How To Apply For Homestead Exemption In Nebraska

Meet household income limits. For additional information to include income requirements on exemptions please review the Nebraska Homestead Exemption.

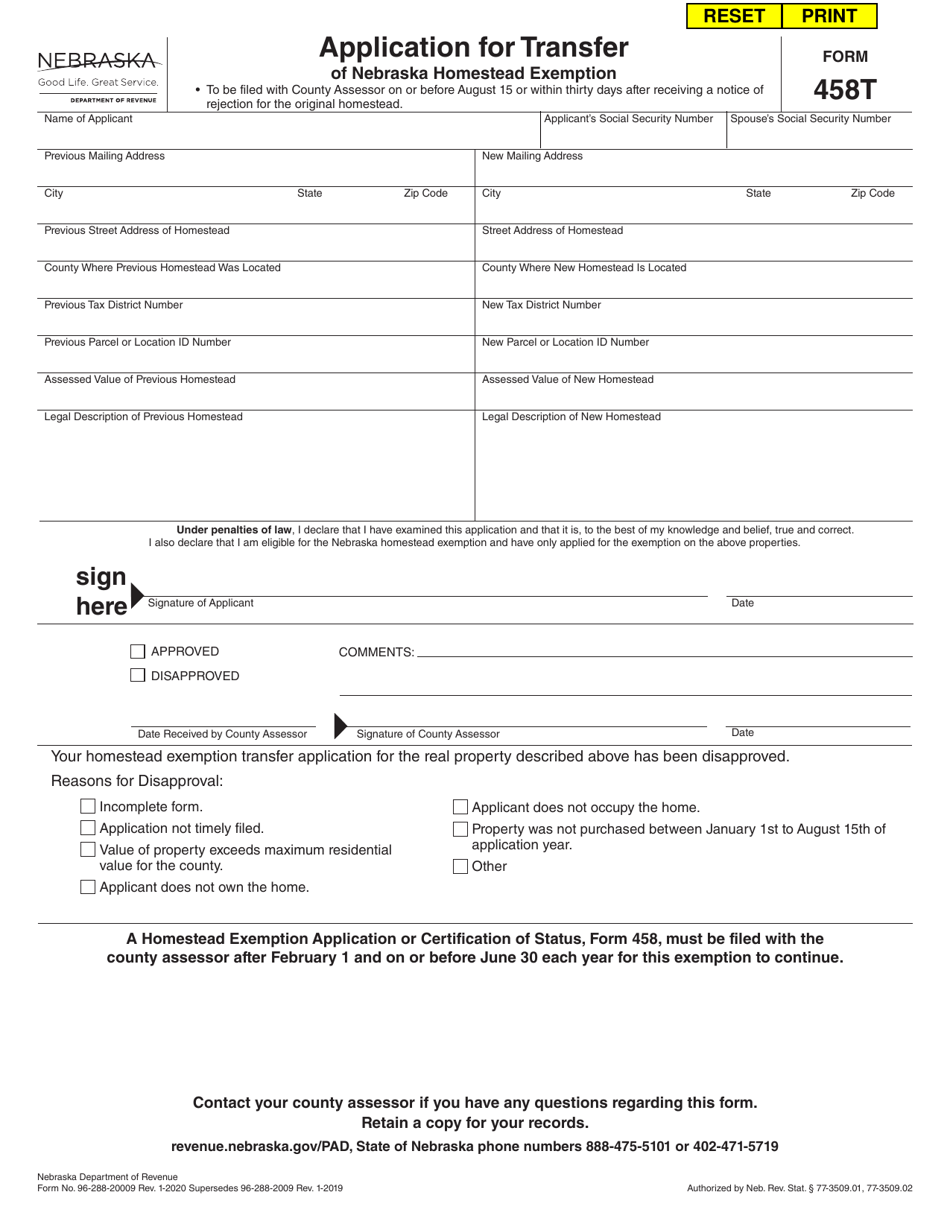

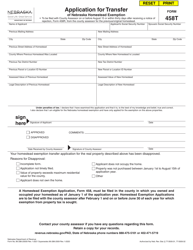

Form 458t Download Fillable Pdf Or Fill Online Application For Transfer Of Nebraska Homestead Exemption Nebraska Templateroller

Form 458t Download Fillable Pdf Or Fill Online Application For Transfer Of Nebraska Homestead Exemption Nebraska Templateroller

And v Have qualifying household income see Table I.

How to apply for homestead exemption in nebraska. V Be 65 or older before January 1 of the application year. Application will result in the loss of the homestead exemption for a period of three years. You also may pick up a homestead exemption application in the AssessorRegister of Deeds 4th-floor lobby area.

