Claim Tax Relief For Working From Home Ireland

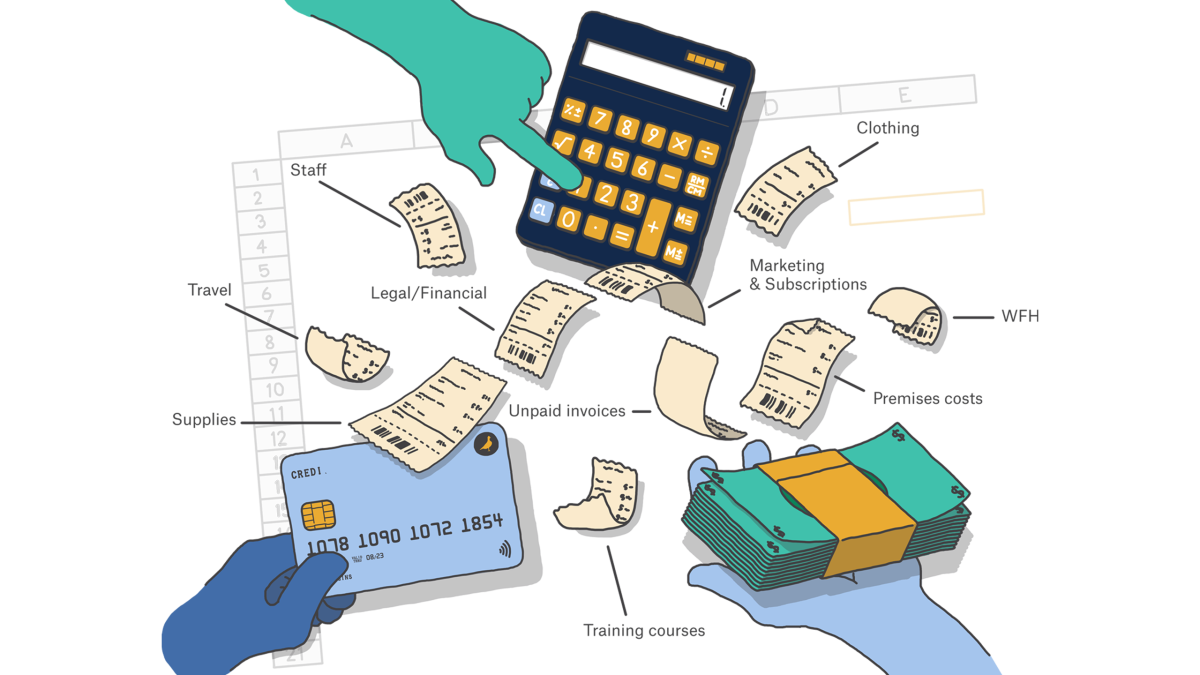

Thousands of workers who have recently been asked to work from home as a result of the outbreak of Covid-19 can avail of Revenues e-worker tax relief. Or A claim for tax relief to Revenue for the expenses incurred as a result of working from home What expenses can be claimed via the employees tax return.

How Do I Claim Tax Relief For Working At Home How Much Can I Save And How Do I Know If I M Eligible

How Do I Claim Tax Relief For Working At Home How Much Can I Save And How Do I Know If I M Eligible

If your employer pays you a working from home allowance towards these expenses you can get up to 320 per day without paying any tax PRSI or USC on it.

Claim tax relief for working from home ireland. Ms Murphy added that even if your company does reimburse the employee you can still claim tax relief from Revenue on any actual cost incurred that. If your employer pays more than 320 per day to cover expenses you pay tax PRSI and USC as normal on. While Marian said that tax relief for working from home has been available for a number of years often applying to employees of large tech companies she said under the current circumstances a lot of people werent aware of it and theres been a lot of.

How much can I claim. Working from home You may be able to claim tax relief for additional household costs if you have to work at home on a regular basis either for all or part of the week. Making a claim is easy tell your employees to go to claim tax relief for your job expenses when working from home.

If there are more than one person working from home in the same household IRAS is prepared to accept an equal apportionment basis for computing the amount of. If the employer does not make this payment the employee may be entitled to make a. Anyone paying nursing home fees either for themselves or for someone else is eligible to claim relief at their marginal rate of tax.

The employer is entitled to pay each employee 320 per tax free to cover additional costs incurred in working from home. Team who are recruited on the basis that they will work from home. A person can claim up to 40 relief on nursing home or home.

This short video will explain how to upload receipts. You can make the payment of 320 per workday tax free when. Your employee is required to work for substantial periods at home.

