How To Determine Property Tax From Millage Rate

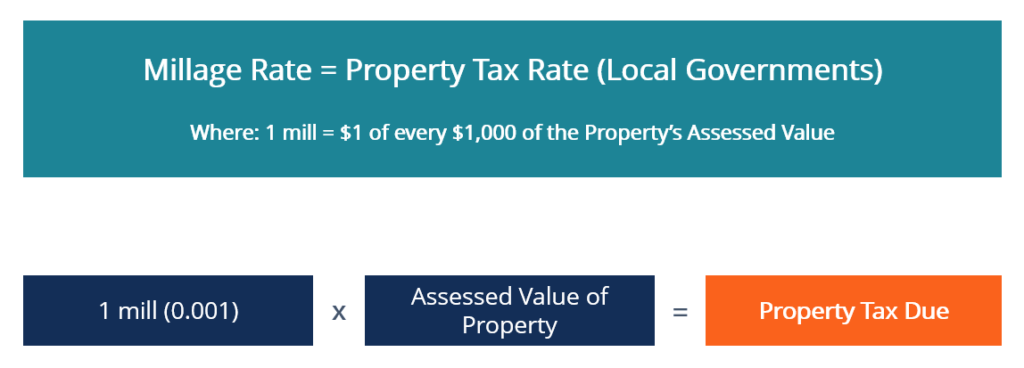

One mill is equal to 01 For example a 1 property tax would equal ten mills. The millage rate is the amount per 1000 of assessed value thats levied in taxes.

Property Tax Calculation Boulder County

Property Tax Calculation Boulder County

The millage rate helps set property taxes.

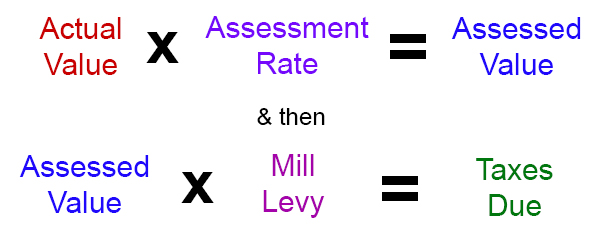

How to determine property tax from millage rate. Thus this calculation results in an effective property tax rate of 3. Property tax bills often seem confusing because taxing agencies use millage to determine the amount of taxes they levy instead of something more familiar like a tax rate. A mill is one one-thousandth of a dollar and in property tax terms is equal to 100 of tax for each 1000 of assessment.

Property owners can calculate their tax bill by multiplying their taxable value by the millage rate. Thats 20000 x 301000. For the category select Excel Exports then select the desired report from the report drop-down list.

A mill is 11000 of a dollar. Millage Rate rate in dollars per 1000 of taxable value set by each taxing authority based upon tax revenue required in their annual budget. Various millage rate exports are available under the Review Reports section.

Millage can be thought of as a proportional system of measure. For example if the citys millage rate is 10 mills property taxes on a home with a taxable value of 50000 would be 500. 30 mills 1000 003 millage rate.

How Do I Calculate Real Estate Taxes Using the Millage Rate. Millage rates are mathematically expressed as 0. 29 mills therefore is equal to 29 for every 1000 of assessed value or 29.

003 X 250000 7500 property tax bill. Whatever millage rate is set by the local jurisdiction each year is then multiplied by the total taxable value of your property to calculate the property taxes due that year. Millage rates are expressed in tenths of a penny meaning one mill is 0001.

Taxable value is the number used to calculate property taxes and in general is less than half of the propertys market value. TAX RATE MILLS ASSESSMENT PROPERTY TAX. So if your tax rate is 30 mills and your assessed value is 20000 your property tax bill would be 600.

Millage Code A two-digit code related to your property location and jurisdiction which shows the taxing authorities and. Government bodies commonly adjust the mill rate during their budgeting process. How to calculate property tax There are a number of factors that come into play when calculating property taxes from your propertys assessed value to the mill levy tax rate in your area.

100000 60000. Understand the Fundamentals of Millage. Property Tax Disclosure NOTE.

100000 30000. 100000 300000. A mill is equal to 11000 or one tenth of a percent.

By definition one mill is equivalent to 1 owed per 1000 one-thousandth of a dollar. The rate represents the amount a homeowner has to pay for every 1000 of a propertys assessed value. The millage rates in Arkansas vary by county city and school district.

