Yakuza 0 Property Payout Time

The glitz glamour and unbridled decadence of the 80s are back in Yakuza 0. This list is mainly for people wondering just where each property is because its not like the game is telling you.

Https Encrypted Tbn0 Gstatic Com Images Q Tbn And9gcq6fxs Utsbzyub8nz1sro9lsqta1elqdhyducf1vqluildkgmw Usqp Cau

Dont bother with the rainbow-coloured targets unless youre feeling confident.

Yakuza 0 property payout time. Interaction with the world triggers side-quests and. A lot of you will be playing Yakuza 0 over the next few weeks and for many it will be your first time with the series. Id suggest getting the payout upgrade from the shrine.

Racked up all the dough I needed to max out Kiryus styles and now Im doing it to funnel a ton of money to Majima because I just dont make enough with him to fill him out and I want to unlock his secret style before I go to the end game. Yakuza 0 takes place in 1988 Yakuza Kiwami a remake of Yakuza on PS2 takes place in 2005. This Yakuza 0 Real Estate Royale Guide will cover everything you need to know about the real estate game including mechanics staff stores payouts and more.

You can do that later on if you want to focus on the. Like the first time I played 0 I was doing the story mostly because it was that good. As time passes you can return to the Sugita Building to collect the earnings from your properties.

Its actually very in-depth when compared to the other mini-games and has the potential to earn you millions of Yen whilst also being quite exciting to play. The Real Estate Royale feature in Yakuza 0 plays a pivotal role in both story and side content throughout the game although it is not available straight away. He will move the bat around a lot at the start but when he stops moving the bat and keeps it still thats your cue to hit the button.

Eventually the last number is highlighted and it stays there. Yakuza 0 2015 is an action-adventure game developed and published by Sega. The game is set in an open world environment where it is possible to battle enemies on the street play mini-games speak with people etc.

Yakuza 0 Real Estate Staff List Guide Get The Best Staff Once you reach a certain point during Chapter 5 in the main story you will unlock the Real Estate mini-game. For a reference gambling king near maxed in close to 300 million yet payout. 1 Pachinko New Eden 18400000 2 Pachinko Marufuku 18400000 3 Kamuro Health Plaza 12400000 4 Sukiyaki Muranaka 14000000.

If the 2 is highlighted then the payout will be i think 110. Pachinko Marufuku - Across the street from Poppo. Usually I try to do side stuff in the rest of the series but 0 was on another level so I found myself really hooked.

Yakuza 0 2015 is an action-adventure game developed and published by Sega. Pay attention to Kiryus stance. Yakuza 0 Guide and.

Yea I have the third upgrade for collection time doesnt seem to take that long. Instead of real-time brawling Yakuza. The pitches are the same every time meaning you can memorise the timing of each one.

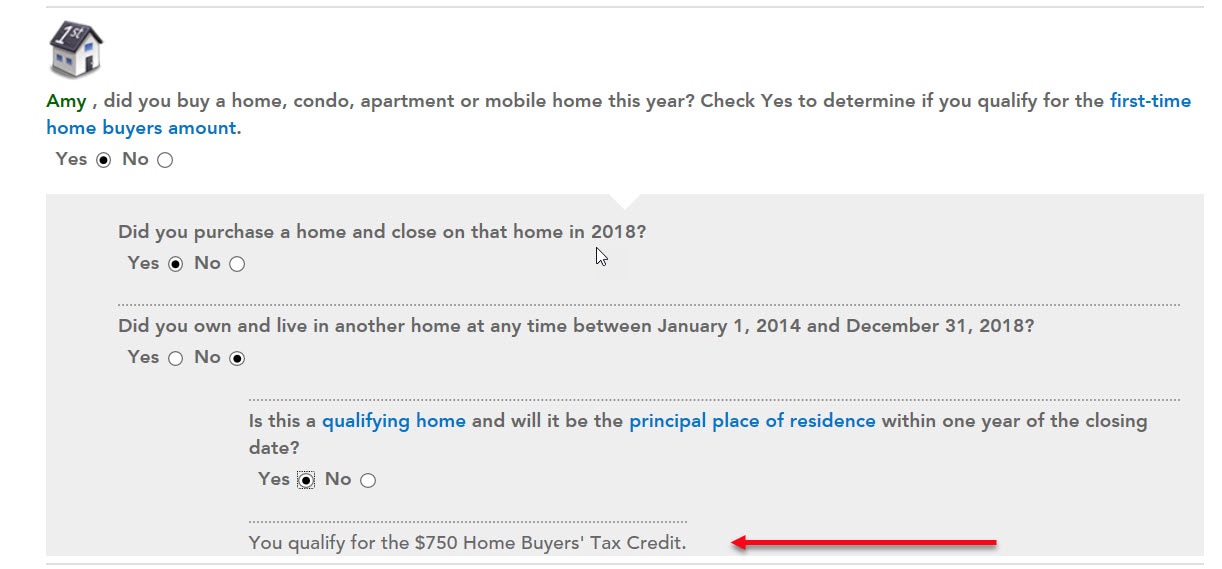

If 0 is highlighted and you send them on a collection then you get 100 payout. The only way to reset the highlighted number back to the first one for that manager is to assign them to another property. Yakuza 0 may take place almost 30 years in the past but aside from some cheesy 80s hairdos and a handful of smaller details much of Kamurocho feels like its stuck in modern times the fact.

While it may seem daunting at first were here to help. Its the sixth game from the Yakuza series and the player follows the story of two characters Kiryu and Majima. The story hooking you is something every Yakuza does.

Im wondering if its worth the time investment or not Oh they definitely provide more issue is they take longer to payout. So dont worry about not exploring. Its the sixth game from the Yakuza series and the player follows the story of two characters Kiryu and Majima.

Yakuza 0 Wiki Guide. Leisure King Area - Pachinko New Eden - South of Serena a couple of buildings. Each day you collect on a property.

A prequel to the long-running series set in Japans criminal underworld this entry introduces mainstay protagonist Kazuma Kiryu and series regular Goro Majima as they fight like hell through Tokyo and Osaka in their climb through the yakuza ranks. I spent a night doing stuff on my PC while taking a break every 15 minutes to collect and restart payment.

Read more »