Working From Home Tax Relief 2021/22 Gov

The government has recently made it much easier for those working from home to claim tax relief worth up to 125 to help cover the extra costs of things such as stationery and some household. It was announced in Budget 2021 that the following expenses will be covered as an allowable home expense for e-working tax relief.

Ca Dwr To Award 222m In Grants For Water Management Projects Water Management Projects Dwr

Ca Dwr To Award 222m In Grants For Water Management Projects Water Management Projects Dwr

From 6 April 2020 employers have been able to pay employees up to 6 a week tax-free to cover additional costs if they have had to work from home.

Working from home tax relief 2021/22 gov. Share on Facebook Share on Twitter Share by email. Working from home You may be able to claim tax relief for additional household costs if you have to work at home on a regular basis either for all or part of the week. It meant you could claim once and get it automatically for ALL of the tax year at the 6week relief.

The Government created a new temporary working-from-home microservice to help claim the tax relief for the 202021 tax year. Employees are not eligible to claim the home. HM Revenue Customs.

Employees can claim the Working from Home allowance for tax year 2021-22 Employees who incur extra household costs due to working from home regularly for either part or all the week are eligible to claim the Working from Home allowance for tax year 2021-22. At the end of this tax year the tax relief will stop. If you have been asked to work from home because of the COVID-19 emergency you may be able to claim tax relief against the cost of home expenses.

Heres how you can claim a tax relief of 125 With Tier 4 restrictions in Lancashire set to be in place for most of. This includes if you have to. Going to be working from home in 2021.

That now applies for the new 202122 tax year too meaning many are due TWO years relief worth up to 280. Once you get to the actual form to submit a claim the text is updated to reflect the new tax year. Claiming for the 202122 tax year.

People working from home for even a single day this year will be able to claim tax relief against increased costs as the fallout from the Covid-19 pandemic rolls on. Yes you can. Home Sweet Home tax relief and home working Update re 202122 - we have added a further section on the information we have to date on the position for tax relief on unreimbursed homeworking expenses for 202122 below.

If you also worked from home during 2020-21 you can still claim for that too meaning you can gain up to 250 in total for both tax years. Here are some things to help taxpayers understand the home office deduction and whether they can claim it. Total number of hours worked from home from 1 March 2020 to 30 June 2020 80 cents for the 201920 income year total number of hours worked from home from 1 July 2020 to 30 June 2021 80 cents for the 202021 income year.

The HMRC tax relief will help to cover extra costs such as work equipment and utility bills. The same eligibility criteria is applicable and due to. With more people working from home than ever before some taxpayers may be wondering if they can claim a home office deduction when they file their 2020 tax return next year.

Employees can claim the relief if they are required to work from home and have additional expenses even if. HM Revenue and Customs HMRC has received more than 54800 claims from customers using a new online portal which allows workers to claim tax relief for working at home. Where employees continue to work from home a new claim will need to be made for the 202122 tax year.

You will receive tax relief on your expenses for working from home for the whole of this tax year 6 April 2021 to 5 April 2022. As mentioned above HMRC has confirmed that employees are able to continue claiming the working from home tax relief for the entire 202122 tax year however a new claim must be submitted. You can calculate your working from home deduction using the shortcut method with this formula.

HMRC has announced that applications are now open to claim tax relief for the 202122 tax year that began on 6 April 2021. Last updated 8 April 2021 Since the outbreak of COVID-19 homeworking has become the norm for many millions of people. The home office deduction allows qualifying taxpayers to deduct certain home expenses on their tax return.

The governments website states that you can claim tax relief on some of your bills if you are required to work from home however you cannot do so if you are working from home by choice. Employees who are working from home will need to make new claims for tax relief for the 202122 tax year HMRC has stated. ICAEW understands that once the pandemic is over these rules will revert to the previous position under which the allowance is tax-free only where paid by employers.

13 Apr 2021 If youre working from home even if its not full-time you can now make a tax relief claim of up to 125 for the new 2021-22 tax year. Looks like the process is identical to last year.

Swarnim Gujarat Sports University Sgsu Admission Notification 2020 Admissions University Website Public University

Swarnim Gujarat Sports University Sgsu Admission Notification 2020 Admissions University Website Public University

40 Years Ago And Now From 70 To 30 Peak I T Rate Tax Rules Inheritance Tax Income Tax

40 Years Ago And Now From 70 To 30 Peak I T Rate Tax Rules Inheritance Tax Income Tax

I Am Currently Working As A Chartered Accountant What Are The Other Options For Me To Diversify My Career Chartered Accountant Career Options My Career

I Am Currently Working As A Chartered Accountant What Are The Other Options For Me To Diversify My Career Chartered Accountant Career Options My Career

Bstc 2017 Counselling Form Bstc2017 Org Online Counselling Form Date Readers Check Bstc Counselling 2017 Details Bstc Teaching Jobs Counseling Railway Jobs

Bstc 2017 Counselling Form Bstc2017 Org Online Counselling Form Date Readers Check Bstc Counselling 2017 Details Bstc Teaching Jobs Counseling Railway Jobs

