How Do I Apply For Homestead Exemption In Greenville Sc

You must apply for the Homestead Exemption at your County Auditors office. Proof of Residency such as your SC drivers license SC Identification Card or SC Resident Tax Return.

About Grc Greenville Revitalization Corporation Greenville County Sc

About Grc Greenville Revitalization Corporation Greenville County Sc

You must be a legal resident of South Carolina for at least one year.

How do i apply for homestead exemption in greenville sc. When you apply for the homestead exemption you can also apply for other personal exemptions such as widows widowers blind disability and service connected disability. To apply for the exemption based on your age you will need to supply documents that prove your age such as your drivers license birth certificate Medicaid or Medicare card. Apply between July 16th and before the first penalty date of the tax year that the exemption can first be claimed.

By fax to 803-896-0151. However we will need the birth date and social security number of both owners. Where do I apply.

OR ARE a legal resident of South Carolina for at least one year on or before December 31 of the year prior to the exemption. A birth certificate or South Carolina Drivers License when applying for age. If all the above statements are true then you are qualified for the Homestead Exemption.

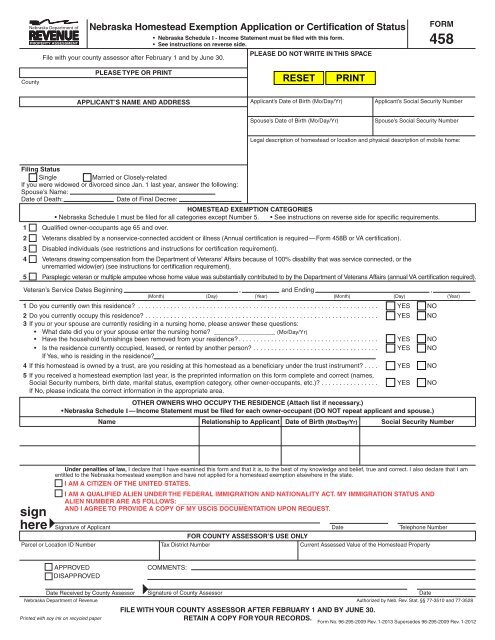

The above identified property is my our permanent home and legal residence and I am entitled to the Homestead Exemption. Welcome to the Sarasota County Property Appraisers online homestead exemption application. The exemption allowed results in a Taxable Value of 75 of the ATI Fair Market Value of the previous Fair Market Value whichever is higher.

