Property Tax Impact On Income Tax

Theyre both taxes you may have to pay but one is for your income while the other is for the things you own. For example deducting 2000 for property taxes paid saves a taxpayer in the 37 percent top tax bracket 740 but saves.

How Is Tax Liability Calculated Common Tax Questions Answered

How Is Tax Liability Calculated Common Tax Questions Answered

You may qualify if you didnt get a payment.

Property tax impact on income tax. While these are extreme cases they do illustrate the effect of taxes and they are useful guides of what happens at other tax rates. If youre flipping the property and youve owned it for less than a year you pay short-term capital gains tax which is the same rate as your marginal income tax rate. Most state and local tax authorities calculate property taxes based on the value of the homes located within their areas and some agencies also tax personal property.

Many states impose limits on how local jurisdictions may tax property. If you pay either type of property tax claiming the tax deduction is a simple matter of itemizing your personal. The IRS taxes you on any net profits you get out of a property when you sell it.

Whether you intended to be a landlord or you fell into it because you had vacant property you couldnt or didnt sell owning rental property is a source of income and it affects your tax return. Knowing the rules can help you maximize the tax advantages of owning rental property and help you create a strategy to help lower or defer some of your taxes. File Your Taxes for Free Get Your Tax Record View Your Account Make a Payment Get Answers to Your Tax Questions Forms and Instructions.

HR Block employees including Tax Professionals are excluded from participating. This ceiling applies to income taxes you pay at the state and possibly local level as well as property taxes. The TCJA limits the amount of property taxes you can claim.

All these taxes fall under the same umbrella. Referred client must have taxes prepared by 4102018. The short answer is that rental income is taxed as ordinary income.

When you received your stimulus checks also known as an Economic Impact Payment you should have received a Notice 1444. Property tax should be pretty clear. If youre in the 28 tax bracket youll pay a 28 tax on short-term capital gains.

A disadvantage to the taxpayer is that the tax liability is fixed while the taxpayers income is not. At this point the difference between income tax vs. It places a 10000 cap on state local and property taxes collectively beginning in 2018.

If youre in the 22 marginal tax bracket and have 5000 in rental income to. You can file your taxes now even if you owe Long said. Third Economic Impact Payments.

The property tax typically produces the required revenue for municipalities tax levies. Now the total of state and local taxes eligible for a deductionincluding property and income taxesis limited to 10000 per tax return or 5000 if youre married and filing separately. Available at participating offices and if your employers participate in the W-2 Early Access SM program.

But you dont have to pay until April 15 That remains the deadline to file your 2020 federal income tax return. Check Status in the Get My Payment Tool. How does a trust impact property taxes additional fees and funding.

A Revocable Living Trust is an arrangement you. Property taxes pay for community services based on the needs of each locality. What information do I need about my stimulus checks when I file my taxes.

For a married couple filing jointly with a taxable income of 280000 and capital gains of 100000 taxes on the profits from the sale of a rental property would amount to 15000. The tax is administered at the local government level. The deductions and exclusions available to homeowners are worth more to taxpayers in higher tax brackets than to those in lower brackets.

A 99 tax rate is awfully like a 100 tax rate and if you ignore collection costs having a 2 tax rate is not much different from having no taxes at all. If you pay taxes on your personal property and owned real estate they may be deductible from your federal income tax bill. The notice has information about your stimulus check and should be kept with your important tax records like your W-2s or 1099s.

Tax Implications On A Gifted Property Property Lawyers In India Property Tax Tax Exemption Tax

Tax Implications On A Gifted Property Property Lawyers In India Property Tax Tax Exemption Tax

