Claim Tax Back For Working From Home Northern Ireland

Irish Tax Rebates have helped thousands of short-term workers in Ireland to claim tax back. Your employee is required to perform essential duties of the employment at home.

If you worked in Ireland for part of the year and you have now gone to live abroad you may be due a refund of tax.

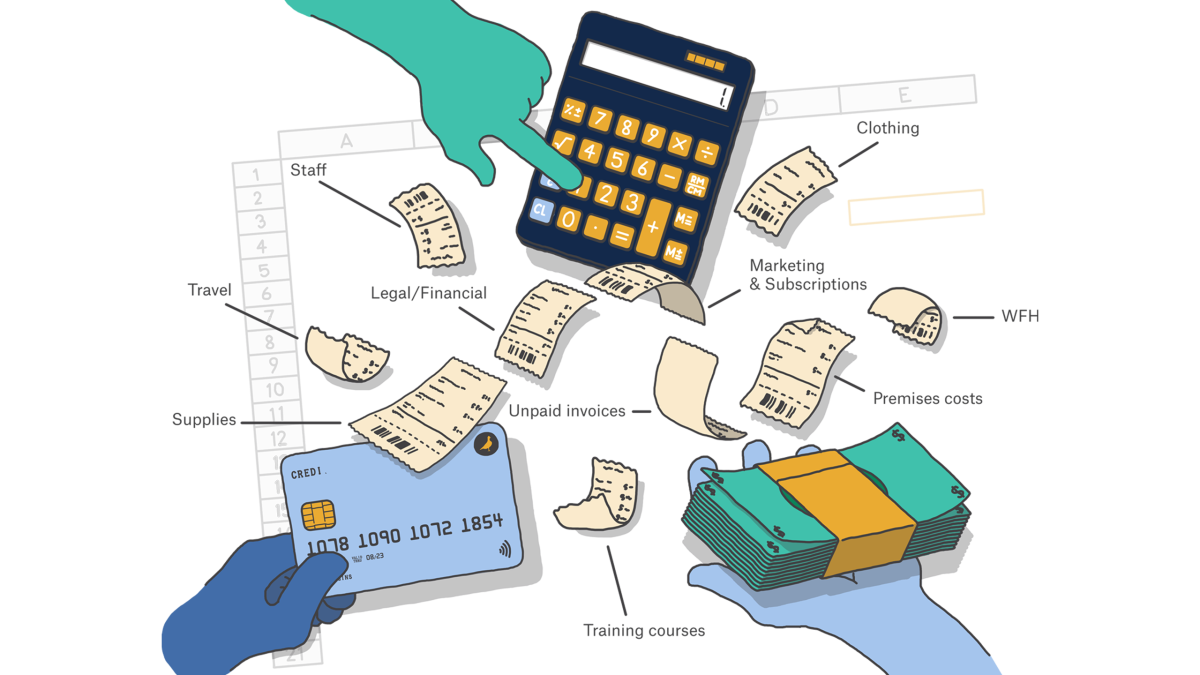

Claim tax back for working from home northern ireland. If you are claiming Remote Working Relief you will need to complete an Income Tax Return. If your employer pays you a working from home allowance towards these expenses you can get up to 320 per day without paying any tax PRSI or USC on it. Your employer can pay you a contribution towards these costs or you can make a claim for tax relief at the end of the year.

If there is no tax refund for you there is no fee. You can potentially make a claim from HMRC but the amount you would receive back would equate via an amendment to your tax code of 120 per week for a basic rate tax payer. Apply Online our website today.

If you have a question about a government service or policy you should contact the relevant government organisation directly as we dont have access to information about you held by government departments. However it is not a legal obligation for. However its important to note that you cannot claim this relief for work you bring home outside of normal working hours.

If your employer pays more than 320 per day to cover expenses you pay tax PRSI and USC as normal. Your employees costs might be higher than 320 per workday and you may repay these expenses. Log into PAYE Services within myAccount and select Claim unemployment repayment.

NI company employees who live in the Irish Republic have to pay tax in both states if they work from home. They can claim relief against tax already paid in NI on their salary. This includes if you have to.

This short video will explain how to upload receipts. Use this service to see how to claim if you paid too much on. How much can I claim.

The NICS has a duty to ensure that staff who are compelled to workfrom home should not bear any additional costs and NIPSA will continue to raise this issue. HMRC has launched an online portal allowing employees an easy way to claim tax relief on working from home. The tax relief is provided to workers provided they have been told by their employer to work from home and provided they have not received home expenses payments directly from their organisation.

You can take all the complexities and hassle out of claiming your tax back for a short term contract by utilising our simple and efficient tax back service. Employers can pay 320 tax-free a day to their employee to cover the additional costs associated with working from home. You may be able to get a tax refund rebate if youve paid too much tax.

