Property Tax Rate In San Francisco Ca

If you need to find your propertys most recent tax assessment or the actual property tax due on your property contact the San Francisco County Tax Appraisers office. The Agreement form and payment can be submitted.

Understanding California S Property Taxes

Understanding California S Property Taxes

Box 7426 San Francisco CA 94120-7426.

Property tax rate in san francisco ca. How Property Taxes in California Work. If the tax rate is 1400 and the home value is 250000 the property tax would be 1400 x 2500001000 or 3500. County of San Mateos Treasurer-Tax Collector offers a Secured Property Tax Search where you can find your property tax by searching by address or parcel number.

Proposition 13 enacted in 1978 forms the basis for the current property tax laws. A taxable PI may be created or acquired in a number of ways including but not limited to through a contract lease concession agreement. Pay at least 20 of the total tax excluding delinquent penalties plus a 50 installment plan fee per parcel.

Property Tax Rate. Access and view your bill online learn about the different payment options and how to get assistance form the Citys Treasurer Tax Collector Office. This compares well to the national average which currently sits at 107.

The median property tax in San Francisco County California is 4311 per year. Search - TaxSys - San Francisco Treasurer Tax Collector. A taxable PI is created when real property owned by a government agency is leased rented or used by a private individual or entity.

If you choose to use a browser other than the ones listed your experience may not be optimal or secure. - Condo for sale. City and County of San Francisco.

THE BACKGROUND OF PROPERTY TAXES IN CALIFORNIA Prior to 1912 the state derived up to 70 percent of its revenue from property taxes. 250 with 200 minimum. You also may pay your taxes online by ECheck or Credit Card.

Learn about the Citys property taxes. SOTHEBYS INTERNATIONAL REALTY Gregg Lynn. SEE Detailed property tax report for 324 3 Ave San Francisco County CA.

The average effective property tax rate in California is 073. 1st Floor 555 County Center. 25 minutes agoThe analysis said Evers proposed changes to school district levies would have the greatest impact on the property tax bill resulting in reductions of.

San Francisco County collects on average 055 of a propertys assessed fair market value as property tax. The median property tax on a 78520000 house is 431860 in San Francisco County. Click here for Property Tax Look-up.

This is the effective tax rate. San Francisco County residents pay a total rate of around 055 of their propertys assessed fair. City and County Tax Collector PO.

The median property tax on a 78520000 house is 581048 in California. Enter only the values not the words Block or Lot and include any leading zeros. Assessed value is calculated based.

225 with 200 minimum. Our payment systems support Microsoft Internet Explorer 11 Windows EDGE and current versions of Google Chrome Mozilla Firefox and Apple Safari. The California Constitution mandates that all property is subject to taxation unless otherwise exempted by state or federal law.

The median property tax in San Francisco County California is 4311 per year for a home worth the median value of 785200. The assessed value is initially set at the purchase price. The tax rate changes every year.

So when you buy. Bill block-lot ex. Redwood City CA 94063.

The state no longer relies on property taxes as its primary source of fundssince 1933 the only property tax directly levied collected and retained by the state has been the tax on privately owned railroad cars. 504 The property tax rate shown here is the rate per 1000 of home value. The Property Tax Rate for the City and County of San Francisco is currently set at 11801 of the assessed value for 2019-20.

California property taxes are based on the purchase price of the property. Complete and sign a Secured Escape Installment Plan. For best search results enter your bill number or blocklot as shown on your bill.

This is for a home at the median value of 785200. 0001-002 or property location. PIs are subject to property taxes under California law unless a qualifying exemption applies eg welfare exemption etc.

Look Up an Account. 2230 Pacific Ave APT 202 San Francisco CA 94115. San Francisco is ranked 52nd out of the 3143 US.

Counties for the highest median home value property taxes.

San Francisco Is A Very Difficult City To Raise A Family Due To High Home Prices High Taxes A Public Real Estate Buying Real Estate Investing Buying Property

San Francisco Is A Very Difficult City To Raise A Family Due To High Home Prices High Taxes A Public Real Estate Buying Real Estate Investing Buying Property

