How To Apply For Homestead Exemption In Wv

An eligible owner shall apply for this special 15000 homestead exemption by filing for and signing an application with the Assessors office establishing that the owner qualifies for this exemption. For example if you will turn 65 between July 1st 2021 and June 30th 2022 you may come to the office between July 1st 2021 and Dec.

Homestead Exemption Wv Form Page 1 Line 17qq Com

Homestead Exemption Wv Form Page 1 Line 17qq Com

Applicant must have been a resident of West Virginia for two 2 consecutive years preceding July 1st of the relevant tax year.

How to apply for homestead exemption in wv. To start please fill out this application HOMESTEAD EXEMPTION. As of December 31 preceding the tax year of the exemption you were a legal resident of South Carolina for one calendar year. Only one exemption can be granted for each owner-occupied residence.

1st 2021 to apply for Exemption for the 2022 tax year. See Table 1 below. First middle initial middle initial Zip Code.

If you have any questions or need additional information please call the office 304 258-8570 and someone will be more than happy to assist you. How to Apply To apply for homestead exemption you must bring the required documents listed above to our office and apply in person. First Joint Owners Name If Applicable.

Proof of age will be. You may qualify if. Application Based on Age An application to receive the homestead exemption is filed with the property valuation administrator of the county in which the property is located.

You must have been a resident of West Virginia for the 2 consecutive calendar years prior to your application. Property Location if PO. Lewisburg WV 24901.

Applicant must also sign an oath stating that they do not receive a similar exemption in another state or county. Personal Property Account No. If granted it is permanent.

You must fill it out print it and then sign it and scan it back in to your computer and email it to ASSESSORKANAWHAUS Along with that you must send a copy of your drivers license and if filing with a disability you will need to send a copy of your disability form. Property Location If P. In order to complete your application and be eligible for the homestead exemption for the up-coming tax year we must obtain a copy of the following documents in our office prior to December 1.

Participate in the Homestead Exemption program contact your county assessors office for more information Have paid their property tax and. The qualified homeowner must also produce documents from the United States Department of Veterans Affairs showing the extent of the disability. Last 20000 Assessed Valuation Tax District.

You must have lived at your homestead for at least six 6 months. Filing for the exemption is available at any county assessors office. To apply for homestead you must bring the following.

The filing must take place by Dec1 of the year an individual turns 65 or becomes disabled. Elderly homeowners may apply for this exemption annually at the office of their county assessor from July 1 through October 1 provided that the applicant will be at least sixty-five years old by June 30 of the following year. APPLICATION FOR HOMESTEAD EXEMPTION 20000 ASSESSED VALUATION FOR ASSESSORS USE ONLY.

A taxpayer only needs to file for the exemption once. Application for Homestead Exemption FOR ASSESSORS USE ONLY Map No. Provided however That when a resident of West Virginia establishes residency in another state or country and subsequently returns and reestablishes residency in West Virginia within a period of five years such resident may be allowed a homestead exemption.

The owners application for exemption shall be accompanied by a sworn affidavit stating that such owner is not receiving a similar exemption in another state. Only 1 Homestead Exemption may be applied per household. You must be 65 years of age on or before June 30th of the next year.

The Homestead Exemption Program exempts 50000 from the value of your legal residence for property tax purposes. Homestead Exemption if the person otherwise qualifies. You hold complete fee simple title or life estate to your primary residence.

A person who is. Property belonging to or held in trust for colleges or universities located in West Virginia or any public or private nonprofit foundation or corporation which receives contributions exclusively for such college or university used for educational purposes. Car tag numbers for all vehicles owned by you or in your possession non-Jackson County tags must be changed before filing.

The applicant must be 65 years of age or older by July 1st of the relevant tax year. St of the current year. Applicant must be an owner of and occupy the real property in which seeking the Homestead Exemption.

- - - - Account Number. Have income which is less than 150 of federal poverty guidelines based on the number of people in the household. Tax Information and Assistance.

All deeds to your property recorded instruments only - warranty deeds or quit-claims - not the deed of trust.