This form must be completed signed and filed after February 1 and by June 30 with your county assessor. Own and occupy a homestead continuously from January 1 through August 15. When and Where to File.

200000 minus 195100 4900 over the maximum so a 10 reduction. 1 and on or before June 30. An application to receive the homestead exemption is filed with the property valuation administrator of the county in which the property is located.

How to Apply for Homestead Exemptions. Check the applicable box and indicate your alien registration number if you are a qualified alien. Be 65 years of age or older before January 1 of the application year.

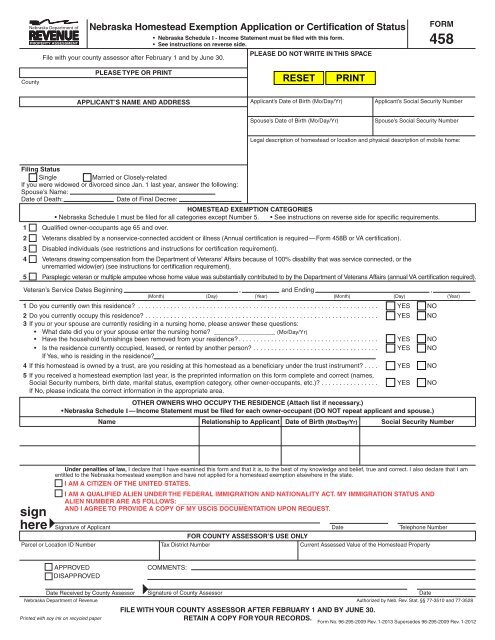

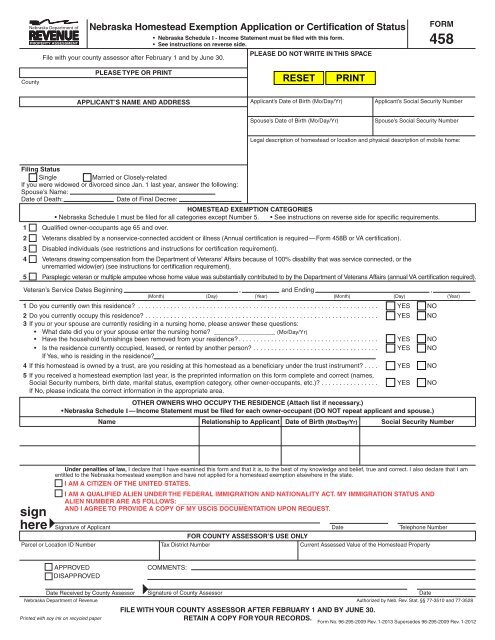

Applications are available from your County Assessors office or you can find them online at wwwrevenuestateneustaxcurrentcurrenthtm Where can I get help filing for the Homestead Exemption. Form 458 Nebraska Homestead Exemption Application 012021 Form 458 Schedule I - Income Statement and Instructions 012021 Form 458B Certification of Disability for Homestead Exemption is not available online. Homestead exemption application forms are available February 2 2021.

Current homestead recipients will receive an application by mail. When you do apply expect to have the following information on. Over 65 applicant qualifies for 100 based on the income criteria.

97550 times 010 10 9755 reduction. Table I Homestead Exemption For Persons Over Age 65 Income Income. Homestead Exemption Application Form 458 and NE Schedule 1 - Income Statement Previous filers should expect a pre-filled form mailed from the Sarpy County Assessors office the first part of February.

If you need assistance in completing the application visit or call your County Assessors office. The Nebraska Homestead Exemption Information Guide is available at revenuenebraskagovPAD by clicking on Homestead Exemption in the menu to the left. Deposit completed applications into a drop box in the lobby.

The Nebraska Homestead Exemption Information Guide is available at revenuenebraskagovPADhomestead-exemption. New applicants can get Homestead Exemption applications by contacting the Douglas County Assessors Office at 402 444-7060. Failure to timely file is a waiver of the homestead exemption.

To qualify for a homestead exemption under this category an individual must. A homestead exemption is available to US. The best way to submit yours is to obtain the application from our website unless you already have one print the application that is on the left side of the page.

To receive the homestead exemption you must be 1 at least 65 years of age during the year you firstfile or be determined to have been permanently and. Homestead Exemption Application Form 458 PDF format Statutes and Constitution - Nebraska keyword search or view chapter-by-chapter. Homestead applications must be filed with the county assessor after February 1 and on or before June 30 of each year.

Contact your states tax office or secretary of states office for specific instructions on how to apply for a homestead exemption. Form 451 - Exemption Application PDF Form 451A - Reaffirmation of Exemption Application PDF Form 402 - Improvements on Leased Land PDF Form 456 - Special Valuation Greenbelt Application PDF Form 191 - Vacant or Unimproved Lot Application PDF Form 425 - Report of Destroyed Real Property PDF Valuation Review Request Form. The trust and place the record title in his or her name.