Homeworking Tax Relief Program How It Works For 2021 22 Fr24 News English

Homeworking Tax Relief Program How It Works For 2021 22 Fr24 News English

Senator James Sanders Jr And The Senate Majority Pass 2021 22 New York State Budget Ny State Senate

Senator James Sanders Jr And The Senate Majority Pass 2021 22 New York State Budget Ny State Senate

All The Nassau County Property Tax Exemptions You Should Know About

All The Nassau County Property Tax Exemptions You Should Know About

Gov Kemp Signs Modest State Income Tax Cut Into Law Georgia News Us News

Gov Kemp Signs Modest State Income Tax Cut Into Law Georgia News Us News

House Approves Big Municipal Aid Pledge Tax Incentive Bills

House Approves Big Municipal Aid Pledge Tax Incentive Bills

German Tax System Taxes In Germany

German Tax System Taxes In Germany

Senate Majority Announces Highlights Of 2021 22 Budget Ny State Senate

Senate Majority Announces Highlights Of 2021 22 Budget Ny State Senate

.png?ver=2021-01-13-142627-917) Breaking News Gov Newsom Proposes 3 Csu Funding Increase In 2021 2022 State Budget

Breaking News Gov Newsom Proposes 3 Csu Funding Increase In 2021 2022 State Budget

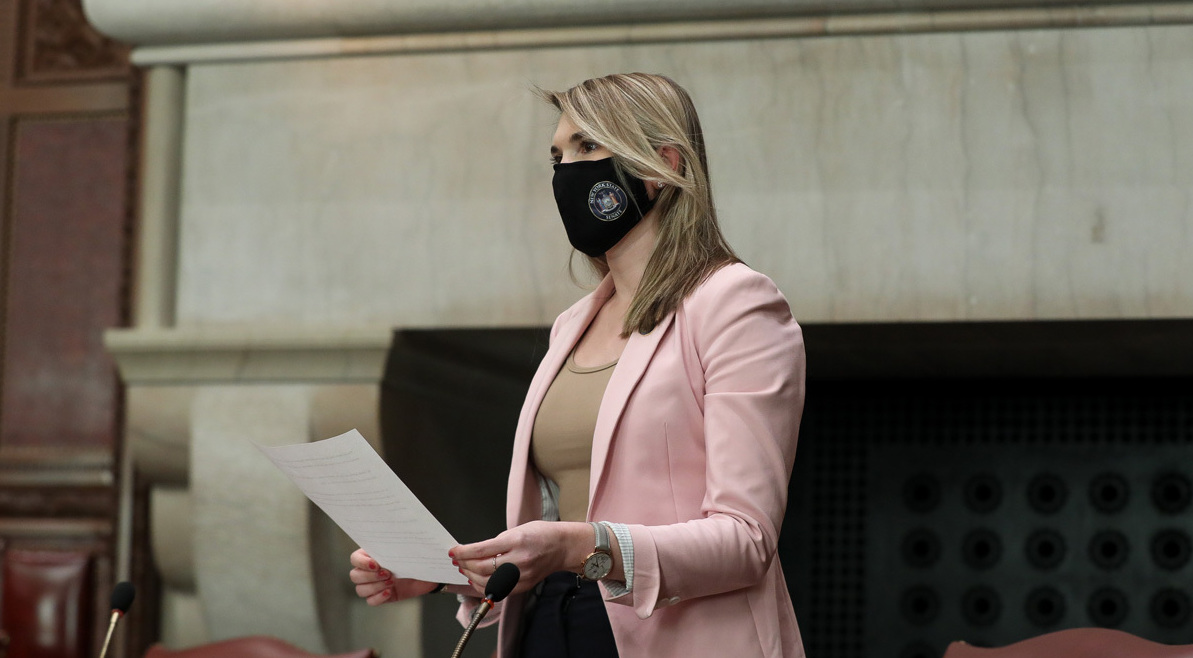

Senator Michelle Hinchey Announces Key Funding Wins For Upstate New York In Senate One House Budget Resolution Ny State Senate

Senator Michelle Hinchey Announces Key Funding Wins For Upstate New York In Senate One House Budget Resolution Ny State Senate

How To Claim Tax Relief If You Re Working From Home Due To Covid 19

How To Claim Tax Relief If You Re Working From Home Due To Covid 19

Budget 2021 Govt May Consider Tax Deduction For Employees Working From Home

Budget 2021 Govt May Consider Tax Deduction For Employees Working From Home

2021 22 State Budget Proposal Pa Partnerships For Children

2021 22 State Budget Proposal Pa Partnerships For Children

What S In Pennsylvania S New Proposed Budget For 2021 22 Pittsburgh Business Times

What S In Pennsylvania S New Proposed Budget For 2021 22 Pittsburgh Business Times

How To Claim The Working From Home Tax Relief Times Money Mentor

How To Claim The Working From Home Tax Relief Times Money Mentor

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home