Your employee is required to perform essential duties of the employment at home. This includes if you have to. Relief for home working expenses is available for an employee in one of two ways.

Your employer can pay you a contribution towards these costs or you can make a claim for tax relief at the end of the year. Employers can pay 320 tax-free a day to their employee to cover the additional costs. You need to do this to process the receipts and bills you entered on Revenue Receipts Tracker App or in myAccount.

You may also be entitled to claim if your working week is split between your home and an office. Claim tax relief on 6 a week. There is a formal agreement between you and your employee that the employee is required to work from home.

From 6 April 2020 this tax relief is based on 6 per week or 26 per month 4 per week or 18 per month before 6 April 2020. If your employer wont pay expenses for your extra costs due to necessary working from home but you have them then you can ask for the amount to be deducted from your taxable income. So if you work from home either full or part time you may be eligible for tax relief.

However its important to note that you cannot claim this relief for work you bring home outside of normal working hours. A tax-free payment by the employer of 320 per workday. If you are claiming Remote Working Relief you will need to complete an Income Tax Return.

One-time charges such as installation or connection fees also cannot be claimed as they are capital in nature. SINGAPORE With telecommuting set to be the new norm workers have the option of claiming tax deductions against their employment income for expenses incurred while working from home such as.

Covid 19 Employment Tax Consequences Of Working From Home Crowe Uk

Covid 19 Employment Tax Consequences Of Working From Home Crowe Uk

Authorization Letter Claim Tax Refund For Sample Printable Formats Tax Refund Lettering Life Insurance Corporation

Authorization Letter Claim Tax Refund For Sample Printable Formats Tax Refund Lettering Life Insurance Corporation

Home Buying Tax Deductions What S Tax Deductible Buying A House Private Mortgage Insurance Tax Deductions Mortgage

Home Buying Tax Deductions What S Tax Deductible Buying A House Private Mortgage Insurance Tax Deductions Mortgage

Tax Refund Ireland Tax Refund Tax Services Tax Preparation

Tax Refund Ireland Tax Refund Tax Services Tax Preparation

Income Tax Prep Services Time Instagram Story Instagram Story Ads Income Tax Instagram Story

Income Tax Prep Services Time Instagram Story Instagram Story Ads Income Tax Instagram Story

Online Tax Return Australia Lodge Tax Return Tax Accountant Tax Consulting Filing Taxes

Online Tax Return Australia Lodge Tax Return Tax Accountant Tax Consulting Filing Taxes

Stay Spend Scheme Ireland Tax Refund Tax Ireland

Stay Spend Scheme Ireland Tax Refund Tax Ireland

Why Real Property Management Investment Solutions In Grand Rapids Mi Property Management Rental Property Investment Property

Why Real Property Management Investment Solutions In Grand Rapids Mi Property Management Rental Property Investment Property

Claim 6 A Week Tax Back Working From Home Theformfiller Youtube

Claim 6 A Week Tax Back Working From Home Theformfiller Youtube

You Can T Deduct Starbucks As A Work Space But I Really Think You Should Be My Blog Dezdemonhumor T Accounting Humor Accounting Jokes Tax Season Humor

You Can T Deduct Starbucks As A Work Space But I Really Think You Should Be My Blog Dezdemonhumor T Accounting Humor Accounting Jokes Tax Season Humor

Simple Guide To Paye Tax Pay As You Earn Tax Refund Tax Tax Credits

Simple Guide To Paye Tax Pay As You Earn Tax Refund Tax Tax Credits

Covid 19 Wage Subsidy Schemes Prepare For A Possible Tax Liability In The New Year

Covid 19 Wage Subsidy Schemes Prepare For A Possible Tax Liability In The New Year

How To Claim Tax Relief If You Re Working From Home Due To Covid 19

How To Claim Tax Relief If You Re Working From Home Due To Covid 19

Tax Exemption Steps For Getting An 80g Certificate Tax Accounting Books Tax Exemption Tax

Tax Exemption Steps For Getting An 80g Certificate Tax Accounting Books Tax Exemption Tax

A Guide To Claiming Tax Relief On Medical Expenses Medical Relief Tax

A Guide To Claiming Tax Relief On Medical Expenses Medical Relief Tax

How To Start Your Own Homebased Tax Preparation Business Not Now Mom S Busy Tax Preparation Tax Prep Preparation

How To Start Your Own Homebased Tax Preparation Business Not Now Mom S Busy Tax Preparation Tax Prep Preparation

Taxes From A To Z 2018 L Is For Line Of Credit Line Of Credit Finance Service

Taxes From A To Z 2018 L Is For Line Of Credit Line Of Credit Finance Service

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home