How To Apply For Homestead Exemption In Dekalb County Ga

Start by going to the Georgia Department of Revenue and filing an application for homestead exemption application. Applicants for senior or disability exemptions must apply in person and present copies of the previous years Federal and State.

You should check with your county tax office for verification.

How to apply for homestead exemption in dekalb county ga. Johnson - dekalb county tax commissioner. You must be at least 62 years or older on January 1st of the year in which you are applying you must apply by April 1st and you must meet certain income requirements. Failure to file constitutes your waiver of the exemption for that year.

In some counties the county tax commissioner accepts homestead applications and in others the county board of tax assessors accepts applications. The homestead exemption can reduce the amount you have to pay on property taxes. Documentation will be required if there is.

Please complete application in capital letters. 404 298-4000 404 298-3104 FAX. The deadline to apply for a 2021 homestead exemption has passed.

Application for Basic Homestead Exemption and. Fulton County homeowners can qualify for a variety of homestead exemptions offered through the Fulton County Tax Assessors office. Our 2022 online homestead application will be available by April 15 th 2021.

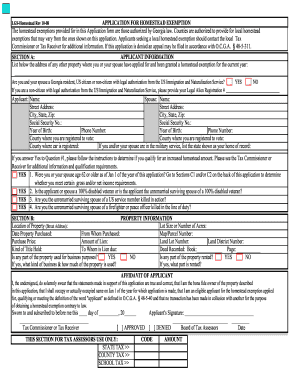

Please be aware that any existing homestead exemption will be researched to determine continuing eligibility. Then complete the form and submit it to your county tax commissioner. DeKalb County Tax Commissioner - Homestead Exemption and Property Assessment Freeze Application.

Also if the property is located within city limits the homeowner may be required to file with the city as well. Special exemptions must be applied for in person. Address change requests do NOT automatically apply homestead exemption.

Homestead exemptions are not transferable and must be reapplied for at the new home. City of Atlanta homeowners living in DeKalb have until June 1 to apply for a 2021 homestead exemption. Application for basic homestead exemption and assessment freeze.

Applicant 1 Information Name. Once the exemption has been granted it remains in place for as long as you own and reside at the home. File for Homestead Exemption.

Please contact the Tax Commissioners office at 404 298-4000 to apply for homestead exemptions. To qualify for a homestead exemption the property must be the legal residence for all purposes including filing of federal and state income taxes registering any owned or leased vehicles registering to vote etc on January 1 of each year to qualify for or retain an exemption. 2021 Apply for Homestead Exemption.

If this request is for an international address please email our office from the Contact Us page. Homestead exemptions are not transferable and must be reapplied for at the new home. Currently there are three basic requirements.

When applying for homestead exemption please note that you may need to provide to provide a copy of your Warranty Deed book and page proof of residence social security numbers drivers license andor car tag info. The following local homestead exemptions are offered in this county. Basic homestead applications may be submitted online at the DeKalb tax commissioner website by mail via the United States Postal Service drop box or in person by April 1.

Learn how to apply in your county below. Applications for homestead exemptions in DeKalb County can be filed at any time but must be received before April 1st to be applied to the current tax year. Applications may be submitted in person by drop box or mail before the deadline.

Failure to apply is considered a waiver of the exemption. Learning how to file homestead exemption in Georgia is easy. Once approved the exemption remains in effect as long as you own and reside in your home subject to periodic audits to verify continuing eligibility.

2021 Apply for Homestead Exemption. Homestead Exemption and Property Assessment Freeze. Will be applied to the following year.

Applications received after the April 1 stdeadline. Basic homestead applications may be processed by mail in person or online at wwwdekalbcountygagovtaxcommissioner. Exemption applications must be filed separately.

These include basic homestead exemptions as well as homestead exemptions for seniors low income homeowners surviving spouses of public safety and military personnel killed in the line of. Homestead exemptions are a form of property tax relief for homeowners. Applicants for senior or disability exemptions must apply in person and present copies of the previous.

Exemption by calling any Georgias Clean Air Force GCAF Service Center or the GCAF Call Center and supplying GCAF with the current owner and vehicle information. Our 2022 online homestead application will be available by April 15 th 2021. DeKalb County Tax Commissioner - Homestead Exemption and Property Assessment Freeze Application.

4380 Memorial Drive Suite 100. The deadline to apply for a 2021 homestead exemption has passed.

Dekalb Exemption Fill Online Printable Fillable Blank Pdffiller

Dekalb Exemption Fill Online Printable Fillable Blank Pdffiller

Https Www Csdecatur Net Cms Lib Ga02000365 Centricity Domain 562 Senior 20exemption 20committee 20faq Pdf

You Re A Homeowner Take Advantage Of Homestead Exemption Atlanta Ben

Dekalb County Property Tax Reduction Homestead Exemptions

Dekalb County Property Tax Reduction Homestead Exemptions

Apply For Georgia Homestead Exemption Grant Park Atlanta Real Estate Grant Park Homes For Sale

Https Www Brookhavenga Gov Sites Default Files Fileattachments Finance Page 19247 9 Appendices Pdf

Dekalb County Homestead Exemption Form Fill Out And Sign Printable Pdf Template Signnow

Dekalb County Homestead Exemption Form Fill Out And Sign Printable Pdf Template Signnow

Homestead Exemptions In Dekalb County News Cbs46 Com

Homestead Exemptions In Dekalb County News Cbs46 Com

Decatur Schools Closer To Offering A New Senior Homestead Exemption

Decatur Schools Closer To Offering A New Senior Homestead Exemption

Dekalb Homestead Exemptions Due April 1 What You Need To Know Decatur Ga Patch

Dekalb Homestead Exemptions Due April 1 What You Need To Know Decatur Ga Patch

Https Www Brookhavenga Gov Sites Default Files Fileattachments Finance Page 15957 Appendices Final Pdf

Dekalb Exemption Fill Online Printable Fillable Blank Pdffiller

Dekalb Exemption Fill Online Printable Fillable Blank Pdffiller

Dekalb County Georgia Property Tax Calculator Unincorporated Millage Rate Homestead Exemptions

Https Www Brookhavenga Gov Sites Default Files Fileattachments Finance Page 21901 Appendices Website Final Pdf

Dekalb Exemption Fill Online Printable Fillable Blank Pdffiller

Dekalb Exemption Fill Online Printable Fillable Blank Pdffiller

Dekalb County Property Tax Reduction Homestead Exemptions

Dekalb County Property Tax Reduction Homestead Exemptions

How To Apply For Homestead Exemption In Georgia Growatlantahomes Com

How To Apply For Homestead Exemption In Georgia Growatlantahomes Com

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home