Vehicle Property Tax Calculator Kentucky

6 is the smallest possible tax rate Kentucky. To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price.

Jefferson County Ky Property Tax Calculator Smartasset

Jefferson County Ky Property Tax Calculator Smartasset

Kentucky Tax Calendar Important dates that define the Kentucky tax assessment process.

Vehicle property tax calculator kentucky. You can find the VIN. Appeal Process The process to pursue if you disagree with your real estate assessment. TurboTax will allow you to input multiple lines so list your car twice- once for each of these figures.

All rates are per 100. Kentucky VIN Lookup Vehicle Tax paid in 2020. This publication reports the 2019 2018 ad valorem property tax rates of the local governmental units in Kentucky including county city school and special district levies.

On average homeowners pay just a 083 effective property tax rate annual taxes as a percentage of home value. To use our Kentucky Salary Tax Calculator all you have to do is enter the necessary details and click on the Calculate button. Not all states collect an annual property tax on motor vehicles but Kentucky is one of them.

Frequently Asked Questions Frequent questions we receive about real estate motor vehicles and tangible property. The Kentuckys tax rate may change depending of the type of purchase. This calculator can help you estimate the taxes required when purchasing a new or used vehicle.

On the drivers side of the dashboard viewable through the windshield in the Drivers side door jamb looks like a sticker. Not ALL STATES offer a tax and tags calculator. 121 rows Kentucky Property Tax Rules.

2000 x 5 100. Actual amounts are subject to change based on tax rate changes. Search tax data by vehicle identification number for the year 2020.

This breakdown will include how much income tax you are paying state taxes. Motor Vehicle Property Tax Motor Vehicle Property Tax is an annual tax assessed on motor vehicles and motor boats. See below for states that do and dont offer these services In addition CarMax offers a free tax and tag calculator for some states only.

For vehicles that are being rented or leased see see taxation of leases and rentals. To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price. Historic motor vehicles are subject to.

The car registration and personal property taxes deduction is allowed when you are taxed based on the value of the car. The tax is collected by the county clerk or other officer. Kentucky state rates for 2021.

Once you have the tax rate multiply it with the vehicles purchase price. Non-historic motor vehicles are subject to full state and local taxation in Kentucky. After a few seconds you will be provided with a full breakdown of the tax you are paying.

Please note that this is an estimated amount. Using our Kentucky Salary Tax Calculator. Property taxes in Kentucky are some of the lowest in the country.

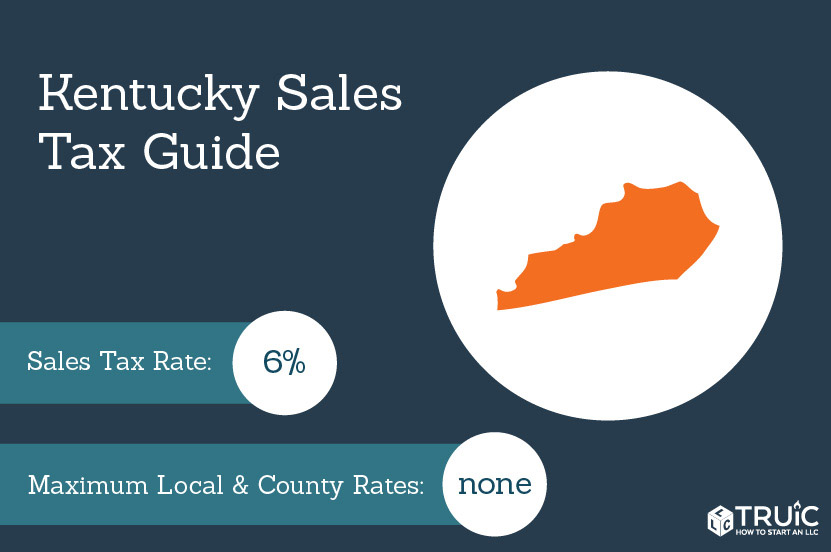

Payment shall be made to the motor vehicle owners County Clerk. Kentucky collects a 6 state sales tax rate on the purchase of all vehicles. It is levied at six percent and shall be paid on every motor vehicle used in Kentucky.

Motor Vehicle Usage Tax is a tax on the privilege of using a motor vehicle upon the public highways of the Kentucky and shall be separate and distinct from all other taxes imposed by the Commonwealth. In addition to taxes car purchases in Kentucky may be subject to other fees like registration title and plate fees. Clothing vehicles and other large purchases are all subject to the full sales tax rate.

Where can I find my Vehicle Identification Number VIN. 551 PM EST February 22 2019. All property that is not vacant is subject to a 911 service fee of 75 for each dwelling or unit on the property.

Motor Vehicle Usage Tax Motor Vehicle Usage Tax is collected when a vehicle is transferred from one party to another. Given the complexity in determining vehicle registration fees its best to use an online calculator or what some states refer to as a Fee Estimator. Since both of the tax charges you described are based on the cars value you may deduct both figures in Kentucky.

Andrea Ash John Charlton Mary Lyons Published. Anytime you are shopping around for a new vehicle and are beginning to make a budget its important to. Some of the Kentucky tax type are.

It is based ONLY upon the taxes regarding inventory. Most Kentucky property tax bills do not separately itemize the tax on inventory from taxes on other categories of tangible property. Our Jefferson County Property Tax Calculator can estimate your property taxes based on similar properties and show you how your property tax burden compares to the average property tax on similar properties in Kentucky and across the entire United States.

It is levied at 6 percent and shall be paid on every motor vehicle used in Kentucky. Consumers use rental tax sales tax sellers use lodgings tax and more. Real Property Tax Rates Current real estate tax rates.

Therefore the DOR Inventory Tax Credit Calculator is the best tool to correctly compute the tax credit. Our Kentucky Property Tax Calculator can estimate your property taxes based on similar properties and show you how your property tax burden compares to the average property tax on similar properties in Kentucky and across the entire United States. KRS 1322201a The person who owns a motor vehicle on January 1 st of the year is responsible for paying the property taxes for that vehicle for the year.

Please enter the VIN. Property taxes in Kentucky follow a one-year cycle. Please refer to the Kentucky website for more sales taxes information.

You can do this on your own or use an online tax calculator. Property Valuation Administrators PVAs in each county must list value and assess the property tax on motor vehicles and motor boats as of January 1 st of each year.

Read more »