Citizens or qualified aliens. Please contact your county assessor for Form 458B. Qualifications for the Homestead Exemption for Real Property and Manufactured or Mobile Homes.

Form 458T Application for Transfer of Nebraska Homestead Exemption 012021. V Own and occupy a homestead continuously from January 1 through August 15. 87795 times 100 100 87795 homestead exemption value allowed per income limit.

You must file for a homestead exemption after Feb. 97550 minus 9755 87795 reduced exemption amount. To qualify for a homestead exemption at least one homeowner must meet these requirements.

Homestead Exemption Assistance March June Vas

Homestead Exemption Assistance March June Vas

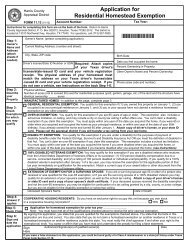

Www Yumpu Com En Image Facebook 38616658 Jpg

Www Yumpu Com En Image Facebook 38616658 Jpg

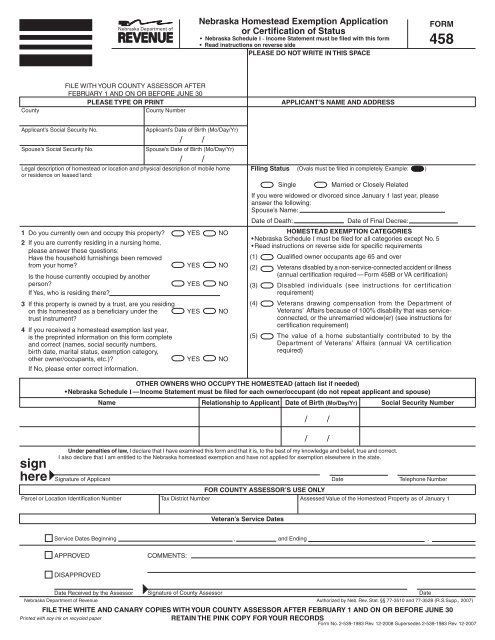

Form 458 Nebraska Homestead Exemption Application

Form 458 Nebraska Homestead Exemption Application

New Texas Home Owners Don T Forget To File Your Homestead Exemption It Will Save You On Your Property Ta Real Estate Branding Homeowner Texas Real Estate

New Texas Home Owners Don T Forget To File Your Homestead Exemption It Will Save You On Your Property Ta Real Estate Branding Homeowner Texas Real Estate

Residence Homestead Exemption Information Youtube

Residence Homestead Exemption Information Youtube

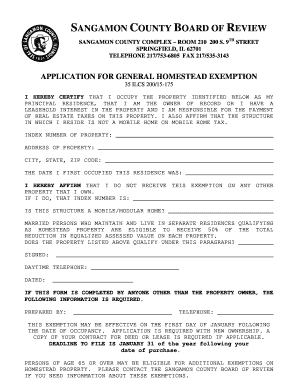

Sangamon County Homestead Exemption Fill Online Printable Fillable Blank Pdffiller

Sangamon County Homestead Exemption Fill Online Printable Fillable Blank Pdffiller

Homestead Exemption Harris Texas Page 1 Line 17qq Com

Homestead Exemption Harris Texas Page 1 Line 17qq Com

Santa Can T Do What Real Estate Advertising Home Buying Real Estate Infographic

Santa Can T Do What Real Estate Advertising Home Buying Real Estate Infographic

Homestead Exemption Texas Form Page 6 Line 17qq Com

Homestead Exemption Texas Form Page 6 Line 17qq Com

Application For Limited Use Claim Password For Electronic Case Filing System Nebraska Electronics Cases Filing System

Application For Limited Use Claim Password For Electronic Case Filing System Nebraska Electronics Cases Filing System

Fillable Online Hcad Affidavit As Proof Of Eligibility For Residence Homestead Exemption Hcad Fax Email Print Pdffiller

Fillable Online Hcad Affidavit As Proof Of Eligibility For Residence Homestead Exemption Hcad Fax Email Print Pdffiller

2021 Homestead Exemption Forms Available Sarpy County

2021 Homestead Exemption Forms Available Sarpy County

Homestead Exemption Codes Qpublic

Homestead Exemption Codes Qpublic

Nebraska Homestead Exemption Application Or Certification Of Status

Nebraska Homestead Exemption Application Or Certification Of Status

Homestead Exemption Applications Have Been Mailed Government And Politics Fremonttribune Com

Homestead Exemption Applications Have Been Mailed Government And Politics Fremonttribune Com