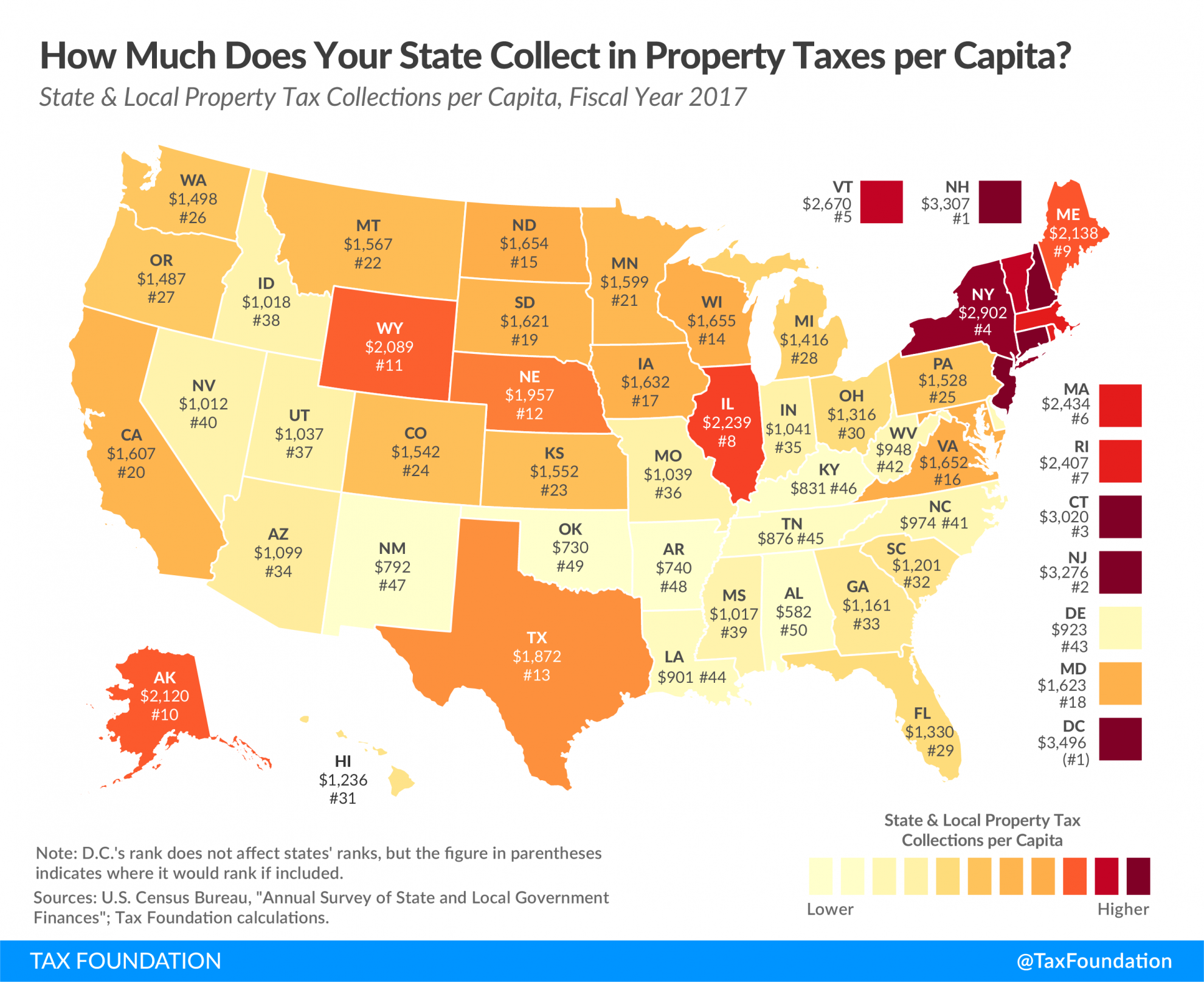

Monday Map State Local Property Tax Collections Per Capita Property Tax Map Best Places To Retire

Monday Map State Local Property Tax Collections Per Capita Property Tax Map Best Places To Retire

Image Result For U S National Map Of Property Taxes Property Tax History Lessons Historical Maps

Image Result For U S National Map Of Property Taxes Property Tax History Lessons Historical Maps

Income Tax Slab Rates For Fy 2017 18 Ay 2018 19 Budget 2017 18 Income Tax Return Income Tax Tax Return

Income Tax Slab Rates For Fy 2017 18 Ay 2018 19 Budget 2017 18 Income Tax Return Income Tax Tax Return

State And Local Tax Deduction Salt The Impact By State Tax Deductions Deduction Real Estate Marketing

State And Local Tax Deduction Salt The Impact By State Tax Deductions Deduction Real Estate Marketing

Rental Property Tax Preparation Worksheet In 2021 Income Tax Income Tax Preparation Tax Preparation

Rental Property Tax Preparation Worksheet In 2021 Income Tax Income Tax Preparation Tax Preparation

Chicago Renters Can T Afford Rahm S Property Tax Hike Landlords Say Renter Being A Landlord Property Tax

Chicago Renters Can T Afford Rahm S Property Tax Hike Landlords Say Renter Being A Landlord Property Tax

Sources Of Government Revenue In The United States Tax Foundation

Sources Of Government Revenue In The United States Tax Foundation

The States With The Highest And Lowest Taxes For Retirees Low Taxes Retirement State Tax

The States With The Highest And Lowest Taxes For Retirees Low Taxes Retirement State Tax

New Tax Regime Tax Slabs Income Tax Income Tax

New Tax Regime Tax Slabs Income Tax Income Tax

How Does The Deduction For State And Local Taxes Work Tax Policy Center

How Does The Deduction For State And Local Taxes Work Tax Policy Center

New Income Tax Forms On Hold For Now Tax Forms Income Tax Income

New Income Tax Forms On Hold For Now Tax Forms Income Tax Income

Income Tax Deductions List Fy 2019 20 List Of Important Income Tax Exemptions For Ay 2020 21 Tax Deductions List Tax Deductions Income Tax

Income Tax Deductions List Fy 2019 20 List Of Important Income Tax Exemptions For Ay 2020 21 Tax Deductions List Tax Deductions Income Tax

How Gst Will Impact Home Prices The Property Market Gst Goods Service Tax Property Tax Market Income Inter Property Marketing House Prices Property

How Gst Will Impact Home Prices The Property Market Gst Goods Service Tax Property Tax Market Income Inter Property Marketing House Prices Property

Reit Investments Tax Implications In India Reit Real Estate Investment Trust Investing

Reit Investments Tax Implications In India Reit Real Estate Investment Trust Investing

Property Tax Map Tax Foundation

Property Tax Map Tax Foundation

Rental Property Tax Deductions The Ultimate Tax Guide 2021 Edition Stessa

Rental Property Tax Deductions The Ultimate Tax Guide 2021 Edition Stessa

How Property Taxes Can Impact Your Mortgage Payment Property Tax Mortgage Marketing Mortgage Payment

How Property Taxes Can Impact Your Mortgage Payment Property Tax Mortgage Marketing Mortgage Payment

Labels: impact

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home