Is Property Tax Rebate Taxable Iras

Because IRA distributions are considered taxable income they should not be. The Property TaxRent Rebate Program is one of five programs supported by the Pennsylvania Lottery.

7 Types Of Iras A Savings Comparison Inside Your Ira Investing For Retirement Ira Traditional Ira

7 Types Of Iras A Savings Comparison Inside Your Ira Investing For Retirement Ira Traditional Ira

If you pay taxes on your personal property and owned real estate they may be deductible from your federal income tax bill.

Is property tax rebate taxable iras. The revised property tax payable on the property for the period 1 January 2020 to 31 December 2020 is 4200 after a 30 property tax rebate with tax savings of 1800. Get Your Refund Status Get Coronavirus Tax Relief File Your Taxes for Free Get Your Tax Record View Your Account Make a Payment Get Answers to Your Tax Questions Forms and Instructions. If annual value is 40000 the annual value is 4000.

A 30 rebate on the tax which can be around 10 of the annual value. Contributions you make to a traditional IRA may be fully or partially deductible depending on your filing status and income and. Since the programs 1971 inception older and disabled adults have received more than 69 billion in property tax and rent relief.

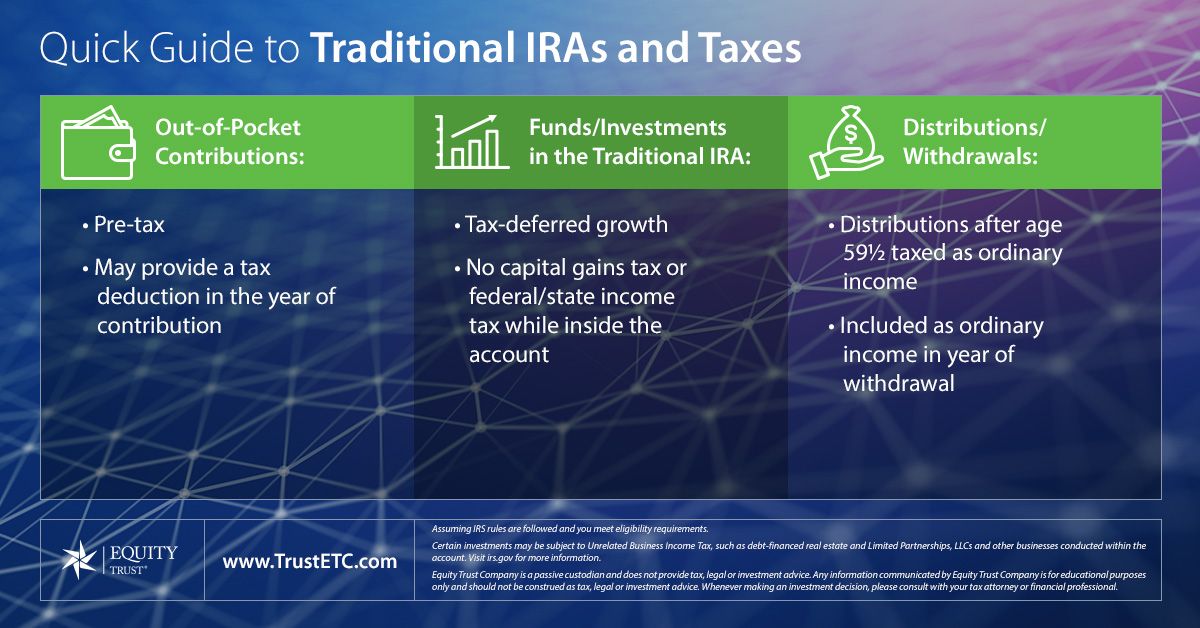

Rental 3 yield for a 1000000 property is 30000 or 2500 a month. A traditional IRA is a way to save for retirement that gives you tax advantages. Traditional IRAs are taxed when you make withdrawals and you end up paying tax on both contributions and earnings.

You received no income tax benefit when you paid the property tax so the refund is not taxable income and does not affect your income tax return. With Roth IRAs you pay taxes upfront and qualified withdrawals are tax-free. On 20 July 2020 the Inland Revenue Authority of Singapore IRAS published on its website guidance on the tax treatment of many of the support measures introduced to assist taxpayers and ease their cash flow during the period of the COVID-19 pandemic.

The rebate aims to help businesses and taxpayers deal with the impact of the COVID-19. 1040 and Schedules 1-3 Individual Tax Return. This is the first time in the history of the program that an electronic filing option is available for the Pennsylvanians who benefit from this program.

Traditional IRAs offer tax-deferred growth you pay taxes when you take the money out. Owner A must pass on the excess Property Tax Rebate of 2000 Property Tax Rebate of 6000 less rental waivers of 4000 to the tenant in accordance with the Property Tax Rebate scheme. If you did claim an itemized deduction for property tax in the earlier year technically you should treat the refund as an itemized deduction recovery.