Secured Property Taxes Treasurer Tax Collector

Secured Property Taxes Treasurer Tax Collector

San Francisco Property Tax Rates Redmond Realty

San Francisco Property Tax Rates Redmond Realty

Metropolitan New York And San Jose Highest Property Tax Burdens Newgeography Com

Metropolitan New York And San Jose Highest Property Tax Burdens Newgeography Com

Metropolitan New York And San Jose Highest Property Tax Burdens Newgeography Com

Metropolitan New York And San Jose Highest Property Tax Burdens Newgeography Com

How Do Property Taxes Work Ruth Krishnan Top Sf Realtor

How Do Property Taxes Work Ruth Krishnan Top Sf Realtor

State By State Guide To Taxes On Retirees Most Tax Friendly Dark Green Tax Friendly Lime Green Mixe Retirement Retirement Income Happy Retirement Quotes

State By State Guide To Taxes On Retirees Most Tax Friendly Dark Green Tax Friendly Lime Green Mixe Retirement Retirement Income Happy Retirement Quotes

California Prop 15 Explained Voters To Decide Split Roll Property Tax Hike On Big Business Abc7 San Francisco

California Prop 15 Explained Voters To Decide Split Roll Property Tax Hike On Big Business Abc7 San Francisco

San Francisco County Property Tax Records San Francisco County Property Taxes Ca

San Francisco County Property Tax Records San Francisco County Property Taxes Ca

Understanding California S Property Taxes

Understanding California S Property Taxes

Usa County Of Orange California Property Tax Bill Template In Word Format Bill Template Property Tax Templates

Usa County Of Orange California Property Tax Bill Template In Word Format Bill Template Property Tax Templates

Map State Sales Taxes And Clothing Exemptions Trip Planning Sales Tax Tax

Map State Sales Taxes And Clothing Exemptions Trip Planning Sales Tax Tax

Secured Property Taxes Treasurer Tax Collector

Secured Property Taxes Treasurer Tax Collector

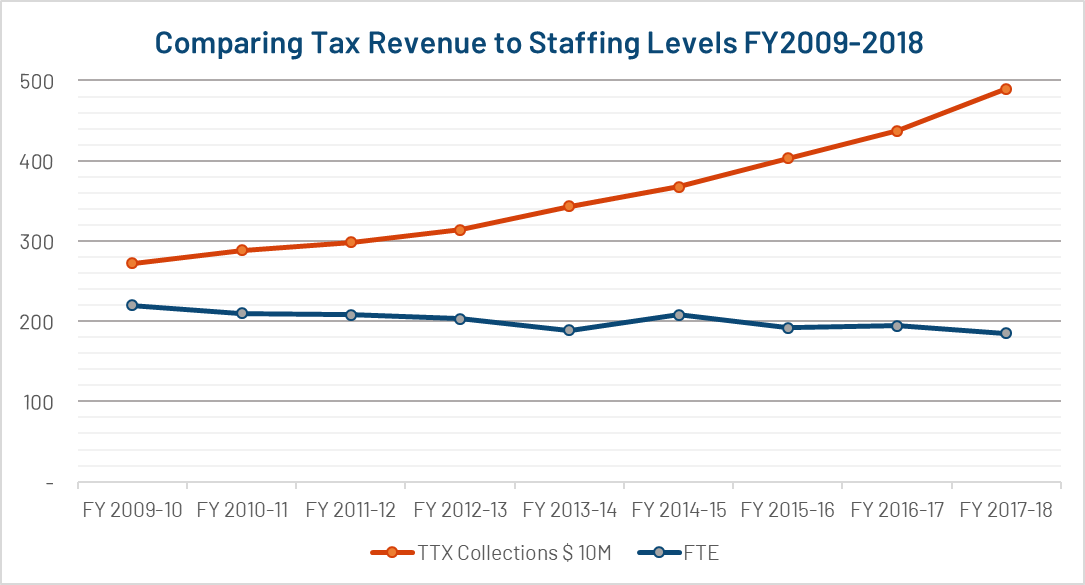

Annual Report Fiscal Year 2018 19 Treasurer Tax Collector

Annual Report Fiscal Year 2018 19 Treasurer Tax Collector

Secured Property Taxes Treasurer Tax Collector

Secured Property Taxes Treasurer Tax Collector

The Most Expensive Neighborhoods For Renters In Every State Apartmentguide Com The Neighbourhood San New Urbanism

The Most Expensive Neighborhoods For Renters In Every State Apartmentguide Com The Neighbourhood San New Urbanism

Understanding California S Property Taxes

Understanding California S Property Taxes

The 25 Best Performing Large Cities In The Us Milken Institute City Performance Create Jobs

The 25 Best Performing Large Cities In The Us Milken Institute City Performance Create Jobs

Map Bay Area Property Taxes Kron4

Map Bay Area Property Taxes Kron4

Labels: property

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home