How To Apply For Working Tax Credit Northern Ireland

Everyone resident in Ireland is entitled to Personal Tax Credits. You cant claim Working Tax Credit if youre getting Universal Credit.

Fast Loans Reviews Fast Loans Loans For Bad Credit Payday Loans

Fast Loans Reviews Fast Loans Loans For Bad Credit Payday Loans

Developing ideas products and services remotely.

How to apply for working tax credit northern ireland. Most employees in Ireland pay tax through the PAYE Pay As You Earn system where your employer deducts tax directly from your wages for Revenue. They do not apply to workers who bring work home outside of normal working hours. You must also work a certain number of hours each week.

Have at least one PRSI contribution in the 4 weeks before claiming PUP or be in insurable self-employment. To qualify for WTC you must meet the basic conditions which are. Aged 65 or older.

Working Tax Credit counts as income when working out your entitlement to most other means-tested benefits. Youll need to update your existing tax credit claim by reporting a change in your circumstances. England Wales Scotland and Northern Ireland.

Select Remote Working Expenses and insert the amount of expense at the Amount Claimed section You must be able to account for each expense you intend to claim. We would like to show you a description here but the site wont allow us. The form usually takes 2 weeks to arrive.

Not be subject to immigration control. Be genuinely seeking work. If youve asked your employees to work from home and youve not reimbursed them already your employees may be entitled to claim tax relief on additional household expenses theyve incurred such as heating and lighting.

This can include someone leaving or moving into your household a young person leaving or continuing in full time non-advanced education changes to your childcare costs or provider employment changes marriage cohabitation separation or divorce relevant. Welfare Reform in Northern Ireland has faced a number of difficulties and due to the many delays in getting the primary legislation in place UC rolled out on a. Even if youve left the country but have worked in Ireland within the last 4 years or you only worked part of.

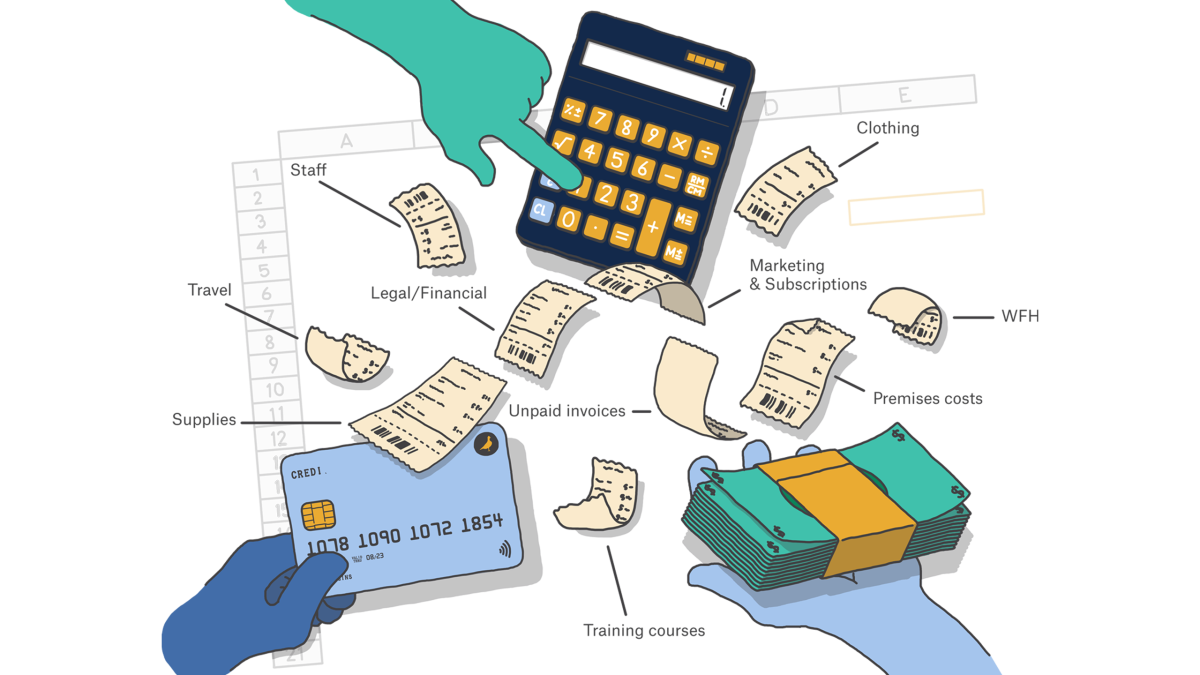

What can I claim for. Advisory support and financial assistance up to a maximum of 25k available towards 50 of the first 12 months salary costs for a new dedicated supply chain role within your business. Where your employer does not wish to reimburse the 320 you are entitled to claim a deduction in respect of actual vouched expenses supported by receipts incurred in the performance of your employment duties.

Not be getting any income from employment. Informing the Tax Credit Office about a change in your circumstances does not require a claim form. Yes the work from home relief would apply.

Sending and receiving email data or files remotely. You can only make a claim for Working Tax Credit if you already get Child Tax Credit. In England and Wales you cant get free school meals if you get working tax credit you can only qualify with the working tax credit run-on.

How this works is explained in Calculating your Income Tax. Every PAYE worker gets tax credits which include reliefs you may be able to claim depending on your circumstances. You need to inform HMRC of any changes that might affect your tax credits award.

Logging onto a work computer remotely. Be aged 16 or over. The arrangements on this page only apply to your eWorking employees.

This page explains the roll-out of Universal Credit UC in Northern Ireland. Have been in employment or self-employment in Ireland on or after 13 March 2020. Working tax creditworking tax credit run-on 1 1 Working tax credit is only taken into account in Scotland and Northern Ireland.

Be in the UK. Employers should make staff that are working from home aware of the tax relief available to them for expenses such as heating and lighting. You can request a Working Tax Credit claim form using the online tool or by contacting the Tax Credits Office.

Do I qualify for working tax credit WTC. Live in the Republic of Ireland. Your employer may pay you 320 per day tax free to cover this.

You may also be entitled to extra tax credits if for example you are. A Pay As You Earn PAYE employee. You can only make a claim for Child Tax Credit or Working Tax Credit if you already get tax credits.

Tax credits reduce the amount of tax you pay. You might be able to apply for Pension Credit if you and your partner are State Pension age or over. The number of hours you need to work varies depending on your age and household circumstances.

Select the Income Tax return for the relevant tax year In the Tax Credits and Reliefs page Page 4 of 5 select the Your job tab. What changes do I need to tell tax credits about. You will need to prepare certain documents and information when you call including.

Contact details for the Tax Credits Helpline and Tax Credit Office which gives information about Working Tax Credit and Child Tax Credit.

Read more »