Capital Gains Tax First Property

Long-term capital gains are the returns earned from a property that was held for more than one year and sold for more than its purchase price. Currently the tax rate is 15.

What this means in a simplified sense is if you bought your primary residence for 300000 in 2010 lived in it for 8 years and then sold it in 2018 for 550000 you wouldnt have to pay any capital gains tax.

Capital gains tax first property. If certain criteria are met the IRS offers a tax exclusion of 250000 on capital gains you make when selling a home. The first R2 million profit on sale of a primary residence is not subject to CGT. Understanding Capital Gains Tax on a Real Estate Investment Property Real estate properties generate income for investors but taxes play a factor in returns.

In this scenario no capital gains tax is due from you. He needed to have been living in the property for at least one year prior and one year after the period of absence for it to be considered a primary residence for capital gains purpose. At 22 your capital gains tax on this real estate sale would be 3300.

This exemption is only allowable once. This video is an excerpt from my longer video on Tax Efficiency which covers how to use 2 very simple rules to enure you are efficient in income inheritance. Based upon IRS Section 121 exclusion if you sell the main home you live in the IRS lets you exclude -- not be taxed on -- up to 250000 of capital gains on real estate if youre single.

Tax basis gets a little more complicated when property is. You have to live in the residence for two of five years before selling it. If you sell it in one year or less you have a short-term capital gain.

But if his tax basis had been the same as his mothers 75000 then he would have owed capital gains tax on his gain of 125000 on the same transaction. Further if you are not able to buy the house before the due date of filing of tax return for the relevant year you will need to deposit the capital gains amount in a capital gains. Read on to.

Thankfully property owners who have owned a property for over a year are eligible for a 50 discount on their CGT. The new residential property must be bought either one year before or two years after the sale of the old property. If it is an investment property you will have to follow the normal capital gains rules.

4 rows If youre selling a property you need to be aware of what taxes youll owe. Capital gains are a form of taxable income but gains you make on property you hold longer than a year also called long-term gains are generally taxed at lower rates than ordinary income. Investors can take.

The main differences are that expenses cant be written off against capital gains and the capital gains tax rate is lower than the income tax rate for most taxpayers. The property has to be your principal residence you live in it. Capital Gains Tax on Your Investment Property The IRS allows 250000 of tax-free profit on a primary residence.

If your purchase costs in 2001 were 2100 your ownership costs paying taxes and home insurance over the years for instance were 152000 and your selling costs in 2021 were 31000 your total capital gains would be 364900. If the amount you realize which generally includes any cash or other property you receive plus any of your indebtedness the buyer assumes or is otherwise paid off as part of the sale less your selling expenses is more than your adjusted basis in your home you have a capital gain on the sale. In a nutshell capital gains tax is a tax levied on possessions and propertyincluding your homethat you sell for a profit.

The taxes are determined by a unique tax bracket that is lower than the ordinary tax rates that apply to income. Tax benefits of commercial real estate. Capital gains tax only applies to profits from the sale of assets held for more than a year referred to as long term capital gains The rates are 0 15 or 20 depending on your tax.

One of the greatest advantages to investing in commercial real estate is the tax benefits that come along with it. There are some requirements that have to be met for you to avoid paying capital gains tax after selling your home. If you recall the short-term capital gains tax rate is the same as your income tax rate.

You can sell your primary residence and be exempt from capital gains taxes on the first 250000 if you are single and 500000 if married filing jointly. The first exemption you may qualify for is if the property is your main home as a Tax resident for three years The profit you create on your property sale is then to be reinvested in the purchase of your next home. 15000 x 22 3300 If you owned the home for one year or longer then youd be liable for the long-term capital gains tax rate.

