Property Tax Fayette County Kentucky

You are responsible for property tax for any vehicle registered to you on January 1. Fayette County Clerk 162 East Main Street Lexington KY 40507 Office Hours.

Bourbon Fayette Madison Montgomery Other County Clerk S Offices Closing To Public Set Procedures Abc 36 News

Bourbon Fayette Madison Montgomery Other County Clerk S Offices Closing To Public Set Procedures Abc 36 News

Downloadable 2009-2010 Tax Rates.

Property tax fayette county kentucky. GIS Maps are produced by. Forms cannot be e-mailed or faxed as they must contain the original signature. Property tax for your vehicles trailers and boats are assessed by the Property Valuation Administrator on January 1st of each year.

Fayette County Kentucky Property Valuation Administrator The Property Valuation Administrators office is responsible for. The tax bills resulting from these returns will be generated and mailed by local officials in the fall of the year. Maintaining list of all tangible personal property.

Downloadable 2012-2013 Tax Rates. 51A280 - Out of State Purchase - Use Tax Form For trailers and boats only 62A044 - Affidavit for CorrectionExoneration of Motor VehicleBoatTrailer Property Tax. 859-252-1771 Fax 859-259-0973.

These records can include Fayette County property tax assessments and assessment challenges appraisals and income taxes. Tax planning strategies will differ depending on depending on where you live. Certificates of Delinquency will be recorded in the Fayette County Clerks Office on all unpaid property tax bills on April 16 2021.

On April 15 2021 the Fayette County Sheriff will turn over the unpaid tax bills to the County Clerks Office. Downloadable 2010-2011 Tax Rates. Fayette County collects on average 089 of a propertys assessed fair market value as property tax.

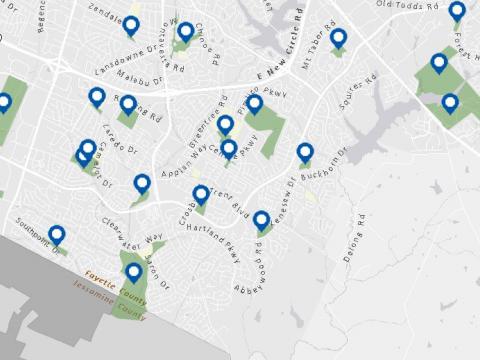

Fayette County GIS Maps are cartographic tools to relay spatial and geographic information for land and property in Fayette County Kentucky. Taxes are collected upon renewal or registration change. Payments are accepted between 800 AM and 400 PM or until 600 PM through the month of November and parking is available in the public garage on Barr Street.

They are paid in arrears annually on a calendar year. In fact the typical homeowner in Kentucky pays just 1257 each year in property taxes which is much less than the 2578 national median. Median Property Taxes Mortgage 1773.

Over the years the State real property tax rate has declined from 315 cents per 100 of assessed valuation to 122 cents due to this statutory provision. A separate return must be filed for each property location within Kentucky. State law - KRS 1320202 - requires the State real property tax rate to be reduced anytime the statewide total of real property assessments exceeds the previous years assessment totals by more than 4.

Downloadable 2011-2012 Tax Rates. Fayette County Property Tax Payments Annual Median Property Taxes. Property Tax Search - Tax Year 2020.

Median Property Taxes No Mortgage 1567. Tentative date for the. From that date on a search on any bill which does not show a status of Paid indicates that the bill may be delinquent.

For information on these bills please contact the Fayette County Clerks Office at 859 253-3344. There are no extensions for filing of tangible personal property tax forms 62A500. Downloadable 2013-2014 Tax Rates.

The states average effective property tax rate annual tax payments as a. Certificates of Delinquency will be recorded in the Fayette County Clerks Office on all unpaid property tax bills on April 16 2019. Downloadable 2014-2015 Tax Rates.

