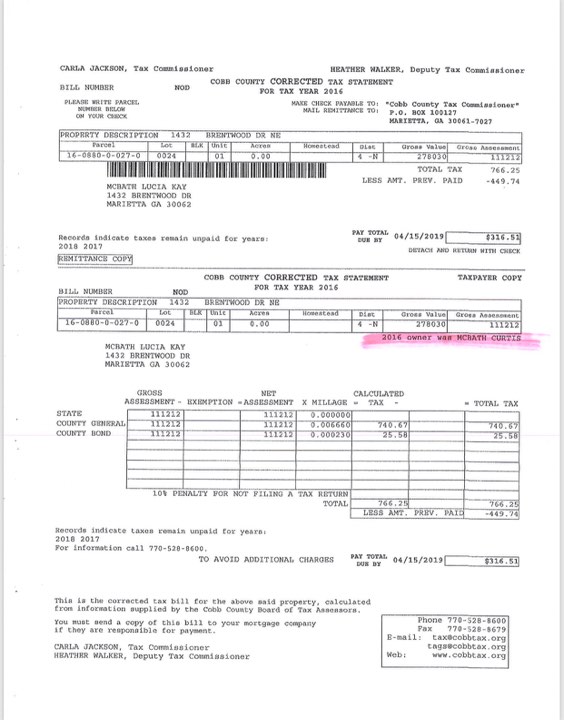

3 Years Of Homestead Exemptions Revoked For Ga Congresswoman Back Taxes Assessed Allongeorgia

3 Years Of Homestead Exemptions Revoked For Ga Congresswoman Back Taxes Assessed Allongeorgia

3 Years Of Homestead Exemptions Revoked For Ga Congresswoman Back Taxes Assessed Allongeorgia

3 Years Of Homestead Exemptions Revoked For Ga Congresswoman Back Taxes Assessed Allongeorgia

Business License Cobb County Georgia

Business License Cobb County Georgia

Cobb County Board Of Tax Assessors Official Website Of The Cobb County Ga Board Of Tax Assessors

Cobb County Board Of Tax Assessors Official Website Of The Cobb County Ga Board Of Tax Assessors

Sample Cobb County Georgia Home Expemtion Form Fill Online Printable Fillable Blank Pdffiller

Sample Cobb County Georgia Home Expemtion Form Fill Online Printable Fillable Blank Pdffiller

Cobb County School District Archives East Cobb News

Cobb County School District Archives East Cobb News

First Cobb Millage Rate And Budget Hearing Tuesday Cobb County Courier

First Cobb Millage Rate And Budget Hearing Tuesday Cobb County Courier

3 Years Of Homestead Exemptions Revoked For Ga Congresswoman Back Taxes Assessed Allongeorgia

3 Years Of Homestead Exemptions Revoked For Ga Congresswoman Back Taxes Assessed Allongeorgia

Cobb County Leaders Vote To Increase Millage Rate News Cbs46 Com

Cobb County Leaders Vote To Increase Millage Rate News Cbs46 Com

Tax Commissioner Warns People With May June Tag Renewals To Act Early Video Cobb County Georgia

Tax Commissioner Warns People With May June Tag Renewals To Act Early Video Cobb County Georgia

What Would You Need To File An Appeal With The Cobb County Tax Assessor For

What Would You Need To File An Appeal With The Cobb County Tax Assessor For

Ga Application For Cobb County Homestead Exemptions 2020 2021 Fill Out Tax Template Online Us Legal Forms

Ga Application For Cobb County Homestead Exemptions 2020 2021 Fill Out Tax Template Online Us Legal Forms

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home