Average Property Tax In Kentucky

Thats partly because of low home values in the state the median home value is 151700 but also because of low rates. 246 cents per gallon of regular gasoline 216 cents per gallon of diesel.

Jefferson County Ky Property Tax Calculator Smartasset

Jefferson County Ky Property Tax Calculator Smartasset

The assessment of property setting property tax rates and the billing and.

Average property tax in kentucky. KENTUCKY PROPERTY TAX RATES 2019 This is the annual publication of Kentucky Property Tax Rates. 121 rows Overview of Kentucky Taxes. This rate is set annually by July 1 and it applies to all real property tax bills throughout Kentucky.

Percentage of Home Value Median Property Tax in Dollars A property tax is a. All tax rates are expressed in terms of cents per 100 of the taxable value of properties subject to taxation. 13 rows Compare by.

Over the years the State real property tax rate has declined from 315 cents per 100 of assessed valuation to 122 cents due to this statutory provision. Most counties and cities charge a percentage ranging from 001 to 250. The median property tax in Kentucky is 84300 per year for a home worth the median value of 11780000.

Kentucky has a flat income tax rate of 5 a statewide sales tax of 6 and property taxes that average 1257 annually. Various sections will be devoted to major topics such as. The median property tax in Indiana is 105100 per year for a home worth the median value of 12310000.

You can look up your recent appraisal by filling out the form below. The Office of Property Valuation has compiled this listing to serve as a source of information for those affected by property taxation in the Commonwealth of Kentucky. A financial advisor in Kentucky can help you understand how taxes fit into your overall financial goals.

Indiana has one of the lowest median property tax rates in the United States with only ten states collecting a lower median property tax than Indiana. Kentucky is ranked 1539th of the 3143 counties in the United States in order of the median amount of property taxes collected. We then used the resulting rates to obtain the dollar amount paid as real-estate tax on a house worth 217500 the median value for a home in the US.

All tax rates are expressed in terms of cents per 100 of the taxable value of. KENTUCKY MOTOR VEHICLE PROPERTY TAX RATES 2019 2018 The Office of Property Valuation has compiled this listing to serve as a source of information for those affected by motor vehicle property taxation in the Commonwealth of Kentucky. The median property tax in Boyle County Kentucky is 965 per year for a home worth the median value of 126700.

Kentucky has one of the lowest median property tax rates in the United States with only seven states collecting a lower median property tax than Kentucky. The average effective property tax rate in Kentucky is 083. 404 Average Real Estate RateZero Rates Included 224845 406 Average Tangible Rate 405396 120 Average Motor Vehicle Rate 252628 120 Average Motor Vehicle RateZero Rates Included 65102 240 Average Tangible RateZero Rates Included 71775 240.

For real-estate property tax rates we divided the median real-estate tax payment by the median home price in each state. 53 rows States with the lowest property tax rate are ranked lowest whereas states with the highest. The median property tax in Kentucky is 84300 per year based on a median home value of 11780000 and a median effective property tax rate of 072.

AVERAGE LOCAL PROPERTY TAX RATES Tax rates are expressed in cents per 100 of assessed value. More than 767000 residents call Jefferson County Kentucky home. Counties in Kentucky collect an average of 072 of a propertys assesed fair market value as property tax per year.

Property taxes in in Kentucky are relatively low. These taxes are levied on your wages not your taxable income. Tax amount varies by county.

083 average effective rate. As of 2019 according to the Census Bureau. How high are property taxes in Kentucky.

Property taxes in Jefferson County are slightly higher than Kentuckys state average effective rate of 083. Local Property Tax Rates. Kentucky homeowners pay 1257 annually in property taxes on average.

Counties in Indiana collect an average of 085 of a propertys assesed fair market value as property tax per year. Boyle County collects on average 076 of a propertys assessed fair market value as property tax. Kentuckys Median Property Tax Is Lower Than Average 43rd out of 50.

Properties in Jefferson County are subject to an average effective property tax rate of 093. In an effort to assist property owners understand the administration of the property tax in Kentucky this website will provide you with information that explains the various components of the property tax system.

