One Time Property Tax Kerala

Software Design Development and Hosting Services By. Annual property tax Plinth area x Monthly rental value per sq ft x 12 x 017 030 depending on MRV and based on slab rate of taxation 10 per cent depreciation 8 per cent library cess.

Download Property Tax Receipt Fy 2020 2021 View Upic Details Of Property Owner Tax Computations Youtube

Download Property Tax Receipt Fy 2020 2021 View Upic Details Of Property Owner Tax Computations Youtube

The state has a good connection of roads network throughout villages towns and cities.

One time property tax kerala. The new tax structure will be in force once the Governor approves the bill. Vahan Tax in Kerala- Calculate Road Tax Pay Vahan Tax Updated on April 12 2021 33425 views. In a major relief to apartment owners in the state the state government has issued a clarification on a 1999 amendment to Kerala Building Tax Act 19.

Network Services by State e-Governance Data CenterState e-Governance Data Center. In these rules unless the context otherwise requires- a Ordinance means the Kerala Building Tax Ordinance 1974. The new tax rate for houses of 350 to 400 sqm in villages will be Rs 6000.

The amendment was passed in the Finance bill passed by the Assembly on Monday. 2 They shall extend to the whole of the State of Kerala. The Web application is designed to enable service of payment of land tax online mutation and resurvey correctionThis can be accessed through your mobiletab also.

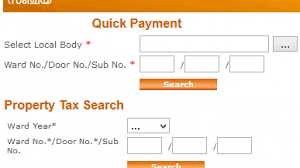

Sanchaya an egovernance application software suite for Revenue and Licence System in local governments of Kerala. - One time building tax is applicable for all buildings constructed on or after April 1 1973 as per the Kerala Building Tax Act 1975. Know your Property Tax.

Fine waived up to 31032020 for One-time payment of property tax with Dues. Buildings are taxed on the basics of area in sqftbuilding having from 3000 sq ft onwards will have to pay luxury tax yearly and the normal building tax in the local bodyBuilding below 3000sqft in area have to pay one time tax in the Village Office and the normal tax in the local body yearly. Tax ordinance 1974 10 of 1974 the Government of kerala hereby make the following rules- 1 These rules may be called the Kerala Building Tax Rules 1974.

- Further when the building construction is completed for the residential purpose if it is below 3000 sqft the owner should pay a one time tax to the concerned village office but if the building is above 3000 sqft owner should pay should pay luxury tax every year. Property tax is Land tax karam any one have land in Kerala should pay this tax to village office. Official Web Portal of Kerala Local Government Government of Kerala Owned by Local Self Government Department Developed by Information Kerala Mission Powered by Samveditha Ver 30.

For this year 2020 the fines were waved off because of the coronavirus pandemic and in some cases the last date of submissions was also extended. Property tax in Kolkata. Kerala property tax payment.

Factors determining the property tax value. Land Tax Plantation Tax Building Tax Luxury tax. But these are extraordinary circumstances and it is best to pay property tax online Kerala on time.

One time building tax is applicable for all buildings constructed on or after April 1 1973 as per the Kerala Building Tax Act 1975. For houses ranging 400-459 sqm it is Rs 7000 Rs 8000 and Rs 9000 respectively. How to pay home tax online.

Known for the most exquisite scenic view of the coast Kerala is one of the most beautiful states of India. Each land is allotted one survey number the tax should pay against that. The one-time building tax imposed by the Kerala Revenue Department has been restructured.

For houses having a floor area above 450 sqm an additional tax of Rs 1000 will be levied for each 50 sqm. 4000 is levied on buildings which are constructed on or after 141997 having a plinth area of 2787 sqm or more in addition to the one-time tax. It will be Rs 7000 in municipalities and Rs 8000 in corporations.

It depends on the area and type also for farm land tax is there and extra tax was there to give pension to Agriculture labours. There will be an increase of up to 30 percent. 9 rows In kerala different kinds of taxes are there.

Building owners can get their online Ownership Certificate from the Local Governments having e-payment facility. A yearly luxury tax of Rs.

Stamp Duty And Registration Charges In Kerala Kalyan Developers Blog

Stamp Duty And Registration Charges In Kerala Kalyan Developers Blog

Sanchaya Online Payment Procedure For Local Self Govt Lsg Kerala Building Property Tax Fee Lopol Org

Sanchaya Online Payment Procedure For Local Self Govt Lsg Kerala Building Property Tax Fee Lopol Org

What Is The Process For Changing Names On Property Taxes Quora

Stamp Duty For Property Registration In Kerala By Luxury Kerala Flats Medium

Stamp Duty For Property Registration In Kerala By Luxury Kerala Flats Medium

10 Legal Aspects To Consider Before Investing In A Home Confident Group

10 Legal Aspects To Consider Before Investing In A Home Confident Group

10 Legal Aspects To Consider Before Investing In A Home Confident Group

10 Legal Aspects To Consider Before Investing In A Home Confident Group

10 Legal Aspects To Consider Before Investing In A Home Confident Group

10 Legal Aspects To Consider Before Investing In A Home Confident Group

Sanchaya Online Payment Procedure For Local Self Govt Lsg Kerala Building Property Tax Fee Lopol Org

Sanchaya Online Payment Procedure For Local Self Govt Lsg Kerala Building Property Tax Fee Lopol Org

Property Tax Kerala Know Details About Online Payment

Property Tax Kerala Know Details About Online Payment

Sanchaya Online Payment Procedure For Local Self Govt Lsg Kerala Building Property Tax Fee Lopol Org

Sanchaya Online Payment Procedure For Local Self Govt Lsg Kerala Building Property Tax Fee Lopol Org

Property Tax Kerala Know Details About Online Payment

Property Tax Kerala Know Details About Online Payment

10 Legal Aspects To Consider Before Investing In A Home Confident Group

10 Legal Aspects To Consider Before Investing In A Home Confident Group

How To Check The Fair Value Of Land In Kerala Housing News

How To Check The Fair Value Of Land In Kerala Housing News

Sanchaya Online Payment Procedure For Local Self Govt Lsg Kerala Building Property Tax Fee Lopol Org

Sanchaya Online Payment Procedure For Local Self Govt Lsg Kerala Building Property Tax Fee Lopol Org

Kerala House Residential Home Gram Panchayat Building Tax Payment Online 2020 2021 Youtube

Kerala House Residential Home Gram Panchayat Building Tax Payment Online 2020 2021 Youtube

10 Legal Aspects To Consider Before Investing In A Home Confident Group

10 Legal Aspects To Consider Before Investing In A Home Confident Group

Sanchaya Online Payment Procedure For Local Self Govt Lsg Kerala Building Property Tax Fee Lopol Org

Sanchaya Online Payment Procedure For Local Self Govt Lsg Kerala Building Property Tax Fee Lopol Org

One Time Building Tax Rates In Kerala To Increase By Up To 30 Percent Building Tax

One Time Building Tax Rates In Kerala To Increase By Up To 30 Percent Building Tax

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home