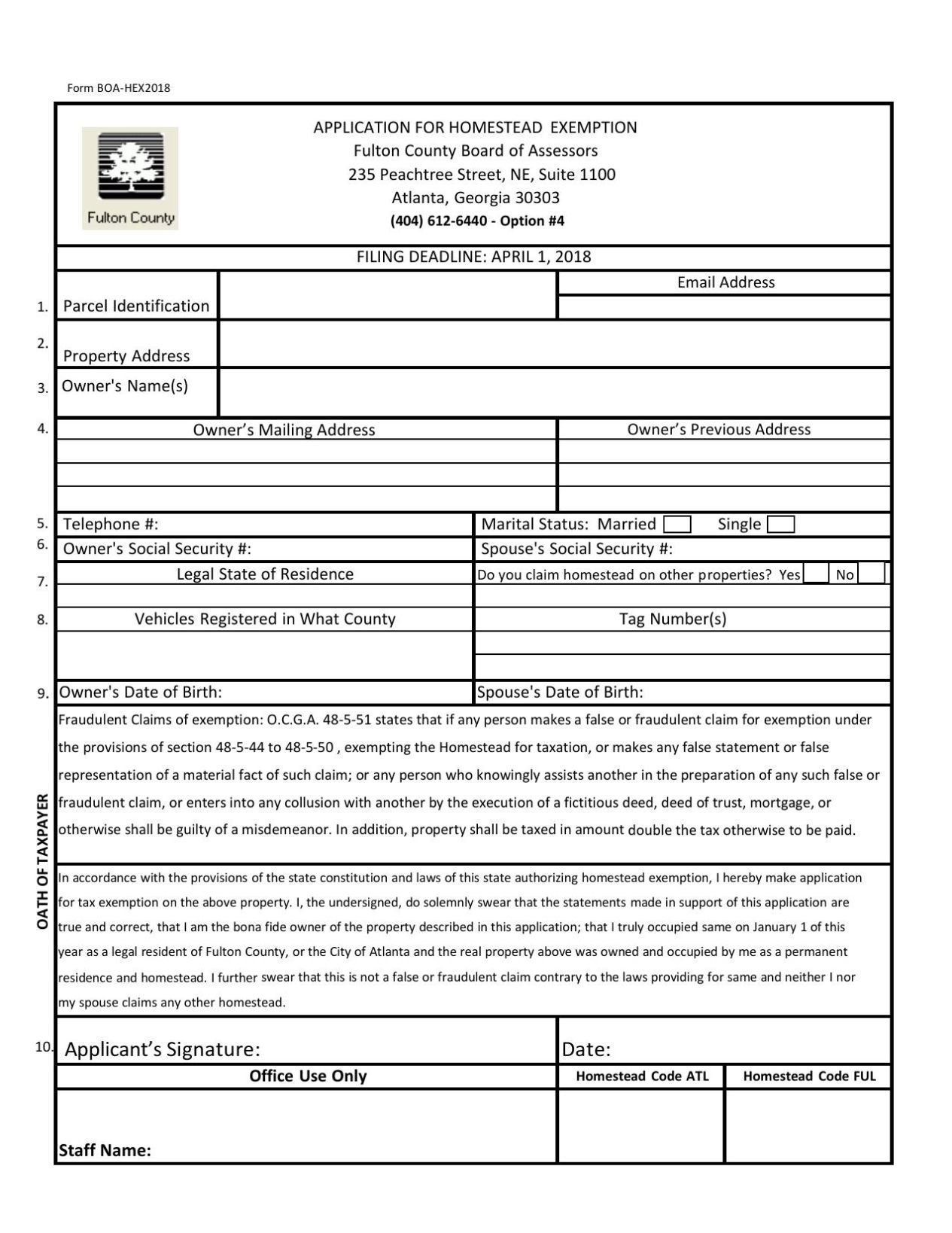

Fulton County 2018 Homestead Exemption Application Neighbornewsonline Com Suburban Atlanta S Local News Source Mdjonline Com

Fulton County 2018 Homestead Exemption Application Neighbornewsonline Com Suburban Atlanta S Local News Source Mdjonline Com

How To Apply For A Homestead Exemption Howstuffworks

How To Apply For A Homestead Exemption Howstuffworks

Nebraska Homestead Exemption Application Or Certification Of Status

Nebraska Homestead Exemption Application Or Certification Of Status

Form 458t Download Fillable Pdf Or Fill Online Application For Transfer Of Nebraska Homestead Exemption Nebraska Templateroller

Form 458t Download Fillable Pdf Or Fill Online Application For Transfer Of Nebraska Homestead Exemption Nebraska Templateroller

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home