First Time Home Buyers Tax Credit Ontario

To be eligible for the Home Buyers Tax Credit you must meet both of these criteria. Home Buyers Plan HBP.

Can First Time Home Buyers Get A Tax Credit

Can First Time Home Buyers Get A Tax Credit

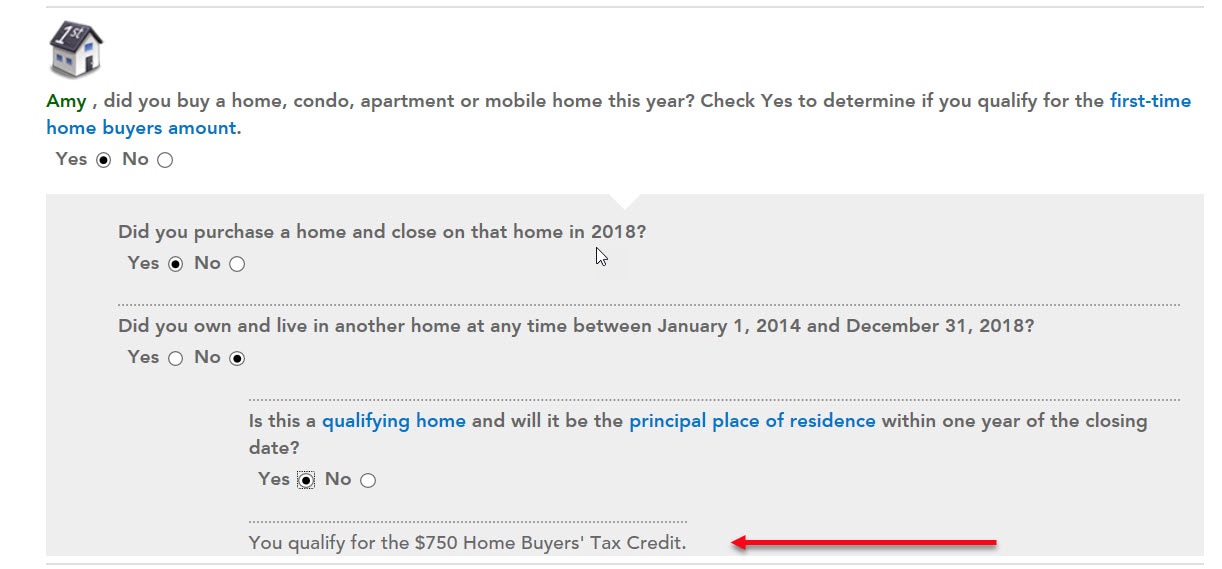

You will answer Yes for your name or your spouse or both should you choose to split the credit.

First time home buyers tax credit ontario. You are a first-time home. It is designed to help recover closing costs such as legal expenses inspections and land transfer taxes. How to Apply for Land Transfer Tax Rebate Ontario.

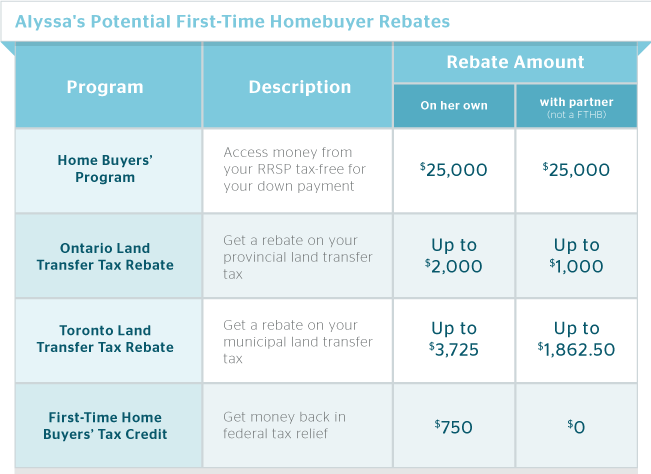

For an eligible individual the credit will provide up to 750 in federal tax relief. The First-Time Home Buyers Tax Credit was first introduced in 2009 and is available to all. For eligible first-time home buyers you can receive a maximum land transfer tax rebate of 4475 on your municipal land transfer tax and up to 4000 on your provincial land transfer tax.

