Are Property Taxes High In Kentucky

School District Tax Rate The Frankfort Independent School Districts tax rate for the year 2019 is 99 per hundred dollars of assessed value on real estate and on personal property business furniture fixtures and inventory. In order to rank property taxes by state from highest to lowest researchers compared all 50 states and the District of Columbia using US.

States With The Highest Taxes Google Search Property Tax Tax States

States With The Highest Taxes Google Search Property Tax Tax States

Census Bureau data to determine real estate property.

Are property taxes high in kentucky. Census Bureau data to determine real-estate property tax rates and applying assumptions based on national auto-sales data to determine vehicle property tax rates. The government uses the money that property taxes generate to pay for schools public services libraries roads parks and the like. When Kentucky homeowners dont pay their property taxes the overdue amount becomes a lien on.

Kentucky homeowners pay 1257 annually in property taxes on average. On a median home of 178600 thats an annual tax bill of 2149. The assessment of property setting property tax rates and the billing and.

Oldham County collects the highest property tax in Kentucky levying an average of 224400 096 of median home value yearly in property taxes while Wolfe County has the lowest property tax in the state collecting an average tax of 29300 054 of median home value per year. States with the lowest property tax rate are ranked lowest whereas states with the highest rates are ranked highest. Learn about Kentucky tax rates rankings and more.

Property taxes in Kentucky are relatively low. The Citys tax rate for the year 2019 is 198 per hundred dollars of assessed value on real estate and on personal property business furniture fixtures and inventory. Larue County Property Valuation Administrator 209 West High St Hodgenville KY 42748 Phone 270358-4202 Fax 270358-0552 Return to Top Laurel County.

To start tax rates on commercial property are often higher than the rates on comparable residential property. Property taxes matter to businesses for several reasons. The exact property tax levied depends on the county in Kentucky the property is located in.

These dates have been established by the Legislature in an attempt to provide for the equitable and timely levy and collection of property taxes as well as continuity in PVA. Overall the effective property tax rate for homeowners is 12 in the US. The average effective property tax rate in Kentucky is 083.

Typically the amount of property taxes that a homeowner must pay is based on the assessed value of the property. 121 rows Good news. In an effort to assist property owners understand the administration of the property tax in Kentucky this website will provide you with information that explains the various components of the property tax system.

Statewide data is estimated by multiplying the number of single family homes by the average property tax. State property taxes. Explore data on Kentuckys income tax sales tax gas tax property tax and business taxes.

Various sections will be devoted to major topics such as. Hamilton County collects the highest property tax in Indiana levying an average of 227400 108 of median home value yearly in property taxes while Orange County has the lowest property tax in the state collecting an average tax of 51500 057. Thats partly because of low home values in the state the median home value is 151700 but also because of low rates.

The exact property tax levied depends on the county in Indiana the property is located in. Beside this do you have to pay property tax after age 65 in Kentucky. The property tax component accounts for 154 percent of each states overall Index score.

In order to determine the states with the highest and lowest property taxes WalletHub compared the 50 states and the District of Columbia by using US. In fact the typical homeowner in. Click on any column header to sort by that column.

How high are property taxes in Kentucky. Calendar Year 2016 Property Taxes. The following tables are sortable.

The Kentucky property tax calendar provides a general outline of the major statutory due dates for various parts of the property tax assessment and collection cycle. If you are eligible to receive the Homestead Exemption the exemption amount is subtracted from your propertys assessed value reducing your property tax liability. Kentuckys Constitution allows property owners who are 65 or older to receive the Homestead Exemption on their primary residence.

Lowest Highest Taxed States H R Block Blog Infographic Property Tax Family Income

Lowest Highest Taxed States H R Block Blog Infographic Property Tax Family Income

Are There Any States With No Property Tax In 2021 Free Investor Guide

Are There Any States With No Property Tax In 2021 Free Investor Guide

How Much Income Do I Need Qualify For Kentucky Home Loan Mortgage Lenders Income Loan

How Much Income Do I Need Qualify For Kentucky Home Loan Mortgage Lenders Income Loan

