How To Claim Tax Relief For Working From Home During Covid

Your employer completes and signs this form to certify that you worked from home in 2020 due to COVID-19 and had. Did you make a claim before October 2020.

How To Keep Up With Income And Expenses For Business The Right Way Atkins E Corp Small Business Tax Business Tax Deductions Business Tax

How To Keep Up With Income And Expenses For Business The Right Way Atkins E Corp Small Business Tax Business Tax Deductions Business Tax

Demand for this working from home tax relief shot up last year 54800 claims were submitted in the first 10 days of October 2020 for example.

How to claim tax relief for working from home during covid. The working-from-home tax relief is an individual benefit. You have two options. Form T2200S Declaration of Conditions of Employment for Working at Home During COVID-19 is a shorter version of Form T2200 that you get your employer to complete and sign if you worked from home in 2020 due to the COVID-19 pandemic and are not using the temporary flat rate method.

1 Claim tax relief to the amount of 6 per week on coronavirus working from home expenses. In this case you do not need to. In the Tax Credits and Reliefs page Page 4 of 5 select the Your job tab.

Click on Review your tax link in PAYE Services. During the pandemic the government launched a new microservice which let people claim a whole years tax relief. The Guardian - You can claim if you were told by your employer to work from home either full or part time Coronavirus latest updates See all our coronavirus coverage If you are one of the millions of people who has been working at home over the last 12 months because of Covid either full or part-time have.

Select Remote Working Expenses and insert the amount of expense at the Amount Claimed section. HMRC Extends COVID-19 Working From Home Tax Relief. You can claim if you were told by your employer to work from home either full or part time.

For employees now forced to work from home the Tax Cuts and Jobs Act eliminated deductible expenses tied to maintaining a home. For anyone who made a claim for 202021 this does not automatically roll across into 202122. Claim 2 for each day that you worked at home during that period plus any other days you worked at home in 2020 due to COVID-19 up to a maximum of 400.

SINGAPORE With telecommuting set to be the new norm workers have the option of claiming tax deductions against their employment income for expenses incurred while working from home such as. This includes if you have to. If two or more of you live in the same property youre all required to work from home and its fair to say that costs have increased specifically from each individual working from home you can all claim it.

You can calculate your working from home deduction using the shortcut method with this formula. You dont need any supporting documents for this method nor do you need a signed T2200. A new temporary flat rate method will allow eligible employees to claim a deduction of 2 for each day they worked at home in that period plus any other days they worked from home in 2020 due to COVID-19 up to a maximum of 400.

Select the Income Tax return for the relevant tax year. Tax Wrinkles for Work-at-Home Employees During COVID-19. Back in November 2020 we explained how in relation to the year ended 5 April 2021 HMRC were introducing new measures to provide some measure of tax relief for added costs due to working at home during the pandemic.

You can claim tax relief if you have been working at home over the past 12 months because of Covid. Working from home You may be able to claim tax relief for additional household costs if you have to work at home on a regular basis either for all or part of the week. 2 days agoPeople working from home during the coronavirus lockdown could each be owed 280.

So if youve had an increase in costs because youre required to work from home you can claim it. Under this new method employees will not have to get Form T2200 or Form T2200S completed and signed by their employer. Claim the amount on line 22900 of.

Total number of hours worked from home from 1 March 2020 to 30 June 2020 80 cents for the 201920 income year total number of hours worked from home from 1 July 2020 to 30 June 2021 80 cents for the 202021 income year.

How People Working From Home Can Claim A Home Office Tax Deduction

How People Working From Home Can Claim A Home Office Tax Deduction

Four Reasons Why You Should File Your Tax Return Early Filing Taxes Tax Return Tax Prep

Four Reasons Why You Should File Your Tax Return Early Filing Taxes Tax Return Tax Prep

Renting Out A Property Tax Smart Atkins E Corp Tax Deductions Property Tax Filing Taxes

Renting Out A Property Tax Smart Atkins E Corp Tax Deductions Property Tax Filing Taxes

Working From Home By The Numbers Working From Home Digital Trends Virtual Private Network

Working From Home By The Numbers Working From Home Digital Trends Virtual Private Network

Running Your Business From Home Here S How To Get A Tax Deduction Business Tax Deductions Deduction Education Templates

Running Your Business From Home Here S How To Get A Tax Deduction Business Tax Deductions Deduction Education Templates