The actual date of the sale will be determined by the Revenue Department and will be posted on their website wwwrevenuekygov. Tax bills most always get mailed to whoever. Our Property Tax Division is located in Room 236 on the second floor of the Fayette District Courthouse at 150 North Limestone.

The tax sale may occur no earlier than 90 days and no later than 135 days after the bills have been turned over to the County Clerks Office. This rate is set annually by July 1 and it applies to all real property tax bills throughout Kentucky. For information on these bills please contact the Fayette County Clerks Office at 859 253-3344.

Kentucky has unique laws defining which actions trigger a taxable event and has the 22nd highest total tax burden in the US including income property and sales tax. Fayette County Clerk 162 East Main Street Lexington KY 40507. Property Tax Search - Tax Year 2019.

Fayette County Tax Records are documents related to property taxes employment taxes taxes on goods and services and a range of other taxes in Fayette County Kentucky. If you have lost or misplaced your bill call our main office 859-252-1771 during normal working hours or e-mail us anytime. GIS stands for Geographic Information System the field of data management that charts spatial locations.

Downloadable 2015-2016 Tax Rates. Financial advisors in the Fayette County area often offer tax planning services to their clients. The median property tax in Fayette County Kentucky is 1416 per year for a home worth the median value of 159200.

Kentucky is ranked 880th of the 3143 counties in the United States in order of the median amount of property taxes collected. After that date a search on any bill which does not show a status of Paid indicates that the bill may be delinquent. All bills get mailed out sometime during the month of October by each countys sheriffs department.

Limestone Ste 265 Lexington KY 40507 Tel. State Real Property Tax Rate. Property taxes in Kentucky are relatively low.

Property Taxes in Kentucky Fayette Co. Enter the bill number and account number listed in the top-left corner of your property tax bill.

Property Search Jessamine Pva Property Search Property Search

Property Search Jessamine Pva Property Search Property Search

Bourbon County Kentucky Ancestorsology

Shelby County Kentucky 1905 Map Shelbyville Ky Shelbyville Kentucky Shelby County

Shelby County Kentucky 1905 Map Shelbyville Ky Shelbyville Kentucky Shelby County

Geographic Information Services City Of Lexington

Geographic Information Services City Of Lexington

Fayette County Ky Recently Sold Homes Realtor Com

Fayette County Ky Recently Sold Homes Realtor Com

Sugar Land Real Estate Touchstonefineproperties Sugarlandrealtor House Prices Property Real Estate

Sugar Land Real Estate Touchstonefineproperties Sugarlandrealtor House Prices Property Real Estate

Debraun Thomas One Of The Co Founders Of Take Back Cheapside Stood Next To Explanatory Text In The Fifth Third Bank Fayette County Lexington Kentucky Fayette

Debraun Thomas One Of The Co Founders Of Take Back Cheapside Stood Next To Explanatory Text In The Fifth Third Bank Fayette County Lexington Kentucky Fayette

Garrard County Kentucky 1905 Map Lancaster Ky Kentucky County Ancestor

Garrard County Kentucky 1905 Map Lancaster Ky Kentucky County Ancestor

4004 Peppertree Drive Lexington Ky 40513 Open House Lexington Ky House

4004 Peppertree Drive Lexington Ky 40513 Open House Lexington Ky House

Lexington Cemetery Lexington Fayette County Ky Cemetery Records Romanesque Lexington

Lexington Cemetery Lexington Fayette County Ky Cemetery Records Romanesque Lexington

Fayette County Ky Property Tax Records Property Walls

Fayette County Ky Property Tax Records Property Walls

Jefferson County Ky Property Tax Calculator Smartasset

Jefferson County Ky Property Tax Calculator Smartasset

Logan County Kentucky Genealogy Familysearch

It S Property Tax Time Fayette Counties Mailing Notices Abc 36 News

It S Property Tax Time Fayette Counties Mailing Notices Abc 36 News

Fayette County Ky Property Tax Records Property Walls

Fayette County Ky Property Tax Records Property Walls

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home