Kentucky Property Taxes By County 2021

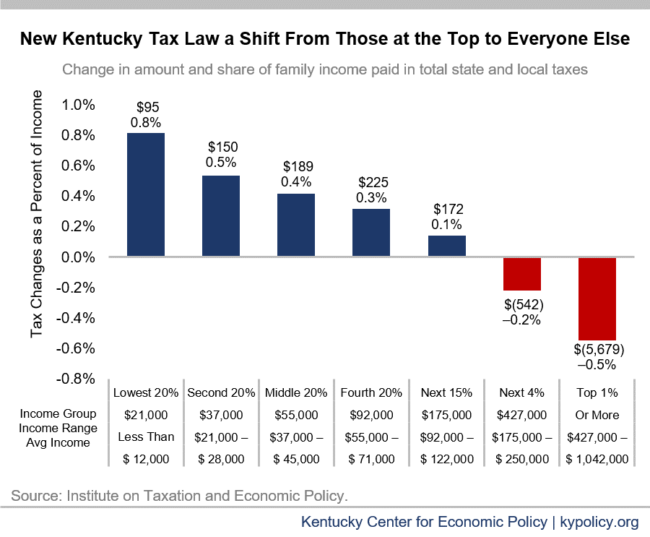

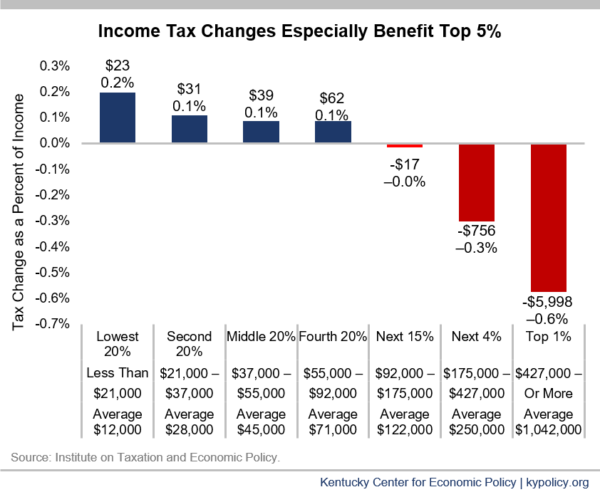

Kentucky Tax Shift Going Into Effect Kentucky Center For Economic Policy

Kentucky Tax Shift Going Into Effect Kentucky Center For Economic Policy

Kentucky Tax Shift Going Into Effect Kentucky Center For Economic Policy

Kentucky Tax Shift Going Into Effect Kentucky Center For Economic Policy

Jefferson County Ky Property Tax Calculator Smartasset

Jefferson County Ky Property Tax Calculator Smartasset

Kentucky Property Tax Calculator Smartasset

Kentucky Property Tax Calculator Smartasset

Are There Any States With No Property Tax In 2021 Free Investor Guide

Are There Any States With No Property Tax In 2021 Free Investor Guide

Signage Dan Dry Louisville Kentucky My Old Kentucky Home Louisville Ky

Signage Dan Dry Louisville Kentucky My Old Kentucky Home Louisville Ky

Https Revenue Ky Gov News Publications Property 20tax 20rate 20books Property 20tax 20rate 20book 202018 Pdf

100 Financing Home Loan Ky Credit Reports Credit Scores Debt Ratios Down Payment Assistance Fannie Mae Homep Debt Ratio First Time Home Buyers Home Loans

100 Financing Home Loan Ky Credit Reports Credit Scores Debt Ratios Down Payment Assistance Fannie Mae Homep Debt Ratio First Time Home Buyers Home Loans

Kentucky Property Tax Calculator Smartasset

Kentucky Property Tax Calculator Smartasset

What Is The Minimum Credit Score For A Kentucky Fha Mortgage Home Loan Approval Fha Mortgage Credit Score Mortgage Loans

What Is The Minimum Credit Score For A Kentucky Fha Mortgage Home Loan Approval Fha Mortgage Credit Score Mortgage Loans

Historical Kentucky Tax Policy Information Ballotpedia

Historical Kentucky Tax Policy Information Ballotpedia

Where To Retire Early Health Insurance Early Retirement Life Insurance For Seniors

Where To Retire Early Health Insurance Early Retirement Life Insurance For Seniors

Kentucky Property Tax Calculator Smartasset

Kentucky Property Tax Calculator Smartasset

Property Taxes By State County Lowest Property Taxes In The Us Mapped

Property Taxes By State County Lowest Property Taxes In The Us Mapped

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home