Its an effective means of offsetting some of the upfront costs associated with buying a home. The 5000 can be split between the house owners as long as the total amount claimed on all tax returns doesnt exceed 5000. HOW TO RECEIVE IT Homebuyers register electronically or on paper to claim an immediate refund when registering the land transfer and paying the tax.

The Home Buyers Amount HBA is a non-refundable credit that allows first-time purchasers of homes and purchasers with disabilities to claim up to 5000 in the year when they purchase a home. First-time home buyers in Ontario are eligible for a maximum 4000 land transfer tax rebate on the Ontario land transfer tax. When I did my taxes on paper in the spring of 1996 I was left with a staggering tax bill of something like 700.

You get access to this tax credit when you purchase your first home and submit a tax return. While 750 isnt a life-changing amount of money it can make buying your first home a little bit easier. If youre buying a home in Ontario for the first time you can request for a rebate or refund equivalent to the full amount that you pay as land transfer tax that may be a maximum of 4000.

You can claim 5000 for the purchase of a qualifying home in the year if both of the following apply. Taxpayers who took the credit on their federal income tax returns in 2008 are obligated to repay the tax credit over 15 years beginning with their 2010 tax returns. After the first two years HERA had some minor changes.

The amount of the credit is 5000. Eligible homebuyers may receive a tax credit of up to 750. The first-time homebuyer tax credit ended in 2010 at least for most taxpayers but it still applies to those who purchased homes in 2008 2009 or 2010.

Lived in Ontario all my life. The First-time Home Buyers Tax Credit was introduced as part of Canadas Economic Action Plan to assist Canadians in purchasing their first home. You or your spouse or common-law partner purchased a qualifying home.

Ensure that the correct checkbox s are marked and click Continue until you reach the First Time Home Buyers Credit screen. You or your spouse or common-law partner acquired a qualifying home. The Home Buyers Amount offers a 5000 non-refundable income tax credit amount on a qualifying home acquired during the year.

Use our land transfer tax Ontario calculator 2020 to see how much your rebate could be. You cannot have owned property anywhere in the world previously to qualify. However the Ontario Land Transfer Tax Refund for First-Time Homebuyers facility is subject to certain conditions.

Consumers have been closely following President Joe Bidens proposed first-time homebuyer tax credit but the latest legislative effort to assist homebuyers differs in. The First-Time Home Buyers Tax Credit is a 5000 non-refundable tax credit. First-Time Home Buyers Tax Credit.

Created as a response to the 2008 financial crisis the Housing and Economic Recovery Act HERA allowed new homebuyersto get a tax credit of up t0 7500 during the first year of the initiative. You did not live in another home owned by you or your spouse or common-law partner in the year of acquisition or in any of the four preceding years first-time home buyer. In 2009 Congress increased the amount first-time buyers could earn to 8000.

HOME BUYERS TAX CREDIT The First Time Home Buyer Tax Credit is a non-refundable tax credit that helps homeowners recover closing costs such as legal expenses and inspections. The Home Buyers Tax Credit at current taxation rates works out to a rebate of 750 for all first-time buyers. When you pay land transfer tax on your home purchase as a first-time home buyer in Ontario you will be eligible to receive a rebate on a portion of the amount up to 4000.

First-time buyers can claim up to 5000 for the purchase of a qualifying home on their personal tax return on the year of purchase. You need to be at least 18 years of age. I own a house just outside the GTA in Ontario.

The following are considered qualifying homes. Use this form to apply for the Ontario Land Transfer Tax Rebate. As a young 20.

Go to the Home Buyers Amount webpage to see if you are eligible. If youre buying a home for the first time claiming the first-time homebuyer credit can land you a total tax rebate of 750. I bought a house last year and when I do my taxes I am going to claim the full 5000.

The credit is claimed on line 31270 on your income tax and benefits return previously line 369. You could net up to 750.

Read more »