You may also be entitled to claim if your working week is split between your home and an office. You can use it to report a problem or suggest an improvement to a webpage. Employees who have not received the working from home expenses payment direct from their employer can apply to receive the tax relief from HMRC.

This feedback form is for issues with the nidirect website only. Your employee is required to work for substantial periods at home. Working from home You may be able to claim tax relief for additional household costs if you have to work at home on a regular basis either for all or part of the week.

Employers can pay staff up to 6 a week tax-free to cover additional costs for working from home. Are you entitled to a refund of tax. Youll need to use the EU VAT refund system to make a claim for a refund of VAT incurred in an EU member state if youre a business established in Northern Ireland or have an establishment in.

You need to do this to process the receipts and bills you entered on Revenue Receipts Tracker App or in myAccount. Expenses higher than 320 per workday. HMRC is encouraging customers claiming tax relief.

Any amount higher than 320 per workday must have tax deducted. Employees who have not received the working from home expenses payment direct from their employer can apply to receive the tax relief from HMRC. To claim a refund.

Pay from your current or previous job. You must be aged 13 years or older - if you. Northern Ireland tax relief of up to 6 per week From 6 April 2020 employers have been able to pay employees up to 6 a week tax-free to cover additional costs if they have had to work from home.

Alternatively employees can claim the money from the tax man.

Floral Heart Wall Art Print Heart Art Print Floral Prints Art Heart Wall Art

Floral Heart Wall Art Print Heart Art Print Floral Prints Art Heart Wall Art

Starlight Breeze Guided Meditations Guided Meditation Audio Guided Meditation Meditation Audio

Starlight Breeze Guided Meditations Guided Meditation Audio Guided Meditation Meditation Audio

I Am Standing On The Threshold Of Another Trembling World Irish History Family Genealogy Family History

I Am Standing On The Threshold Of Another Trembling World Irish History Family Genealogy Family History

More Top Irs Audit Triggers To Avoid Irs Infographic Audit

More Top Irs Audit Triggers To Avoid Irs Infographic Audit

Karen Huger On If She Gave Husband Ray Half Of Her Money Shades Rhop Costar Gizelle Bryant For Claim Karen Bryant Real Housewives

Karen Huger On If She Gave Husband Ray Half Of Her Money Shades Rhop Costar Gizelle Bryant For Claim Karen Bryant Real Housewives

Virtual Mailbox Rental And Registered Limited Address Service In Belfast Company Address For Ltd Company In Northern I Mailbox Rental Company Address Let It Be

Virtual Mailbox Rental And Registered Limited Address Service In Belfast Company Address For Ltd Company In Northern I Mailbox Rental Company Address Let It Be

Leadymore Killala Co Mayo Detached House For Sale Detached House House House Styles

Leadymore Killala Co Mayo Detached House For Sale Detached House House House Styles

Police Officer Threw Homeless Man Out Of Station Then Watched Dvd As He Died Of Hypothermia The Independent Homeless Man Police Officer Homeless

Police Officer Threw Homeless Man Out Of Station Then Watched Dvd As He Died Of Hypothermia The Independent Homeless Man Police Officer Homeless

Fake Bank Statement Template Elegant Create Fake Bank Statement Letter Examples Make A App Free Statement Template Bank Statement Statement

Fake Bank Statement Template Elegant Create Fake Bank Statement Letter Examples Make A App Free Statement Template Bank Statement Statement

The Lodge At Ashford Castle Connaught Ireland Ashford Castle County Mayo Ireland Images Of Ireland

The Lodge At Ashford Castle Connaught Ireland Ashford Castle County Mayo Ireland Images Of Ireland

How To Get A Vat Refund In Ireland Tax Free Shopping Ireland Ireland Tourist

How To Get A Vat Refund In Ireland Tax Free Shopping Ireland Ireland Tourist

About The Uw Amp Amp Seattle Uw Education Policy Master S Degree Seattle Seattle Car Rental City Restaurants

About The Uw Amp Amp Seattle Uw Education Policy Master S Degree Seattle Seattle Car Rental City Restaurants

Taxes From A To Z 2018 L Is For Line Of Credit Line Of Credit Finance Service

Taxes From A To Z 2018 L Is For Line Of Credit Line Of Credit Finance Service

Foreign Offices The Britons Who Work From Home Abroad Work Careers The Guardian

Foreign Offices The Britons Who Work From Home Abroad Work Careers The Guardian

Primark My City Story Anouska House Styles Building City

Primark My City Story Anouska House Styles Building City

Abandoned Steel Plant In Muskegon Abandoned Muskegon Michigan Forest House

Abandoned Steel Plant In Muskegon Abandoned Muskegon Michigan Forest House

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home