Capital Gains Tax On Real Estate Home Sales Rocket Mortgage

Capital Gains Tax On Real Estate Home Sales Rocket Mortgage

12 Ways To Beat Capital Gains Tax In The Age Of Trump

12 Ways To Beat Capital Gains Tax In The Age Of Trump

How High Are Capital Gains Taxes In Your State Tax Foundation

How High Are Capital Gains Taxes In Your State Tax Foundation

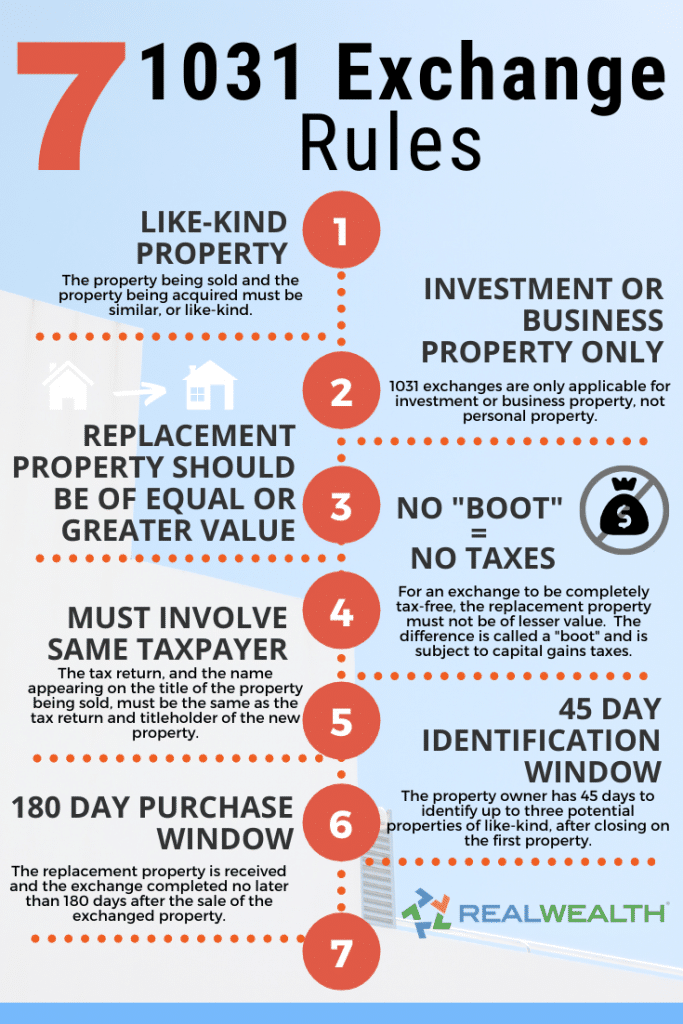

1031 Exchange Rules Success Stories For Real Estate Investors 2021

1031 Exchange Rules Success Stories For Real Estate Investors 2021

What Is The Capital Gains Tax On Real Estate Thestreet

What Is The Capital Gains Tax On Real Estate Thestreet

The Capital Gains Tax And Inflation Econofact

The Capital Gains Tax And Inflation Econofact

Congress Should Reduce Not Expand Tax Breaks For Capital Gains Itep

Congress Should Reduce Not Expand Tax Breaks For Capital Gains Itep

Capital Gains Yield Cgy Formula Calculation Example And Guide

Capital Gains Yield Cgy Formula Calculation Example And Guide

How To Avoid Capital Gains Tax When You Sell A Rental Property

How To Avoid Capital Gains Tax When You Sell A Rental Property

Selling Your Investments Take This Factor Into Account First

Selling Your Investments Take This Factor Into Account First

Section 54 54f Income Tax Act Tax Exemption On Capital Gains

Section 54 54f Income Tax Act Tax Exemption On Capital Gains

Long Term Capital Gains Tax For Real Estate Millionacres

Long Term Capital Gains Tax For Real Estate Millionacres

Congress Should Reduce Not Expand Tax Breaks For Capital Gains Itep

Congress Should Reduce Not Expand Tax Breaks For Capital Gains Itep

Congress Should Reduce Not Expand Tax Breaks For Capital Gains Itep

Congress Should Reduce Not Expand Tax Breaks For Capital Gains Itep

How To Calculate Capital Gains Tax H R Block

How To Calculate Capital Gains Tax H R Block

3 Ways To Calculate Capital Gains Wikihow

3 Ways To Calculate Capital Gains Wikihow

Congress Should Reduce Not Expand Tax Breaks For Capital Gains Itep

Congress Should Reduce Not Expand Tax Breaks For Capital Gains Itep

Congress Should Reduce Not Expand Tax Breaks For Capital Gains Itep

Congress Should Reduce Not Expand Tax Breaks For Capital Gains Itep

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home