Beneficiaries of a retirement account or traditional IRA must include in their gross income any taxable distributions they receive. Most state and local tax authorities calculate property taxes based on the value of the homes located within their areas and some agencies also tax personal property. During this period of uncertainty IRAS continues to extend its assistance and provide tax certainty to taxpayers.

And a 30 rebate amounts to 1200 only. Submit forms to IRAS by completing. We have set out the following tax guidance for.

Owner A can retain the full cash grant amount of 4000. COVID-19 Relief Measures Affecting the IRAS Property Tax According to the information released by IRAS regarding this relief owners of non-owner-occupied properties in Singapore can expect tax rebates ranging from 30 to 100 of their property tax bill depending on the type of property. Other 1040 Schedules Information About.

Property Owners Obligation to Pass the Property Tax Rebate on to Tenants In the FY2020 Budget and the FY2020 Supplementary Budget announced on 18 February and 26 March 2020 respectively it was announced that non-residential properties will receive a property tax rebate of up to 100 for the. A beneficiary can be any person or entity the owner chooses to receive the benefits of a retirement account or an IRA after he or she dies. GIRO application forms for the different taxes.

At AXS Stations if you are a DBSPOSB customer for Individual Income Tax and Property Tax only. In light of the global COVID-19 outbreak a series of support measures have been introduced to help businesses and individuals to ease their cash flow. The maximum standard rebate is 650 but supplemental rebates for qualifying homeowners can boost rebates to 975.

Roth IRAs into which you contribute after-tax money offer tax-free growth on investment earnings. The tax savings of 1800 is passed on to Company B in the form of a monetary payment. Owner A is required to provide rental waivers amount to 1000 x 4 4000.

Property TaxRent Rebate Program claimants now have the option to submit program applications online with the Department of Revenues myPATH system. If a traditional IRA is inherited from a spouse the surviving spouse generally has. The guidance addresses various COVID-19 related payments to businesses and individuals certain employee benefits and the passing on of the property tax PT rebate.

IRA Beneficiaries Inherited from spouse. You may choose Master Giro application form if you wish to pay more than one of your taxes Individual Income Tax Property Tax GST or Withholding Tax. Under the Resilience Budget owners of qualifying properties are granted rebates of up to 100 on their property tax payable.

The property tax rebate is enhanced by extending the rebate to additional types of properties and increasing the amount of rebate for certain types of properties. Because IRAs are tax-deferred assets taxes are not paid until the beneficiary takes a distribution from the account. Generally amounts in your traditional IRA including earnings and gains are not taxed until you take a distribution withdrawal from your IRA.

Traditional Ira Equity Trust Company

Traditional Ira Equity Trust Company

Traditional Individual Retirement Accounts Are Pre Tax Vehicles Meaning The Money You Put Into Them Has Never Been Ta Income Tax Tax Return Federal Income Tax

Traditional Individual Retirement Accounts Are Pre Tax Vehicles Meaning The Money You Put Into Them Has Never Been Ta Income Tax Tax Return Federal Income Tax