How the Millage Rate Is Determined. Thus 45 mills are equal to 45 per every 1000 of the estimated property value. The millage rate then is dollars of tax levied for each 1000 of property value.

Property taxes are computed by multiplying the taxable value of the property by the number of mills levied. The Tax Amount shown is an ESTIMATE based upon 90 percent of the Sales Price you entered and the current ad. Each mill equates to 1 of tax per 1000 of taxable value.

The millage rate can be found on the property tax statement or by contacting your city. Millage rates are the tax rates used to calculate local property taxes. In property tax a mill is one thousandth of a dollar.

For example on a 300000 home a millage rate of 0003 will equal 900 in taxes owed 0003 x 300000 assessed value 900. It is important to make a clear distinction between the property value of a home as. A millage rate is the rate at which property taxes are levied on property.

It means that 10 represents one part per thousandth and can also be expressed as 01. The tax liability can also be calculated by multiplying the taxable value of the property by the mill rate and then dividing by 1000. The mathematical equation below illustrates how this is figured.

A millage rate also known as the mill rate is commonly used to determine how much a person owes in property taxes.

Tax Rates Gordon County Government

Tax Rates Gordon County Government

Millage Rate Overview Sources How To Calculate

Millage Rate Overview Sources How To Calculate

Statewide Average Property Tax Millage Rates In Michigan 1990 2008 Download Table

Statewide Average Property Tax Millage Rates In Michigan 1990 2008 Download Table

Brookhaven Dekalb County Georgia Property Tax Calculator Millage Rate Homestead Exemptions

Millage Rate Sample Chart And Instructions

Millage Rate Sample Chart And Instructions

Figure Your Property Taxes Updated Millage Rates For 2019 Hilton Head 360

Figure Your Property Taxes Updated Millage Rates For 2019 Hilton Head 360

Real Estate Taxes City Of Palm Coast Florida

Real Estate Taxes City Of Palm Coast Florida

Millage Rate Overview Sources How To Calculate

Millage Rate Overview Sources How To Calculate

Pin By Raf On Adam Reality Property Tax Government Constitution

Pin By Raf On Adam Reality Property Tax Government Constitution

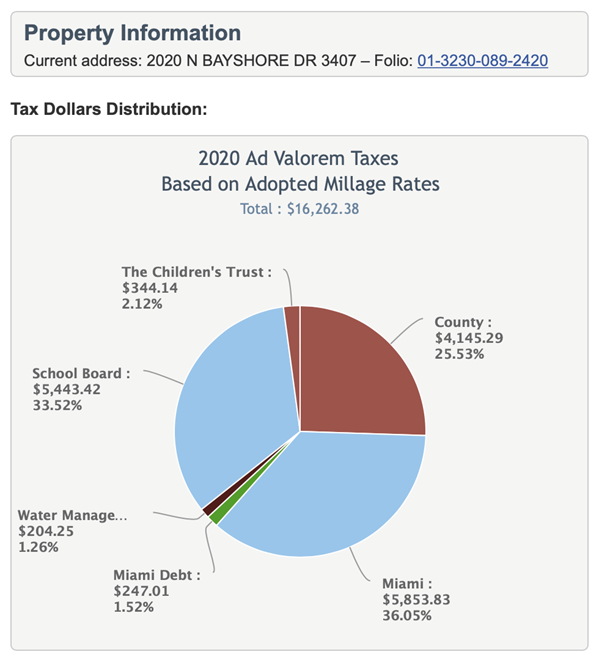

Where To Find The Lowest Property Taxes In Miami Condoblackbook Blog

Where To Find The Lowest Property Taxes In Miami Condoblackbook Blog

Stuff You Should Know Real Property Taxes In Ohio Waller Financial Planning Group

Stuff You Should Know Real Property Taxes In Ohio Waller Financial Planning Group

Millage Rate Sample Chart And Instructions

Millage Rate Sample Chart And Instructions

Statewide Average Property Tax Millage Rates In Michigan 1990 2008 Download Table

Statewide Average Property Tax Millage Rates In Michigan 1990 2008 Download Table

Welcome To Gaines Charter Township

Welcome To Gaines Charter Township

Florida Property Taxes Explained

Florida Property Taxes Explained

Millage Rate In Real Estate Modeling Top Shelf Models

Millage Rate In Real Estate Modeling Top Shelf Models

:max_bytes(150000):strip_icc()/taxes_due-6bb60b22f93948bbb123e098ecbf5d21.jpg)

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home