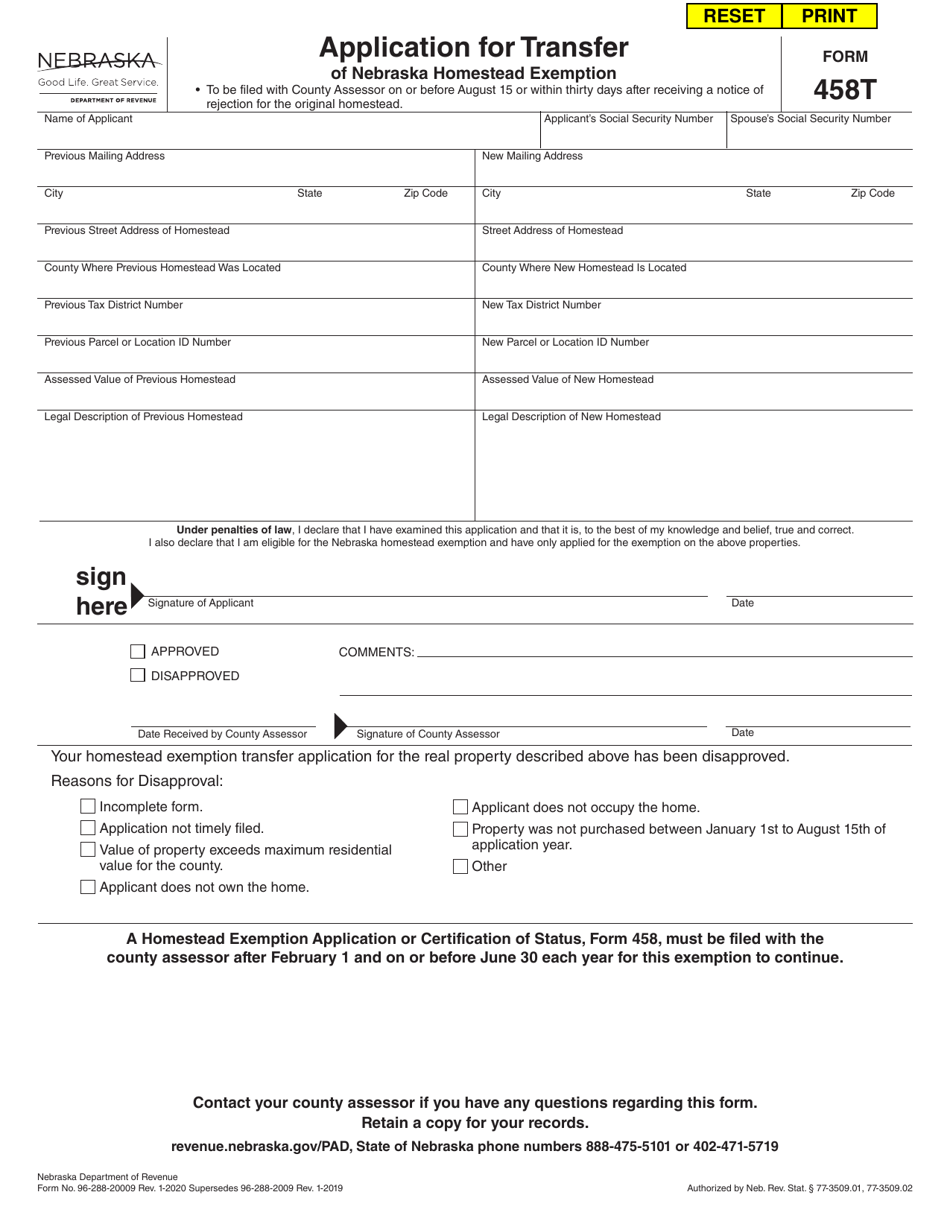

Applications are available at the assessors office or online. Be at least 65 years old be declared disabled by state or federal agency or be legally blind. This application is known as the Transfer of Homestead Assessment Difference and the annual deadline to file for this benefit and any other property tax exemption is March 1st.

When applying you must submit the following. SCDOR examines the exemption application and notifies the applicant of the decision and will inform the appropriate local county official of the approved exemptions annually. By email to PropertyExemptionsdorscgov by mail to address listed on the form.

Do I qualify for the Homestead Exemption. To apply for South Carolinas Homestead Exemption Program you will need to provide proof of your eligibility. Where Do I Apply.

This exemption only applies to. Exemptions are strictly construed in South Carolina. I we do hereby certify under penalty of perjury that the above information is true and correct and that I we have been a resident of South Carolina for one year as of 31 December last year.

OR ARE legally blind. OR ARE certified totally and permanently disabled by a state or federal agency. In order to qualify for the Homestead Exemption the following must be true.

Property owners with Homestead Exemption and an accumulated SOH Cap can apply to transfer or Port the SOH Cap value up to 500000 to a new homestead property. In person to a Taxpayer Assistance Office. Where do I apply.

How do I apply for the Homestead Exemption. Homestead Exemptions can be filed at your County Auditors Office. You hold complete fee simple title to your primary legal residence or life estate to your primary legal residence or you are the beneficiary of.

Some common documents used as proof of eligibility Include. It must be your primary residence. You may qualify for the Homestead Exemption if you ARE at least 65 years of age on or before December 31 preceding the tax year in which you wish to claim the exemption.

The property owner was age 65 on or before December 31 st preceding the year in which Homestead is claimed The property is the owners primary residence The owner has been a South Carolina resident for at least one full calendar year January December. You can apply at the County Auditors office located at 366 North Church Street Spartanburg SC Monday through Friday between 830AM and 500PM. Contact the County Auditors Office for details.

In order to file online the property you wish to file on must reflect ownership in your name. Application must be filed on or before January 30th of the year in which the exemption will be first applied. If you are unable to go to the Auditors Office you may authorize someone to make application for you.

You must apply for the Homestead Exemption at your County Auditors Office. To qualify for the Homestead Exemption statements 12 and 3 must be true. If you are unable to go to the Auditors office you may authorize someone to apply for you.

What documents do I need. Applications may be made at any time of the year at the Office of Real Property Services Suite 1000 County Square 301 University Ridge Greenville S. If the home is in both the husbands and wifes name either can come to complete the application.

You will need documentation from the state or federal agency certifying the disability if disabled. First-time Homestead Exemption applicants and persons applying for the Homestead. You may apply for the Homestead Exemption at the Lexington County Auditors office.

If you apply during the post-application period and you qualify you may be eligible for a refund for the preceding year.

Read more »