Tax Benefits Of Roth Iras And Conversions Perspective Financial

Tax Benefits Of Roth Iras And Conversions Perspective Financial

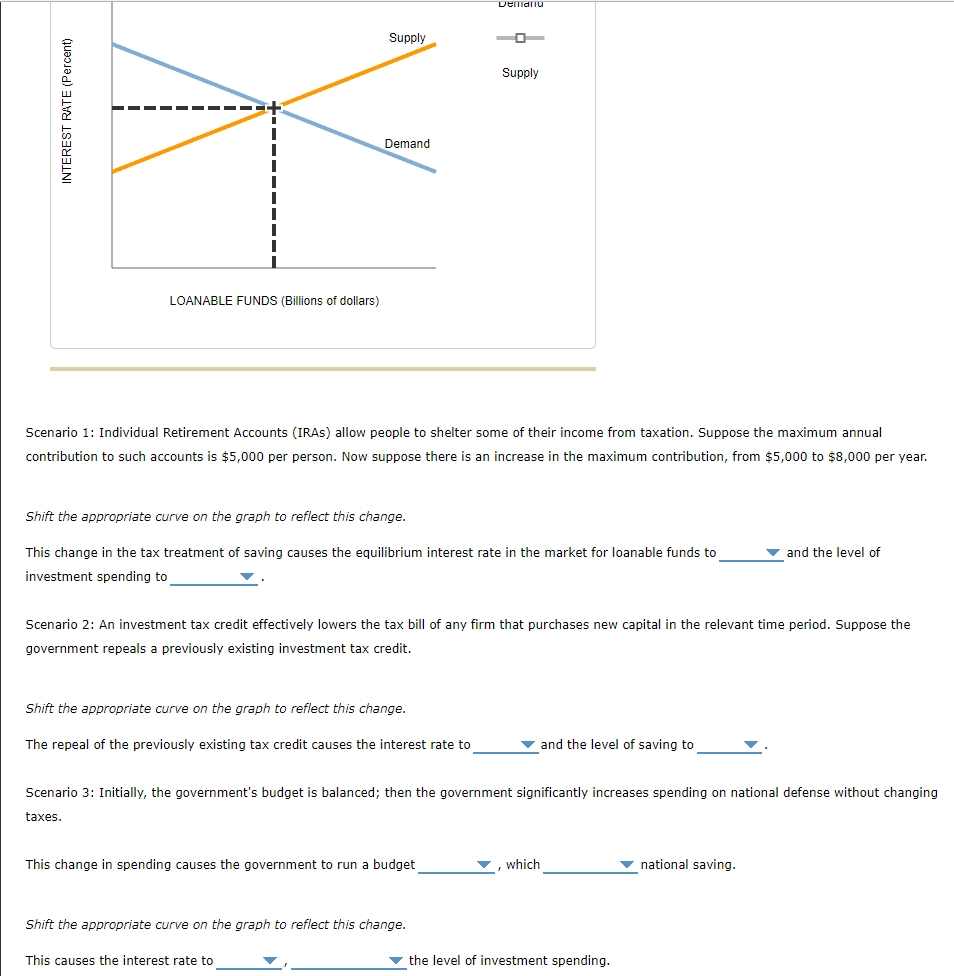

Solved Individual Retirement Accounts Iras Allow People Chegg Com

Solved Individual Retirement Accounts Iras Allow People Chegg Com

Ira Aggregation Rule And Pro Rata Ira Taxation Kitces Com Ira Roth Ira Roth Ira Contributions

Ira Aggregation Rule And Pro Rata Ira Taxation Kitces Com Ira Roth Ira Roth Ira Contributions

There S Still Time To Reduce Your Taxable Income For The 2020 Tax Year Grow Financial

There S Still Time To Reduce Your Taxable Income For The 2020 Tax Year Grow Financial

Backdoor Roth Ira Steps Roth Ira Ira Rollover Ira

Backdoor Roth Ira Steps Roth Ira Ira Rollover Ira

Million Dollar Iras A Tax Problem Bankrate Com Roth Ira Investing How To Raise Money Roth Ira

Million Dollar Iras A Tax Problem Bankrate Com Roth Ira Investing How To Raise Money Roth Ira

What To Bring To Your Tax Appointment Tax Appointment Business Tax Tax Organization

What To Bring To Your Tax Appointment Tax Appointment Business Tax Tax Organization

Revisiting And Revising The Investor Policy Statement Investors Statement Deferred Tax

Revisiting And Revising The Investor Policy Statement Investors Statement Deferred Tax

Magnificent Planned Giving Template Plan Templates Church Letter Intended For Bequest Letter Template 10 Letter Templates Lettering Thank You Letter Template

Magnificent Planned Giving Template Plan Templates Church Letter Intended For Bequest Letter Template 10 Letter Templates Lettering Thank You Letter Template

June 2012 Newsletter Page 2 Tax Brackets Investing Newsletters

June 2012 Newsletter Page 2 Tax Brackets Investing Newsletters

Publication 590 A 2018 Contributions To Individual Retirement Arrangements Ira Social Security Benefits Social Security Disability Benefits Social Security

Publication 590 A 2018 Contributions To Individual Retirement Arrangements Ira Social Security Benefits Social Security Disability Benefits Social Security

Charles Schwab Tips Re Tax Efficient Investing Investing Finance Investing Investing Strategy

Charles Schwab Tips Re Tax Efficient Investing Investing Finance Investing Investing Strategy

W 9 Form 2016 Pdf Fillable Brilliant Free W2 Forms From Irs Throughout Free W 9 Form In 2021 Tax Forms Employee Tax Forms Irs Forms

W 9 Form 2016 Pdf Fillable Brilliant Free W2 Forms From Irs Throughout Free W 9 Form In 2021 Tax Forms Employee Tax Forms Irs Forms

Pin By Jim Probasco On Personal Finance Roth Ira Roth Ira Conversion Roth Ira Contributions

Pin By Jim Probasco On Personal Finance Roth Ira Roth Ira Conversion Roth Ira Contributions

Income Tax Treatment Of Foreign Exchange Gains Or Losses Iras

Income Tax Treatment Of Foreign Exchange Gains Or Losses Iras

Ameriprise Financial Abney Associates Team Choosing A Beneficiary For Your Ira Or 401 K Selecting Beneficia Ameriprise Financial Financial News Financial

Ameriprise Financial Abney Associates Team Choosing A Beneficiary For Your Ira Or 401 K Selecting Beneficia Ameriprise Financial Financial News Financial

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home