How People Working From Home Can Claim A Home Office Tax Deduction

How People Working From Home Can Claim A Home Office Tax Deduction

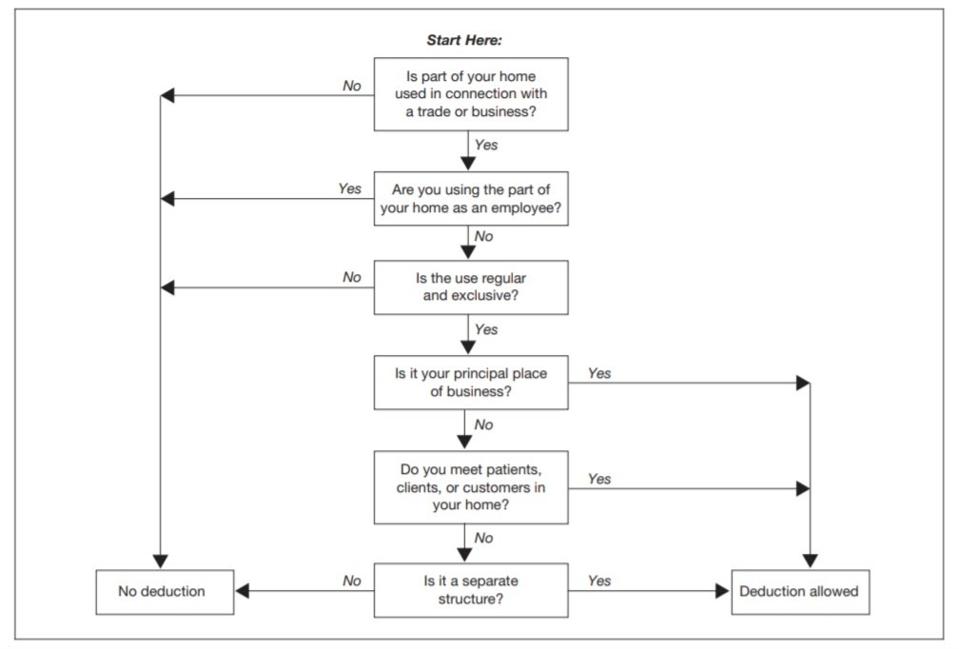

.png) Quiz Do I Qualify For The Home Office Deduction

Quiz Do I Qualify For The Home Office Deduction

How To Use Your Tax Refund To Scale Or Start Your Own Online Business Tax Refund Online Business Start Online Business

How To Use Your Tax Refund To Scale Or Start Your Own Online Business Tax Refund Online Business Start Online Business

Why Working From Home Is Good For Your Well Being In 2020 Working From Home Legitimate Work From Home Home Based Jobs

Why Working From Home Is Good For Your Well Being In 2020 Working From Home Legitimate Work From Home Home Based Jobs

Get Paid Missing Stimulus Money On Your 2020 Taxes How To File Before The May 17 Deadline In 2021 Filing Taxes Tax Refund Tax Credits

Get Paid Missing Stimulus Money On Your 2020 Taxes How To File Before The May 17 Deadline In 2021 Filing Taxes Tax Refund Tax Credits

In Case You Were Wondering Workfromhome Taxes Https Www Marketwatch Com Story Ive Been Working At Home Dur Leadership Coaching Working From Home Workplace

In Case You Were Wondering Workfromhome Taxes Https Www Marketwatch Com Story Ive Been Working At Home Dur Leadership Coaching Working From Home Workplace

How Does Working From Home Change Tax Deductions In 2020

How Does Working From Home Change Tax Deductions In 2020

Home Office Deductions In The Covid 19 Era Mlr

Home Office Deductions In The Covid 19 Era Mlr

These Popular Tax Deductions Have Been Extended Through 2020 Home Insurance Home And Auto Insurance Student Loans

These Popular Tax Deductions Have Been Extended Through 2020 Home Insurance Home And Auto Insurance Student Loans

4 Tips For Notaries Claiming Home Office Tax Deductions Notary Public Business Notary Notary Signing Agent

4 Tips For Notaries Claiming Home Office Tax Deductions Notary Public Business Notary Notary Signing Agent

Get Your Free Small Business Tax Organizer For 2018 Income Tax Prep Organizer Includes Tax Tips Small Business Tax Business Tax Small Business Tax Deductions

Get Your Free Small Business Tax Organizer For 2018 Income Tax Prep Organizer Includes Tax Tips Small Business Tax Business Tax Small Business Tax Deductions

Quiz Do I Qualify For The Home Office Deduction

Quiz Do I Qualify For The Home Office Deduction

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home