Kentucky Property Taxes By County 2021

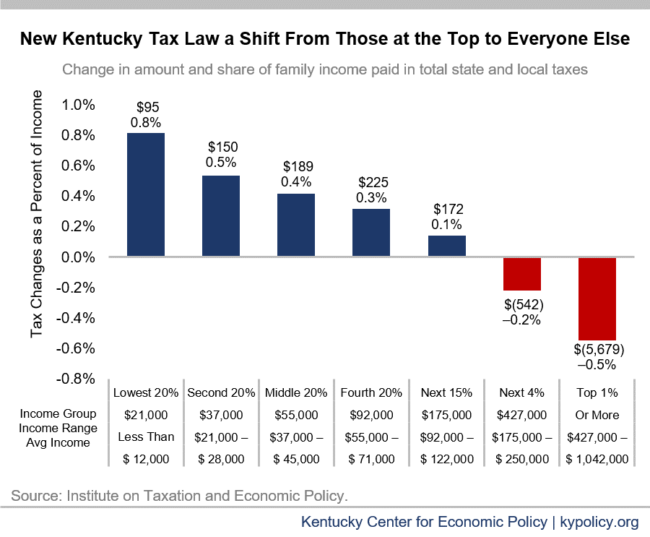

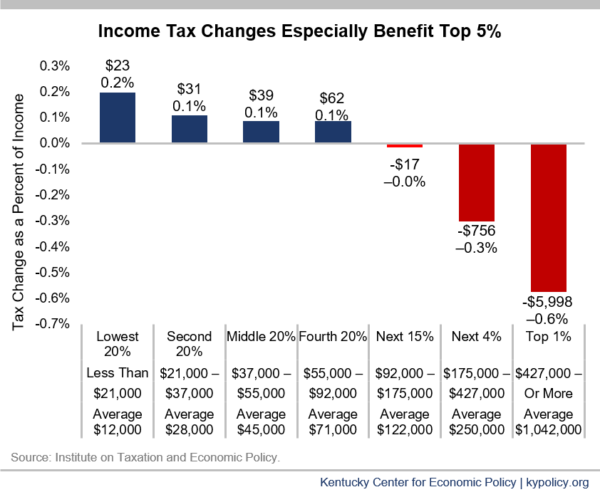

Kentucky Tax Shift Going Into Effect Kentucky Center For Economic Policy

Kentucky Tax Shift Going Into Effect Kentucky Center For Economic Policy

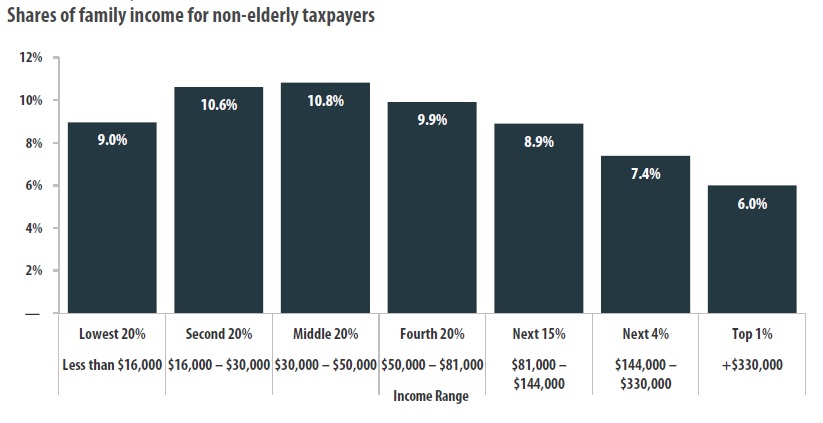

Kentucky S Tax Structure Is Not Fair Kentuckians For The Commonwealth

Kentucky S Tax Structure Is Not Fair Kentuckians For The Commonwealth

Kentucky Tax Shift Going Into Effect Kentucky Center For Economic Policy

Kentucky Tax Shift Going Into Effect Kentucky Center For Economic Policy

Https Revenue Ky Gov News Publications Property 20tax 20rate 20books Property 20tax 20rate 20book 202018 Pdf

Kentucky Property Tax Calculator Smartasset

Kentucky Property Tax Calculator Smartasset

New Hampshire Property Tax Calculator Smartasset

New Hampshire Property Tax Calculator Smartasset

Https Revenue Ky Gov Dor 20training 20materials Tax 20expenditure 20analysis 20fiscal 20years 202018 2020 Pdf