Homestead Exemption Wv Form Page 1 Line 17qq Com

Homestead Exemption Wv Form Page 1 Line 17qq Com

Mountain Statesman Personal Property Assessment Deadline Quickly Approaching

Mountain Statesman Personal Property Assessment Deadline Quickly Approaching

Http Www Marioncountywv Com Document Center Assessment Form Replacement Pdf

Https Www Assessor Org Documentcenter View 5738

What Is A Homestead Exemption And How Does It Work Lendingtree

What Is A Homestead Exemption And How Does It Work Lendingtree

Wv Tax Exempt Form Page 1 Line 17qq Com

Wv Tax Exempt Form Page 1 Line 17qq Com

Https Greenbriercounty Net Wp Content Uploads Homestead Exemption Application Pdf

Http Preston Wvassessor Com Forms 2014ppbrochure Pdf

Homestead Exemption Application Page 1 Line 17qq Com

Homestead Exemption Application Page 1 Line 17qq Com

Putnam County Assessor Homestead Exemption Credit

Putnam County Assessor Homestead Exemption Credit

Homestead Exemption Wv Form Page 1 Line 17qq Com

Homestead Exemption Wv Form Page 1 Line 17qq Com

2021 West Virginia Bankruptcy Exemptions Wv Homestead Exemption West Virginia Bankruptcy Law Legal Consumer Com

2021 West Virginia Bankruptcy Exemptions Wv Homestead Exemption West Virginia Bankruptcy Law Legal Consumer Com

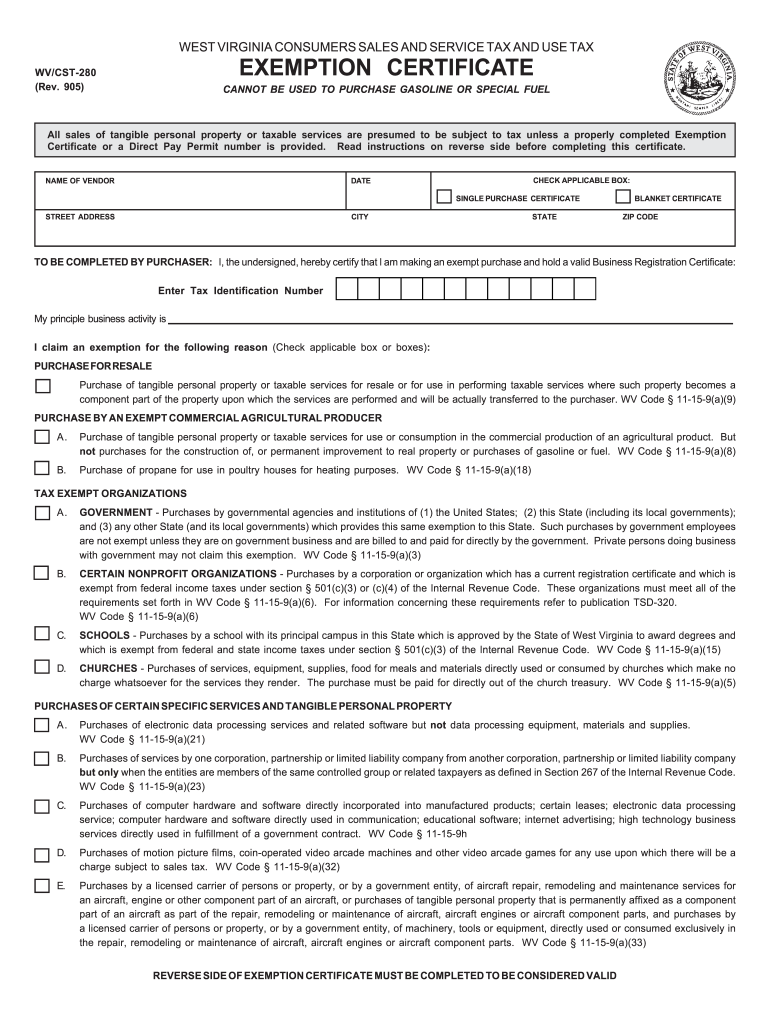

Wv Dor Cst 280 2005 2021 Fill Out Tax Template Online Us Legal Forms

Wv Dor Cst 280 2005 2021 Fill Out Tax Template Online Us Legal Forms

Http Www Fayettecounty Wv Gov Assessor Documents Personal Property Return 2013 Pdf

Fillable Online Homestead Exemption Wv Assessor Fax Email Print Pdffiller

Fillable Online Homestead Exemption Wv Assessor Fax Email Print Pdffiller

Homestead Exemption Wv Form Page 1 Line 17qq Com

Homestead Exemption Wv Form Page 1 Line 17qq Com

Homestead Exemption Application Page 1 Line 17qq Com

Homestead Exemption Application Page 1 Line 17qq Com

Labels: apply

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home