How To Claim Tax Deduction For Working From Home

An automatic maximum home office deduction of 900 euros is available for workers who have been telecommuting for at least half of the working days within a tax. This includes if you have to.

Tax Tips For Remote Workers Can You Claim The Home Office Deduction On Your Tax Return If You Worked From Home Accounting Humor Accounting Jokes Cpa Exam Humor

Tax Tips For Remote Workers Can You Claim The Home Office Deduction On Your Tax Return If You Worked From Home Accounting Humor Accounting Jokes Cpa Exam Humor

If youre working from home for part of the year you only include expenses incurred during that time.

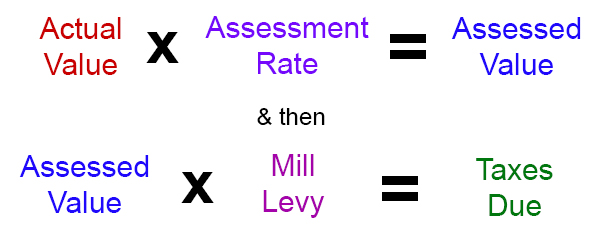

How to claim tax deduction for working from home. For example if you multiply 320 hours by 080 per hour you get 256. The space used for working from home is a major deduction telecommuters can expense in the 2020 tax year. This form is what business owners file with their tax returns to claim the home office deduction.

Then complete IRS Form 8829 and give it to your employer. 2 days agoWith the change in work culture and remote working the question was raised by South African taxpayers whether they would be permitted to claim a deduction. The simplified method provides a deduction of up to 1500.

Using the regular method qualifying taxpayers compute the business use of home deduction by dividing expenses of operating the home between personal and business use. Or you might choose to use the simplified method for home office deductions which is based on the square footage of. The tax break comes in two flavors a simplified deduction and a more complex one.

When you have worked out the total hours you multiply it by 080. If so you may be wondering if youre allowed to take the home office tax deduction for those expenses on your 2020 federal tax return. This means you could claim a deduction of 256 when you lodge your tax return.

For example if your work from home area is 400 square feet and your total home is 2000 square feet you would be able to claim 20 4002000 of your. You worked from home in 2020 due to the COVID-19 pandemic or your employer required you to work from home. Working from home You may be able to claim tax relief for additional household costs if you have to work at home on a regular basis either for all or part of the week.

SINGAPORE With telecommuting set to be the new norm workers have the option of claiming tax deductions against their employment income for expenses incurred while working from home such as. 1 day agoHome office. How to claim the tax relief To process these claims in October 2020 HMRC set up a new dedicated working-from-home microservice that will automatically apply the whole 202021 tax years relief via your tax code making claiming the whole amount very easy.

One method is to keep track of all your expenses including receipts. You are eligible to claim a deduction for home office expenses for the period you worked from home if you meet all of the criteria. Under the simplified method you deduct 5.

Anyone making a claim for this tax year who hasnt already put in a claim can use it. You determine the percentage of your home. A taxpayer can use either the regular or simplified method to figure the home office deduction.

It shows each element of the deduction and gives the total amount. You can deduct 5 per square foot up to 300 square feet of the portion of your home thats used for business. If you file Schedule C Form 1040 to report your business income use IRS Form 8829-Expenses for Business Use of Your Home to deduct your actual home office expenses.

The short answer is probably not. You worked more than 50 of the time from home for a period of at least four consecutive weeks in 2020. Unfortunately most employees working from home cant claim any federal tax deductions connected to being a remote worker during the coronavirus pandemic says Sundin.

For example if you worked from home for 8 weeks and you worked 40 hours each week that would be 320 hours.

Read more »