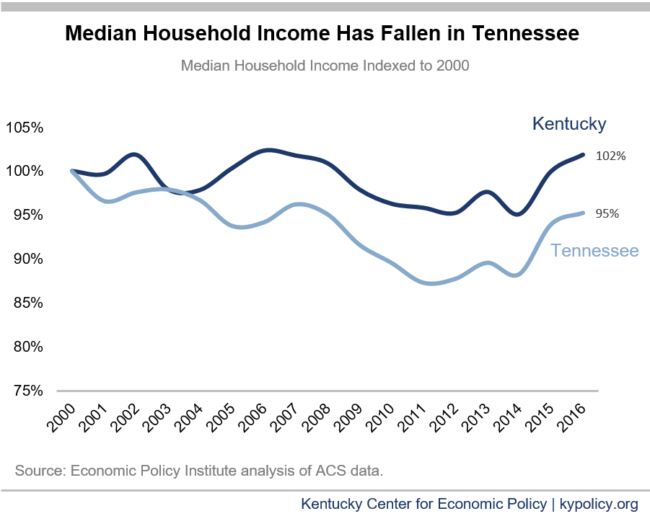

Shifting To A Tennessee Like Tax System Would Harm Kentucky Kentucky Center For Economic Policy

Shifting To A Tennessee Like Tax System Would Harm Kentucky Kentucky Center For Economic Policy

Kentucky State Tax Refund Ky State Tax Brackets Taxact Blog

Kentucky State Tax Refund Ky State Tax Brackets Taxact Blog

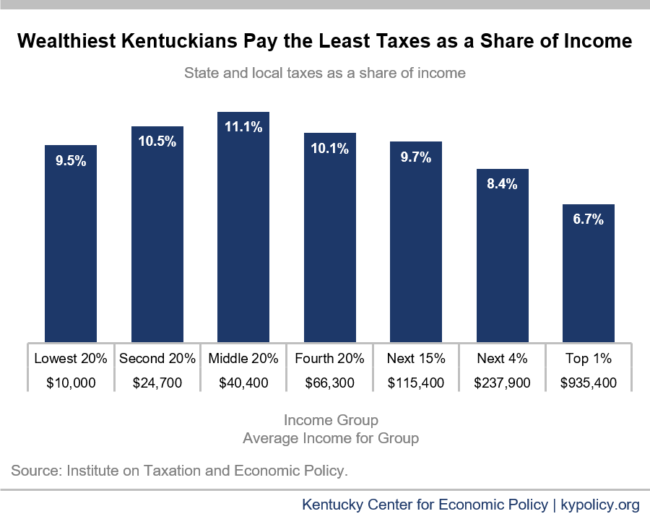

New Report Wealthiest Kentuckians Pay The Lowest Tax Rate And The Problem Is Worsening Kentucky Center For Economic Policy

New Report Wealthiest Kentuckians Pay The Lowest Tax Rate And The Problem Is Worsening Kentucky Center For Economic Policy

Kentucky Property Taxes By County 2021

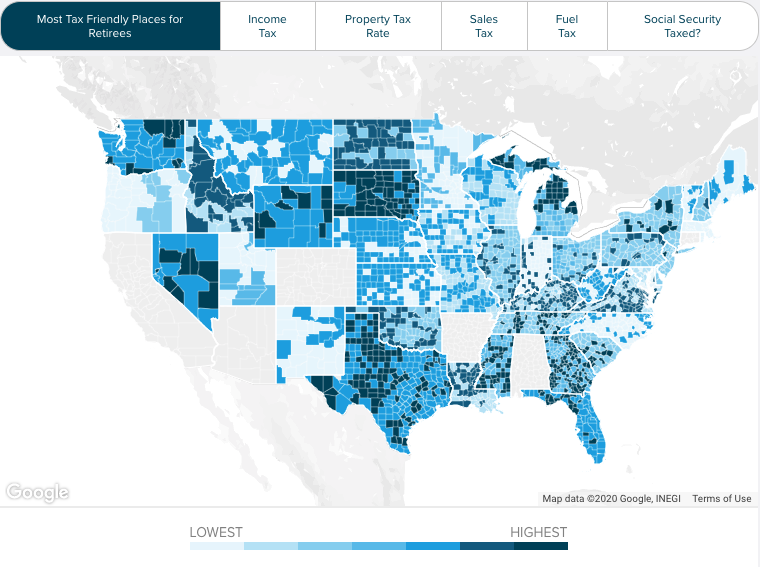

Kentucky Retirement Tax Friendliness Smartasset

Kentucky Retirement Tax Friendliness Smartasset

States With Highest And Lowest Sales Tax Rates

States With Highest And Lowest Sales Tax Rates

Kentucky Property Tax Calculator Smartasset

Kentucky Property Tax Calculator Smartasset

Tax Relief Intended To Save Kentucky Farms Helps Pave Them Instead Lexington Herald Leader

Historical Kentucky Tax Policy Information Ballotpedia

Historical Kentucky Tax Policy Information Ballotpedia

Kentucky Property Tax Calculator Smartasset

Kentucky Property Tax Calculator Smartasset

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home